Table of Contents

QuickBooks Payroll is a popular payroll software solution offered by Intuit, designed to help you manage the payroll processes for your business efficiently. As an extension of the widely-used QuickBooks accounting software, it promises to simplify payroll tasks, automate tax calculations, and provide seamless integration with other QuickBooks products.

However, before diving into this payroll solution, it’s crucial to understand its offerings, limitations, and potential pitfalls.

- Let’s Cut To The Chase!

- Now, Let’s Detail Things For You

- What’s The Catch With Quickbooks Payroll?

- What You Need To Know

- What Are Quickbooks Payroll’s Competitors Offering?

- What Affects Quickbooks Payroll’s Prices?

- What Affects Prices In The Payroll Software Industry Overall?

- How To Get The Best Deal With Quickbooks Payroll?

- Can You Afford Quickbooks Payroll’s Prices?

- Finally: Should You Buy Quickbooks Payroll Or Not?

Let's Cut To The Chase!

Buy If:

- ✅ You are already using QuickBooks for accounting and want seamless integration

- ✅ You need an easy-to-use payroll solution for a small business

- ✅ You want automated tax calculations and filings

- ✅ You are looking for features like same-day direct deposit and workers’ comp administration

MORE >>> Rippling Payroll Software Review

Don't Buy If:

- ❌ You are not based in the United States, Canada, United Kingdom, or Australia

- ❌ You need advanced HR features beyond basic payroll processing

- ❌ You have a large workforce and require more complex payroll management

- ❌ You are on a tight budget and can’t justify the additional cost on top of accounting software

The Bottom Line

🌐 QuickBooks Payroll is a solid choice for many businesses already invested in the QuickBooks ecosystem. However, its limitations in international availability, potential hidden costs, and basic HR features may make it less suitable for certain businesses. Carefully consider your specific needs and budget before committing to this payroll solution.

