Table of Contents

Our Verdict

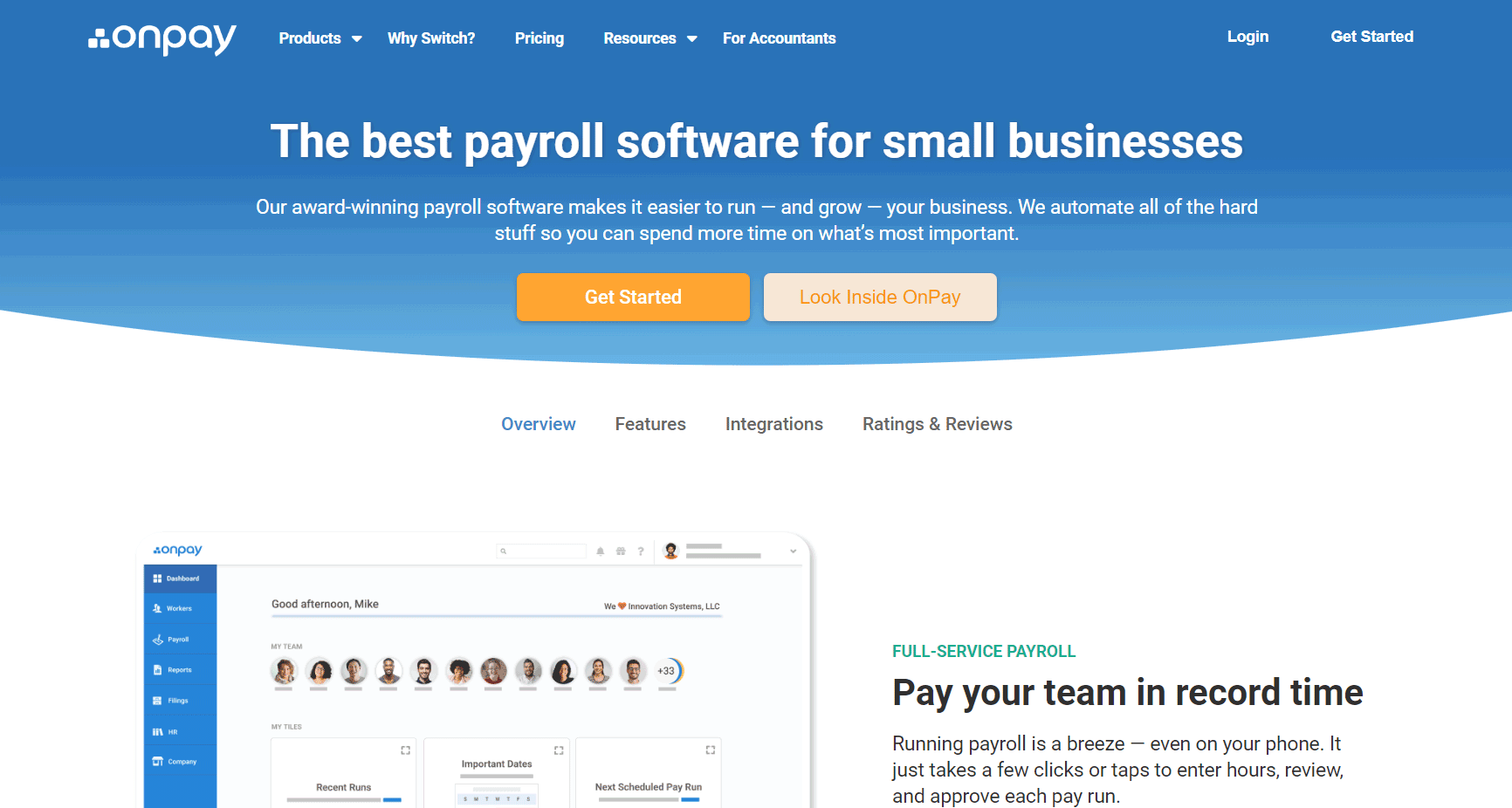

OnPay payroll software emerges as a reliable and efficient solution for businesses seeking to streamline their payroll processes effectively. Its accurate tax calculations, seamless direct deposit functionality, and transparent pricing structure contribute to its reputation as a trusted payroll solution for small to medium-sized businesses. Overall, OnPay stands out as a dependable ally in optimizing payroll operations and driving organizational efficiency.

