Table of Contents

Our Verdict

SurePayroll is an online payroll service, specifically tailored for small businesses, and it’s part of the Paychex family. The best part about it is its simplicity and affordability. If you run a small business, you may probably appreciate how easy it is to use. You don’t need to be a payroll expert to navigate through it.

One of the major perks is that it’s cloud-based. This allows you to handle your payroll from pretty much anywhere, as long as you’re connected to the internet. The interface is straightforward, which is fantastic for those who might not have a dedicated HR or payroll team.

One feature that really stands out is the automatic payroll tax calculation and filing. It saves a ton of time and helps avoid errors, which is a huge plus. Plus, it has a mobile app, which adds another layer of convenience. You can manage everything on the go.

With no doubt, SurePayroll is a solid choice for small businesses looking for an easy-to-use and flexible payroll service. It’s got a good range of features without being overly complicated or expensive.

Pros

- Simplify your payroll process with an easy-to-use interface, perfect for small business owners without a dedicated HR team.

- Access your payroll information from anywhere with its cloud-based system, giving you flexibility and mobility.

- Save time with automatic payroll tax calculations and filings, reducing the risk of errors.

- Utilize its mobile app to manage payroll on the go, offering added convenience.

- Benefit from its affordability, making it a cost-effective solution for small businesses.

- Enjoy a range of services, including direct deposit, employee self-service, and health insurance options.

Cons

- Encounter limited customization options, which might not suit more complex payroll needs.

- Face occasional customer support delays, which can be frustrating if you need immediate assistance.

- Experience additional fees for some services, which can add up over time.

- Deal with limited integration options with other software, which may not fit well with your existing tools.

- Find the mobile app lacks some features available on the desktop version, which can be inconvenient.

- Notice that advanced reporting capabilities are not as robust as some competitors, potentially limiting your analytics.

MORE >>> Onpay Payroll Software Review

Who SurePayroll Payroll Software Is Best For

Choose SurePayroll if you:

- Run a small business and need a simple, user-friendly payroll system without complex features.

- Prefer an affordable solution that offers basic payroll functions without breaking the bank.

- Want the flexibility to manage payroll from anywhere, thanks to its cloud-based system.

- Appreciate automation, as it handles payroll tax calculations and filings automatically, saving you time and reducing errors.

- Need a mobile app to manage payroll on the go, providing added convenience for busy business owners.

Who SurePayroll Payroll Software Isn't Right For

Avoid SurePayroll if your business:

- Requires extensive customization, as its features may be too basic for more complex payroll needs.

- Need advanced reporting capabilities, since it might not offer the robust analytics some other systems provide.

- Rely on integrating with a wide range of third-party software, as it has limited integration options that might not fit your existing tools.

- Expect comprehensive customer support around the clock, as response times can be slower than needed.

- Require a payroll system with a broad array of advanced features, as it may not have all the functionalities that more complex setups offer.

- Need a system that handles international payroll or multi-state compliance in a more advanced way.

What the SurePayroll Payroll Software Offers

- Automated Payroll Processing: You can set up automatic payroll runs, which means once the initial setup is complete, the software can handle regular payrolls with minimal input.

- Tax Calculations and Filing: SurePayroll automatically calculates federal, state, and local taxes, and handles filing on your behalf. This feature reduces the risk of errors and ensures compliance with tax regulations.

- Direct Deposit and Checks: Employees can choose between direct deposit or receiving paper checks. SurePayroll provides flexibility in how employees get paid.

- Mobile App: The mobile app allows business owners to manage payroll from their smartphones, making it convenient to handle payroll tasks on the go.

- Employee Self-Service: Employees have access to their own portal where they can view pay stubs, W-2s, and update personal information.

- New Hire Reporting: The software assists in reporting new hires to the relevant government agencies, ensuring compliance with employment laws.

