Table of Contents

Our Verdict

Gusto Payroll stands out as an exceptional solution for your startup or small businesses, addressing the complexities of payroll, taxes, and benefits administration with automation and compliance. Its strength lies not only in simplifying these processes but also in offering the adaptability to integrate additional HR features like time tracking, making it a versatile choice as your business grows. Consider Gusto your go-to partner for managing payroll effortlessly, ensuring operational smoothness, and staying compliant with regulations.

The platform’s transparent per-person pricing and well-established reputation contribute to its value proposition. Renowned for its user-friendly interface, Gusto caters to you whether you’re tech-savvy or non-tech-savvy, enhancing accessibility and ease of use. However, it’s worth noting that the absence of a free trial and the potential for higher costs at scale compared to some competitors are considerations to keep in mind.

Tailored for small businesses, Gusto’s cloud-based, all-in-one platform allows convenient access from any location through an online browser. The absence of contractual commitments and the ease of adjusting plans to align with your evolving business needs make Gusto a flexible and user-centric payroll solution. Formerly known as ZenPayroll, Gusto brings a proven track record and reliability to the table, making it a trusted choice for businesses seeking comprehensive payroll and HR management.

Pros

• Presents a transparent monthly per person pricing

• Offers scalable Simple, Plus, and Premium plans

• Change your subscription plans easily, whether upgrading or downgrading, at any time.

• Enable seamless integration with third-party services.

• Manage payroll taxes through the platform.

• Provides college savings and charity matching offerings

Cons

• Lacks a free trial period

• Incurs growing costs with larger employee counts

• Fails to handle international W2 payrolls

• Struggle with manual data inputs

• Lacks payroll service on mobile application

• Restricts health benefits availability to specific states

Who Gusto Is Best For

Gusto stands out in catering to modern businesses with diverse workforces, offering tailored solutions for various scenarios. This is the right pick if you:

• Seek core HR services with scalable options for future growth. Gusto evolves alongside your business.

• Manage both W-2 employees and 1099 contractor workers. Gusto adeptly handles complex payrolls.

• Engage in domestic and international hiring. Gusto efficiently manages global contractor payrolls.

• Aim to boost financial wellness. Unique tools, such as Gusto Wallet, distinguish them in this regard.

• Prioritize simplicity in administrative processes. Gusto significantly reduces headaches associated with HR management.

MORE >>> Patriot Payroll Review

Who Gusto Isn’t Right For

While a strong solution for many small businesses, Gusto lacks in certain aspects that may better suit some organizations’ needs like if your firm:

• Hires 500+ people. Per-person pricing causes costs to scale.

• Needs international payroll beyond contractors. Gusto only supports domestic W-2 employees.

• Seeks an extensive performance review component. Engagement features are limited.

• Values automated workflows. Gusto needs admins for manual processes.

• Requires Mobile access. Gusto’s mobile app capabilities are restricted.

What Gusto Offers

Gusto provides complete payroll, HR, benefits, and financial wellness in a straightforward interface. Main features include:

• Processes payroll comprehensively for W-2 employees and 1099 contractors, covering all 50 states and international contractors. Implement automatic tax calculations and filings for a hassle-free experience.

• Simplifies onboarding and manage employee profiles seamlessly with e-signatures, customizable templates, and self-service access.

• Administers health insurance, FSAs, HSAs, commuter incentives, charitable giving matching, and more through a consolidated dashboard.

• Manages paid time off policies, sick days, parental leave, and bereavement with time tracking for payroll available in Plus and Premium plans.

• Oversees Paycard management and explore high-yield savings opportunities to provide holistic compensation beyond regular paychecks.

• Receives guidance on ACA, COBRA, ERISA, and other regulations related to hiring, payroll, and benefits, including HR document posting to stay compliant.

• Generates custom reports on payroll, benefits, compensation, headcount, and more, with depth varying based on your choice of Simple, Plus, or Premium plans.

