Table of Contents

Our Verdict

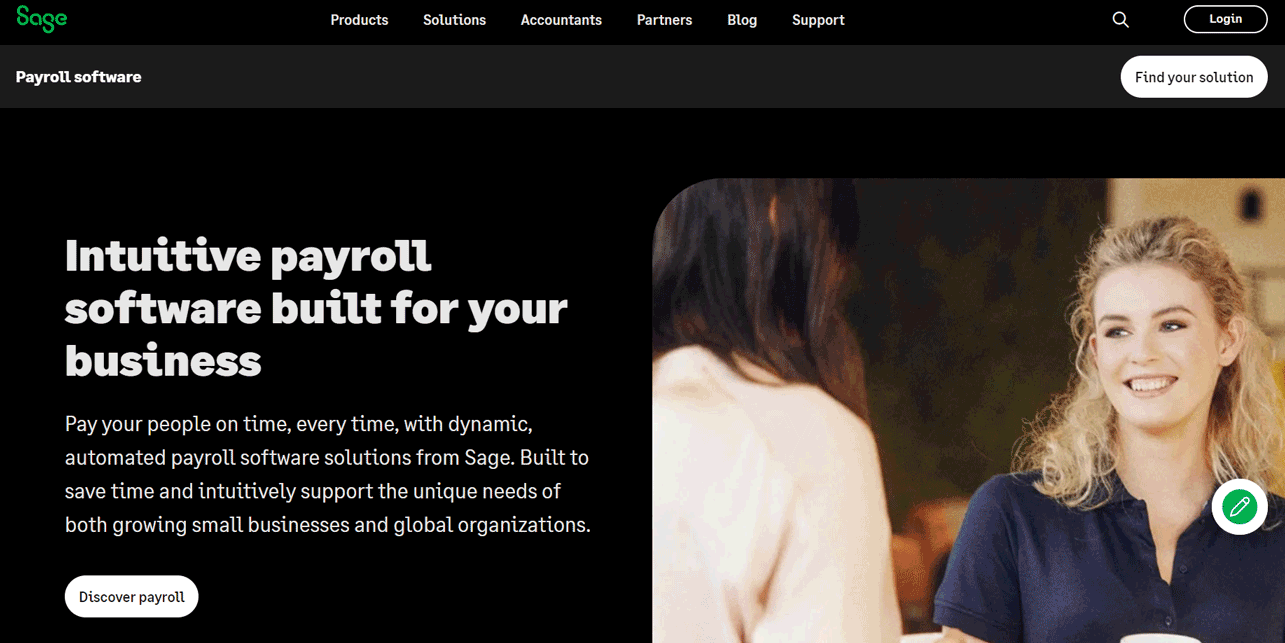

Sage Payroll Software stands out as a leading provider of cloud-based payroll services, catering to businesses of all sizes with its comprehensive range of features. Beyond its core payroll functions, Sage Payroll Software offers added advantages such as tax filing, seamless integration with accounting systems, and efficient management of HR data.

With its three distinct plan options, Sage Payroll Software ensures pricing flexibility, allowing you to select a plan that aligns with your unique requirements. Whether you’re a small startup or a large corporation, Sage Payroll Software provides the tools and flexibility needed to streamline payroll processes and drive operational efficiency.

If you’re seeking a robust payroll solution that goes beyond traditional payroll functions, Sage Payroll Software is undoubtedly a top choice. Explore the full potential of Sage Payroll Software and transform your payroll management with its cloud-based services and comprehensive features.

Pros

- Streamlines payroll tasks with its easy-to-use and navigable interface.

- Provides access to payroll information from any location due to its cloud-based nature.

- Highlights important tasks needing attention through its summary page.

- Generates diverse reports, aiding in payroll and accounting management.

- Corrects payslip errors automatically, enhancing accuracy.

- Offers remote access for managing payroll tasks and accessing documents outside the office.

Cons

- Limits functionality on smartphones, potentially impeding ease of use on mobile devices.

- Lacks certain functions compared to the desktop version, although efforts are underway to address this.

- Reports occasional delays in generating pensions modules, impacting user efficiency.

MORE >>> Square Payroll Software Review

Who Sage Payroll Software Is Best For

Sage Payroll Software is best for you if you:

- Need a comprehensive and user-friendly payroll management solution for your business

- Manage payroll tasks for small, medium, or large-sized enterprises and require flexible and scalable features

- Demand efficient tax filing, integration with accounting systems, and streamlined HR data management

- Seek a software provider offering exceptional customer support and managed payroll services

- Want the flexibility to choose from a range of payroll plans tailored to your specific business requirements

- Require the ability to generate various reports for efficient payroll and accounting management

- Aim to ensure accuracy and efficiency in payroll processing, including auto-adjustment features for error correction

Who Sage Payroll Software Isn't Right For

Sage Payroll Software may not be the best fit for you if you:

- Operate a very small business with only a few employees, as the features and pricing of Sage Payroll Software may be more suited for larger businesses.

