Table of Contents

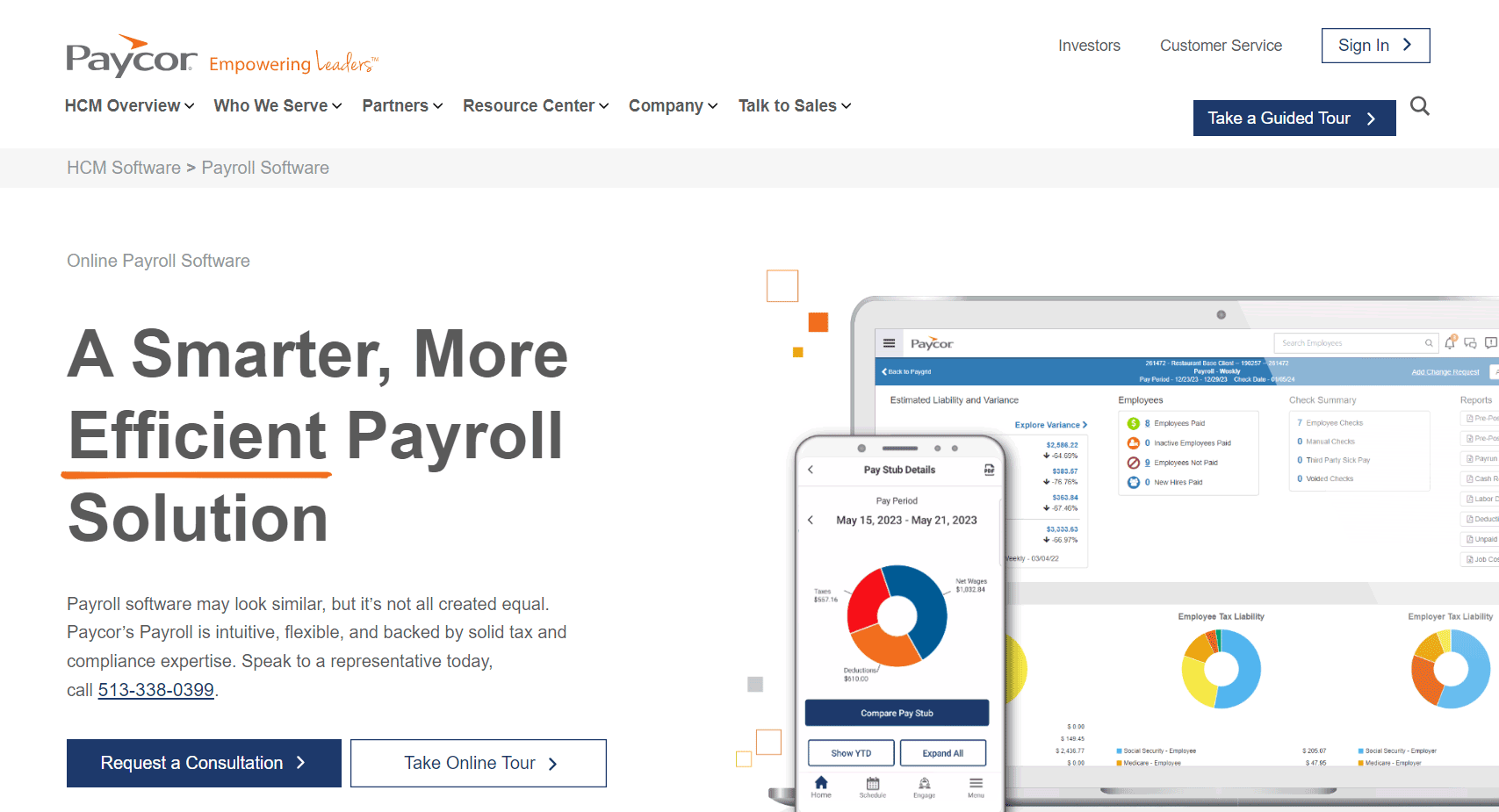

Paycor offers payroll software as a key component of its broader human capital management (HCM) platform. It provides flexible, intuitive payroll solutions, backed by tax and compliance expertise. But does Paycor’s payroll software truly meet expectations? This buyer beware article will take you through the details, helping you decide if Paycor is the right choice for your business.