Pros

- Offers an intuitive and easy-to-navigate interface, making it simple for users to manage payroll tasks efficiently.

- Handles all aspects of payroll taxes, including calculations, filings, and payments, ensuring compliance with federal, state, and local regulations.

- Provides flexible payment options, allowing businesses to pay employees through direct deposit or by printing and mailing physical pay checks, providing convenience for both employers and employees.

- Allows employees to access their pay stubs, W-2 forms, and other payroll documents online, reducing administrative burden for HR staff through the self-service portal.

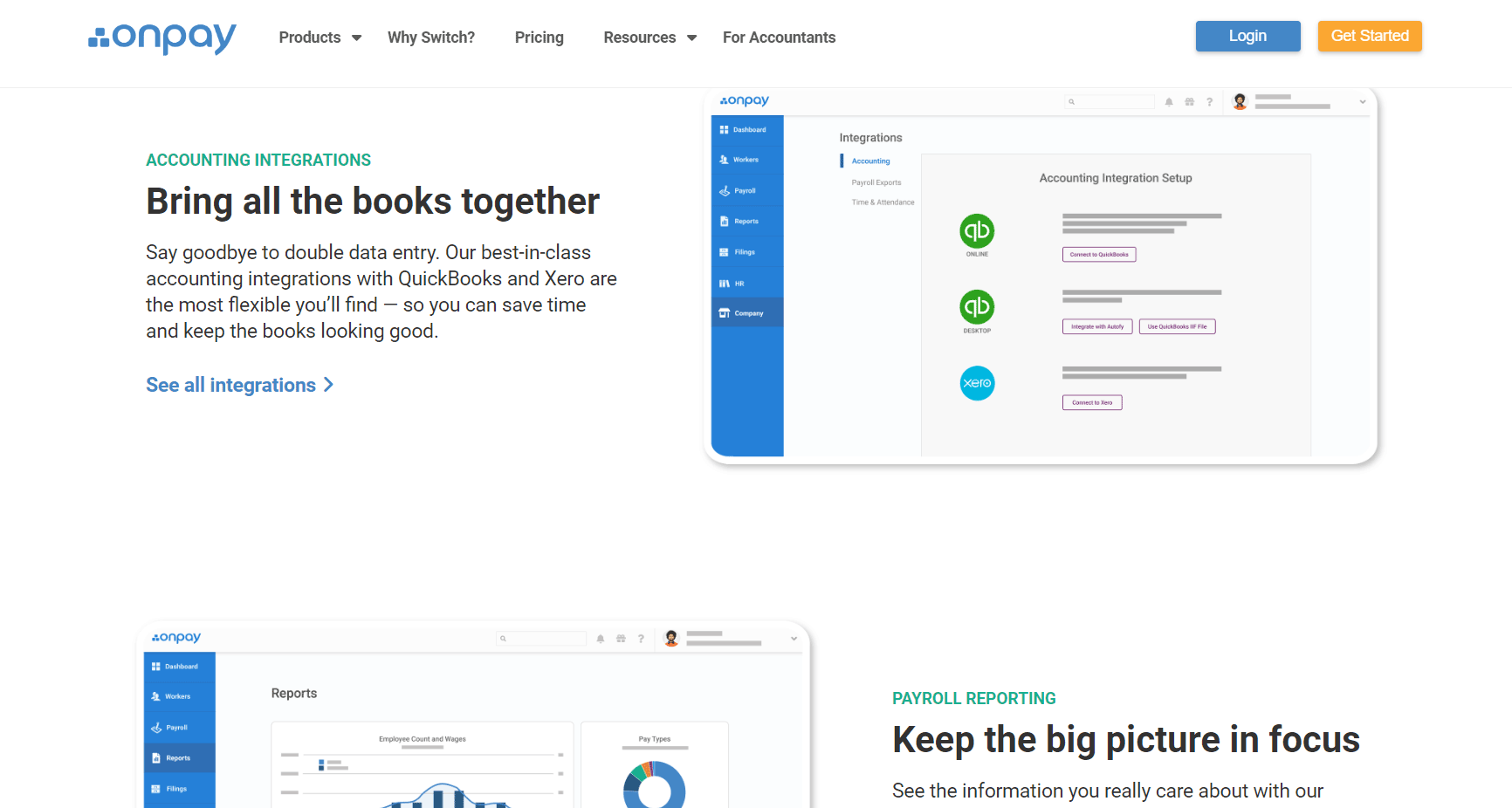

- Integrates seamlessly with popular accounting software like QuickBooks and Xero, streamlining the reconciliation of payroll data with financial records.

