Table of Contents

Our Verdict

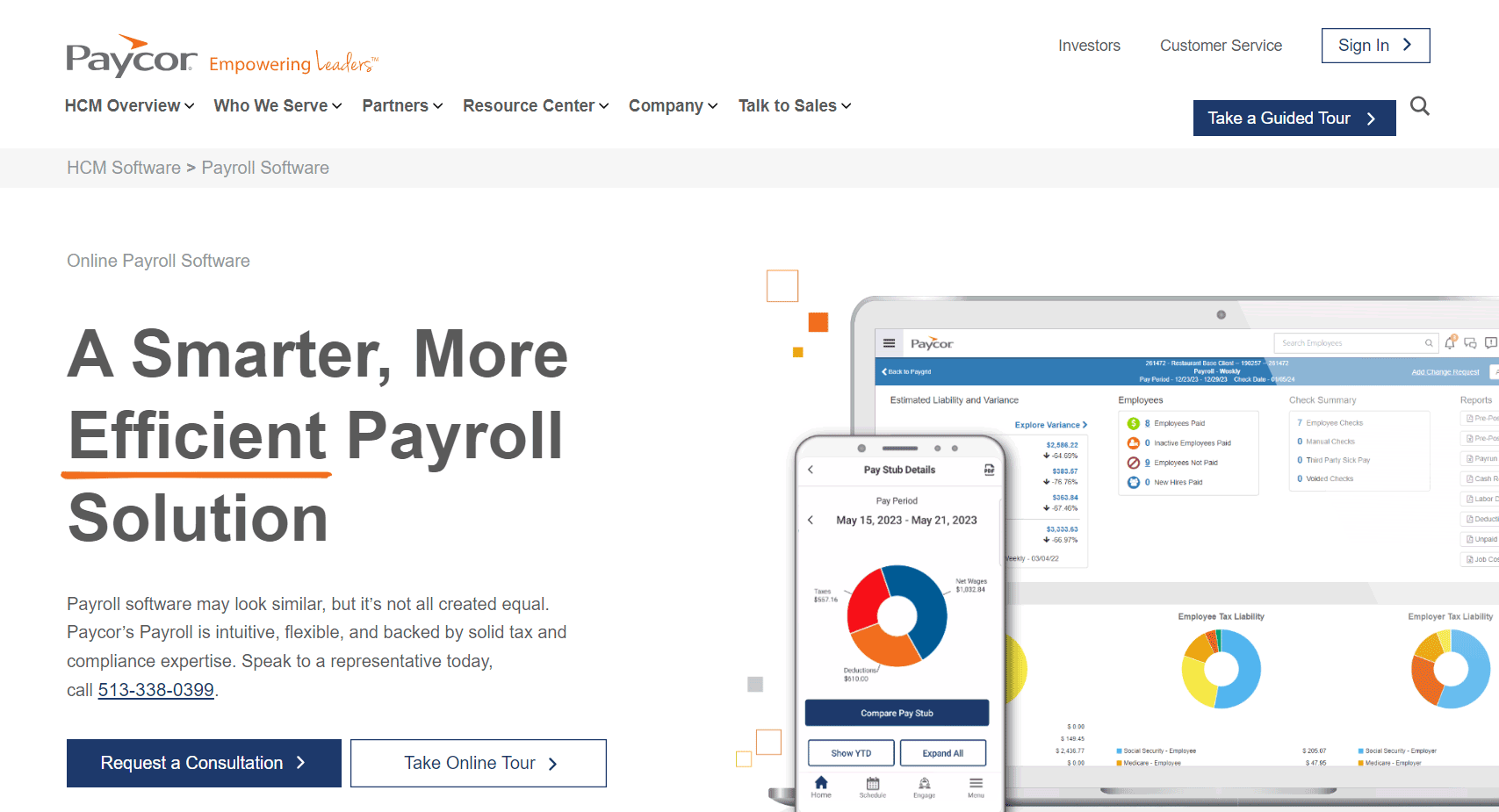

If you’re considering Paycor Payroll Software for your business, you’re looking at a robust solution designed to streamline your payroll and HR processes. Paycor stands out with its intuitive interface and comprehensive features tailored to meet your business needs.