Let’s Cut to the Chase!

Now, Let’s Detail Things for You

What’s the Catch With Paycor?

What Are Paycor’s Competitors Offering?

What Affects Paycor’s Prices?

What Affects Prices in the Industry Overall?

How to Get the Best Deal With Paycor?

Can You Afford Paycor’s Prices?

Finally: Should You Buy Paycor or Not?

Let's Cut To The Chase!

Buy If:

- ✅ You want an all-in-one HCM platform that includes payroll, HR, benefits, and more

- ✅ You need robust tax compliance features and support

- ✅ You’re looking for payroll software with strong mobile capabilities

- ✅ You want analytics and reporting features to gain insights from payroll data

- ✅ You need flexible pay options like earned wage access

MORE >>> Roll by ADP Payroll Review

Don't Buy It If:

- ❌ You only need basic payroll processing without additional HCM features

- ❌ You’re a very small business with simple payroll needs

- ❌ You’re on a tight budget and need a low-cost payroll solution

- ❌ You want a standalone payroll system that isn’t part of a larger HCM suite

- ❌ You need extensive customization options for your payroll processes

The Bottom Line

🌐 You’ll find out that Paycor’s payroll software offers a comprehensive suite of features within its broader HCM platform. It’s ideal for small to mid-sized businesses looking to streamline payroll, HR, and other workforce management functions in a single system. You’ll benefit from strong compliance support, analytics, and mobile capabilities. However, if you run a very small business with basic needs, this solution might be more than you require. Since pricing isn’t transparent, make sure you get a custom quote to see if it aligns with your budget.

Now, Let's Detail Things For You

Paycor does not disclose its payroll software pricing on its website, which makes it challenging for you to quickly determine if Paycor fits your budget. Based on industry averages and competitor pricing, it’s estimated that the base fee is likely between $50 and $150 per month. The per-employee fee probably ranges from $4 to $12 per employee per month. The setup or implementation fee may be between $500 and $2000, depending on your company size.