Cons

- Lacks certain advanced features that larger enterprises or businesses with complex HR needs require, potentially limiting its suitability for certain organizations.

- Does not fully cater to the specific needs of industries with unique HR requirements, such as healthcare or manufacturing, potentially lacking certain industry-specific features or compliance support.

- Has learning curve, particularly for new users when initially setting up the software or navigating its features, requiring time for training and on boarding.

MORE >>> DayForce HCM Payroll Software Review

Who OnPay Payroll Software Is Best For

Consider OnPay payroll software as your best option if you:

- Desire a seamless payroll processing that can help you to easily calculate wages, deductions, and taxes accurately.

- Prefer Convenient Payment Options whether to directly deposit payments to your employees’ bank accounts or opt for printing and mailing physical pay checks.

- Want to handle all aspects of payroll taxes, including calculations, filings, and payments, ensuring compliance with federal, state, and local tax regulations with no hassle.

- Prefer software that give your employees access to their pay stubs, W-2 forms, and other payroll-related documents through the self-service portal and thereby reducing your administrative workload.

Who OnPay Payroll Software Isn’t Right For

Look for other software aside from OnPay payroll especially if you operate:

- Large enterprises with extensive employee bases and intricate organizational structures.

- Businesses with unique HR requirements, such as healthcare, manufacturing, or government contracting.

- Businesses that relies heavily on integration with multiple systems and platforms.

- Companies with operations or employees in multiple countries outside USA.

What OnPay Payroll Software Offers

- Payroll Processing: Easily process payroll with accurate calculations of wages, deductions, and taxes.

- Tax Management: Handle payroll taxes, including calculations, filings, and payments, to ensure compliance with federal, state, and local regulations.

- Payment Options: Choose from flexible payment methods, including direct deposit or physical paychecks, to suit your employees’ preferences.

- Employee Self-Service Portal: Empower employees to access their pay stubs, W-2 forms, and other payroll documents online, reducing administrative burden for HR staff.

- Benefits Administration: Customize benefits such as health insurance and retirement plans to meet the specific needs of your workforce.

- Integration: Seamlessly integrate with popular accounting software like QuickBooks and Xero for easy reconciliation of payroll data with financial records.

- Mobile Accessibility: Access payroll information, process payroll, and manage HR tasks conveniently on the go with OnPay’s mobile app.

- Compliance Assistance: Stay compliant with labor laws and regulations with OnPay’s compliance assistance and support.

- Customer Support: Receive dedicated customer support via phone, email, or live chat to assist with any questions or issues you may encounter.