It offers you automated payroll processing that ensures accuracy and compliance, reducing the risk of errors and penalties. With Paycor, you get features like employee self-service portals, which allow your staff to access pay stubs and manage personal information effortlessly.

The platform supports direct deposit, tax filing, and integrates with other HR functions such as time tracking and benefits administration. Additionally, Paycor’s reporting capabilities provide valuable insights into your payroll data, helping you make informed decisions.

Its cloud-based system ensures you can access your payroll data from anywhere, which is particularly useful for your business if you have remote or distributed teams. The software is designed to scale with your business, accommodating everything from small startups to large enterprises.

Overall, Paycor Payroll combines ease of use with powerful functionality, making it a strong choice for your business if you seek a reliable and efficient payroll management solution.

Paycor HCM, Inc.

Corporate Headquarters: 4811 Montgomery Road Cincinnati, OH 45212 United States

Phone Number: 855-565-3285

Contact Email: [email protected]

Website:www.paycor.com

Pros

Paycor Payroll Software shines with its:

- Efficient customization options for reports

- Seamless onboarding for new employees

- Adaptability for various business sizes

- Innovative mobile app for payroll management

- Comprehensive training and support resources

- Smooth integration with third-party software

Cons

Paycor Payroll Software may not completely suit your business due to its:

- Limited international payroll capabilities

- Occasional slow response from customer service

- Limited advanced scheduling features

- Inconsistent system updates and maintenance

- Complex setup process for first-time users

- High cost for smaller businesses

Who Paycor Payroll Software Is Best For

Paycor Payroll Software is:

- Ideal for mid-sized growing businesses

- Perfect for remote or distributed teams

- Suitable for multi-state payroll operations

- Beneficial for healthcare service providers

- Great for retail businesses with hourly workers

- Efficient for nonprofit organizations managing volunteers

- Helpful for educational institutions with multiple staff tiers

- Effective for manufacturing companies tracking shifts

- Valuable for financial service firms with compliance needs

- Optimal for hospitality industries with fluctuating staff

- Versatile for professional service agencies

- Practical for franchises managing various locations

MORE >>> Gusto Payroll Review

Who Paycor Payroll Software Isn’t Right For

Paycor Payroll Software may be:

- Unfit for international businesses needing global payroll

- Unsuitable for small startups with limited budgets

- Inflexible for businesses needing advanced scheduling tools

- Inadequate for companies with complex international tax needs

- Unsuitable for nonprofits with tight financial constraints

- Quite overwhelming for freelancers or solo entrepreneurs

- Difficult for organizations requiring frequent software customization

- Complicated for businesses without dedicated HR departments

- Restrictive for organizations needing custom benefit plans

- Unsupportive for companies needing 24/7 customer support

- Unfit for small businesses without payroll expertise

What Paycor Payroll Software Offers

Paycor Payroll Software offers you a range of plans designed to cater to your needs:

Basic Plan

If you’re seeking a straightforward payroll solution with minimal extras, the Paycor’s Basic plan offers you essential payroll management at an affordable rate. You get access to features such as payroll processing and employee self-service portals, which allow your staff to access pay stubs and update personal information directly.

Essential Plan

You’ll find the Paycor’s Essential plan a step up from the Basic plan because it offers you additional HR tools to streamline your operations further. In this plan, you gain access to onboarding tools that allow you to integrate new hires smoothly into your system.

It also includes more comprehensive reporting capabilities, so you can analyze your payroll and HR data in greater depth. It’s perfect if you need extra HR support without paying for the advanced functionalities of higher-tier plans.

Core Plan

Do you want to integrate your HR and payroll into one cohesive system? Paycor’s Core plan provides the most comprehensive features. This plan enhances your payroll and HR functions with advanced tools like employee import and Paycor HR.

It also includes performance-tracking features such as Paycor Engage and leadership development through COR Leadership. This plan is ideal for your business if you seek a comprehensive payroll and HR solution with employee engagement tools.

Complete Plan

If your business requires a more robust HR solution, the Paycor’s Complete plan provides you with an array of tools beyond payroll processing. You can manage your team’s performance, track benefits administration, and stay on top of compliance regulations.