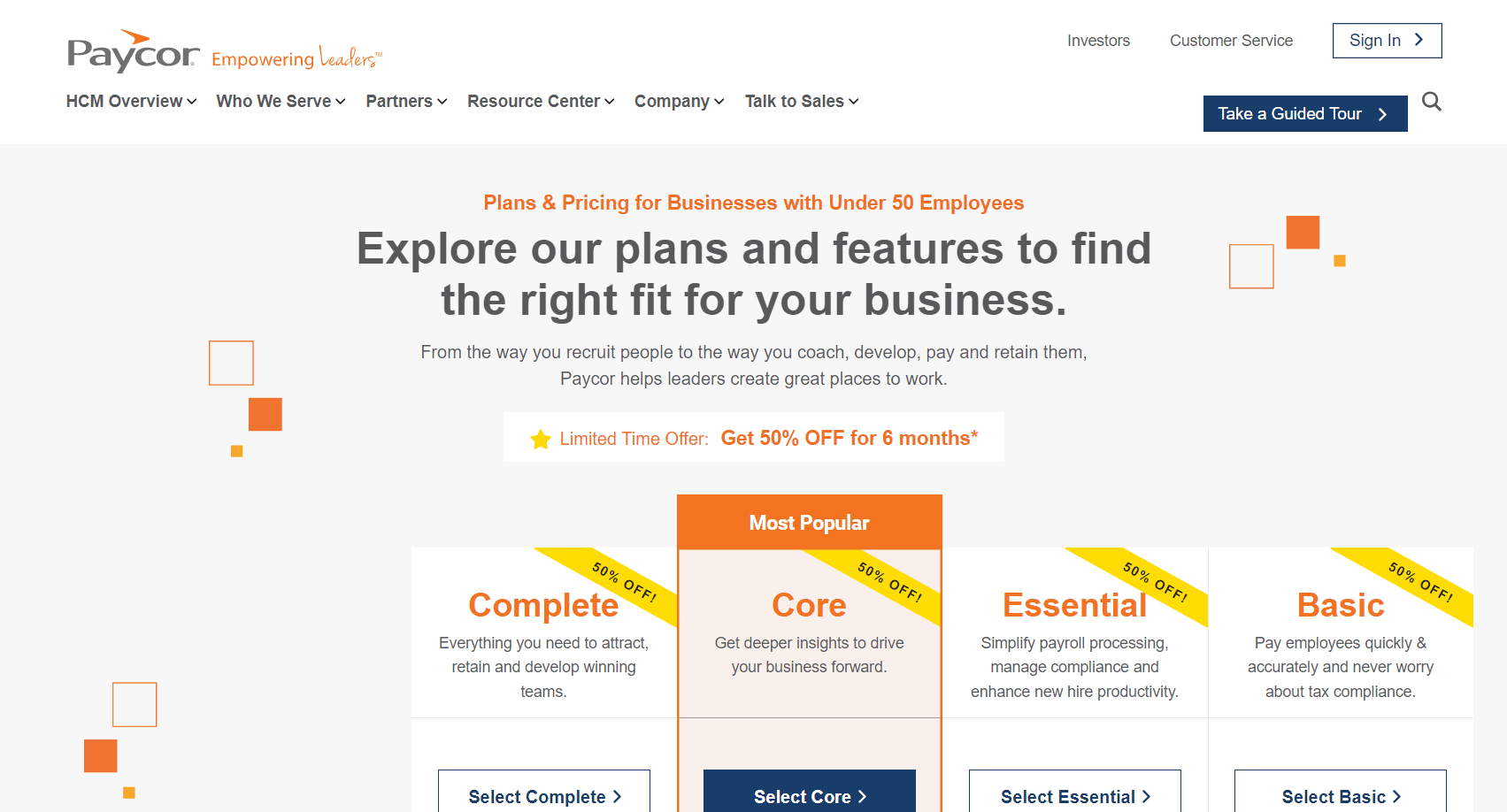

These estimates are rough and actual pricing will vary based on your specific needs, company size, and any additional HCM modules you choose to implement. Paycor offers different product tiers that likely affect pricing. The Basic tier provides entry-level payroll processing and tax filing. The Essential tier adds HR and benefits administration features. The Complete tier includes talent management, workforce management, and analytics.

To get accurate pricing, you’ll need to contact Paycor’s sales team for a consultation and demo. They provide custom quotes based on your business requirements. Factors that may influence your price include the number of employees, frequency of payroll runs, additional HCM modules selected, level of customer support needed, implementation and training requirements, and industry-specific compliance needs.

While the lack of transparent pricing can be frustrating, it’s not uncommon in the HCM industry, especially for comprehensive platforms like Paycor.

What's the Catch With Paycor?

While Paycor generally enjoys a positive reputation, be aware of a few potential concerns. Some users report feeling pressured to purchase additional modules or upgrades, so be prepared to stand firm on your actual needs. Paycor might also push for longer-term contracts, so ensure you fully understand the commitment before signing.

Watch out for possible hidden fees, such as extra charges for year-end tax forms, additional payroll runs, or access to certain reports. Although many praise Paycor’s support, others have encountered slow response times or difficulties reaching knowledgeable representatives.

Lower-tier plans might lack advanced features, so confirm that the plan you choose meets all your functionality requirements. If you need to integrate Paycor with other business software, be aware that it may require extra time and resources.

A few customers feel that certain features were oversold during the sales process, so ensure all promises are documented in writing. Additionally, the comprehensive nature of the platform might lead to a steeper learning curve for you.

