Table of Contents

Our Verdict

Wave Payroll is a cloud-based payroll service that your small business can take advantage of at an affordable price. It offers both manual and automated options, setting up pay schedules and receiving reminders. It has the ability to file taxes for additional paperwork and is user-friendly. Employees can set up profiles and receive payment three days after payroll processing.

Wave Payroll provides automatic tax filings, an employee self-service portal, and seamless integration with other Wave apps, such as Wave Accounting or Wave Invoicing. However, despite its user-friendly interface, it has limitations, such as limited tax filing services in some states, a lack of advanced features, and customer service issues.

Despite these drawbacks, Wave Payroll is a solid choice if you’re seeking a simple and affordable payroll solution. However, if you’re seeking more advanced features or tax filing services, you may need to consider other options.

Pros

- User-friendly interface: Wave Payroll’s user-friendly interface simplifies payroll management for businesses by making it easy for you to navigate and use.

- Employee self-service portal: The self-serve employee portal can significantly reduce administrative burdens and empower your employees.

- Affordable pricing: Wave payroll software offers competitive pricing, making it an ideal solution if you’re looking for a simple and affordable payroll solution.

- Automated payroll and tax filings: Wave Payroll offers automated payroll processing and automatic tax filings, saving you the hassle and time spent on payroll and tax filings and reducing errors.

- Free plan available: Wave payroll offers a forever free plan with most features available.

Cons

- Limited integrations: Wave Payroll has limited third-party integrations, potentially limiting its functionality for some of your businesses. It also lacks advanced features like mileage tracking, time tracking, and inventory management.

- Limited customer support: Wave Payroll’s customer support options are limited, potentially causing concern if your business requires payroll assistance. Plus, some users have reported issues with responsiveness.

Who Wave Payroll Software Is Best For

Wave Payroll software is best for:

- Sole proprietors and freelancers: As a sole proprietor and freelancer, Wave Payroll is an excellent choice for managing your payroll due to its free plan and user-friendly interface.

- Startups: Wave Payroll is an excellent choice if you’re a startup with limited budgets due to its affordability and simplicity.

- Small businesses: Wave Payroll is an ideal choice for your small business with fewer than 10 employees, looking for a simple, affordable, and user-friendly payroll solution.

Who Wave Payroll Software Isn’t Right For

Wave Payroll software may not be suitable for:

- Businesses with complex payroll needs: If your business has complex payroll structures or needs, Wave Payroll may not be suitable. Needs such as multiple pay rates, overtime rules, employee benefits, or those with complex payroll needs like payroll deductions.

- Businesses requiring extensive reporting: If your business needs detailed payroll reports or analytics beyond Wave’s offerings, you may require a more robust solution.

- Large businesses: Although Wave is user-friendly, it may not offer the advanced features and scalability required by a large enterprise with complex payroll needs.

- Multi-state businesses: Wave Payroll does not support multi-state payroll, making it unsuitable if your business has employees in multiple states since automatic filing is only available in 14 states for small businesses with multistate employees.