This plan also includes additional tools for employee development, such as performance reviews and goal-setting features. It’s a great choice if you need a more well-rounded HR and payroll system that scales with your growing business.

HCM Plan

The HCM plan is perfect for your business if you need a scalable, all-in-one solution to handle the intricate demands of both payroll and human capital management, giving you control over your workforce data while making better decisions with the insights provided.

With the HCM plan, you can align your HR strategy with your business goals by tracking employee performance, developing talent, and analyzing workforce data to make informed decisions. It’s ideal for your large business or organization if you have complex HR needs that demand an all-encompassing solution.

Paycor Payroll Software Details

Basic Plan

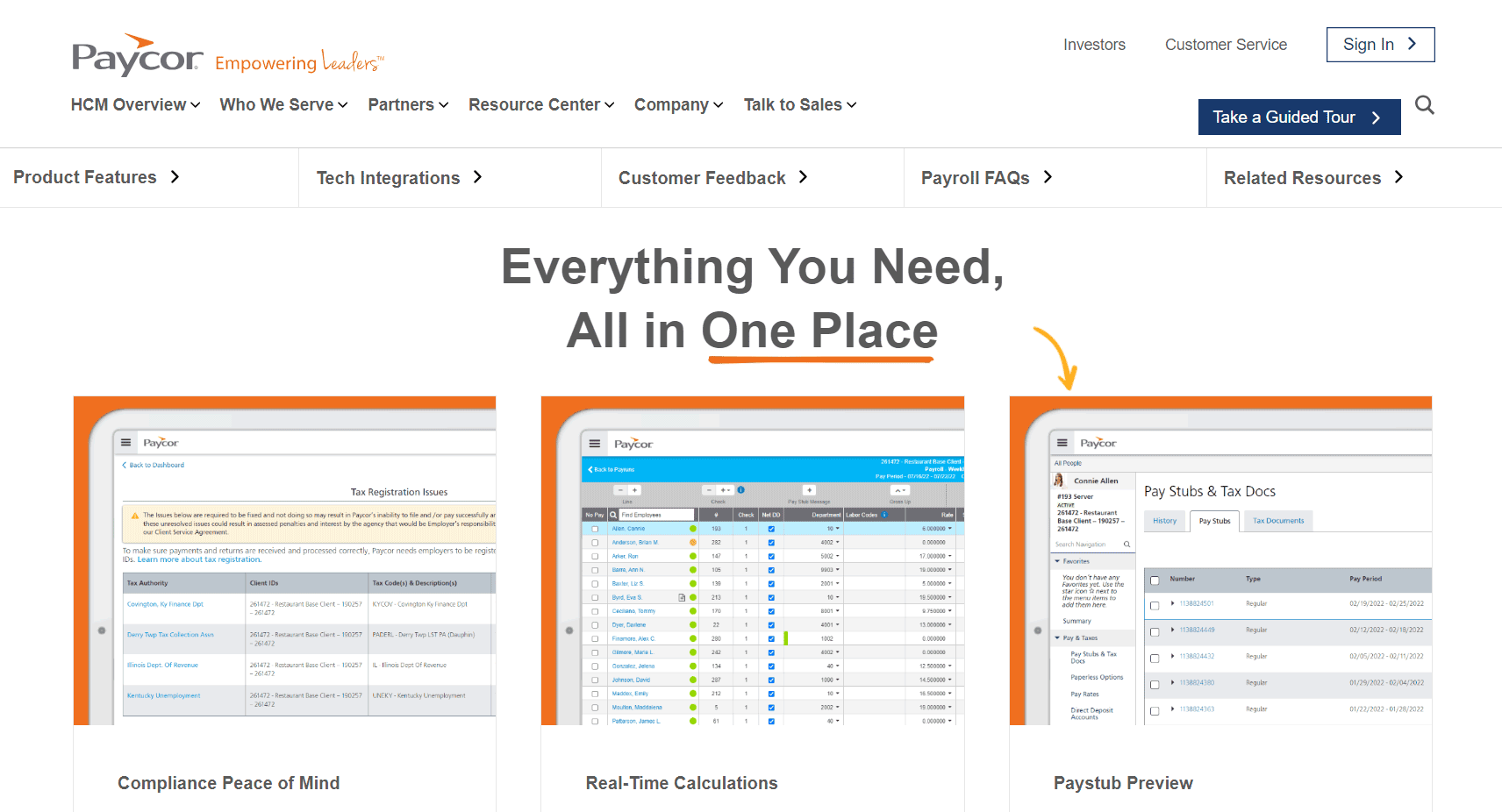

When you choose the Basic plan, you receive a streamlined payroll solution designed to cover essential payroll functions. You can process payroll and handle tax filings with ease, ensuring compliance with local, state, and federal authorities.

This plan also supports basic wage garnishments and off-cycle pay runs for added flexibility. Additionally, you get convenient pay options like direct deposit, check stuffing, and online check stubs, which your employees can access through the platform.

You’ll appreciate the reporting features, which allow you to keep track of payroll data, and the AutoRun feature that automates recurring payrolls. New hires can be seamlessly integrated through the EVS system, and with OnDemand Pay, your employees can access earned wages when needed.

For added convenience, Paycor offers you worker opportunity tax credits and additional tax filings with local authorities, making this plan ideal if you need simple yet reliable payroll services with basic HR features.

Essential Plan

With the Essential plan, you not only get everything included in the Basic plan but also enjoy advanced features that streamline both payroll and HR management. You have access to more comprehensive wage management tools, robust reporting options, and a custom report builder, allowing you to track and analyze payroll and HR data in detail.

You’ll also benefit from general ledger reporting and labor distribution, which make it easier to manage month-end accounting. Additionally, this plan includes valuable HR features like onboarding tools to simplify your company’s hiring process and job costing for better financial management.