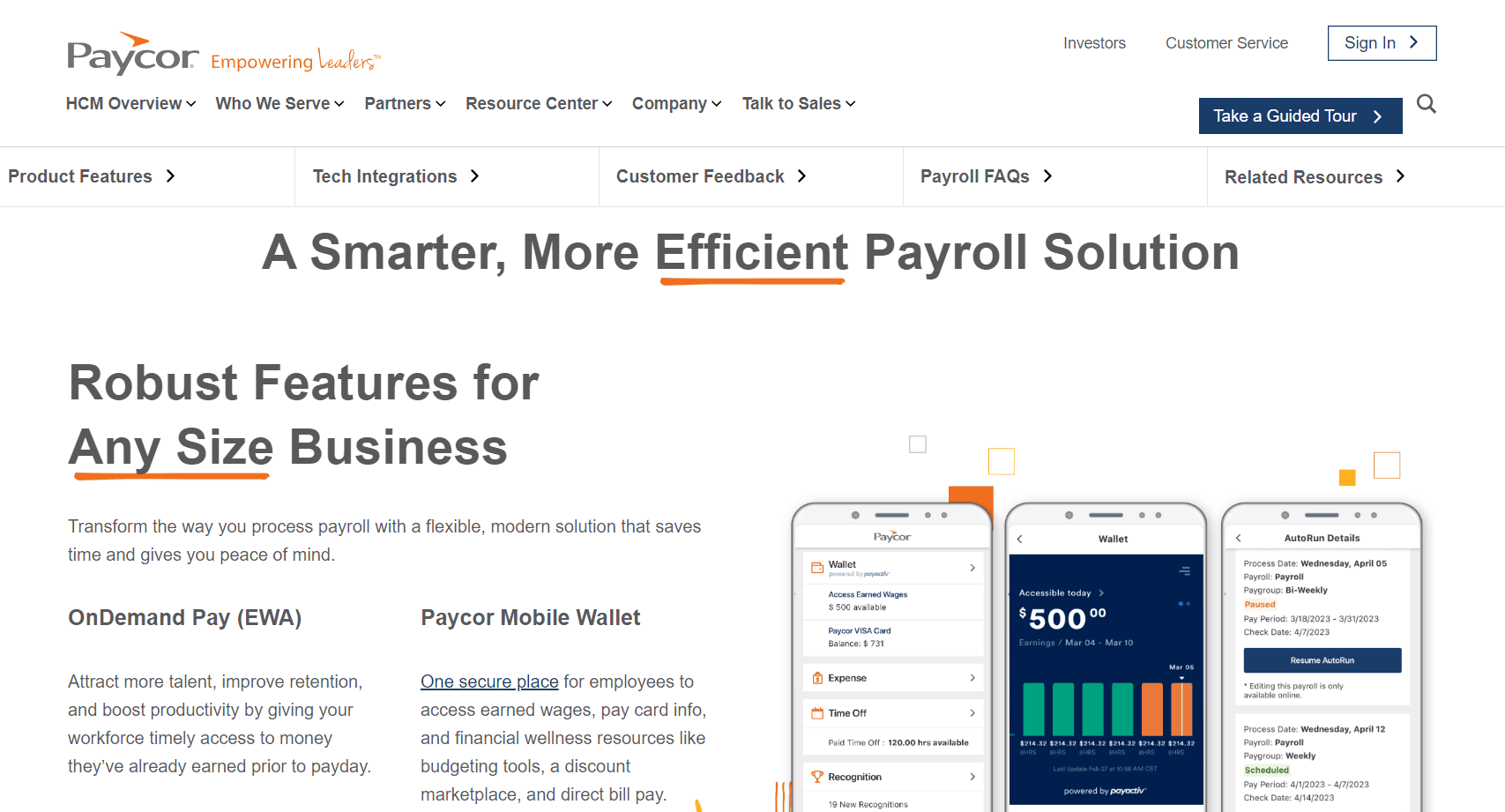

Paycor’s payroll software includes features such as flexible pay options like direct deposit, paper checks, and pay cards. It supports multiple pay frequencies and provides real-time payroll calculations, automatic tax calculations and filings, garnishment management, and off-cycle and bonus pay runs. The employee self-service options include a mobile app for viewing pay stubs and tax forms, updating personal information and banking details, and accessing historical pay information.