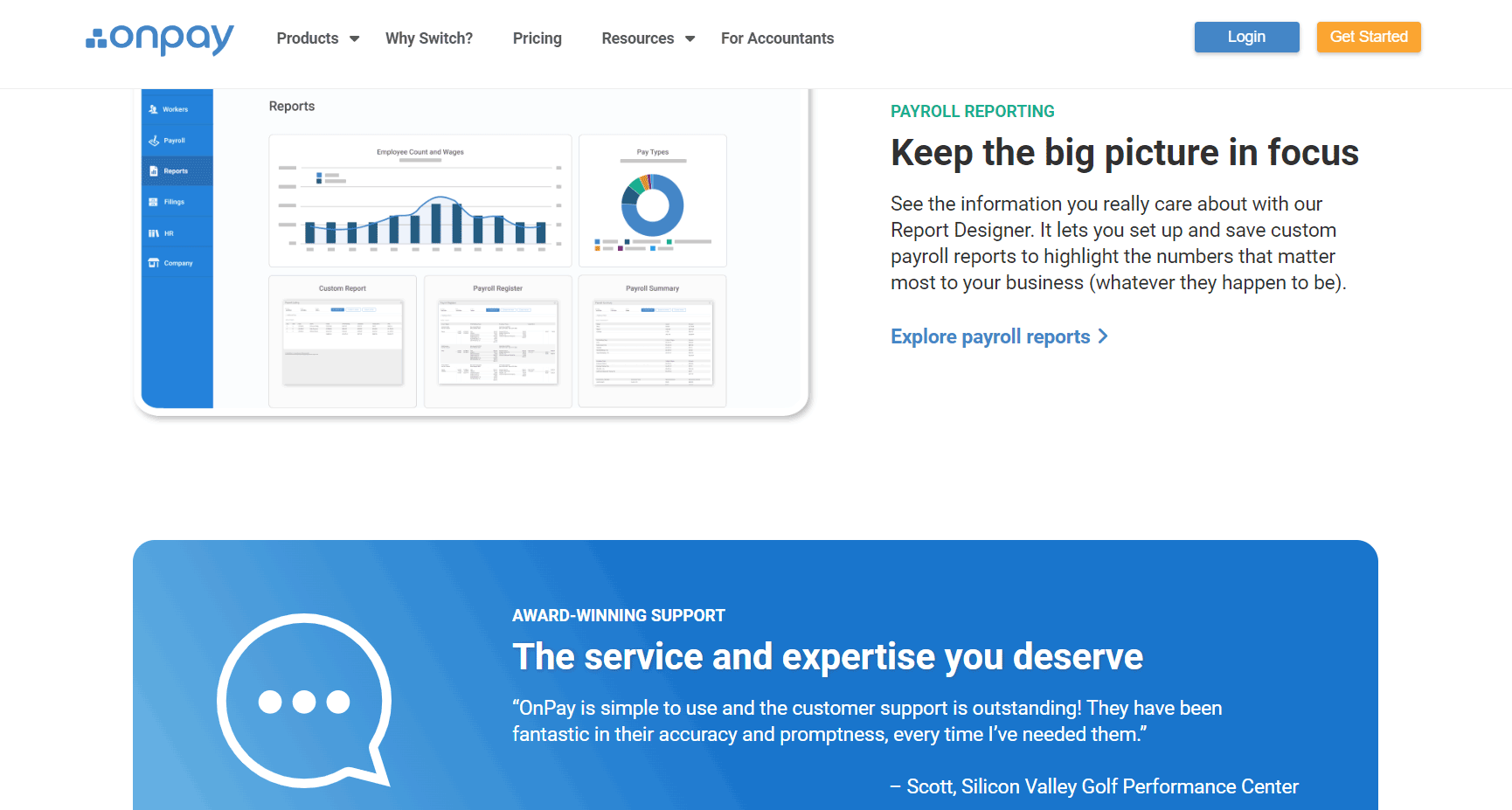

- Reporting: Generate detailed payroll reports to track expenses, monitor trends, and analyze payroll data for better decision-making.

- Time Tracking: Monitor employee hours, manage time-off requests, and track overtime accurately to streamline workforce management.

- Document Management: Store and organize employee records, contracts, and other HR documents securely within the OnPay platform.

OnPay Payroll Software Details

Here’s what OnPay payroll software offers directly to you:

Effortless Payroll Processing

With OnPay, you can effortlessly process your payroll, ensuring accurate calculations of wages, deductions, and taxes every time, saving you time and reducing errors.

Flexible Payment Options

Choose how you pay your employees with OnPay—whether through direct deposit to their bank accounts or by printing and mailing physical pay checks—providing flexibility and convenience for both you and your team.

