Table of Contents

In this article:

- ADP Payroll Review: Our Verdict

- ADP Payroll Review: Who ADP Payroll Is Best For

- ADP Payroll Review: Who ADP Payroll Isn’t Right For

- ADP Payroll Review: What ADP Payroll Offers

- ADP Payroll Review: ADP Payroll Details

- ADP Payroll Review: Where ADP Payroll Stands Out

- ADP Payroll Review: Where ADP Payroll Falls Short

- ADP Payroll Review: Alternatives to ADP Payroll

- ADP Payroll Review: Customer Reviews

- Pro Tips

- Recap

Our Verdict

ADP Payroll is a comprehensive payroll and human capital management (HCM) solution designed to streamline your payroll and HR processes, making it an invaluable tool for businesses of all sizes. It automates payroll calculations, tax filings, and benefits administration, reducing manual effort and minimizing errors.

With seamless integration capabilities, ADP connects effortlessly with your existing business applications like QuickBooks, enhancing workflow efficiency. The platform also provides robust HR management tools for recruitment, onboarding, and performance management, ensuring you can attract and retain top talent.

One of ADP’s key strengths is its scalability and customization, making it suitable for both small startups and large enterprises. The system leverages machine learning and data analytics to identify and flag potential payroll errors, reducing the risk of costly mistakes and ensuring compliance with labor laws. Additionally, ADP offers 24/7 customer support and supports various payment methods, including direct deposit, pay cards, and checks, offering flexibility for both employers and employees.

However, ADP Payroll does have some drawbacks. Its pricing is not transparent, requiring you to contact its sales team for quotes, which can be inconvenient. It also tends to be more expensive than some competitors, which may be a barrier for small businesses on a tight budget. Also, the extensive features and integrations can be overwhelming for users who prefer a simpler solution.

Despite these challenges, ADP Payroll’s extensive capabilities and reliable support make it a strong contender for effectively managing your payroll and HR needs.

Please explore any of these contacts for questions or additional information on ADP Payroll:

- Website: https://www.adp.com

- Phone: 1-844-227-5237, 800-225-5237, 877-647-6603

- Office Addresses: ADP Headquarters: One ADP Boulevard, Roseland, NJ 07068, USA

Pros

- Automates payroll processing and tax filing, ensuring accuracy and compliance.

- Integrates with other HCM functions like time and attendance tracking, benefits administration, and talent management.

- Supports multiple payment methods, including direct deposit, pay cards, and checks, offering flexibility.

- Leverages machine learning and data analytics to identify and flag potential payroll errors.

- Scales to accommodate businesses of all sizes, from small startups to large enterprises.

Cons

- Lacks transparent pricing, which can be a barrier for small businesses on a tight budget.

- Presents a steep learning curve for new users due to its extensive features.

- Offers inconsistent customer service, as reported by some users.

- Charges relatively high fees, which may be expensive for smaller businesses.

Who ADP Payroll Is Best For

ADP Payroll is best for you if:

- You want to automate payroll processing and tax filing to ensure accuracy and compliance.

- You need a system that integrates with other HCM functions like time and attendance tracking, benefits administration, and talent management.

- You require support for multiple payment methods, including direct deposit, pay cards, and checks, offering flexibility.

- You value a platform that leverages machine learning and data analytics to identify and flag potential payroll errors.

- You seek a solution that scales to accommodate businesses of all sizes, from small startups to large enterprises.

MORE >>> Onpay Payroll Software Review

Who ADP Payroll Isn’t Right for

Go for an alternative to ADP Payroll if:

- You are a small business with a tight budget, as ADP’s pricing can be relatively high and lacks transparency.

- You are new to payroll systems and prefer a simpler platform, as ADP’s extensive features may present a steep learning curve.

- You require consistent customer service, as some users complain of reported variability in the quality of support.

- You need a highly customizable payroll solution, as ADP may not offer the level of customization you need.