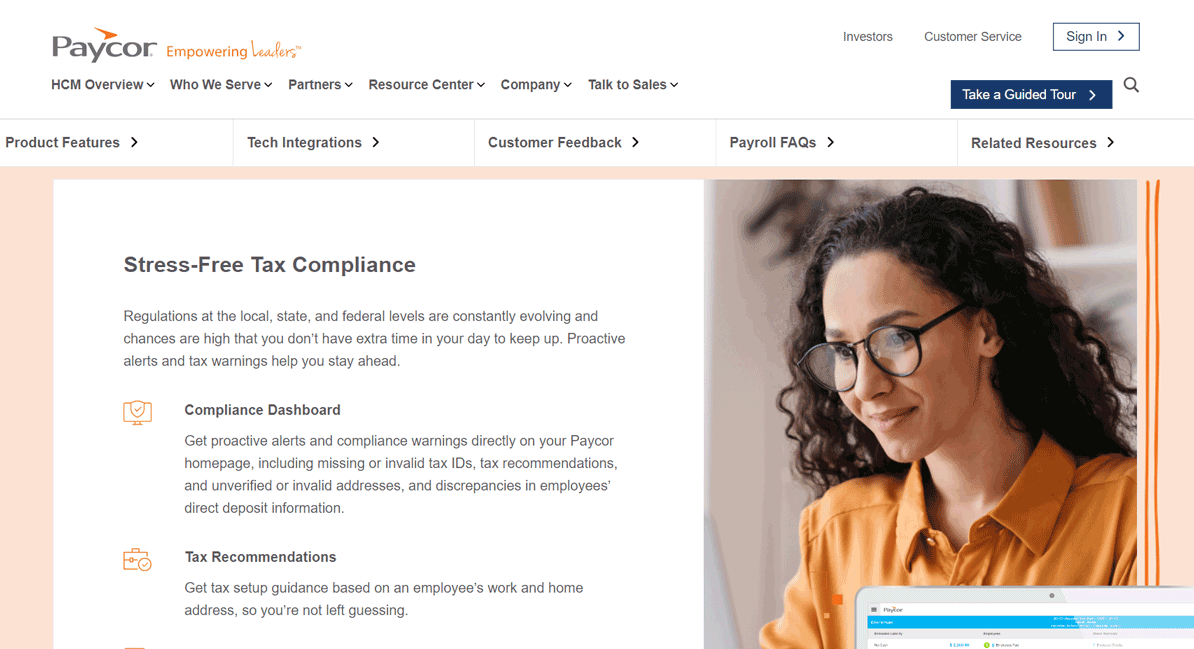

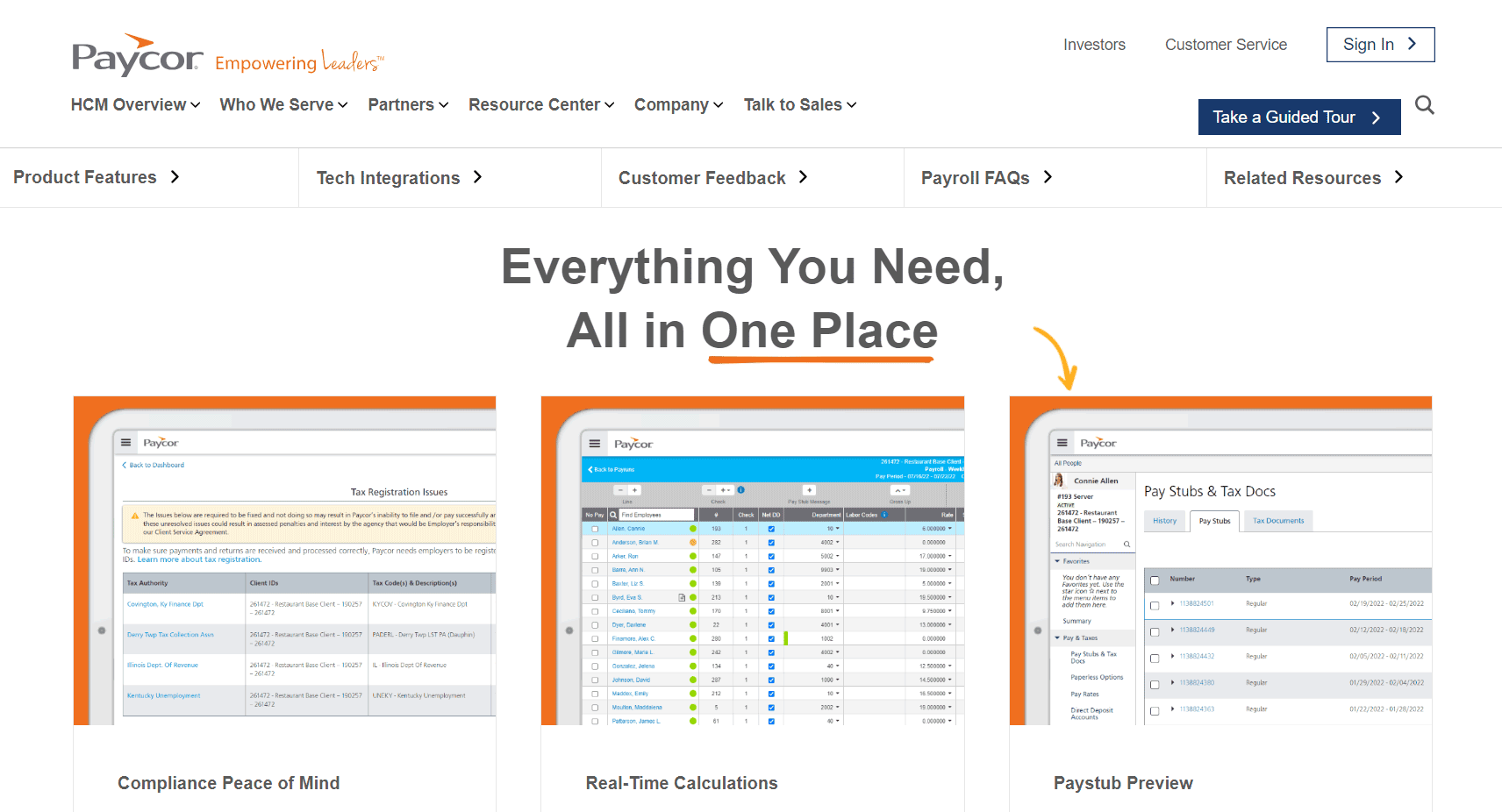

The tax compliance features offer automatic updates for federal, state, and local tax laws, handling tax filing and payments, and preparing year-end tax forms like W-2s and 1099s. There is also a tax compliance dashboard with alerts and recommendations. Reporting and analytics include standard and customizable payroll reports, real-time analytics dashboards, benchmarking against industry data, and predictive analytics for labor costs and turnover.

Time and attendance integration provides seamless syncing of hours worked to payroll and automatic overtime calculations with alerts. Benefits administration includes integration with Paycor’s benefits module, automatic deduction calculations, and support for various benefit types such as health insurance and 401(k). Earned wage access allows your employees to access earned wages before payday, which supports financial wellness and retention.

Compliance support includes ACA compliance tracking and reporting, FLSA compliance tools, and EEO-1 reporting capabilities. The mobile access feature provides a Paycor mobile app for managers and employees to run payroll from anywhere, approve time cards, and manage PTO requests. Security features include data encryption, multi-factor authentication, and regular security audits and updates.

Paycor doesn’t publicly disclose pricing, but the pricing model includes modular pricing, allowing you to choose which HCM modules to implement, and a per-employee-per-month (PEPM) model, where you pay a base fee plus a per-employee charge each month. Costs may decrease on a per-employee basis as your company grows. Longer contracts might offer better rates but provide less flexibility. There are one-time implementation fees for setup, data migration, and training, and additional fees may apply for features like custom reports, extra payroll runs, or premium support.