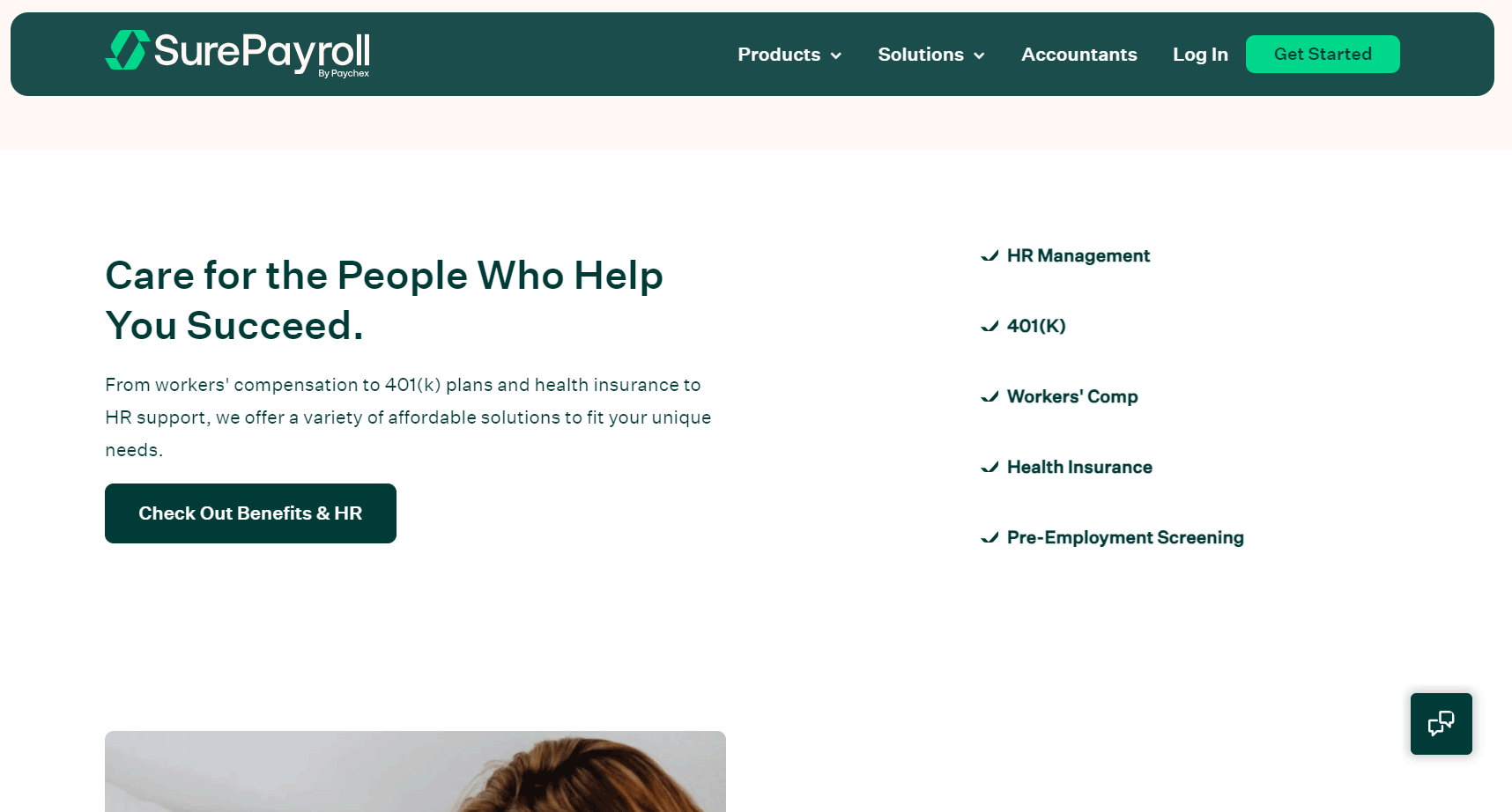

- Benefits Integration: SurePayroll offers some level of benefits administration, including 401(k) plans, health insurance, and workers’ compensation.

- Customer Support: SurePayroll provides customer support through phone, email, and chat, which can be crucial for resolving any issues that arise.