Now, Let's Detail Things For You

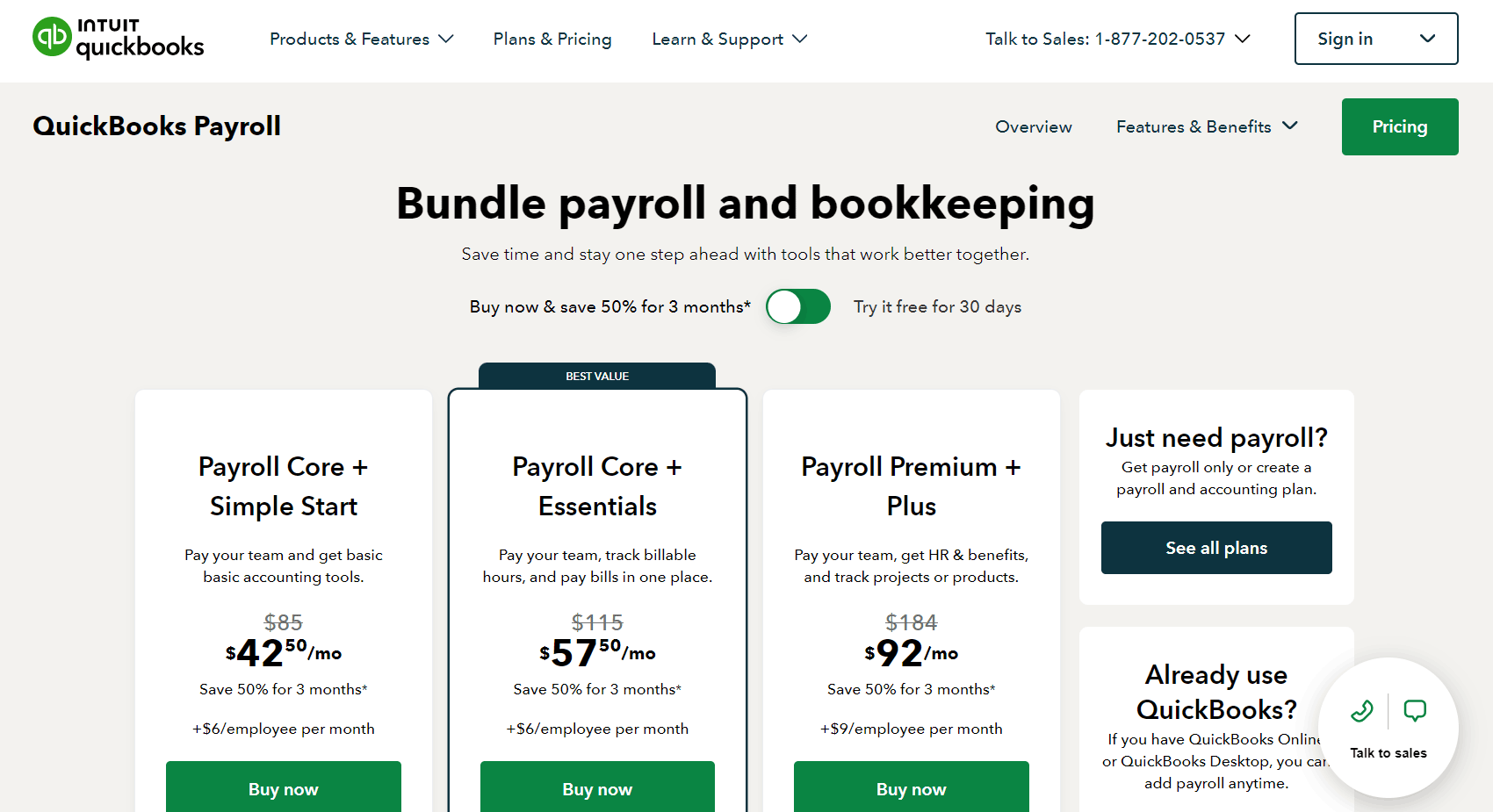

QuickBooks offers three pricing tiers for its payroll service: Core, Premium, and Elite. The Core plan is priced at $50 per month with an additional $6 per employee per month, the Premium plan costs $80 per month with an additional $9 per employee per month, and the Elite plan is priced at $125 per month with an additional $11 per employee per month.

The Core plan includes full-service payroll, automated taxes and forms, next-day direct deposit, and expert product support. The premium plan, which includes all Core features, adds same-day direct deposit, workers’ compensation administration, an HR support center, and mobile time tracking. The elite plan includes all premium features, along with 24/7 expert support, tax penalty protection up to $25,000 per year, a personal HR advisor, and expert setup.

Additional costs include state tax filing at $12 per month for each additional state for Core and Premium plans, fees for the 1099 E-File service, and varying premiums for workers’ compensation insurance.

What's The Catch With Quickbooks Payroll?

While QuickBooks Payroll offers a comprehensive range of features, there are several potential drawbacks you should consider. First, the service is only available in the United States, Canada, the United Kingdom, and Australia, so if you operate outside these countries, you need to seek alternative solutions or third-party integrations.

Second, the tiered pricing structure can be confusing, and the overall cost may not be immediately clear. The base price is just a starting point, with additional per-employee fees and potential charges for extra services like multi-state tax filing or 1099 e-filing.

Also, Intuit, QuickBooks’ parent company, is known for aggressive upselling, and you may feel pressured to upgrade to higher tiers or purchase additional services you may not need. QuickBooks Payroll subscriptions auto-renew, and cancellation policies can be strict.

The HR functionality offered by QuickBooks Payroll, especially in the higher tiers, is relatively basic compared to dedicated HR software solutions, which may be inadequate if your business requires more comprehensive HR management. The tax penalty protection included in the Elite tier comes with significant conditions, such as submitting tax notices within 15 days to be eligible for coverage and while QuickBooks Payroll integrates seamlessly with other QuickBooks products, it may not work well with non-Intuit software, which can be a limitation for your business or businesses which uses a mix of different software solutions.

Meanwhile, there are reports about unexpected fees, such as charges for adding or removing services, or fees for accessing historical data after canceling a subscription and despite promises of expert support, the quality of customer service can be inconsistent, especially for complex issues or during peak tax seasons.