You may qualify for a discount rate if you own a large organization and certain industries with complex payroll needs may face higher costs. Be aware of potential price increases upon contract renewal and inquire about bundle discounts for implementing multiple Paycor modules.

What Are Paycor's Competitors Offering?

To help you make an informed decision, check out what Paycor’s competitors offer:

ADP

ADP has extensive experience and a large customer base, offering a wide range of features and add-ons. It is prominent for strong customer support and robust reporting capabilities, although it can be more expensive than some competitors, and its interface may feel dated compared to newer options. You may experience a steeper learning curve. Pricing is not publicly disclosed, but ADP is generally considered to be on the higher end of the market.

Gusto

Gusto provides a user-friendly interface with transparent pricing starting at $40 per month plus $6 per person. It is geared towards small businesses and includes built-in time tracking at no extra cost. However, Gusto has limited features for larger businesses, fewer integrations than some competitors, and less robust reporting capabilities. Pricing starts at $40 per month base plus $6 per person per month, with higher tiers available for more features.

Rippling

Rippling offers a comprehensive platform that integrates HR, IT, and finance functions. It features a modern, intuitive interface, a fast implementation process, and strong automation capabilities. On the downside, Rippling can be complex for very small businesses, and pricing can add up with multiple modules. As a newer company, it also has a shorter track record. For pricing, you need to contact Rippling for a custom quote.

Paylocity

Paylocity provides a comprehensive HCM suite similar to Paycor, with a strong focus on employee engagement features, a robust mobile app, and a good reputation for customer support. It can be pricier than some alternatives, with occasional system glitches reported by some users. It may also offer more features than necessary for small businesses. Pricing is not publicly disclosed but is generally considered mid-range in the market.

How Paycor Compares:

Paycor provides a feature set that typically matches or exceeds that of most competitors, being more robust than Gusto while remaining comparable to ADP, Paylocity, and Paycom. Though the pricing isn’t publicly disclosed, you’ll find Paycor generally falls into the mid-range category – likely pricier than Gusto but possibly more affordable than ADP for some businesses.

Expect mixed reviews regarding user-friendliness with Paycor. It’s easier to navigate than ADP but might not be as intuitive as Gusto or Rippling. You’ll appreciate its customer support, which is well-regarded and on par with Paylocity, offering a better experience than what some users report with ADP or Paycom.

Paycor is ideal for small to mid-sized businesses, providing more scalability than Gusto but potentially less suitability for very large enterprises compared to ADP. You’ll enjoy a solid range of integrations available, though perhaps not as extensive as what ADP or Rippling offer.

PRO TIPS >>> How to Choose Payroll Software

What Affects Paycor's Prices?

Here are the factors which may influence Paycor’s pricing structure:

- Assess Your Company Size: The number of employees you have will significantly impact your pricing. Larger companies might benefit from volume discounts but may also face more complex implementations.

- Evaluate Your Selected Modules: Paycor offers various HCM modules beyond payroll. The more modules you implement, the higher your overall cost will be.

- Consider Payroll Complexity: If you’re in an industry with complex payroll needs, such as healthcare or manufacturing, you might face higher costs due to additional compliance requirements and calculations.

- Review Your Pay Frequency: More frequent payroll runs, like weekly versus monthly, could increase your costs.

- Factor in Your Geographic Location: If you operate in multiple states or regions with complex local tax laws, you may encounter higher prices due to increased compliance needs.

- Examine Your Implementation Requirements: The complexity of your implementation, including data migration and training, can affect your upfront costs.

- Look at Contract Length: Committing to a longer-term contract might lower your monthly rates but could reduce your flexibility.

- Determine Your Support Level: Opting for higher tiers of customer support or dedicated account management will increase your costs.

- Account for Additional Services: Adding services like time tracking, benefits administration, or recruiting tools will increase your overall costs.

