Table of Contents

Our Verdict

Gusto emerges as robust employee software for your organization—a partner that champions both efficiency and employee well-being, inviting your business to dance to the rhythm of modern HR management.

With the power to simplify the complex, it harmonizes the intricate components of payroll finesse, benefits administration, and HR management within a singular digital architecture. Demonstrating an unwavering commitment to regulatory compliance, the platform orchestrates tax complexities through automated precision, leaving no room for discord.

Gusto stands out as a payroll and HR software system owing to its user-friendly design, clear pricing, and extensive features. It provides full-service payroll, benefits, time tracking, tax compliance, onboarding, personnel management, analytics, reporting, and employee self-service. It also provides automated charitable giving, college savings, and employee financial wellness initiatives.

For your employees, the provision of self-service portals affords autonomous access to their payroll domain, while HR teams find solace in the optimized management of benefits administration.

Gusto has its headquarters in San Francisco, California, and also has offices in Denver, Colorado, and New York City, New York. Make inquiries by sending a letter to Gusto, 525 20th Street, San Francisco, CA 94107, or an email to hello@gusto.com, calling (800) 936-0383, or simply filling out an online form on their website, gusto.com.

Pros

- Simplifies the management of payroll, benefits, and HR tasks.

- Offers an integrated platform that combines payroll, benefits administration, and HR management. This streamlines processes and reduces the need for multiple software solutions.

- Empowers businesses to effectively manage employee benefits, from health insurance to retirement plans, enhancing the management of employee perks.

- Automates compliance tasks, assisting your business with accurate tax calculations, filings, and other regulatory requirements.

- Provides employee self-service portals, allowing your employees to access pay stubs, benefits details, and personal information updates independently, lightening the load on HR teams.

- Offers responsive support, ensuring your business gets all the support it needs.

Cons

- Involves higher pricing, which may not suit small businesses with constrained budgets.

- Offers limited scalability, which means it may not scale as effectively for larger enterprises with complex HR and benefits requirements.

- Lacks advanced features, unlike larger, enterprise-focused solutions in the market.

- Poses integration challenges with other tools, potentially requiring additional effort and resources.

Who Gusto Employee Benefits Software Is Best For

Gusto Employee Benefits Software is best for you if you:

- Seek a comprehensive and user-friendly solution for payroll, benefits administration, and HR management.

- Prefer software that caters well to businesses with limited HR expertise or resources, as its intuitive interface simplifies complex tasks.

- Desire automated compliance features and assistance with tax calculations

- Need a platform with employee self-service portals that cater to organizations aiming to enhance employee engagement and empower staff to access relevant information independently.

Who Gusto Employee Benefits Software Isn't Right For

Gusto Employee Benefits Software is not the right option for you if you:

- Run a large enterprise with complex HR needs like: advanced customization, sophisticated reporting, or specialized HR functionalities

- Manage an industry that requires specialized HR software tailored to unique compliance and operational needs, such as healthcare or manufacturing.

- Operate a business that relies heavily on a complex ecosystem of existing software tools, especially those that Gusto does not integrate with.

- Seek international support for your business, or you run a global business. Gusto’s features lacks adequate capacity to handle complex international payroll and compliance needs like specialized global payroll solutions.

- Run HR and benefits administration that involve intricate approval processes, multi-level hierarchies, or complex workflows

What Gusto Employee Benefits Software Offers

- Payroll management

- Benefits Administration

- Time tracking

- Tax Compliance

- Onboarding

- Analytics and reporting

- Employee self-service portals

- Employee onboarding and offboarding

- Customization

- Document storage

Gusto Employee Benefits Software Details

Payroll

Use Gusto for your employee payroll and enjoy its automated or manual options, direct deposit, tax filing, compliance guidance, and more. Gusto also offers extras such as automated charitable donations, college savings benefits, and employee financial wellness tools.

Benefits administration

Gusto offers health, retirement, college savings, and other benefits to your employee, with flexible plans and pricing. Gusto also has a licensed advisor, who can help you find the best coverage for your team.