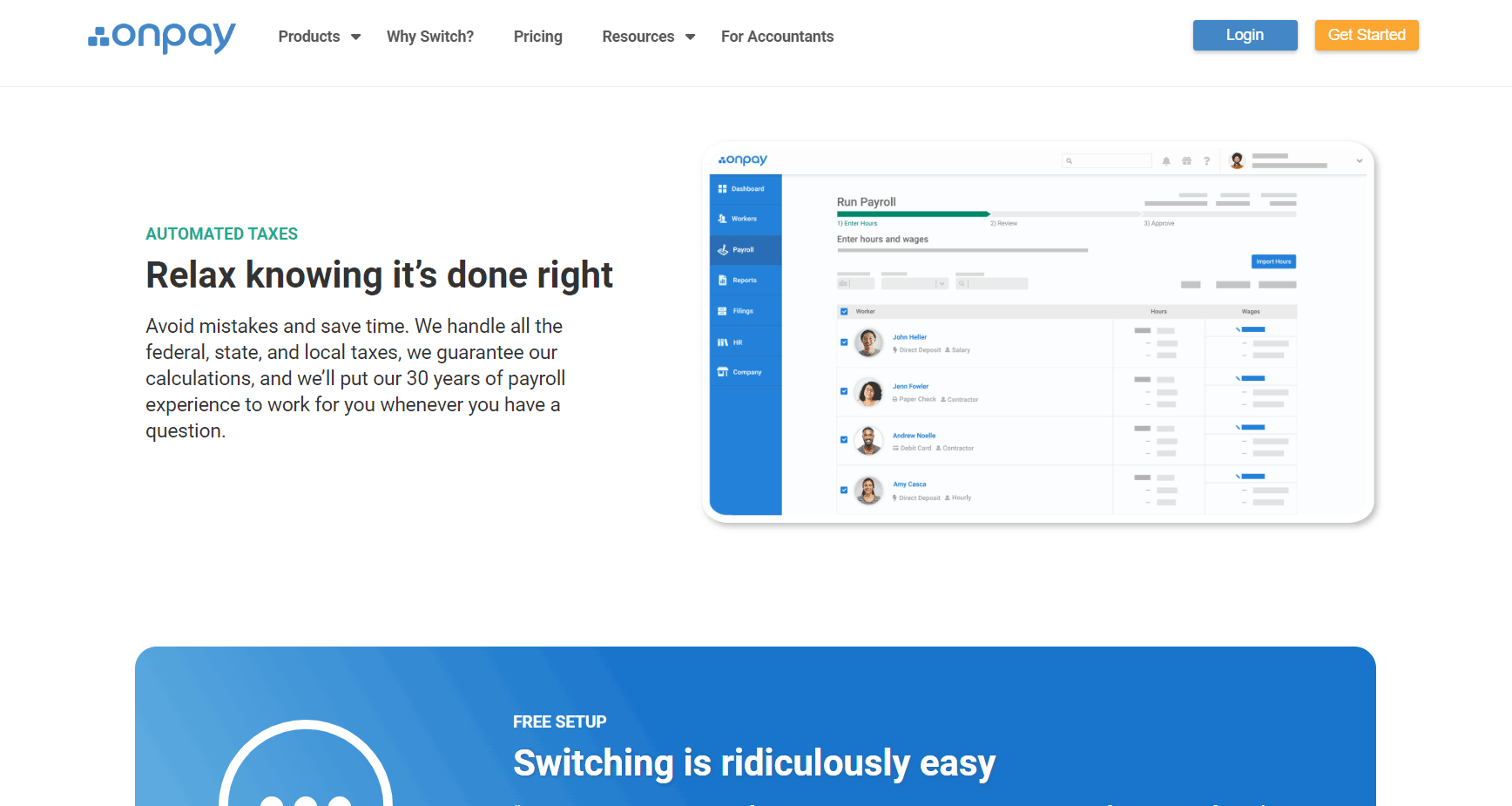

Tax Relief

Let OnPay handle all your payroll tax needs, from calculations to filings and payments, ensuring compliance and relieving you of the burden of managing complex tax regulations.

Empower Your Team

Give your employees access to their pay stubs, W-2 forms, and other payroll documents through OnPay’s self-service portal, empowering them and saving you time on administrative tasks.

Tailored Benefits Administration

Customize benefits such as health insurance and retirement plans to suit your business needs with OnPay’s benefits administration services, providing tailored solutions for your team.

Track Time Efficiently

Monitor employee hours, manage time-off requests, and accurately track overtime with OnPay’s time tracking features, allowing you to effectively manage your workforce.

Streamlined HR Tools

Utilize OnPay’s HR tools for employee profiles, document storage, and compliance assistance to streamline your human resources management, making it easier to maintain employee records and ensure compliance.

Seamless Integration

Integrate OnPay seamlessly with your accounting software like QuickBooks or Xero for easy payroll data reconciliation, ensuring smooth data flow between systems.

Stay Connected Anywhere

Access payroll information, process payroll, and manage HR tasks from anywhere with OnPay’s convenient mobile app, providing flexibility and accessibility for busy business owners and managers.

Dedicated Support

Count on OnPay’s dedicated customer support team to assist you with any questions or issues you may have via phone, email, or live chat, ensuring you have the support you need when you need it.