SurePayroll Payroll Software Details

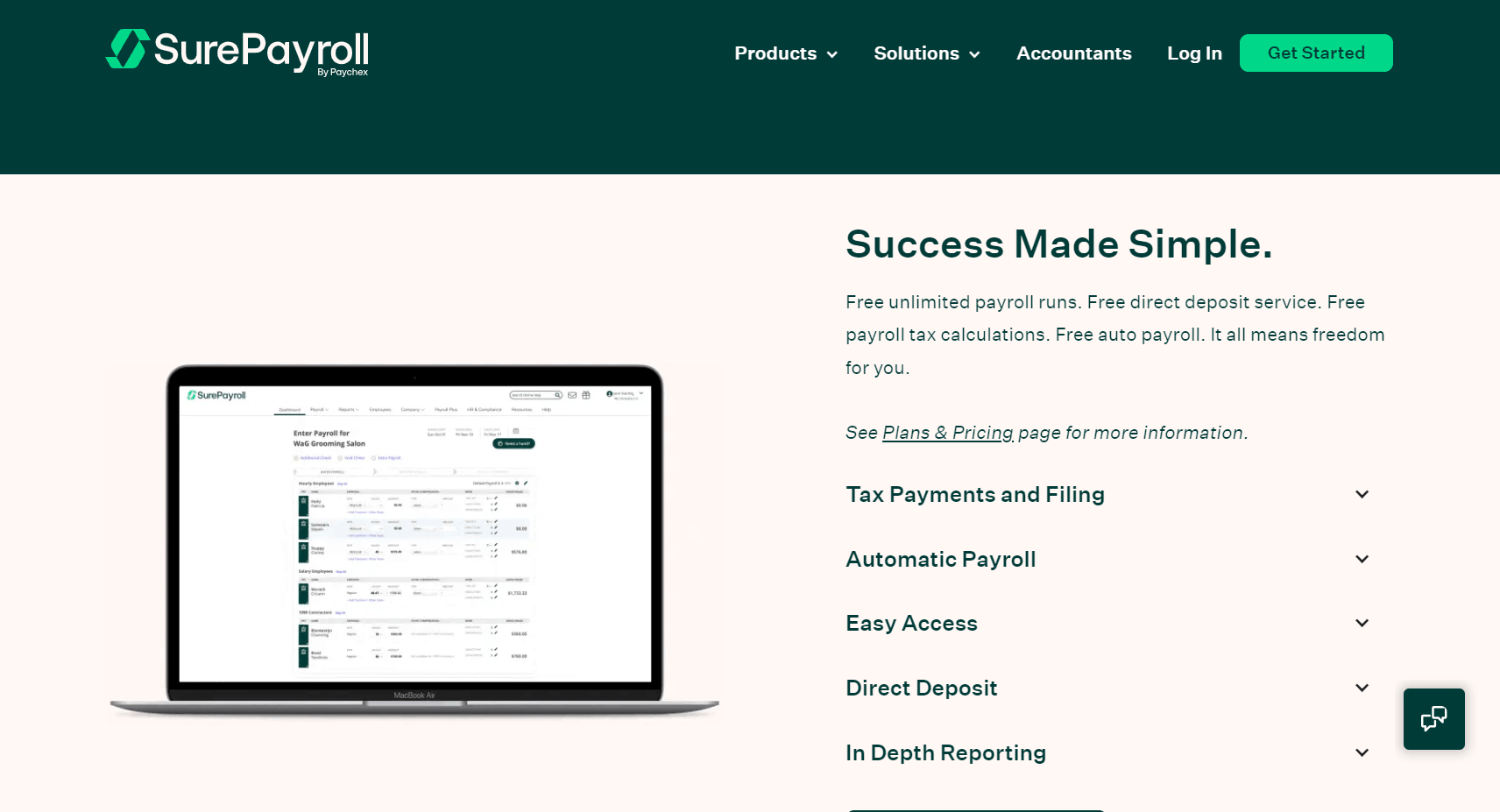

- Use SurePayroll’s easy-to-navigate dashboard, which is designed to help you manage payroll tasks effortlessly and without confusion.

- Set up your account quickly by providing basic details about your business and employees, making the initial setup process straightforward.

- Process payroll rapidly; just enter the required information, review a summary, and submit. The system can automatically handle calculations, taxes, and payments.

- Rely on SurePayroll to manage all payroll-related calculations and tax filings, ensuring accuracy and saving you time.