- Prefer a more hands-on approach to payroll processing and do not require extensive automation features.

- Are seeking a cloud-based payroll software solution, as Sage Payroll Software may not offer the level of cloud integration or flexibility you desire.

- Prefer a payroll solution with full functionality accessible on smartphones for managing tasks on the go.

- Are accustomed to the desktop version of Sage and require specific features not yet available in the cloud version, despite ongoing improvements.

- Need a payroll system that consistently generates pensions modules without delays to maintain efficiency in managing employee benefits.

What Sage Payroll Software Offers

- Attendance management

- Employee Self Service Management

- HR & Payroll

- Payroll Management

- Recruitment Management

- Reimbursement Management

- Taxation Management

- Time & Attendance Management

- Arrears Calculation

- Data Security

- PF/ESIS Calculation

Sage Payroll Software Details

Attendance Management

Sage Payroll offers tools to efficiently manage employee attendance, including tracking working hours, leave, and absences. This feature helps businesses ensure accurate payroll processing and compliance with attendance policies.

Employee Self Service Management

HR & Payroll

Recruitment Management

This feature assists in managing the recruitment process, from job postings to candidate selection, helping businesses streamline their hiring procedures and maintain organized records of applicants.

Reimbursement Management

Sage Payroll facilitates the management of employee reimbursements, ensuring accurate tracking and processing of expenses, which is essential for maintaining financial transparency and compliance.

Taxation Management

The software includes features for managing various aspects of taxation, such as tax calculations, filings, and compliance with tax regulations, helping businesses stay on top of their tax responsibilities.

Time & Attendance Management

This feature enables businesses to track and manage employee work hours, attendance, and related data, providing insights into workforce productivity and facilitating accurate payroll processing.

Arrears Calculation

The software includes functionality for calculating and managing arrears, ensuring accurate accounting for any missed or overdue payments to employees.

Data Security

PF/ESIS Calculation

Sage Payroll includes features for managing Provident Fund (PF) and Employee State Insurance Scheme (ESIS) calculations, ensuring compliance with relevant regulations and accurate employee benefit calculations.

PRO TIPS >>> Best Payroll Software For Large Clients

Sage Payroll Software Pricing

The Sage Payroll software offers three distinct pricing tiers, each tailored to different business needs:

Payroll Essentials — £10/month

- This tier provides essential tools for running payroll, including employee self-service for payslips and P60s, automatic pension enrollment, and employee holiday tracking.

- Ideal for small teams, startups, and small businesses, offering a simple and affordable payroll solution.

Payroll Standard — £20/month

- Adds functionality such as a custom onboarding portal, workflow automation, tracking of all leave and absence types, and the ability to submit and approve employee expenses.

- Suited for SMBs with 10-50 employees, providing added value and functionality compared to the Essentials tier.

Payroll Premium — £30/month

- Offers advanced features for managing timesheets, overtime, project-based time tracking, detailed reports on timesheet status, and shift and schedule management.

- Recommended for businesses working on multiple projects simultaneously or running retail stores with employees working in shifts.

Where Sage Payroll Software Stands Out

Sage Payroll software stands out in several key areas, offering a comprehensive and reliable platform for various payroll needs. Here’s where Sage Payroll excels:

Comprehensive Payroll Solutions

Sage Payroll offers a range of payroll solutions tailored to meet specific business needs, including payroll essentials, standard, and premium plans. These plans provide essential tools for running payroll, custom onboarding portals, and advanced features for managing timesheets and overtime.

Employee Self-Service

The software provides employee self-service for payslips and P60s, allowing employees to access and manage their own payroll information, enhancing transparency and reducing administrative workload for HR staff.

Flexible Integration and Add-Ons

Allows integration with a range of other software, including accounting, HR management, time management, and payments. Offers a variety of add-on products related to accountancy and payroll, such as Recruit and hire, Worker’s comp, General Ledger, Tax credits, Time and attendance, HR compliance, 401(k), SSN verification, Payment options, HR data management, Section 125, ACA, Employee check, and W-2 view.

Scalability and Flexibility

Sage Payroll’s plans are designed to cater to businesses of varying sizes, from small teams to larger SMBs with 10-50 employees, providing scalable and flexible payroll solutions to accommodate evolving business needs.

Expert Sales Support

Similar to Liquid Web’s expertise in sales support, Sage Payroll offers guidance and support through its sales team, assisting users in making informed decisions about the best payroll solution for their specific requirements.