• Gusto offers straight-forward per person monthly pricing, starting at $40 plus $6 per paid user. Competitors often have vague base fees then tack on rates per feature.

Gusto Payroll Details

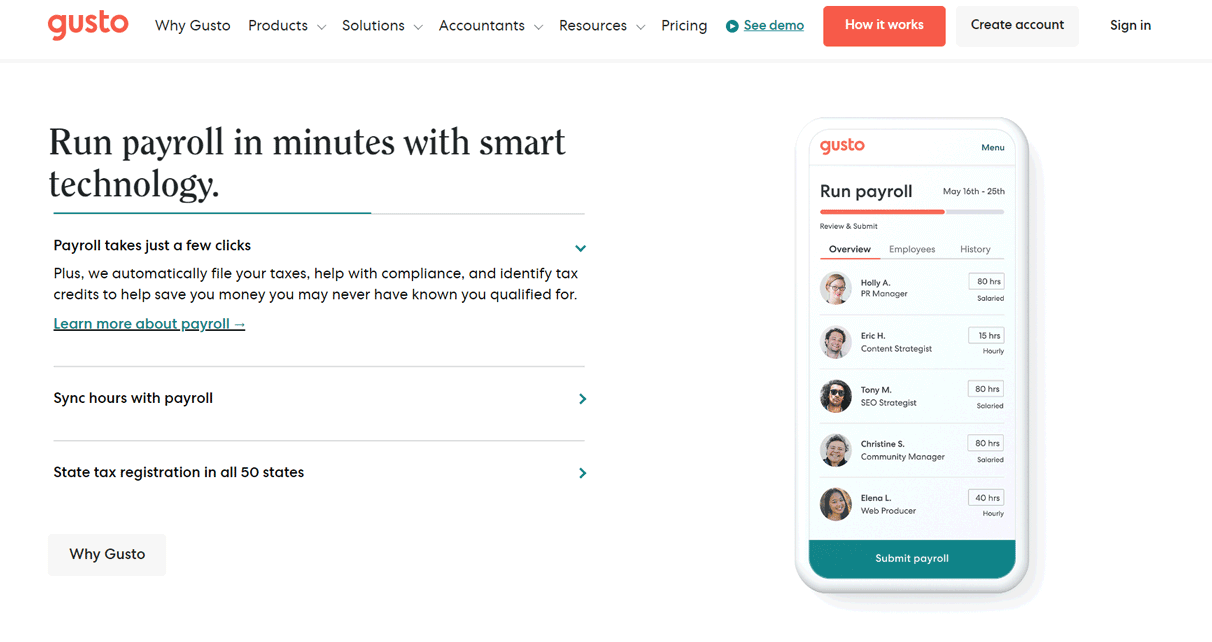

Payroll

• Initiates W-2 employee payroll by entering details such as pay rates and direct deposit info. Establish schedules for automatic or manual payroll based on hourly or salary considerations.

• Facilitates contractor payments by seamlessly adding 1099 contractors, whether domestically or internationally. Easily input pay amounts each period and submit payments without complications.

• Streamlines tax filing with automated federal, state, and local payroll tax calculations and filings, including the generation of W-2s and 1099s annually.

Onboarding

• Develops comprehensive employee profiles storing essential information like tax forms, pay rates, benefits elections, and PTO accruals.

• Grants admin permissions to external accountants, bookkeepers, or HR professionals without compromising login credentials.

• Utilizes reusable offer letter templates with editable compensation and variable fields per hire, simplifying the documentation of offers.

Benefits Administration

• Offers a range of health plans, including group medical, dental, vision, FSA, and HSA options. Enable employees to conveniently elect plans within the system.

• Manages commuter perks by handling transit incentives and company car policies directly through Gusto.

• Administers retirement accounts, going beyond company match and profit-sharing contributions with 401(k) administration.

• Provides additional perks such as college savings plans, charitable donations matching, and more, setting Gusto apart as a comprehensive benefits administration platform.