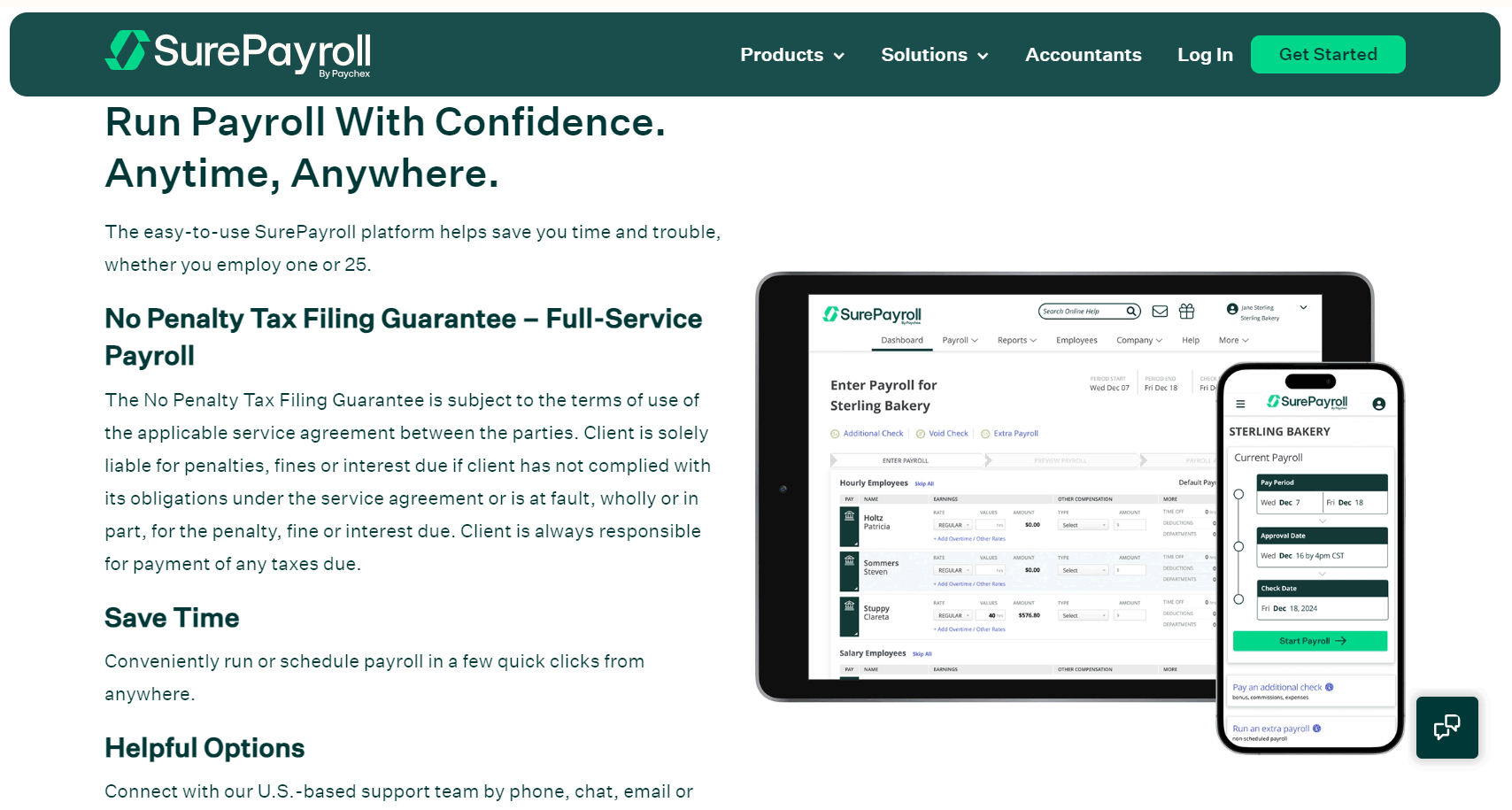

- Access the mobile app on both iOS and Android devices. The app lets you perform the same tasks as the desktop version, such as running payroll and checking reports.