PRO TIPS >>> SurePayroll Payroll Software Review

Where OnPay Payroll Software Stand Out

Simplified Payroll Processing

With OnPay, calculating wages, deductions, and taxes becomes a breeze. Its intuitive tools and easy-to-follow workflows make it simple for businesses like yours to manage payroll accurately, saving you time and minimizing errors.

Comprehensive Tax Management

Say goodbye to tax headaches with OnPay’s comprehensive tax management services. They handle everything from calculating payroll taxes to filing forms and making payments, ensuring you stay compliant with federal, state, and local regulations without the stress.

Employee Self-Service Portal

OnPay empowers your team with a self-service portal, giving them instant access to pay stubs, W-2 forms, and other payroll documents online. This means less paperwork for your HR staff and more control over their finances for your employees, all with secure, user-friendly access.

Customizable Benefits Administration

Tailor your employee benefits with OnPay’s customizable administration services. Whether it’s health insurance or retirement plans, you can design packages that suit your team’s needs, boosting satisfaction and retention rates.

Integration with Accounting Software

Seamlessly sync your payroll data with accounting software like QuickBooks and Xero with OnPay’s integration features. This ensures smooth data transfer, fewer errors, and better financial reporting, giving you a clear picture of your business finances.

Mobile Accessibility

Manage payroll tasks anytime, anywhere with OnPay’s mobile app. Whether you’re on the road or working remotely, you can process payroll and handle HR tasks right from your smartphone or tablet, ensuring flexibility and productivity on the go.

Exceptional Customer Support

Need help? OnPay’s dedicated support team is just a call, email, or chat away. Whether you have questions about the software or need assistance with payroll regulations, their knowledgeable team is there to provide prompt and helpful assistance, ensuring a smooth experience for you and your team.

Where OnPay Payroll Software Fall Short

Here are areas where OnPay payroll software may fall short:

Limited Advanced Features

While OnPay excels in simplifying payroll for businesses of various sizes, it may lack certain advanced features required by larger enterprises or those with complex HR needs. If your business requires highly specialized functionalities, you may find OnPay’s feature set somewhat limited. Consider your specific requirements carefully to ensure OnPay aligns with your business goals and objectives.

Industry-Specific Needs

Businesses operating in industries with unique HR requirements, such as healthcare or manufacturing, should be aware that OnPay may not fully cater to their specific needs. Certain industry-specific features or compliance support may be lacking, potentially impacting your ability to manage HR tasks effectively. Evaluate whether OnPay can adequately address the specific challenges and requirements of your industry before making a decision.

International Support

If your business operates internationally or has employees in multiple countries, be aware that OnPay may not provide comprehensive support for global operations. While OnPay’s features and services are tailored primarily for U.S.-based businesses, companies with international operations may need to explore alternative solutions that offer broader support for global payroll and compliance requirements.

Scalability Constraints

While OnPay is well-suited for small to medium-sized businesses, larger enterprises or those experiencing rapid growth may find its scalability limited. As your business expands, you may outgrow OnPay’s capabilities, necessitating a transition to a more scalable payroll solution. Consider your long-term growth plans and scalability requirements when evaluating OnPay as a payroll solution.

Mobile App Limitations

While OnPay offers a mobile app for convenient access to payroll information and HR tasks, some users may find its functionality limited compared to the desktop version. If you primarily rely on mobile devices for managing payroll and HR tasks, consider whether OnPay’s mobile app meets your needs or if you may encounter usability issues that could impact your experience.

Learning Curve for New Users

It’s important to note that OnPay may have a learning curve, particularly for new users when initially setting up the software or navigating its features. Businesses may need to invest time in training and onboarding to ensure that their team can effectively use the software. Be prepared to provide adequate support and resources to facilitate a smooth transition to OnPay for your team.

How to Qualify and Apply For OnPay Payroll Software

Qualifying for and applying to use OnPay payroll software involves several straightforward steps:

- Assess Your Payroll Needs: Before applying, assess your business’s payroll needs, including the number of employees, frequency of payroll processing, and any specific payroll requirements or challenges you may have.

- Check Eligibility: Ensure that your business meets OnPay’s eligibility criteria. OnPay primarily serves small to medium-sized businesses, so confirm that your organization falls within this category.