What Affects Prices in the Industry Overall?

Consider these key factors affecting pricing in the payroll and HCM software industry:

- Acknowledge Market Competition: You’ll find that increased competition in the HCM space pressures prices, especially for solutions aimed at small businesses.

- Leverage Technological Advancements: Use AI, machine learning, and automation to enhance software capabilities and potentially reduce operational costs for providers.

- Stay Aware of the Regulatory Environment: Watch for changes in labor laws, tax regulations, and compliance requirements, as these can drive up development and support costs for payroll providers.

- Monitor Cloud Computing Costs: Track fluctuations in cloud infrastructure costs, as these can impact the pricing of cloud-based payroll solutions.

- Factor in Data Security Demands: Consider the costs of addressing increasing cybersecurity threats and data protection regulations, which necessitate ongoing investments in security measures.

- Be Aware of Mergers and Acquisitions: Notice that industry consolidation, where larger companies acquire smaller ones, can lead to adjustments in pricing models.

- Note Customer Expectations: Observe that as businesses demand more advanced features (like analytics and mobile capabilities), development costs for providers increase.

- Consider the Shift Towards Integrated HCM: Evaluate how the trend of including payroll in broader HCM suites impacts pricing structures across the industry.

- Recognize Global Expansion Needs: Acknowledge that global expansion requires payroll providers to invest in supporting international payroll, which can influence overall pricing.

- Understand API and Integration Capabilities: Note that the need for software integration with other business tools drives investment in API development, affecting pricing.

- Account for Mobile Technology Needs: Factor in the requirement to develop and maintain robust mobile apps, which influences development costs and pricing.

- Note the Shift Towards Employee Experience: Observe that a focus on employee engagement and experience leads to the development of new features, which can impact pricing.

How to Get the Best Deal With Paycor?

To secure the most favorable terms with Paycor, consider the following strategies:

- Conduct thorough needs assessment

- Compare multiple quotes

- Negotiate contract length

- Time your purchase

- Bundle services

- Leverage company size

- Ask about promotional offers

- Negotiate implementation fees

- Review all fees

- Explore payment terms

- Ask for a trial period

GET SMARTER >>> Gusto vs OnPay Payroll

Can You Afford Paycor's Prices?

Evaluate your budget carefully before committing to Paycor. While the company does not publicly disclose pricing on their website, industry reports suggest Paycor’s solutions fall into the mid-range pricing tier for HR and payroll software. Are you prepared for a base fee of $99-$199 per month for core payroll processing, plus per-employee costs of $3-$5 each month, and additional charges for add-on modules like benefits administration or time tracking?

Have you considered scalability costs, one-time implementation fees ranging from $500-$2000, and the potential need for extra training at $500-$1500, along with the impact of annual price increases, multi-year discount opportunities, and the risk of overages?

Finally: Should You Buy Paycor or Not?

After a detailed review, you should strongly consider Paycor for your HR and payroll needs (with caveats) if your business has 50-1000 employees. Here’s why:

You’ll find that Paycor provides a unified platform that covers the entire employee lifecycle – from recruiting and onboarding to payroll, benefits, and talent management. This means you can eliminate the hassle of managing multiple solutions. Paycor’s analytics stand out. With AI-powered insights, you can identify turnover risks, optimize compensation, and benchmark performance against industry standards.

For a data-driven approach, this can be immensely valuable. With over 30 years of payroll expertise, Paycor excels in tax management and regulatory compliance. You’ll appreciate their proactive alerts and built-in safeguards, which significantly reduce the risk of costly errors or penalties. Paycor offers tailored solutions for sectors like healthcare, manufacturing, and hospitality. This specialized approach often outperforms one-size-fits-all alternatives.

That said, Paycor isn’t a one-size-fits-all solution. Make sure to thoroughly evaluate your needs, budget, and growth trajectory. Schedule a detailed demo and take advantage of any trial periods Paycor offers. Pay special attention to the modules and features that address your pain points.