- Enable your employees to use the self-service portal to view their pay stubs, access tax forms, and update their personal information, which reduces your administrative workload.

- Benefit from the convenience of managing payroll and employee information from anywhere, whether through the desktop or mobile app, ensuring flexibility and efficiency in your operations.

Where SurePayroll Payroll Software Stands Out

Ease of Use

SurePayroll is crafted to be user-friendly, so even if you have little or no experience with payroll systems, you won’t struggle. The interface is designed to be clean and simple, which means you won’t have to wade through confusing menus or complex options. Everything is laid out in a straightforward manner, making it easy to process payroll quickly and efficiently without needing extensive training.

Automation

One of the standout features of SurePayroll is its ability to automate tasks. This includes running payroll and handling tax filings automatically. By automating these processes, you save a significant amount of time and reduce the chance of making errors. Automation also helps ensure that you stay compliant with tax regulations, as the system handles all the necessary calculations and submissions for you.

Affordability

When it comes to cost, SurePayroll is quite competitive. It offers a good range of features without being overly expensive, which makes it an appealing choice if you’re running a small business and are mindful of your budget. Compared to other payroll services that might charge higher fees, SurePayroll provides a cost-effective solution while delivering solid functionality.

Mobile Accessibility

The SurePayroll mobile app is a strong feature, giving you almost the same capabilities as the desktop version. This means you can manage payroll, check reports, and perform other tasks directly from your smartphone or tablet. For busy business owners who are often on the go, this flexibility is incredibly valuable, allowing you to stay on top of payroll activities no matter where you are.

Customer Service

SurePayroll is well-regarded for its customer service. The support team is both knowledgeable and responsive, which is essential when you encounter payroll issues or have questions. Having reliable customer service means that you can get help quickly and efficiently, ensuring that any problems are resolved promptly and that you can keep your payroll running smoothly.

Where SurePayroll Payroll Software Falls Short

Limited Customization

SurePayroll, while user-friendly, doesn’t provide the same level of customization as some more advanced payroll systems. If your business has specific payroll needs or requires tailored solutions—such as unique pay structures or intricate reporting formats—you might find SurePayroll’s options somewhat restrictive. It’s designed to cover general payroll functions well but may not adapt easily to highly specialized requirements.

Reporting Capabilities

The reporting features in SurePayroll are somewhat basic, which could be a drawback for businesses that need more in-depth or customizable reports. For example, if you require detailed analytics or reports with specific parameters, SurePayroll may not offer the depth you need. Larger businesses or those with complex data reporting needs might find these features insufficient for their requirements.

Benefits Administration

It provides some tools for managing employee benefits, but it doesn’t offer the comprehensive benefits administration found in other more robust systems. If your business has an extensive benefits program—such as various types of health insurance, retirement plans, or employee perks—you may find SurePayroll’s capabilities lacking. You need to use additional software or tools to manage these benefits effectively.

Scaling Limitations

As your business grows, SurePayroll might not keep pace with your expanding needs. The software is well-suited for small to medium-sized businesses, but larger enterprises may find it lacking in advanced features and integrations. If your business scales up and requires more sophisticated payroll functionalities or the ability to integrate with other complex systems, SurePayroll might not offer the solutions you need.

How to Qualify for SurePayroll Payroll Software

- Assess Your Business Size: Determine if your business is small to medium-sized, as SurePayroll is best suited for these types of businesses.

- Review Payroll Needs: Ensure that your payroll requirements are straightforward since SurePayroll is ideal for simple payroll processes.

- Check Your Budget: Confirm that SurePayroll’s pricing fits within your financial plan, as it’s competitively priced for small businesses.

- Verify Compliance Needs: Ensure that your business needs align with SurePayroll’s capabilities in handling tax filings and compliance.

- Evaluate Software Integration: Assess if you need integrations with other systems, as SurePayroll may require additional software for broader HR functions.

- Consider User Experience: Make sure that you and your team are comfortable with a user-friendly interface, which SurePayroll offers.

GET SMARTER >>> Rippling Payroll Software Review

How to Apply for SurePayroll Payroll Software

- Visit the SurePayroll Website: Go to the SurePayroll website and click on the “Get Started” or “Sign Up” button.