- Research Pricing Plans: Explore OnPay’s pricing plans to determine which option best suits your budget and payroll needs. Consider factors such as the number of employees you have and the features included in each plan.

- Schedule a Demo or Consultation: Reach out to OnPay to schedule a demo or consultation. This will allow you to learn more about the software’s features and capabilities and ask any questions you may have about the application process.

- Gather Necessary Information: Before applying, gather relevant information about your business, such as company details, employee information, and current payroll processes. Having this information ready will expedite the application process.

- Complete the Application Form: Once you’re ready, proceed with completing the application form on OnPay’s website or through a representative. Provide accurate information to ensure a smooth application process.

GET SMARTER >>> Sage Payroll Software Review

Alternatives to OnPay Payroll software

Gusto

Gusto provides a comprehensive payroll solution with features for payroll processing, benefits administration, compliance, and employee self-service. It offers a user-friendly interface and integrates with various accounting and HR software.

QuickBooks Payroll

QuickBooks Payroll integrates seamlessly with QuickBooks accounting software and offers features for payroll processing, tax calculations, and employee management. It’s suitable for small businesses looking for an integrated payroll solution.

Paychex Flex

Paychex Flex is a comprehensive payroll and HR solution offering features such as payroll processing, tax services, benefits administration, and time and attendance tracking. It caters to businesses of all sizes, from startups to large enterprises.

Paycor

Paycor provides payroll and HR solutions for small to medium-sized businesses, offering features such as payroll processing, tax compliance, benefits administration, and employee on boarding.

Zenefits

Zenefits offers an all-in-one HR platform that includes payroll processing, benefits administration, time tracking, and compliance tools. It’s suitable for small to medium-sized businesses looking for a comprehensive HR solution.

Customer Reviews

Customer reviews of OnPay payroll software are generally positive, with high ratings across various platforms including BBB and Trustpilot. Users appreciate OnPay’s user-friendly interface, ease of use, and comprehensive payroll features, making it a popular choice among small to medium-sized businesses. Positive feedback highlights OnPay’s accurate tax calculations, seamless direct deposit functionality, and responsive customer support. Additionally, users praise OnPay’s affordability and transparent pricing structure, with no hidden fees or surprises. Overall, OnPay earns high marks for its reliability, efficiency, and commitment to customer satisfaction, solidifying its reputation as a trusted payroll solution for businesses.

Pro Tips

- Keep Payroll Data Updated: Ensure that employee information, tax withholdings, and other payroll data are kept accurate and up-to-date within the OnPay system to avoid errors and compliance issues.

- Set up Direct Deposit: Take advantage of OnPay’s direct deposit feature to streamline payments to employees, reducing paperwork and processing time while increasing convenience for your team.

- Utilize Self-Service Features: Encourage employees to use OnPay’s self-service portal to access their pay stubs, tax forms, and other payroll-related documents, reducing the burden on HR staff and empowering employees.

- Stay Informed About Tax Changes: Stay informed about changes to federal, state, and local tax laws and regulations that may affect payroll processing. OnPay may provide updates and resources to help you stay compliant.

- Take Advantage of Integrations: Explore integrations with other business tools and systems to streamline processes and improve efficiency. OnPay integrates with various accounting, HR, and time tracking software to simplify data management.

- Review Reports Regularly: Regularly review payroll reports generated by OnPay to ensure accuracy and identify any discrepancies or trends that may require attention.

- Plan for Payroll Processing: Establish a schedule and process for payroll processing to ensure that payments are made accurately and on time. Consider setting reminders and deadlines to avoid last-minute rushes.

- Utilize Customer Support: Don’t hesitate to reach out to OnPay’s customer support team for assistance with any questions or issues you may encounter. They are there to help you navigate the software and address any concerns effectively.

Recap

In conclusion, OnPay payroll software is your reliable and user-friendly ally in streamlining your payroll processes. You’ll find consistent praise from users like you, highlighting its ease of use, affordability, and accurate payroll calculations.

OnPay stands out as a convenient choice for efficient payroll management, ensuring compliance with tax regulations and offering seamless integrations to suit your business needs. Whether you’re a small start-up or a larger enterprise, OnPay caters to businesses of all sizes. Overall, it’s a highly recommended solution for organizations seeking a straightforward and cost-effective payroll solution.