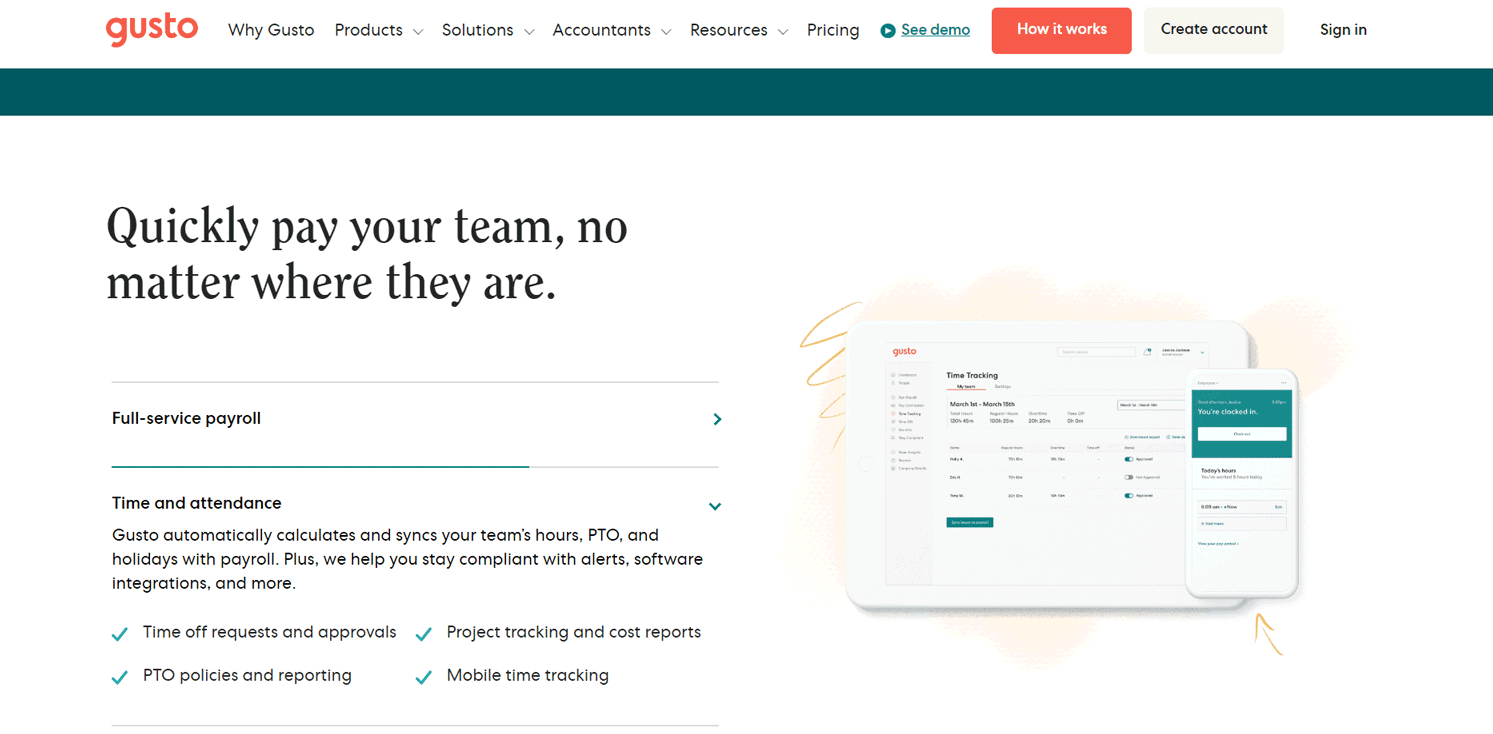

Time tracking

Gusto integrates with popular time tracking apps such as TSheets, Homebase, and When I Work and syncs hours to payroll automatically. Gusto also allows you to create and manage PTO policies, time-off requests, overtime alerts, and project tracking.

Tax compliance

Gusto calculates, files, and pays federal, state, and local payroll taxes on your behalf, and helps you with forms such as W-2s and 1099s. Gusto also helps you claim tax credits, such as the R&D tax credit.

Onboarding

Gusto streamlines the hiring process by allowing you to send offer letters, collect e-signatures, run background checks, and set up payroll and benefits for new hires.

Talent management

Explore talent management by checking performance reviews, feedback requests, learning and development tools, and personalized employee communications.

Analytics and reporting

Get insights into your payroll and benefits data, such as payroll history, tax payments, employee demographics, benefits costs, and more.