What ADP Payroll Offers

Some of the services ADP Payroll provides are:

Automated Payroll Processing

ADP Payroll automates the entire payroll process, ensuring accurate and timely payment to employees. It handles payroll calculations, direct deposits, check printing, and tax filings for federal, state, and local taxes. The system also supports multi-state and international payroll processing, making it ideal for businesses with a diverse workforce. This automation reduces manual effort and errors, streamlining payroll management.

Time-and-Attendance

ADP’s Time-and-Attendance solution integrates seamlessly with its payroll system, providing an all-in-one platform for scheduling, timekeeping, and attendance management. It eliminates the need for paper timesheets and manual data entry, reducing errors and improving productivity. Employees can log their hours using web-based timesheets, smart time clocks, or mobile devices, making it convenient for both on-site and remote workers.

Talent

ADP’s Talent Management solutions cover the entire employee lifecycle, from recruitment and onboarding to performance management and development. The platform offers tools for applicant tracking, employee training, and succession planning, helping businesses attract, retain, and develop top talent. These features enable organizations to build a skilled and engaged workforce.

Benefits

ADP’s Benefits Administration services simplify the management of employee benefits, including health insurance, retirement plans, and other perks. The platform integrates with top benefit carriers, streamlining data exchange for plan setup, enrollment, and billing. This reduces the risk of data entry errors and saves time, making benefits administration more efficient and engaging for employees.

HR Services

ADP provides a wide range of HR services designed to support businesses in managing their workforce. These services include HR consulting, compliance support, employee relations, and policy development. ADP’s HR experts offer ongoing assistance, helping businesses navigate complex HR challenges and stay compliant with employment laws.

HR Outsourcing and PEO

ADP’s HR Outsourcing and Professional Employer Organization (PEO) services offer comprehensive HR management, including payroll, benefits, compliance, and risk management. By partnering with ADP, businesses can offload HR tasks to experts, allowing them to focus on core operations. This service is particularly beneficial for small and mid-sized businesses seeking to offer competitive benefits and streamline HR processes.

Integrations

ADP integrates with a wide range of business applications, including accounting software like QuickBooks, ERP systems, and time-tracking tools. These integrations ensure seamless data flow between systems, reducing manual data entry and improving accuracy. ADP’s API Central also allows businesses to build custom integrations tailored to their specific needs.

App Marketplace

ADP Marketplace is a digital HR storefront offering a collection of solutions from ADP and third-party partners. Businesses can explore, try, and buy apps that integrate seamlessly with ADP’s platform, enhancing HR capabilities. The marketplace includes solutions for recruiting, compliance, financial wellness, and more, providing a flexible and customizable HR ecosystem.