The inclusion of Paycor Recruit allows you to manage hiring more effectively. Time-off management ensures smoother leave tracking, while the HR support center provides you with expert advice when needed. If your business requires more control over HR functions without sacrificing payroll simplicity, the Essential plan offers the right balance.

Core Plan

The Core plan, Paycor’s most popular offering, is designed to give you the perfect balance between payroll and advanced HR features. This plan builds on the Essential plan with additional HR support and management tools.

You’ll appreciate Paycor’s expense management feature, which helps you track and manage employee expenses with ease, along with employee import options for smoother data transitions. Paycor HR allows you to oversee employee data and documents in a centralized platform.

This plan is perfect if you’re looking to enhance employee engagement through features like Paycor Engage, which helps track performance and increase productivity. Leadership tools like COR Leadership give you the resources to nurture and develop your workforce.

With the HR support center available on demand, you’re never left in the dark when complex HR issues arise. If your business is seeking a more comprehensive solution, this plan provides a powerful combination of payroll and HR capabilities.

Complete Plan

The Complete plan takes everything in the Core plan and amplifies it with additional tools for managing your team’s growth and development. You have access to Paycor’s Pro and Plus analytics, providing deeper insights into payroll and workforce data, helping you make data-driven decisions.

Paycor’s talent development features allow you to track employee growth and performance, ensuring that your team members are meeting their professional goals.

You can also manage employee compensation more effectively through Paycor Compensation Planning, which enables you to set and track compensation packages based on performance.

Paycor Career Management supports employees by mapping out career paths within your organization, boosting retention and employee satisfaction. This plan is ideal if you’re focused on scaling your HR and payroll systems to support not just administrative tasks but employee development as well.

HCM Plan

If your organization is larger, with 50 to 1,000 employees, the HCM Plan is designed to meet your complex HR and payroll needs. You can manage payroll and tax compliance with ease, ensuring that every aspect of your payroll process is automated and accurate.

The plan provides comprehensive HR software solutions to help you automate routine tasks, driving efficiencies across the entire organization.

With Paycor’s advanced analytics tools, you have the power to create custom dashboards, making it easy to track performance, payroll data, and HR metrics in real-time.