What You Need To Know

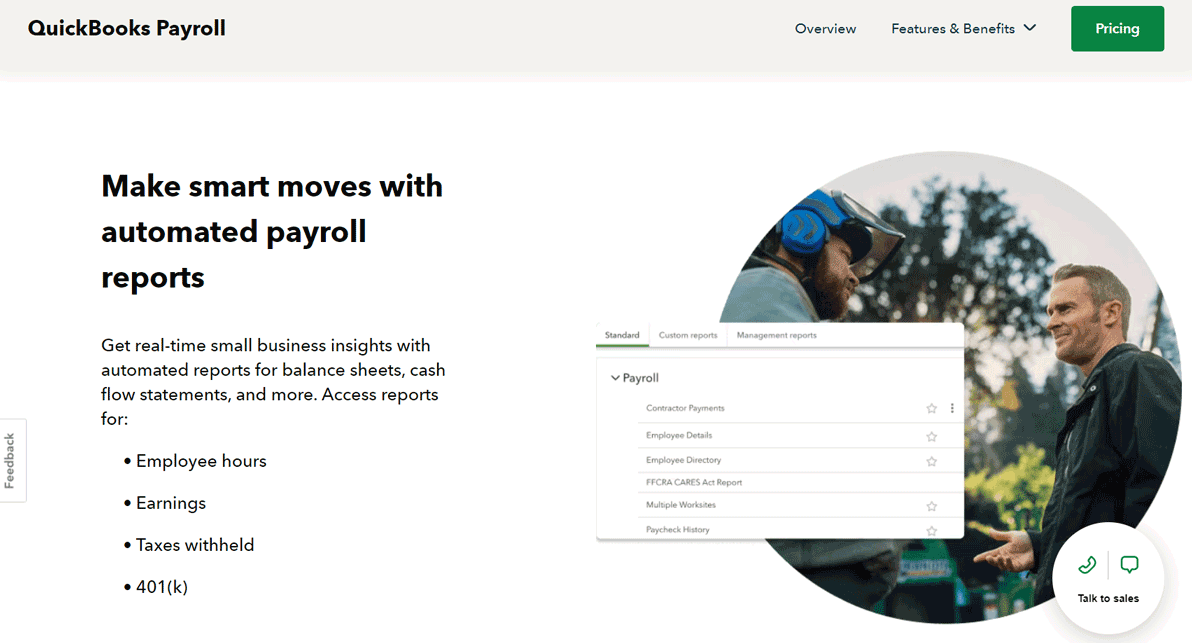

To make an informed decision about QuickBooks Payroll, you need to understand the details of its pricing model and feature offerings. The base price for each tier – Core, Premium, and Elite – is just the starting point; you must also add a per-employee fee to determine your total monthly cost. For example, with 10 employees and the Core plan, the monthly cost would be $50 for the base fee plus $60 for the employees, totaling $110. If your business operates in multiple states, there is an additional fee of $12 per month for each state beyond your primary state for the Core and Premium plans, which can quickly add up. Additionally, if you pay contractors, there is a fee of $6 per month for Core, $9 per month for Premium, and $11 per month for Elite.

QuickBooks often offers promotional discounts, such as 50% off for the first three months, but these are temporary and the price will increase after the promotional period. You can also get a lower bundled price if you use QuickBooks Online for accounting. For instance, Payroll Core bundled with QuickBooks Online Simple Start is $85 per month, compared to the usual $115 per month. QuickBooks provides a 30-day free trial for new customers, which allows you to test the software, but remember to cancel before the trial ends to avoid automatic billing.