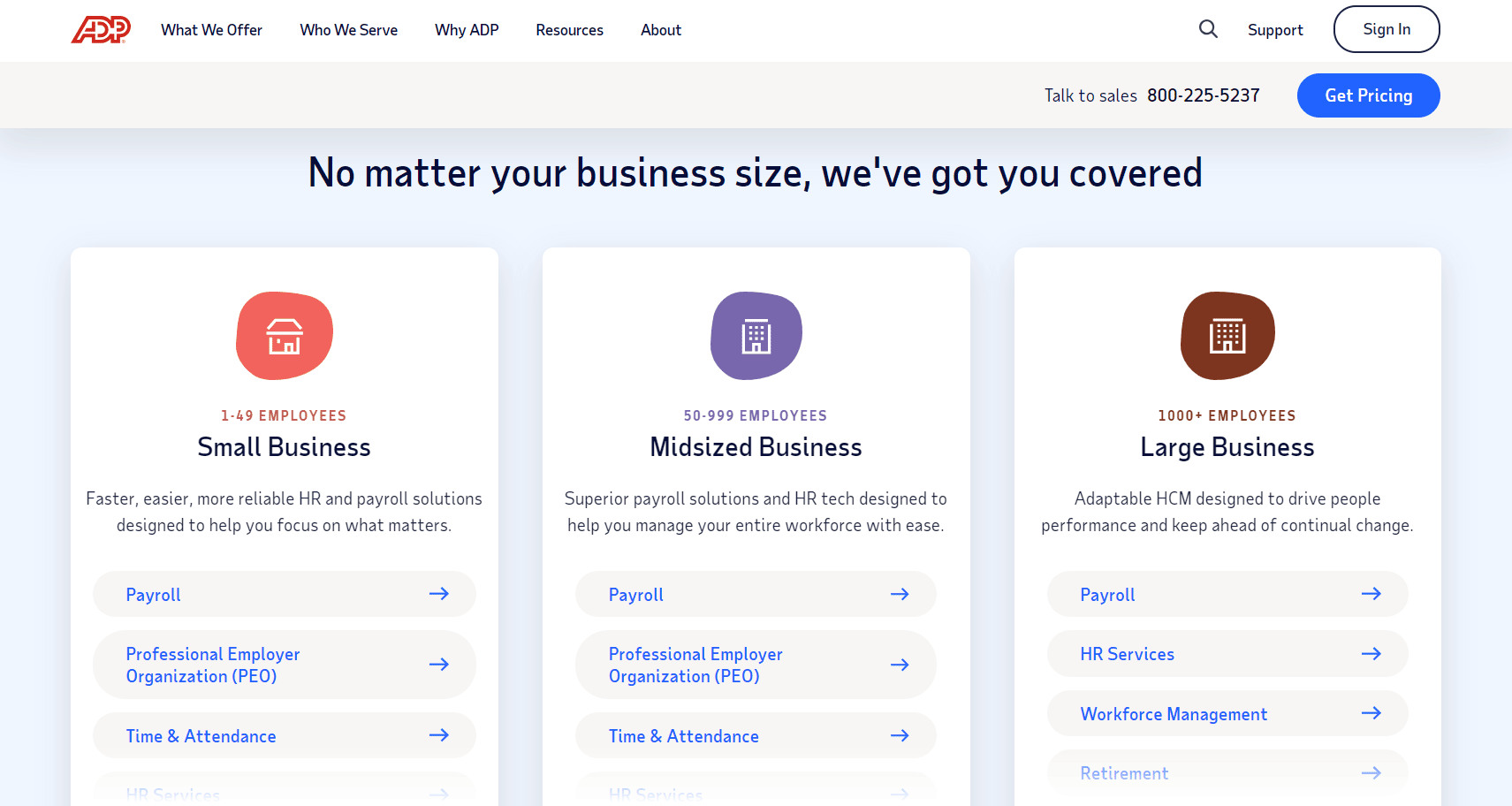

Products by Name

ADP offers a variety of products tailored to different business needs, including RUN Powered by ADP® for small businesses, ADP Workforce Now® for mid-sized companies, and ADP Vantage HCM® for large enterprises. Each product provides a comprehensive suite of payroll, HR, and talent management tools, designed to streamline operations and support business growth.

Tax Filing and Compliance

ADP takes care of payroll tax calculations and filings at the federal, state, and local levels. This service helps businesses stay compliant with ever-changing tax laws and regulations, reducing the risk of penalties and fines. ADP also manages year-end tax forms, such as W-2s and 1099s, ensuring they are distributed to employees and contractors promptly.

Advanced Reporting and Analytics

The platform offers robust reporting and analytics capabilities, enabling employers to generate detailed payroll reports. These reports provide insights into labor costs, tax liabilities, and employee compensation, helping businesses make informed decisions. ADP also uses machine learning and data analytics to identify and flag potential payroll errors, enhancing accuracy and compliance

Employee Self-Service

ADP provides a user-friendly self-service portal where employees can access their pay stubs, tax forms, and personal information. This feature empowers employees to manage their own data, reducing the administrative burden on HR departments. The portal is accessible from any device, offering convenience and flexibility.

Scalability and Customization

ADP Payroll is designed to scale with businesses as they grow, making it suitable for small startups as well as large enterprises. The platform offers various service packages that you can customize to meet the specific needs of each business. Whether your company prefers to handle payroll in-house or outsource it to ADP’s experts, there is a solution available for you.