PRO TIPS >>> Best Payroll Software for Church

Where Paycor Payroll Software Stands Out

Intuitive Pulse Surveys

You get real-time employee insights using Paycor Payroll’s Pulse Surveys, which help you gather confidential feedback and analyze sentiment effortlessly. With customizable questions and expression analysis, Paycor ensures that employee feedback transforms into actionable insights, fostering continuous engagement and improvement in your workforce.

Seamless Learning Management System

You will experience a streamlined approach to employee training and development with Paycor’s Learning Management System (LMS). It allows you to deliver training modules efficiently, track progress, and ensure compliance, promoting a culture of growth and continuous learning within your organization.

Robust Data & Security

Security is paramount, and Paycor Payroll ensures that your data remains protected. With advanced encryption protocols and multi-layered defenses, you are safeguarded from cyber threats. This ensures compliance with data protection regulations and helps you maintain trust within your workforce.

Advanced Compensation Management

Paycor’s Compensation Management feature enables you to seamlessly plan salary increases, bonuses, and one-time payments across your organization. You can automate compensation events, assign pay by department or location, and ensure smooth payroll integration, boosting your efficiency in rewarding performance.

Comprehensive Time + Attendance Software

Time tracking becomes a breeze with Paycor’s Time and Attendance Software. You get multiple clock options, overtime insights, and geo-validation for your workforce, ensuring accurate timekeeping and cost control. This feature is perfect for reducing your labor costs and mitigating compliance risks.

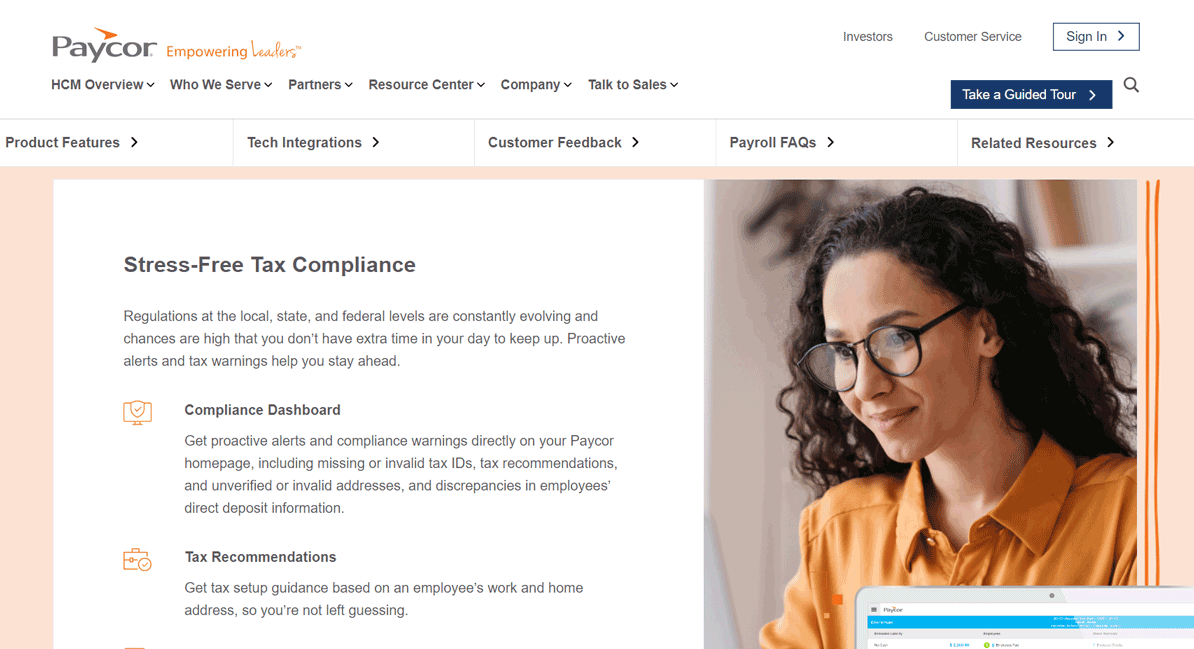

Simplified ACA Reporting Software

Paycor Payroll’s ACA Reporting Software allows you to stay compliant effortlessly. You get proactive notifications, seamless filing, and comprehensive reporting tools to track benefits eligibility. It helps you meet ACA requirements without any administrative headaches, giving you peace of mind during tax season.