Time Management

• Establishes accrual policies for vacation, sick days, and paid holiday leave options, ensuring compliance with labor laws.

• Implements time tracking by connecting hourly wages to hours worked through manual entry or integrations with apps like Homebase.

• Facilitates approvals by reviewing and either approving or denying employee time-off requests directly in the dashboard.

Financial Wellness

• Provides a Paycard feature, granting employees access to interest-earning checking and high-yield savings.

• Enables pay splitting, allowing the allocation of funds to different accounts or direct donations to charities directly from paychecks.

• Offers spending insights through the Wallet app, detailing expenditures from each pay period.

PRO TIPS >>> Square Payroll Software Review

Where Gusto Stands Out

Gusto distinguishes itself by excelling in areas such as contractor payments, financial wellness tools, and an all-encompassing feature set, all while maintaining a straightforward pricing structure.

Streamlines Global Contractor Payments

Gusto sets itself apart by seamlessly managing payroll for various employee types, including international contractors. Its platform adeptly navigates the intricacies of diverse workforces, providing a unified solution for streamlined payroll operations.

Enhances Financial Wellness

Prioritizing employees’ overall compensation, Gusto introduces innovative financial health opportunities. From facilitating college savings plans to enabling pay splitting across different accounts, and offering the Wallet app for budgeting, Gusto enhances financial well-being.

Utilizes a Consolidated HR Platform

While promoting simplicity, Gusto consolidates a vast array of HR functions, covering payroll, benefits, PTO, hiring, and more within a unified platform. This design minimizes the reliance on multiple systems, providing businesses with a comprehensive solution.

Where Gusto Falls Short

While Gusto stands as a robust and reliable platform for payroll and HR management, it does exhibit certain areas where it falls behind its competitors. Here’s a detailed exploration of the aspects where Gusto lags:

Lacks international employee payroll support

Gusto’s capabilities in handling international employee payroll are somewhat constrained. It primarily focuses on independent contractors, omitting comprehensive support for international W-2 payrolls. In contrast, several competing platforms offer more expansive solutions catering to businesses with a global workforce, allowing for a broader spectrum of payroll management.

Features minimal mobile app capabilities

Gusto’s mobile app, while providing some level of convenience, falls short of delivering the full functionality available on the web platform. The app, including the Wallet app, offers basic insights but lacks the comprehensive features found on the desktop version. Managing critical tasks such as payroll processing and handling PTO requests is more seamlessly executed on the desktop interface.

Provides no free trial offering

One notable drawback of Gusto is the absence of a free trial option. Unlike many of its prominent competitors, Gusto currently does not provide users with the opportunity to test the system before committing to a purchase. The lack of a free trial hinders potential buyers from experiencing the platform firsthand and directly evaluating its suitability for their specific business needs.

How to Sign Up for Gusto

How to Set Up a Gusto Payroll Account

To initiate your Gusto Payroll account, start by creating a company profile on the Gusto website. This step is complimentary and involves providing basic information about your company, including the number of employees. Here’s the continuation of the process for establishing a payroll account with Gusto:

• Add your company details, including the phone number, address, etc. If you have an accountant, select “Add Your Accountant” and input their details to grant them access to your account.

• Link your business to your bank account within Gusto, ensuring that employee salaries can be paid through the platform. Provide your account number and routing details, and verify the account, which can be done using Plaid.

• Input your tax information, including payroll taxes. Furnish details like your Employer Identification Number (EIN) during this step.

• Include the benefits your employees will receive. You can allow Gusto to serve as a Broker of Record or manually manage this process.

• Specify the type of plan, and proceed to set up Gusto as your Payroll account. This involves entering individual employee information, pay schedules, tax details, and other pertinent details.