Employee self-service

Make your employees access their paystubs, tax forms, benefits information, time-off requests, and personal details online or through the mobile app

Diverse Pricing Tiers

Gusto offers four pricing tiers, which are:

Simple

Costs $40 per month with an additional $6 per person per month, this option encompasses fundamental payroll and benefits integration. It covers features like comprehensive single-state payroll services, employee profiles with self-service capabilities, management of health insurance through Gusto, and employee financial benefits.

Plus

Costs $80 per month plus $12 per person per month, the Plus plan encompasses all that the Simple plan offers, and takes it a step further. It provides advanced attributes like multi-state payroll management, next-day direct deposit, sophisticated tools for hiring and onboarding, policy management for paid time off (PTO), time and project tracking, comprehensive workforce analysis, reporting features, and tools for team administration.

Premium

Costs $160 per month along with an additional $18 per person per month, the Premium package builds upon the Plus plan. In addition to the features available in the Plus tier, Premium subscribers have access to a dedicated Gusto success manager, HR experts with certifications, and the HR resource centre.

Contractor Only

Tailored for businesses primarily engaging contractors and freelancers, this tier is priced at $6 per person per month, with no base fee. It covers unlimited contractor payments, management of 1099-NEC forms and filings, contractor self-service capabilities, and seamless integration with accounting and expense management applications.

PRO TIPS >>> Employee Benefits Software How Does It Work

Where Gusto Employee Benefits Software Stands Out

Several distinctive attributes of Gusto include:

Gusto Cashout

This innovative functionality empowers employees to access their earned wages prior to their scheduled payday, without incurring any fees or interest charges. Employees have the flexibility to determine the amount they wish to cash out and select a repayment timeline. This feature proves invaluable for addressing unforeseen expenses or urgent financial needs.

Gusto Wallet

This feature is designed to assist you, as an employer, in managing your finances and working towards your financial objectives. You can create multiple savings accounts, set up automated transfers, monitor expenditures, and receive personalized financial advice. Gusto Wallet seamlessly integrates with Gusto Cashout and other associated benefits.

Gusto Concierge

This feature offers personalized support through a dedicated Gusto success manager and certified HR experts. With Gusto Concierge, users gain access to Gusto’s comprehensive HR resource center, comprising templates, guides, and best practices spanning various HR-related subjects.

Where Gusto Employee Benefits Software Falls Short

Gusto is a great payroll and HR software for small businesses and startups, but it also has some drawbacks that you should be aware of. Here are some of the areas where Gusto falls short:

Pricing structure

Gusto employs a model where each plan incurs a monthly base fee along with an additional charge per person. This cost can escalate as your team expands, especially if you aspire to utilize the advanced capabilities and support that the premium plan offers. Note that, in contrast to certain competitors, Gusto does not provide a free trial option.

Benefit offerings

Gusto’s range of benefits is contingent upon specific pricing tiers and might not encompass the breadth that some users seek. Note also that Gusto does not extend its offerings to international employee benefits or payroll.

Integration

While Gusto integrates seamlessly with numerous well-known applications like QuickBooks, Xero, and FreshBooks, certain users expressed their challenges with the integration process, describing it as cumbersome and time-intensive. Be aware that Gusto lacks invoicing and accounts receivable features, potentially necessitating the use of another application for those specific functions.

Data synchronization

Though you enter and manage various data points within Gusto, such as payroll, benefits, time tracking, and time-off requests, there are possibilities for difficulties with data synchronization across the platform.

Automation

Gusto doesn’t encompass automated workflows or notifications for tasks such as performance reviews, feedback solicitations, or learning and development initiatives. Depending on your requirements, consider resorting to an alternative application or devise your own reminders to handle these HR-related functions.

Mobile application

Gusto offers a mobile app compatible with iOS and Android devices. However, it’s important to note that the app’s functionality is more limited compared to the web version. The mobile app primarily facilitates payroll processing, access to employee profiles, and viewing paystubs and tax forms. Features like benefits management, time tracking, and other HR functionalities are not available through the mobile app.

How to Qualify for Gusto Employee Benefits Software

- To utilize Gusto’s payroll service, your U.S.-based business must have employees or contractors in any of the 50 U.S. states.

- To access Gusto’s health insurance administration, your business must have a minimum of five employees and be in one of the 38 states where Gusto brokers health insurance.