- Provide Business Information: You need to provide basic information about your business, such as your business name, address, and employer identification number (EIN).

- Employee Information: Enter details about your employees, including names, social security numbers, and pay rates. You also need to provide information on how often they get paid.

- Bank Information: Provide your bank details to set up direct deposit and tax payments. This typically includes your bank account number and routing number.

- Setup Payroll Schedule: Choose how often you want to run payroll (weekly, bi-weekly, monthly, etc.).

- Review and Submit: Review the information you’ve entered to ensure accuracy. Once everything looks good, submit your application.

- Setup Assistance: SurePayroll offers setup assistance if needed. You can contact their customer service for help during the setup process.

Alternatives to SurePayroll Payroll Software

If SurePayroll doesn’t meet your needs, consider these alternatives:

Gusto

Known for its user-friendly interface and comprehensive features, Gusto offers payroll, benefits administration, and HR tools. It’s a bit more expensive than SurePayroll but provides more advanced features.

ADP

A well-known name in payroll, ADP offers a wide range of payroll and HR solutions. It’s more suitable for larger businesses due to its extensive features and higher cost.

Paychex

As the parent company of SurePayroll, Paychex offers more advanced payroll solutions. It’s ideal for medium- to large businesses needing robust payroll and HR tools.

QuickBooks Payroll

Integrated with QuickBooks accounting software, this solution is excellent for businesses already using QuickBooks. It offers comprehensive payroll features and seamless integration with accounting.

OnPay

Another affordable option for small businesses, OnPay provides payroll, HR, and benefits administration. It’s known for its simplicity and ease of use.

Customer Reviews

Customers often appreciate how easy the dashboard is to navigate. The setup process is straightforward, making it accessible even for people who don’t have experience with payroll systems. The ability to run payroll quickly and efficiently is another highlight; entering the data, reviewing, and submitting is streamlined, which saves time and reduces the likelihood of errors.

On the downside, some feedback points out that SurePayroll lacks advanced customization options. For businesses with unique or complex payroll needs, this could be a limitation. Additionally, the reporting features are described as somewhat basic, which may not meet the needs of larger companies that require more detailed or customizable reports.

The mobile app gets positive remarks for its functionality, allowing users to manage payroll and access information on the go. However, the software’s benefits administration capabilities may not be as comprehensive as other solutions, potentially requiring additional tools for complete benefits management. Overall, SurePayroll is valued for its ease of use and efficiency but has areas where more advanced features might be beneficial.

Pro Tips

- Take Advantage of the Free Trial: SurePayroll offers a free trial, so take advantage of this to see if it meets your needs before committing.

- Use the Mobile App: The mobile app is a great tool for managing payroll on the go. Make sure to download it and familiarize yourself with its features.

- Stay Updated on Tax Laws: While SurePayroll handles tax calculations and filings, stay informed about changes in tax laws that might affect your business.

- Regularly Review Payroll Reports: Even though SurePayroll automates many processes, regularly reviewing payroll reports can help catch any discrepancies or errors early.

- Utilize Employee Self-Service: Encourage your employees to use the self-service portal. This reduces the administrative burden on you and empowers employees to manage their own information.

- Explore Integration Options: If you’re using other business software (like accounting or HR software), check if SurePayroll integrates with them. This can streamline your operations and reduce manual data entry.

- Provide Feedback: SurePayroll values customer feedback. If you have suggestions for improvements or encounter issues, don’t hesitate to contact their support team. Your input can help them enhance their services.

Recap

If you’re running a small business and are looking for an affordable and easy-to-use payroll system, SurePayroll is a solid option. It offers automation for tasks like tax calculations, tax filings, and direct deposits. Plus, you can access it from your mobile device, which adds to the convenience. Many people appreciate its user-friendly interface and the reliable customer service.

However, think about what your business really needs. If you require a lot of customization, detailed reporting, or if you’re planning to scale up significantly, you might want to look at other options.

To qualify for SurePayroll, make sure you’re a small business with straightforward payroll requirements.

So, SurePayroll’s simplicity, affordability, and automated features make it a dependable choice for many small businesses, despite a few limitations.