Alternatives to Gusto

If you want an all-in-one HRIS system with integrated payroll, time tracking, reporting, and other functionalities bundled together in the core software, the following could be considered solid alternatives to BambooHR:

Paycor

Revolutionize your payroll processing with Paycor. This intuitive payroll software streamlines the process, saving you valuable time. It automates tasks, aids in tax compliance management, and acts as a centralized source for employee data. Offering features such as OnDemand Pay, AutoRun functionality, employee self-service, robust reporting tools, law alerts, and how-to guides, Paycor ensures businesses can efficiently and accurately compensate their employees.

ADP

ADP’s small business solution, RUN, tailors its services to companies with fewer than 50 employees. The plans are customizable, offering features like automatic tax filing, reports, and easy employee payroll. Additional add-ons for marketing and legal assistance are available. ADP’s pricing structure is more intricate than Gusto’s, with potential extra costs for benefits administration and time tracking.

Paychex Flex

Paychex Flex targets small businesses seeking a straightforward, user-friendly payroll software solution without unnecessary features. The platform provides three customizable plans, integrates with accounting software, and offers a self-service employee portal. However, being more basic than Gusto, Paychex Flex charges additional fees for services like W-2 and 1099 filing and time tracking.

OnPay

OnPay serves as an all-in-one payroll and HR solution explicitly designed for small businesses. Setting itself apart with an error-free tax guarantee and robust benefits administration, OnPay provides straightforward, comprehensive pricing. However, the plans lack customization, making it less suitable for businesses requiring more flexibility in selecting features.

GET SMARTER >>> Gusto vs. Roll Payroll

Customer Reviews

Gusto consistently garners acclaim and high ratings across various evaluation platforms, showcasing its commitment to user satisfaction:

U.S. News rates Gusto with a commendable satisfaction score of 4.5. Gusto excels on G2, earning a stellar rating of 4.5 out of 5 stars. TrustRadius expresses their trust in Gusto, giving it a solid rating of 7.8 out of 10 stars. Capterra awards Gusto an impressive rating of 4.7 out of 5 stars. Business.com rates Gusto exceptionally high with a score of 9.2 out of 10.

These consistent positive reviews and high scores across diverse platforms reinforce Gusto’s position as a reliable and well-regarded solution for payroll and HR services.

Pro Tips

• Utilize Gusto’s features catering to small businesses for seamless onboarding.

• Leverage custom offer letter templates, document storage, and e-signature capabilities.

• Be aware of additional costs for international contractor payments.

• Plan accordingly for international HR needs.

• Capitalize on Gusto’s extensive integration capabilities.

• Check Gusto’s App Directory for potential discounts on various platforms.

• Utilize health insurance broker integration for streamlined benefits administration.

• Utilize Gusto’s Plus plan for customizable PTO policies and performance management.

• Test mobile responsiveness for tasks like paying employees on tablets and smartphones.

• Leverage Gusto’s customer support during available hours and schedule callbacks.

Recap

Gusto Payroll simplifies payroll, taxes, and benefits for startups, offering adaptability as businesses grow, though it lacks a free trial. It excels in global contractor payments and financial wellness tools, consolidating HR functions in a user-friendly platform. While strong, Gusto lags in international employee payroll, mobile app capabilities, and a free trial, making direct evaluation challenging.

Gusto’s features cover comprehensive payroll, HR, benefits, and financial wellness with transparent per-person pricing starting at $40. Gusto’s payroll processes W-2 and 1099 contractor payments, streamlines tax filings, and offers financial tools like college savings plans.

The platform distinguishes itself by streamlining global contractor payments, enhancing financial wellness, and consolidating HR functions but falls short in international employee payroll, limited mobile app capabilities, and the absence of a free trial, impacting direct evaluation. Setting up a Gusto Payroll account involves creating a company profile, linking bank accounts, inputting tax information, and specifying benefits.

Gusto competes with alternatives like Paycor, ADP, Paychex Flex, and OnPay, earning high ratings for user satisfaction. User reviews consistently praise Gusto for its intuitive payroll services, seamless onboarding, strong customer support, and valuable pro tips.