Customer Support

ADP provides expert support to help businesses navigate any payroll-related issues. This includes assistance with setup, troubleshooting, and ongoing maintenance.

ADP Payroll Details

Ideal for

- Small Business Owners

- HR Managers

- Accountants

- Payroll Specialists

- Entrepreneurs

- Financial Officers

- Large Enterprise Executives

- Startups

- Founders

- International Business

- Managers Compliance Officers

Plans and Pricing

Note that the pricing is not transparent. It requires that you get a personalized quote on its website. CLICK HERE. Here’s a look at its plans and available information on the pricing:

Essential Payroll

The Essential Payroll plan offers basic payroll services, including direct deposit, new hire reporting, and the generation of W-2s and 1099s. This plan is ideal for small businesses that need straightforward payroll management without additional HR features. Information from users reveals that the monthly price is $79 plus $4 for each employee.

Enhanced Payroll

The Enhanced Payroll plan includes all the features of the Essential plan, with added benefits such as ZipRecruiter® integration, state unemployment insurance management, and background checks. This plan is suitable for businesses that require more comprehensive payroll and hiring support. Pricing for this plan is custom and depends on the specific needs of the business.

Complete Payroll & HR Plus

The Complete Payroll & HR Plus plan builds on the Enhanced plan by adding basic HR support, making it a good choice for businesses that need both payroll and HR services. This plan includes features like employee handbook assistance and HR guidance. Pricing is custom and typically higher than the Enhanced plan due to the added HR support.

HR Pro Payroll & HR

The HR Pro Payroll & HR plan is the most comprehensive option, including everything in the Complete plan plus enhanced HR support and additional perks such as employee training and legal assistance. This plan is for businesses that need extensive HR and payroll services. Pricing is custom and is the highest among the plans due to its extensive features.

PRO TIPS >>> QuickBooks Payroll Software: Get It or Not?

Accounting Integrations

ADP Payroll integrates with QuickBooks, QuickBooks Online, Xero, and Wave These integrations ensure a seamless transition of data between payroll and accounting systems, streamlining financial management and reducing manual data entry.

Where ADP Payroll Stands Out

ADP Payroll is unique because it:

- Automates payroll processing, including calculations, deductions, and payments

- Integrates seamlessly with popular accounting software like QuickBooks and Xero.

- Provides comprehensive tax filing and compliance support.

- Offers mobile access, allowing payroll management from any device.

- Supports multi-country payroll, making it ideal for international businesses.

- Includes employee self-service features for easy access to pay stubs and tax forms.

- Ensures data security with robust encryption and compliance with data protection regulations

- Delivers scalable solutions that grow with your business needs.

- Facilitates time-tracking integration to streamline payroll and attendance management.

Where ADP Payroll Review Falls Short

ADP Payroll has limitations such as:

- Charges higher fees compared to some competitors, making it expensive for small businesses

- Lacks transparent pricing, which can make it difficult for businesses to budget accurately

- Presents a steep learning curve for entry-level HR personnel due to its complex features

- Requires additional fees for certain features like PTO and expense management

- Offers limited customization options in some of its plans

- Provides customer support that is not always responsive or helpful according to some user reviews

Alternatives to ADP Payroll

Here are some alternatives to ADP Payroll:

Gusto

Gusto is a cloud-based payroll provider known for its user-friendly interface and customizable payroll solutions. It offers features such as automated payroll processing, tax filing, benefits administration, and employee self-service. Gusto is particularly popular among small to medium-sized businesses due to its affordability and comprehensive HR tools. Pricing starts at $40 per month plus $6 per employee.

Paychex Flex

Paychex Flex is a scalable payroll solution that caters to businesses of all sizes. It provides a wide range of services, including payroll processing, tax compliance, HR management, and benefits administration. Paychex Flex is reputable for its flexibility and ability to grow with your business, making it a strong alternative to ADP. Pricing is custom and based on the specific needs of the business.