- To offer Gusto’s retirement plans, your business must have at least one employee and be in any of the 50 U.S. states.

- To claim the Employee Retention Credit (ERC) through Gusto, your business must have fewer than 501 W2 employees in the qualifying quarter and must meet certain criteria related to your business operations and revenue decline.

GET SMARTER >>> Isolved Employee Benefits Software Review

Alternatives to Gusto Employee Benefits Software

OnPay

This is a payroll solution that is ideal for hourly and contract employees. OnPay handles payroll for all 50 U.S. states, with automated or manual options, direct deposit, tax filing, compliance guidance, and more. OnPay also offers benefits administration, such as health, dental, vision, life, retirement, college savings, and other plans. OnPay has a simple pricing model of $40 per month plus $6 per person per month.

QuickBooks Payroll

This is a payroll solution that is best for integrating with QuickBooks apps. QuickBooks Payroll syncs with QuickBooks Online accounting software and other apps such as TSheets and Expensify. QuickBooks Payroll also handles payroll for all 50 U.S. states, with automated or manual options, direct deposit, tax filing, compliance guidance, and more. QuickBooks Payroll offers health insurance benefits through SimplyInsured. QuickBooks Payroll has three pricing plans: Core ($45 per month plus $4 per person per month), Premium ($75 per month plus $8 per person per month), and Elite ($125 per month plus $10 per person per month)

Customer Reviews

Overall, Gusto has a positive reputation among its users and high ratings on review aggregator sites. On Trustpilot, Gusto has an average rating of 3.5 out of 5 stars based on 1,911 reviews. On TrustRadius, Gusto has an average rating of 7.5 out of 10 based on 329 reviews.

Most users praise Gusto for its user-friendly interface, transparent pricing, and comprehensive features. They appreciate how Gusto handles payroll, taxes, benefits, and compliance for them, and how it offers extras such as charitable donations, college savings benefits, and employee financial wellness tools.

However, note that some users criticize Gusto for its cost, benefits limitations, integration issues, data sync problems, lack of automation, and mobile app functionality.

Pro Tips

Here are some pro tips to get the best from Gusto:

- Utilize self-service portals: Encourage your employees to take advantage of the self-service portals to access their pay stubs and benefits information and update their personal details. This reduces the workload on HR teams and empowers your employees to manage their own information.

- Automate time tracking: If your plan includes time tracking features, make sure to set up and utilize this functionality. It can help improve accuracy in payroll processing and provide insights into labor costs.

- Explore integrations: Check out Gusto’s integration options to connect the software with other tools your business uses. This can streamline data flow and minimize manual data entry.

- Customize for branding: Take advantage of Gusto’s customization options to align the platform with your company’s branding and policies. This helps maintain a consistent look and feel for your employees.

- Get regular updates on compliance: Gusto can assist with compliance, but it’s important to stay informed about changing tax regulations and labor laws. Regularly review and verify that the software settings align with the latest requirements.

- Streamline onboarding: Use Gusto’s onboarding features to create a smooth experience for new hires. Digitize paperwork, provide clear instructions, and ensure they have access to necessary resources.

- Regularly review reports: Make use of the reporting and analytics features to monitor payroll expenses, benefit utilization, and other HR metrics. Regularly reviewing these reports can provide insights into your business’s financial health and employee trends.

- Engage customer support: Gusto’s customer support is known to be responsive and helpful. If you have questions or encounter issues, don’t hesitate to reach out to them for assistance.

- Employee communication: Communicate changes and updates related to payroll, benefits, and HR policies to your employees. Ensure they’re aware of how to access information through Gusto and where to find resources.

- Plan for growth: If your business is projected to grow, choose a Gusto plan that can accommodate your future needs. This can help prevent the need to transition to a different platform as your business expands.

- Regularly update information: Keep employee records up-to-date within the software. Regularly verify that employee details, benefit selections, and other information are accurate and current.

Recap

Gusto is a one-stop shop for small businesses’ HR and payroll needs. It is inexpensive, tax-compliant, and easy to use. It also offers additional advantages including college, charity, and employee wellness initiatives. Gusto is not flawless, though. It lacks a mobile app, same-day deposit, and international payroll. Still, if you want a simple and complete solution for your payroll and HR, Gusto might be a good fit for you.