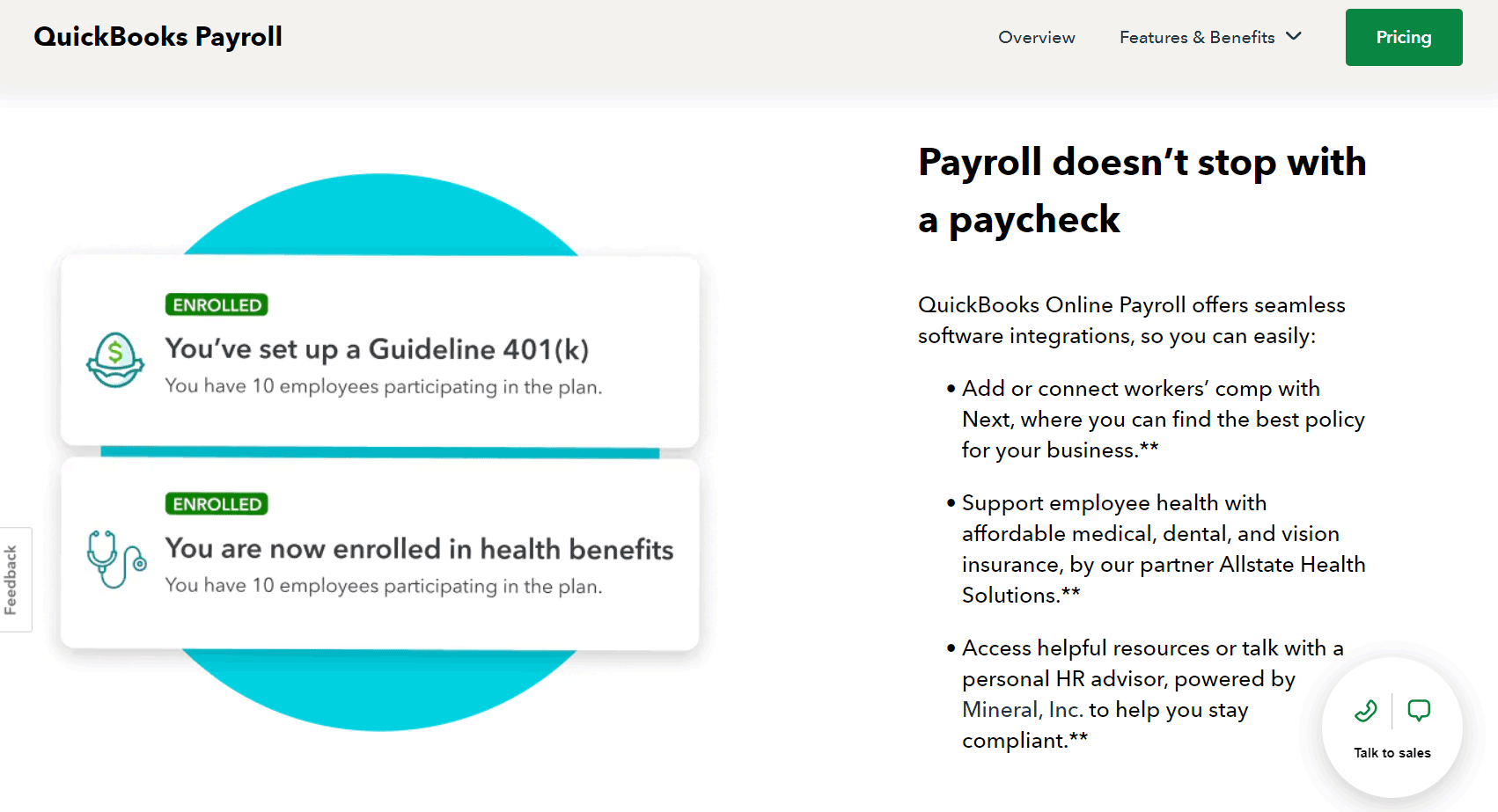

Additional services such as Workers’ Comp Administration are included in the Premium and Elite tiers, but insurance premiums are extra. 401(k) plans are offered through a partnership with Guideline, and health benefits are available through Allstate Health Solutions, each with separate pricing. The Elite tier offers a $25,000 tax penalty protection, but this protection is subject to certain conditions, including timely submission of tax notices and does not cover penalties due to insufficient funds or incorrect information.