What Wave Payroll Software Offers

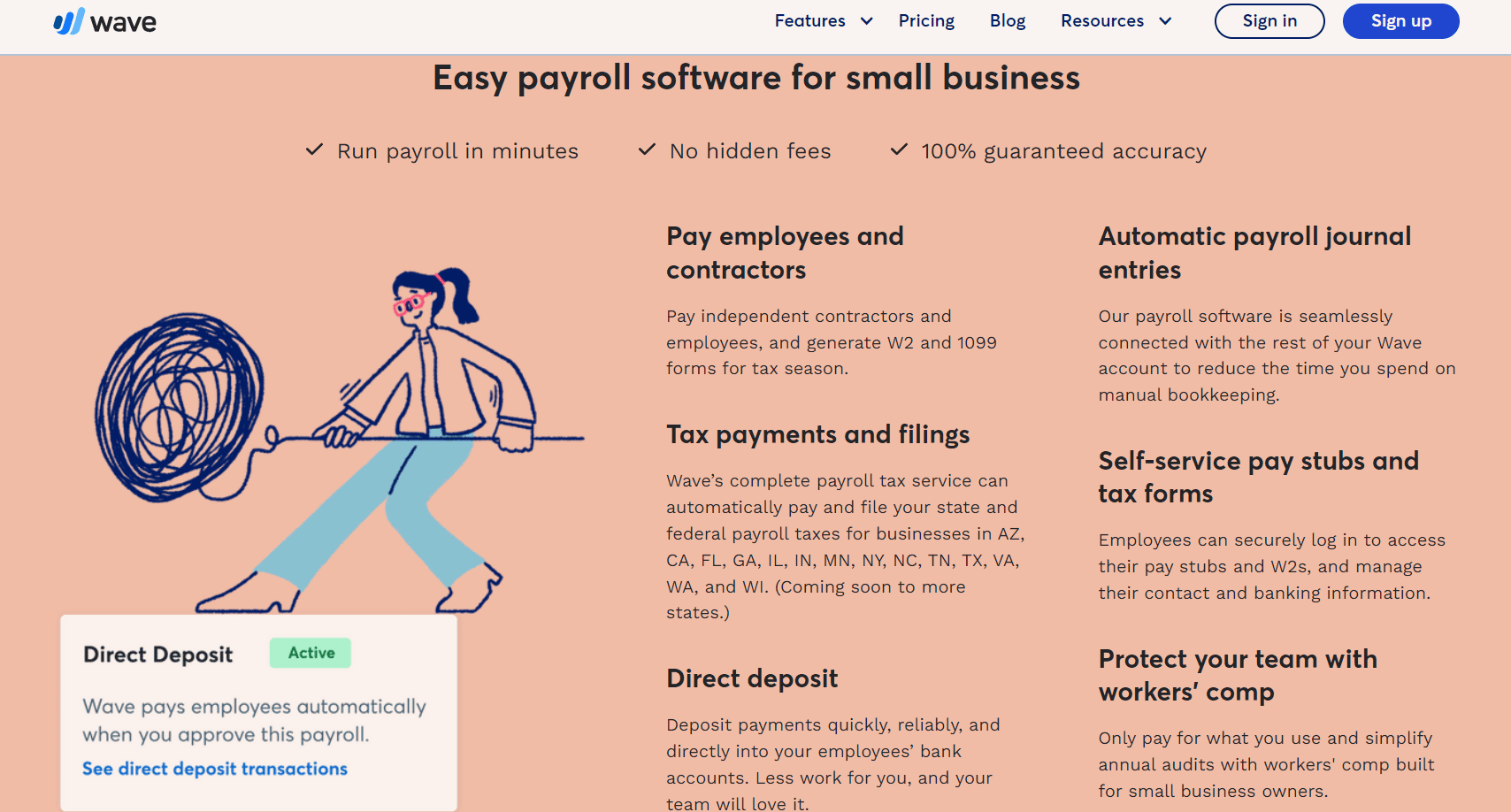

With its range of features, Wave Payroll simplifies payroll management for small businesses. Here are some of the key features it offers:

Payroll processing

Wave Payroll handles payroll processing for your employees, including direct deposit and tax withholdings.

Reporting and analytics

Wave Payroll provides various payroll reports, such as employee earnings summaries, tax reports, and time card reports. You can track wages and taxes and assess payroll benefits and deductions. It also offers more robust reporting options, including cash flow statements, sales tax reports, profit and loss statements, and custom reports.

Integration

Wave Payroll integrates with Wave Accounting and Invoicing, allowing you to manage payroll, accounting, and invoicing processes in one place.