QuickBooks Payroll

QuickBooks Payroll is ideal for businesses already using QuickBooks for accounting. It offers seamless integration with QuickBooks, making payroll and accounting processes more efficient. Features include automated payroll, tax filing, and employee benefits management. QuickBooks Payroll is suitable for small to medium-sized businesses and offers plans starting at $45 per month plus $4 per employee.

Square Payroll

Square Payroll is an affordable payroll solution designed for small businesses and startups. It offers features such as automated payroll processing, tax filing, and employee benefits management. Square Payroll is popular for its simplicity and ease of use, making it a great option for businesses looking for a straightforward payroll solution. Pricing starts at $35 per month plus $5 per employee.

OnPay

OnPay is a versatile payroll service that caters to businesses with hourly and contract workers. It offers features such as payroll processing, tax filing, benefits administration, and HR tools. OnPay is popular for its affordability and ease of use, making it a popular choice for small to medium-sized businesses. Pricing starts at $40 per month plus $6 per employee.

Wave Payroll

Wave Payroll is a cost-effective payroll solution for new and small businesses. It offers basic payroll features such as automated payroll processing, tax filing, and direct deposit. Wave Payroll integrates with Wave’s accounting software, providing a seamless financial management experience. Pricing starts at $20 per month plus $6 per employee.

GET SMARTER >>> Gusto vs Patriot Payroll

Customer Reviews

ADP Payroll holds a rating of 3.4 out of 205 on U.S. News, ranking number 9 in both the Best Payroll Software of 2024 and Best Payroll Software for Small Businesses of 2024. Consumer Affairs users rate it 4.1 out of 205 based on 2,257 reviews, appreciating its flexibility, ease of use, and comprehensive features. On ADP’s official site, it has a rating of 4.2 out of 205 from 470 reviews, with users highlighting its robust payroll and HR solutions. Additionally, Gartner Peer Insights features positive feedback from 600 in-depth reviews by real users, although it doesn’t provide a specific numerical rating.

Pro Tips

Here are some pro tips for you:

- Utilize Training Resources: Take advantage of ADP’s training materials and webinars to fully understand the platform’s features and capabilities.

- Customize Reports: Use the custom reporting tools to generate specific insights that are most relevant to your business needs.

- Automate Processes: Set up automated payroll and tax filing to save time and reduce errors.

- Integrate with Other Software: Connect ADP with your accounting, HR, and time-tracking software to streamline operations.

- Leverage Mobile Access: Use the mobile app to manage payroll on the go, ensuring flexibility and convenience.

- Stay Updated: Regularly check for updates and new features to keep your payroll processes efficient and compliant.

- Engage with Customer Support: Don’t hesitate to reach out to ADP’s customer support for any issues or questions to ensure smooth operation.

- Review Compliance Features: Regularly review ADP’s compliance tools to ensure your business adheres to the latest tax laws and labor regulations.

- Use Employee Self-Service: Encourage employees to use the self-service portal for accessing pay stubs, tax forms, and updating personal information.

- Explore Additional Services: Look into ADP’s additional HR services, such as benefits administration and talent management, to enhance your overall HR strategy.

Recap

ADP Payroll is an essential tool for streamlining payroll and HR processes, saving you time and reducing errors through automation. It ensures compliance with tax regulations, offers robust security measures, and provides comprehensive reporting and analytics. With features like employee self-service and mobile access, ADP Payroll empowers employees to manage their own information, easing the administrative burden on HR departments. Additionally, its seamless integration with popular accounting software enhances operational efficiency and supports business growth.

You can make your payroll management easier and more dependable with ADP Payroll’s scalable solutions, regardless of your role—small business owner, HR manager, or financial officer. The system’s advanced capabilities, including automated tax filing and compliance management, help businesses avoid costly mistakes and legal issues. Furthermore, ADP Payroll supports various payment methods, such as direct deposit, pay cards, and checks, offering flexibility for both employers and employees. With its user-friendly interface and extensive support resources, ADP Payroll is an excellent choice for businesses looking to optimize their payroll and HR operations.