You can cancel your subscription at any time, but no prorated refund will be provided; the service will continue until the end of the billing period. After cancellation, access to historical data will be limited, so download and save any necessary reports before canceling. Some features, like same-day direct deposit and time tracking, are only available in higher-tier subscriptions, and a personal HR advisor is only included in the Elite tier. QuickBooks offers an accuracy guarantee for tax filings, provided you submit accurate and timely information.

What Are Quickbooks Payroll's Competitors Offering?

To gain a clearer understanding of QuickBooks Payroll’s offerings, compare it with some of its main competitors:

Gusto

Gusto starts at $40 per month, plus $6 per employee. It provides full-service payroll, time tracking, health benefits administration, and 401(k) plans. Gusto is noted for its comprehensive HR features and user-friendly interface. However, it has limited accounting integrations compared to QuickBooks.

ADP Run

ADP Run offers custom pricing based on specific business needs. It includes payroll processing, HR support, time tracking, and talent management. ADP Run is scalable for growing businesses and provides extensive HR features, but it can be more expensive and potentially overwhelming for your small business.

Square Payroll

Square Payroll is priced at $35 per month plus $5 per employee. It offers full-service payroll, time tracking, and tax filings. Square Payroll integrates seamlessly with Square POS and is competitively priced. However, it has limited HR features and may not be suitable for larger businesses.

Rippling

It includes payroll, HR management, and IT systems management. Rippling is praised for its comprehensive workforce management platform and modern interface. On the downside, it can be complex for small businesses and its pricing can increase with additional features.

Comparison Points

Pricing

QuickBooks Payroll is priced in the mid-range compared to its competitors. It is more expensive than budget options like Square Payroll but generally cheaper than comprehensive solutions such as ADP or Paychex.

Features

QuickBooks excels in accounting integration but may have fewer HR features compared to competitors like Gusto or ADP. Its tax penalty protection, available in the Elite tier, is a notable feature not commonly offered by others.

Ease of Use

QuickBooks is known for its user-friendly interface, especially for those already familiar with QuickBooks accounting. However, some competitors, such as Gusto, are praised for their even more intuitive designs.

Scalability

While QuickBooks can support growing businesses to some extent, solutions like ADP and Paychex may be better suited for rapidly scaling companies with more complex needs.

Integration

QuickBooks Payroll’s key advantage is its seamless integration with QuickBooks accounting software. While competitors may offer a wider range of third-party integrations, few can match the compatibility within the QuickBooks ecosystem.

Support

QuickBooks provides solid support, especially at higher tiers. Nonetheless, competitors like Paychex offer 24/7 support across all plans.

International Capabilities: QuickBooks Payroll’s limitation to a few countries is a significant drawback compared to competitors that offer more global solutions.

What Affects Quickbooks Payroll's Prices?

Several factors influence the pricing of QuickBooks Payroll:

Feature Set

The range of features included in a QuickBooks Payroll plan significantly impacts its pricing. Advanced features such as same-day direct deposit and tax penalty protection are available only in higher-tier plans, which come at a higher cost.

Number of Employees

The per-employee fee plays a major role in determining the total cost of QuickBooks Payroll. As your business adds more employees, your monthly expense will increase accordingly.

Geographic Coverage

If your business operates in multiple states, you will incur additional state tax filing fees. This factor can considerably raise your overall costs.

Integration with QuickBooks Accounting

Bundling QuickBooks Payroll with QuickBooks Online can influence pricing. Often, you can save money by purchasing the services together rather than separately.

Development and Maintenance Costs

The costs associated with ongoing software development, security updates, and cloud infrastructure maintenance are factored into the pricing of QuickBooks Payroll.

Support Services

Plans that offer comprehensive support, such as 24/7 expert assistance available in the Elite plan, come with higher costs. The level of support directly affects the pricing structure.

Compliance and Regulatory Requirements

Staying compliant with payroll laws and regulations, which can vary across jurisdictions and change frequently, impacts the pricing of QuickBooks Payroll.