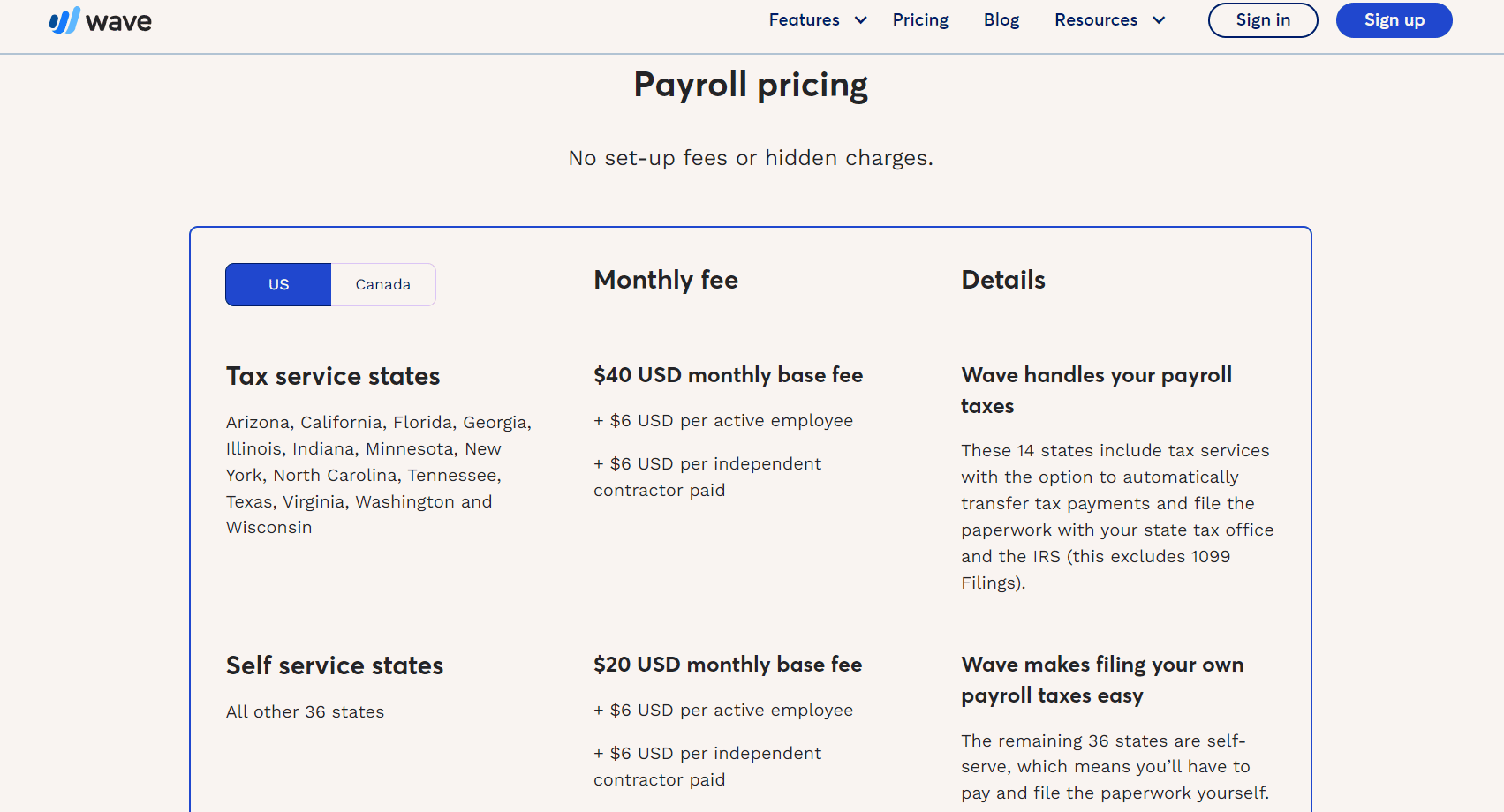

Tax management

Wave Payroll offers tax management by automatically calculating and filing taxes on your behalf. This feature greatly saves time for you. Wave payroll has the ability to automatically file taxes in 14 US states. These states include Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

Customizable payroll schedules

Wave Payroll offers you the ability to customize your payroll schedules, including weekly, biweekly, or monthly, at a lower cost, demonstrating its appeal to small businesses.

Wave Payroll Software Details

Here are some additional details about Wave Payroll software:

- Pricing: Wave offers two pricing tiers, the Starter plan and the Pro plan. The starter plan is a free plan you can use if you’re just starting your business or looking for the basics. However, Wave’s pro plan is billed monthly for the sum of $16, offering you more polished features.

- Support: Wave Payroll provides comprehensive support through its online knowledge base and community forum.

PRO TIPS >>> Roll by ADP Payroll Review

Where Wave Payroll Software Stand Out

Wave Payroll distinguishes itself in the following areas:

Affordability

Compared to other payroll software options, Wave Payroll is affordable. It offers a free plan and low pricing tier, making it an affordable option for your small businesses and startups, a cost-effective solution for those on a tight budget.

Simple and easy to use

Wave Payroll is a user-friendly payroll system that simplifies payroll management for your business, reducing the learning curve and time spent on tasks. Its intuitive interface and automated processing make it simple for you to navigate and manage payroll tasks.

Automatic tax filing

Wave offers automatic payroll tax filing for businesses in certain states, saving time and hassle. This is a great deal, especially if your small business lacks the resources or expertise to handle tax filings independently.

Employee self-service portal

This empowers employees by allowing them to view pay stubs, update personal information, and request time off, reducing administrative burden on your HR department.

Integration

Wave Payroll integrates with Wave Accounting and Wave Invoicing, enabling you to manage payroll, accounting, and invoicing processes in one place. This seamless integration streamlines your business processes, saves time, and reduces errors when used with other Wave products.

Excellent customer support

Wave Payroll provides excellent customer support, offering prompt resolutions and responsive assistance for any questions or issues you may encounter while using the software.

