Table of Contents

Our Verdict

QuickBooks Payroll Software stands out as a leading solution for managing payroll efficiently. You will find its integration with QuickBooks accounting software particularly seamless, allowing for smooth synchronization between payroll and financial data.

The platform offers you a user-friendly interface that simplifies payroll tasks such as calculating wages, withholding taxes, and ensuring compliance with federal and state regulations. You will benefit from features like automated tax calculations, direct deposit options, and the generation of tax forms, which streamline your payroll process significantly.

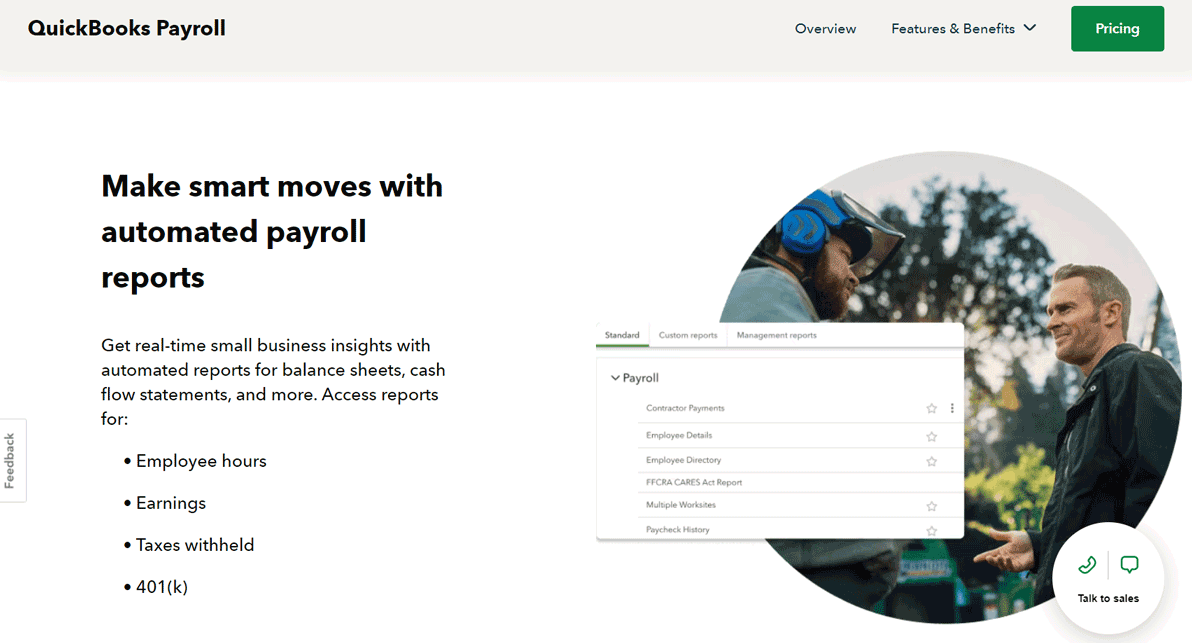

Moreover, QuickBooks Payroll provides robust reporting tools, helping you track payroll expenses, analyze compensation, and maintain accurate records effortlessly. The system’s flexibility supports various payroll schedules and employee types, making it suitable for your business irrespective of its size and your needs.

If you value comprehensive support, you will appreciate the dedicated customer service and extensive resources available for troubleshooting. Overall, QuickBooks Payroll’s efficiency, reliability, and ease of use make it a strong contender for your organization if you’re looking to optimize payroll management and stay compliant with regulations.

QuickBooks

Corporate Headquarters: Mountain View, 2700 Coast Ave, California, United States

Phone Number: +1 844-668-0062

Website: Quickbooks Official Website

Pros

QuickBooks Payroll Software offers you:

- Streamlined integration with accounting software

- Reliable tax calculation and compliance

- Convenient direct deposit setup

- Flexible payroll schedules and options

- Comprehensive employee benefits management

- Efficient handling of tax form generation

Cons

Ignore QuickBooks Payroll Software if you can’t cope with its:

- Limited period for free trial

- Initial learning curve for new users

- Occasional sync issues with third-party apps

- Additional fees for full-service options

Who QuickBooks Payroll Software Is Best For

QuickBooks Payroll Software is best for:

- Businesses using QuickBooks accounting

- Companies with evolving payroll needs

- Organizations requiring accurate tax calculations

- Teams needing seamless direct deposit

- Businesses handling multiple payroll schedules

- Firms with complex employee benefits

- Companies seeking automated tax form generation

- Teams requiring robust payroll reporting

- Organizations with varying employee pay rates

- Businesses needing integrated accounting solutions

- Companies focused on payroll compliance

- Teams looking for user-friendly software

Who QuickBooks Payroll Software Isn’t Right For

QuickBooks Payroll Software may not be best for:

- Organizations needing extensive customization options

- Companies requiring standalone payroll solutions

- Businesses not using QuickBooks accounting

- Firms needing international payroll support

- Companies seeking lower-cost alternatives

- Teams requiring highly specialized features

- Businesses focused on non-traditional payroll setups

- Firms with slow or unreliable internet

- Organizations with complex integration requirements

What QuickBooks Payroll Software Offers

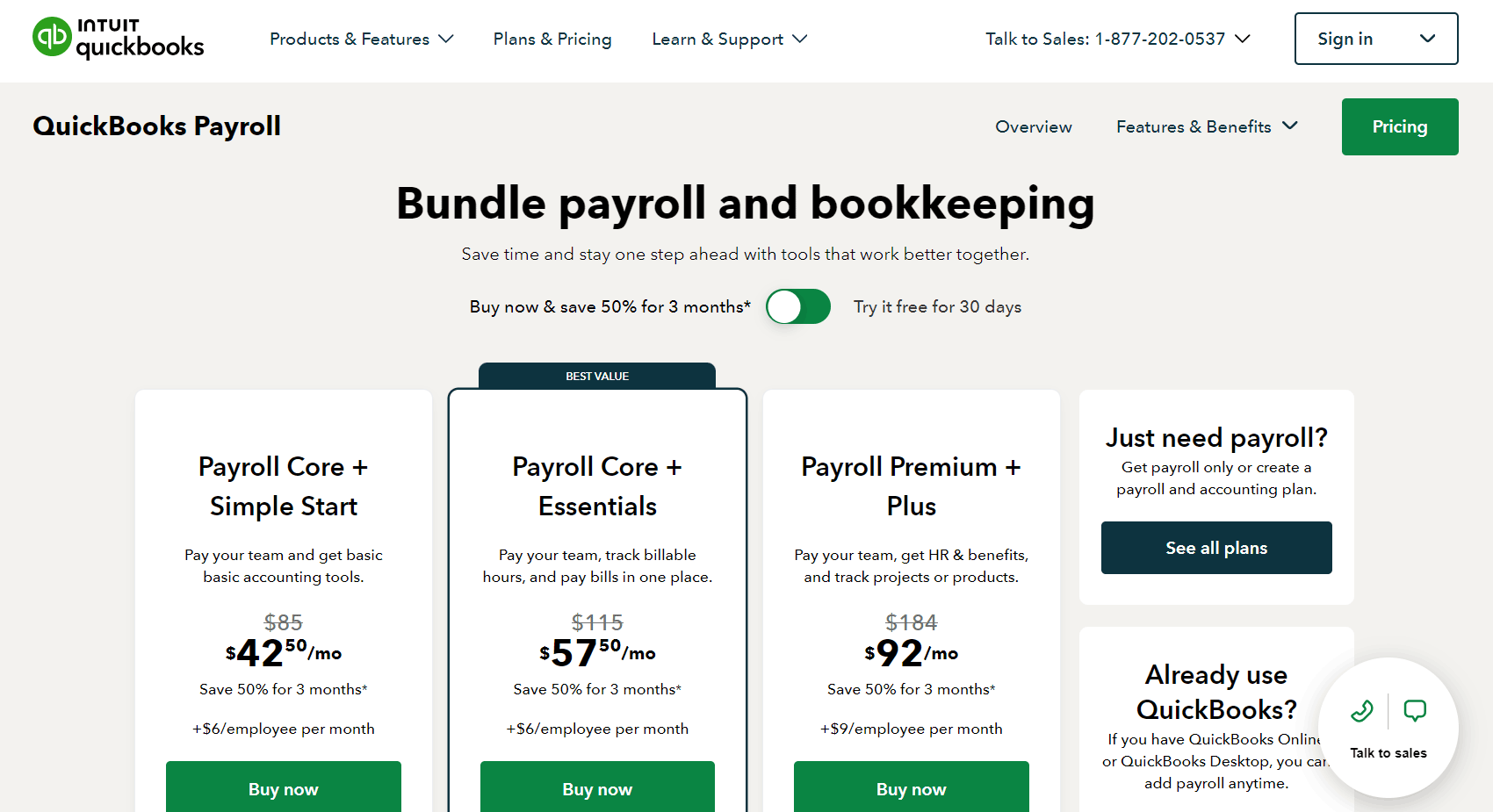

QuickBooks Payroll Software provides you with a range of plans tailored to your business needs:

Payroll Core

For basic payroll needs, you will find QuickBooks’ Payroll Core to be an economical choice. This offer allows you to pay $6.25 per month, down from the regular $25, with a 75% discount for the first six months. You also pay an additional $4 per employee per month, providing essential features like automated tax calculations and direct deposit.