Where Sage Payroll Software Falls Short

Limited Customization for Small Businesses

Sage Payroll software may have limited customization options for small businesses with specific payroll needs. While it offers comprehensive payroll solutions, the level of customization available for smaller businesses may not be as extensive as some other payroll software providers, potentially limiting flexibility for unique payroll requirements.

Complexity for Beginners

Similar to Liquid Web’s advanced hosting solutions, Sage Payroll software may not be as beginner-friendly and may require a certain level of technical knowledge to fully utilize its features. This could pose a challenge for individuals or businesses with limited payroll management experience.

Limited Third-Party Integrations

Sage Payroll software may have a more limited range of third-party integrations compared to some other payroll software providers. Businesses heavily reliant on specific third-party applications may find the available integrations with Sage Payroll to be less extensive, potentially impacting workflow efficiency.

Limited Support for High-Volume Transactions

The software may have limitations in handling high-volume transactions or complex payroll scenarios, potentially impacting its suitability for businesses with extensive payroll requirements.

How to Qualify for Sage Payroll Software

To qualify for Sage Payroll Software, there are no specific qualifications or requirements. Sage Payroll Software is designed to cater to the payroll needs of businesses, ranging from small to medium-sized enterprises. The software offers a range of features tailored to streamline payroll processes, generate reports, ensure compliance, and provide cloud-based accessibility. It is suitable for businesses seeking efficient, compliant, and user-friendly payroll management solutions.

Sage Payroll Software does not have specific qualifications for users to meet. Businesses of varying sizes and needs can explore the software’s features and benefits to determine its suitability for their specific payroll requirements. For detailed information on Sage Payroll Software, including its features, pricing, and any specific requirements, it is recommended to visit the official Sage website or contact their sales team for assistance.

GET SMARTER >>> Gusto vs. Roll Payroll

Alternatives to Sage Payroll Software

Gusto

Gusto offers a range of payroll and HR solutions, with plans starting at $39 per month plus $6 per person. It provides features such as full-service payroll, health benefits administration, workers’ comp administration, and expert HR support.

QuickBooks Payroll

QuickBooks Payroll offers various payroll plans, with the Basic plan starting at $22.50 per month. It includes features such as automatic payroll tax calculations, direct deposit, and expert support.

ADP Workforce Now

ADP Workforce Now provides comprehensive payroll and HR solutions tailored to businesses of all sizes. Pricing is available upon request, and it offers features such as payroll processing, tax filing, time and attendance tracking, and benefits administration.

Paychex Flex

Paychex Flex offers scalable payroll and HR solutions, with pricing tailored to specific business needs. It provides features such as payroll processing, tax services, employee self-service, and HR compliance resources.

Customer Reviews

The reviews of Sage Payroll Software reflect a positive user experience, emphasizing its comprehensive features, ease of use, and value for businesses. The ratings of ⅘ provided by users on Capterra indicate high satisfaction with the software’s functionality, ease of use, and overall value for money. Additionally, the mention of helpful customer support further underscores the software’s ability to meet the needs of start-ups and SMEs, positioning it as a valuable tool akin to a digital CFO. Overall, the reviews and ratings showcase Sage Payroll Software as a reliable and effective solution for payroll management, particularly for businesses seeking comprehensive features and user-friendly functionality.

Pro Tips

Here are some pro tips for using Sage Payroll Software:

- Streamline Payroll Processes: Utilize the cloud-based software to streamline and automate payroll processes, including payslip generation and tax calculations, to save valuable time and effort.

- Ensure Compliance with Auto-Enrolment: Leverage the auto-enrolment functionality to ensure compliance with workplace pension scheme requirements, managing employee enrollment and providing necessary payments and data.

- Access Anytime, Anywhere: Take advantage of the cloud-based nature of Sage Payroll Software, allowing access online 24/7 for convenient payroll management.

- Create Employee Records Efficiently: Utilize the software to quickly and easily create employee records and manage payments, deductions, and tax calculations in a few simple steps.

- Take Advantage of Customer Support: Make use of the helpful resources, quick-start guides, and customer support available to ensure accurate and compliant payroll processing.

Recap

Sage Payroll Software is a comprehensive and user-friendly tool for effectively managing payroll processes. With its cloud-based accessibility, it offers seamless automation of payslip generation, tax calculations, and auto-enrolment compliance. The software’s efficient employee record creation and reliable customer support make it a valuable asset for businesses seeking to streamline payroll operations and ensure compliance with ease.

Overall, Sage Payroll Software emerges as a reliable solution for businesses looking for a comprehensive and efficient payroll management system.