Automated Talent Sourcing

With Paycor Payroll’s automated talent sourcing, you can revolutionize your recruitment process. Smart technology filters candidates based on the required skills and qualifications, allowing you to focus on interviewing the best-fit candidates, ultimately reducing hiring time and improving your talent pool.

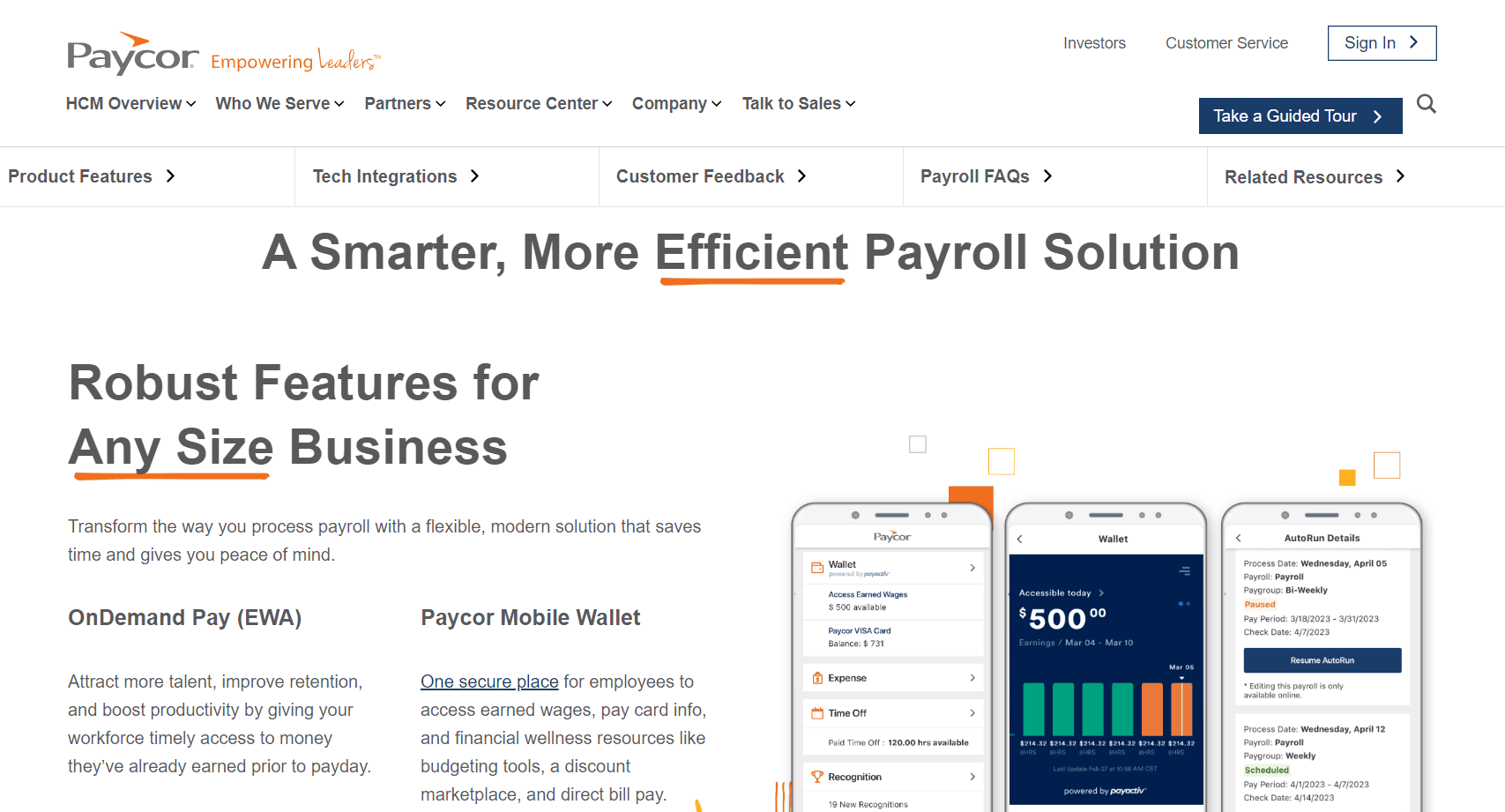

Efficient Benefits Administration

Managing benefits becomes seamless with Paycor’s Benefits Administration software. You can automate workflows, track employee benefits, and allow employees to access and enroll through the mobile app. This helps you streamline open enrollment and improve decision-making for your workforce.