Payroll Premium

If you need more advanced features, QuickBooks’ Payroll Premium provides an enhanced option. You pay $13.75 per month instead of $55, thanks to a 75% discount for the first six months. This plan includes advanced reporting and employee benefits management, with an additional $8 per employee per month. You gain access to features that streamline complex payroll tasks.

Payroll Elite

For comprehensive payroll management, QuickBooks’ Payroll Elite offers you a premium solution. You pay $20 per month, reduced from $80, with a 75% discount for the first six months. This plan includes full-service payroll, tax handling, and support, with an additional $15 per employee per month. You benefit from top-tier features and dedicated support to meet all your payroll needs.

QuickBooks Payroll Software Details

Payroll Core

With Payroll Core, you receive a robust payroll solution tailored for essential payroll needs. You benefit from comprehensive payroll processing that ensures your employees are paid accurately and on time. The plan includes automated payroll calculations, simplifying your payroll tasks.

You also get automatic tax form generation, making tax compliance straightforward. Detailed payroll reports help you keep track of financials and ensure transparency. The Record of Employment feature supports documentation needs, while workers’ compensation integration ensures you meet legal requirements.

You also gain access to a workforce portal and app, which allows your employees to view their pay stubs and manage personal information. QuickBooks Payroll provides a free guided setup to help you get started quickly and efficiently.

Payroll Premium

Choosing Payroll Premium upgrades your payroll management with additional features beyond Payroll Core. You enjoy fast direct deposit, which speeds up payments to your employees, enhancing satisfaction.

The plan includes prioritized support, giving you quicker responses to any issues. You also get advanced time tracking and job scheduling, helping you manage employee hours and shifts more efficiently.

The employee mobile app offers easy access to payroll information and self-service options. Payroll Premium includes all the core features, plus enhanced tools for tracking hours worked and scheduling jobs, making it ideal for you if your business has more complex payroll needs.

Payroll Elite

Opting for Payroll Elite gives you the most comprehensive payroll features available. You get everything included in Payroll Premium, with added advanced functionalities.

Geofencing technology ensures your employees are in the right location when clocking in, which helps manage remote or field-based work effectively.

You also gain project-based collaboration tools, allowing you to track projects with detailed reports. This feature helps you manage tasks and monitor progress with precision.

Payroll Elite is designed for your business with complex payroll and project management needs, offering you advanced tracking and detailed project reporting for better oversight and efficiency.

PRO TIPS >>> QuickBooks Payroll Software: Get It or Not?

Where QuickBooks Payroll Software Stands Out

Simplified Year-End Forms

You benefit from simplified year-end tax filing with QuickBooks Payroll, as it automatically calculates and fills out T4 and RL-1 forms for you. This feature makes tax season less stressful, providing everything you need to print and file. It ensures accuracy and saves you valuable time.

Integrated Time Tracking

Time tracking becomes effortless with QuickBooks Payroll’s built-in system. You can account for every billable hour, making sure payroll and time tracking are fully integrated. This feature helps you avoid manual entries, ensuring your payroll reflects the actual hours worked by your employees.

Easy Employee Access

Your team gains easy access to important information like digital pay stubs, year-end forms, and time tracking through a browser or QuickBooks Payroll mobile app. This self-service access saves you time by reducing the number of requests for payroll-related documents and information from your employees.

Efficient Tax Filing

You save time and hassle with QuickBooks Payroll’s tax filing feature. You can EFILE and remit your payroll taxes directly with the IRS. This automation ensures timely tax payments, reducing the risk of late penalties and keeping your payroll compliance on track.

Automated Payroll Processing

Running payroll becomes a breeze with QuickBooks automated scheduling. You set up your pay schedules and frequencies, and payroll processes automatically, reducing manual work and minimizing the chance of errors. This hands-off approach gives you peace of mind, knowing your payroll runs consistently.

Quick Direct Deposit

You can choose between fast direct deposit options that suit your business’s cash flow needs. With QuickBooks Payroll, you have the flexibility to offer two-day or even next-day direct deposit, ensuring your employees are paid promptly, boosting their satisfaction and engagement.

Comprehensive Setup Support

When you sign up for QuickBooks Payroll, you get expert setup guidance to ensure everything is done right. This feature helps you avoid potential issues down the line, making the onboarding process smooth and straightforward, especially if you’re new to payroll systems.

Unified Accounting, Payroll, and Time Tracking

Your payroll management becomes simpler with the integration of accounting, payroll, and time tracking in one platform. This unified approach gives you a central hub to manage all aspects of your business finances, reducing the need for multiple tools and enhancing your efficiency.