Additional Services

The inclusion of additional services like workers’ comp administration, health benefits, and 401(k) plans—often through partnerships – can influence the overall cost of the payroll service.

What Affects Prices In The Payroll Software Industry Overall?

Factors that could impact pricing across the payroll software industry include:

Technological Advancements

Advancements in AI, machine learning, and automation can impact payroll software pricing in different ways. While these innovations may drive up costs due to the expense of development, they can also reduce costs by increasing efficiency and automating processes.

Market Competition

The ongoing entry of new players and the evolution of existing competitors continually shape pricing strategies in the payroll software industry. Your company must adapt its pricing to remain competitive and capture market share.

Regulatory Changes

Changes in laws and regulations related to payroll, taxes, and employee benefits often require software updates. These updates can affect pricing as providers invest in compliance and system adjustments.

Economic Conditions

The overall economic environment influences pricing strategies and the willingness of businesses to invest in payroll software. Economic fluctuations can lead to adjustments in pricing and service offerings.

Cloud Computing Costs

As most payroll solutions are cloud-based, variations in cloud computing and storage costs can impact pricing. Providers may adjust their prices based on these underlying infrastructure costs.

Data Security Requirements

Growing concerns about data security and privacy necessitate ongoing investments in robust security measures. These costs are often reflected in the pricing of payroll software as companies enhance their security protocols.

Integration Capabilities

The need for seamless integration with other business systems, such as accounting, HR, and time tracking software, influences the development and pricing of payroll solutions. Companies may charge more for advanced integration features.

Customer Support Expectations

Businesses increasingly expect comprehensive and prompt customer support. The cost of delivering high-quality support contributes to the overall pricing of payroll software.

Global Payroll Needs

The demand for payroll solutions capable of handling international payroll adds complexity and can lead to higher costs. Providers may charge more for features that support global payroll requirements.

GET SMARTER >>> WorkBright Employee Benefits Software Review

How To Get The Best Deal With Quickbooks Payroll?

To maximize value and minimize costs with QuickBooks Payroll, consider the following strategies:

- Take advantage of promotional offers

- Bundle with QuickBooks online

- Optimize employee count

- Utilize the free trial

- Annual payment option

- Negotiate for multi-year contracts

- Referral programs

- Minimize add-ons

- Regularly review your subscription

- Consider seasonal needs

- Attend Quickbooks events

Can You Afford Quickbooks Payroll's Prices?

Here’s a framework to help you evaluate:

How do you calculate the total cost for QuickBooks Payroll, including the base price, per-employee fees, and any additional costs for multi-state filings or contractor payments? How does this total compare to your current payroll expenses, and what potential time savings and error reductions might automated payroll offer? What are your growth projections for the next year or two, and how will this impact your QuickBooks Payroll costs? How do the potential benefits, such as time saved and improved compliance, measure up against the overall cost and value to your business?

Finally: Should You Buy Quickbooks Payroll Or Not?

After thoroughly analyzing QuickBooks Payroll’s features, pricing, and market position, the recommendation is that you should not purchase QuickBooks Payroll. Why?

If your business operates outside the US, Canada, UK, or Australia, QuickBooks Payroll won’t meet your needs. While it offers some HR functionality, it’s not as comprehensive as dedicated HR software. If you require robust HR management tools, you might need to explore other options. Though QuickBooks Payroll is priced competitively, there are cheaper alternatives if cost is your main concern. For businesses with hundreds of employees or very complex payroll structures, enterprise-level solutions might be a better fit. Additionally, if you’re not using QuickBooks for accounting and don’t plan to, you may not fully benefit from one of QuickBooks Payroll’s key advantages.

In summary, QuickBooks Payroll is a strong option for your small to medium-sized businesses, particularly if you’re already using QuickBooks for accounting. Its user-friendly design, solid features, and seamless integration can streamline your payroll processes effectively.

However, it’s crucial for you to assess your specific needs, budget, and growth plans before making a commitment. Use the free trial to verify that it meets your requirements, and consider potential limitations, especially in terms of international capabilities and advanced HR features.