Scalable Compensation Planning

With Paycor Payroll’s scalable compensation planning tools, you can automate pay adjustments across your organization. Whether you want to assign by department or location, you can ensure that bulk pay adjustments are seamlessly integrated with payroll, enhancing your organization’s financial management processes.

Advanced Employee Engagement Tools

Engagement is at the core of Paycor’s platform, with tools like real-time chat, feedback loops, and goal alignment. This feature lets you ensure continuous development through ongoing conversations, providing personalized feedback to your employees and keeping your teams aligned with company objectives.

Where Paycor Payroll Software Falls Short

Limited Customization Options

You might find that Paycor Payroll offers fewer customization options than some competitors. While its features are comprehensive, you may struggle to tailor the system to specific workflows or unique reporting requirements, which limits flexibility for your growing or complex organization.

Inconsistent Customer Support

You may experience inconsistent support from Paycor’s customer service. Users have reported longer response times and varying levels of issue resolution, which can create frustration, particularly when you are dealing with urgent payroll or compliance issues that require timely assistance.

Complex Initial Setup

Setting up Paycor Payroll can be a bit challenging for you if you don’t have prior experience. The process might feel more complicated compared to other platforms, and it may require assistance from Paycor’s support or an IT professional, which could delay implementation.

Limited International Payroll Support

You won’t find robust international payroll capabilities in Paycor Payroll. If your business operates across borders, Paycor might not be ideal, as it primarily focuses on U.S.-based payroll management, limiting its utility for companies with global operations.

GET SMARTER >>> ADP Payroll Review

Alternatives to Paycor Payroll Software

Gusto

You might find Gusto to be a more intuitive alternative, especially for your small business. It offers you an all-in-one platform for payroll, HR, and benefits, with a simpler user interface. Gusto also excels in employee onboarding, offering your business a more streamlined experience than Paycor.

ADP RUN

You’ll benefit from ADP RUN’s global payroll capabilities, which surpass Paycor’s U.S.-focused approach. ADP offers you extensive tools for your business with international operations, making it a better choice if you need robust cross-border payroll and tax compliance solutions that Paycor currently lacks.

Rippling

Choose Rippling if you need seamless integration between payroll and IT management. You get the advantage of managing devices and software along with payroll, which is something Paycor doesn’t offer. This makes Rippling ideal for your tech-forward business if you seek to streamline your operations in one place.

Customer Reviews

Paycor Payroll Software receives a 4.4 out of 5-star rating from thousands of users, showcasing a mix of positive and negative feedback. Users praise its ease of use and comprehensive features like automated payroll, employee management, and a user-friendly mobile app.

Positive reviews highlight how the software simplifies complex payroll tasks, allows efficient tracking of Paid-Time Off (PTO), and provides reliable direct deposit options.

However, there are notable criticisms. Some users report frustrating experiences during implementation, requiring external consultants to resolve issues.

Others point out long wait times and difficulties getting support. Multistate payroll support also receives lower marks due to added costs. While the overall experience remains solid for most users, these shortcomings are often emphasized by those seeking more seamless and responsive customer service.

Pro Tips

Using Paycor Payroll Software effectively requires smart practices. Here are some essential tips to help you get the most out of the platform:

- Automate tax filing for fewer errors

- Utilize self-service portals for staff convenience

- Integrate with HR tools for efficiency

- Schedule off-cycle payruns to avoid delays

- Monitor payroll compliance to prevent penalties

Recap

Paycor Payroll Software is a robust solution designed to simplify payroll and HR processes for your business. You benefit from features like automated payroll, tax filing, employee management, and reporting tools. With its intuitive interface, Paycor helps you manage compliance while streamlining your payroll tasks, making it ideal for your growing company.