Mobile-Friendly Accessibility

With QuickBooks Payroll, you enjoy the convenience of managing payroll on the go. The platform’s mobile app allows you to process payroll, track employee hours, and review reports from your phone or tablet, giving you the flexibility to handle payroll tasks wherever you are.

Customizable Pay Schedules

You gain flexibility with customizable pay schedules that fit your business needs. Whether you run weekly, bi-weekly, or monthly payroll, QuickBooks Payroll adapts to your preferences, giving you control over how and when your employees get paid.

Where QuickBooks Payroll Software Falls Short

High Cost for Small Businesses

If you run a small business, you may find the cost of QuickBooks Payroll quite high, especially for premium features. As your team grows, the per-employee charges can quickly add up, making it less budget-friendly than other payroll solutions.

Learning Curve for Beginners

If you’re new to payroll software, the learning curve of QuickBooks Payroll can feel overwhelming. Navigating through the various features, especially when integrating it with accounting tools, requires time and effort, which can delay your operations.

Additional Fees for Full-Service Options

Though the software offers you many features, adding full-service options like tax filing or next-day direct deposit can result in extra fees. If you’re seeking a more all-inclusive package, the incremental costs may reduce its overall value.

Mobile App Lacks Advanced Features

While QuickBooks Payroll offers you a mobile app, its functionality can be somewhat limited. Advanced payroll tasks such as detailed reporting or adjustments may require you to switch to the desktop version, reducing the app’s efficiency.

Occasional Software Bugs

From time to time, you might experience glitches within the QuickBooks Payroll system. These bugs can disrupt payroll runs or delay access to important data, affecting your ability to pay employees or meet tax deadlines smoothly.

GET SMARTER >>> Paychex Flex HR Software: Get It or Not?

Alternatives to QuickBooks Payroll Software

OnPay

If your focus is on flexibility, OnPay offers you more customization options for payroll reports and employee data tracking. You can benefit from its streamlined interface, making it a better choice if you need an adaptable and simple solution than QuickBooks Payroll.

ADP RUN

Consider ADP RUN if your business seeks robust scalability and more advanced features, including deeper integrations and extensive HR tools. If you plan to grow your business, you may find its enterprise-level services better suited to handle expansion compared to QuickBooks Payroll’s offerings.

Paychex Flex

Do you need advanced HR services? Paychex Flex offers you a wide range of features beyond payroll, including compliance assistance and retirement planning. You may prefer its comprehensive HR management tools, which can provide more support compared to QuickBooks Payroll’s limited HR capabilities.

Gusto

If you prioritize user-friendly interfaces, Gusto stands out with its simple setup. You’ll find comprehensive HR tools, employee benefits administration, and seamless tax filing, making it an attractive option over QuickBooks Payroll for your growing business.

Customer Reviews

QuickBooks Payroll Software receives mixed customer reviews, reflecting a range of user experiences. Many customers give it a strong 4.5-star rating, praising its ease of use, seamless integration with QuickBooks accounting, and automated tax filing.

Users often highlight the convenience of running payroll quickly, appreciating features like automatic payroll calculations and timely tax remittance. The fast direct deposit options and the availability of both mobile and desktop platforms also receive positive comments.

However, some users express dissatisfaction, particularly with customer support. Delays in response times and difficulty in resolving issues are common negative remarks.

Additionally, the cost of QuickBooks Payroll, especially after promotional periods end, is a source of frustration for smaller businesses seeking more budget-friendly payroll solutions. Many reviews point out that while the software is powerful, its higher-tier plans may not always justify the price for companies with fewer employees.

Errors in payroll processing and occasional glitches in tax calculations are mentioned as significant drawbacks, with some users feeling that these issues create more work than expected.

Another recurring concern is the learning curve for users unfamiliar with payroll software, as the platform, while intuitive for accounting tasks, can be challenging for payroll newcomers.

Despite these criticisms, the overall sentiment leans positive, particularly for companies already using QuickBooks for their accounting and in need of streamlined payroll management.

Pro Tips

To get the most out of QuickBooks Payroll Software, consider these essential tips:

- Set up direct deposit for your employees

- Review payroll reports regularly for accuracy

- Automate payroll for recurring schedules

- Sync time tracking for billable hours

- Use tax filing reminders for deadlines

- Integrate with QuickBooks accounting for seamless accounting

Recap

QuickBooks Payroll Software offers you a reliable and comprehensive solution for managing payroll. You can automate payroll, handle tax filing, and ensure your team gets paid on time with direct deposit options. Seamless integration with QuickBooks accounting enhances your overall accounting process. This makes it a great choice for your business if you seek efficiency and accuracy in your payroll management system.