Where Wave Payroll Software Fall Short

Here are some areas where Wave Payroll might fall short:

Benefits administration

Wave Payroll won’t help you with benefits; it lacks support for health insurance and retirement plans. Although you can purchase and manage these benefits using different resources, you can add the deductions.

Manual tax filing in certain states

Wave Payroll can automatically file payroll taxes in 14 states, but if your business operates in a state where this feature is not available, you may need to file manually. This can be time-consuming and error-prone.

Limited advanced features

While Wave Payroll offers essential payroll features, it may lack advanced functionalities like multi-state payroll, accrual accounting, and advanced reporting options your larger businesses or those with complex payroll structures might require.

Limited customization

Wave’s payroll software offers limited customization options. This can restrict the flexibility in processing and reporting for your business with unique payroll requirements or reporting needs.

How to Qualify for Wave Payroll Software

To qualify for Wave Payroll software, businesses should meet the following criteria:

- Businesses needing a simple payroll structure: Wave Payroll is suitable for businesses with basic payroll structures but may not be suitable for complex ones with multiple pay rates, overtime rules, or benefits packages.

- Location: Wave Payroll is exclusively accessible to businesses based in 14 states in the United States (Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin). Ensure your business location is one of these to use automated payroll.

- Small businesses: Wave Payroll is tailored for small businesses, so ensure your business does not require advanced features that larger enterprises may require.

How to Apply for Wave Payroll Software

To apply for Wave Payroll software, you should follow these steps:

- Visit the Wave Payroll website.

- Create an account by providing your basic information.

- Start using Wave Payroll once your account is created. You can immediately start adding employees, setting up payroll schedules, and processing pay cheques.

GET SMARTER >>> Wave Payroll Software: Get It or Not?

Alternatives to Wave Payroll Software

OnPay

OnPay is an online payroll and HR platform that simplifies workforce management by offering features such as payroll processing, time and attendance tracking, employee management, and benefits administration. It also offers compliance with labour laws, reporting, and integration with other business applications. The benefits of using OnPay include saving time and money by automating payroll processes and improving employee satisfaction by providing easy access to pay stubs and benefits information.

Gusto

Gusto is a cloud-based payroll and HR platform designed for you to manage your business workforce. It offers features such as payroll processing, time and attendance tracking, employee benefits administration, compliance with labour laws, reporting, and integration with other business applications. Benefits of Gusto include saving time and money by automating payroll processes and improving employee satisfaction by providing easy access to pay stubs and benefits information. Overall, Gusto is a powerful and user-friendly solution if you’re looking to streamline operations and save time and money.

QuickBooks Payroll

QuickBooks Payroll is a cloud-based payroll and HR software solution that simplifies the payroll process for your business, irrespective of its size. It offers features such as payroll processing, time and attendance tracking, employee benefits administration, compliance with labour laws, and reporting. It can be integrated with other QuickBooks products for a seamless workflow.

With QuickBooks Payroll, you can save time and money by automating payroll processes and improving employee satisfaction.

Paychex

Paychex is a top US payroll and HR service provider for small and midsized businesses. You can get comprehensive services like payroll processing, tax filing, benefits administration, and HR consulting. Its experienced staff provides guidance and support, and its mobile app enables you to manage your business payroll and HR processes from anywhere.

Customer Reviews

Wave Payroll Software Review has a positive rating of 4.3 out of 5 stars with 293 reviews on G2.

The software’s low accounting solution and simple interface make it stand out among users.

Pro Tips

Here are some pro tips for using Wave Payroll Software:

- Review payroll reports regularly: Frequently review your payroll reports to ensure accuracy, identify errors, and help track expenses. This enables a better budget for future payrolls.

- Stay organized with employee information: Ensure you maintain accurate and up-to-date employee information, including contact details, tax information, and pay rates. This is crucial for preventing errors and facilitating smooth payroll processing.

- Take advantage of the integration with other Wave products: Wave Accounting and Invoicing can be seamlessly integrated with Wave Payroll, enhancing your workflow efficiency and eliminating the need for manual data entry between different systems.

- Stay up-to-date on tax laws: You must stay informed about tax laws and regulations, as Wave Payroll automatically updates its tax calculations, but it’s crucial to stay current about any potential business impacts.

- Consider using a payroll professional: If you have complex payroll needs or are unsure about using Wave Payroll, consider hiring a payroll professional. They can help you effectively set up and manage your payroll.

Recap

Wave Payroll is a cost-effective cloud-based payroll service for small businesses, offering both manual and automated options, tax filing, and employee profiles. It integrates with other Wave apps but has limitations like limited tax filing services, a lack of advanced features, and customer service issues. For your simple and affordable payroll solutions, Wave payroll is suitable.