Table of Contents

Our Verdict

Gusto wears the crown as the best overall payroll software because it offers comprehensive features like automated payroll processing, tax filing, employee benefits management, and time tracking. Gusto’s user interface is intuitive and designed to make payroll a breeze, even for those who aren’t HR experts. Not only that, it provides robust customer support to help you out whenever you need it.

On the other hand, Patriot Payroll focuses primarily on payroll services. It provides basic payroll functions like paycheck calculations, direct deposit, and tax filing. Patriot is highly affordable and straightforward, making it a great choice for small businesses that need a simple payroll solution without the extra HR features. It’s user-friendly, but its scope is narrower compared to Gusto.

Here’s the bottom line: if you’re looking for a comprehensive HR and payroll solution with advanced features and excellent support, go with Gusto. But if your business only needs a free-effective payroll service, Patriot Payroll is a solid choice. Evaluate your business needs and pick the one that aligns best with your requirements.

Why Choose Gusto

Who Gusto Is Best For

Choose Gusto if you:

- Want an easy-to-use payroll solution with automated tax filings and payments.

- Prefer a platform that integrates seamlessly with accounting software like QuickBooks and Xero.

- Need HR functionalities like employee onboarding, benefits administration, and time tracking.

- Desire comprehensive support for compliance with local, state, and federal regulations.

- Value affordability without compromising on features and customer service.

MORE >>> Patriot Payroll Review

Who Gusto Is Not Right For

Don’t choose Gusto if you:

- Require advanced payroll features tailored to specific industries or complex payroll needs.

- Prefer a payroll solution with extensive customization options.

- Need a platform with built-in project management or robust employee scheduling capabilities.

- Operate in multiple countries and require international payroll support.

- Seek a payroll provider with a long history or established reputation in your industry.

Why Choose Patriot Payroll

Who Patriot Payroll Is Best For

Go for Patriot Payroll if you:

- Are a small business owner looking for an affordable payroll solution with transparent pricing and no hidden fees.

- Prefer a user-friendly platform with straightforward payroll processing and easy-to-understand features.

- Need basic payroll functionalities like direct deposit, tax calculations, and payroll tax filings.

- Value excellent customer support with knowledgeable representatives available to assist you.

- Want a payroll provider that focuses on simplicity and ease of use rather than offering advanced features that may be unnecessary for your business needs.

Who Patriot Payroll Is Not Right For

Consider other alternatives if you:

- Require advanced payroll features such as complex tax calculations, multi-state payroll support, or integration with specialized accounting software.

- Operate a large business with complex payroll needs, multiple locations, or international employees.

- Need comprehensive HR functionalities beyond basic payroll processing, such as employee onboarding, benefits administration, or time tracking.

- Seek a payroll provider with a wide range of integrations with other business tools or platforms.

- Prefer a payroll solution with customizable options tailored to your specific industry or business requirements.

Main Differences

Ideal For

Gusto is ideal for you if your business needs basic HR features, pays contractors frequently, or operates in multiple states. On the other hand, choose Patriot Payroll if you prioritize ease of use, strong customer support, and a simpler payroll solution.

Contractor Payments

Gusto is the more affordable option for paying contractors, charging a $6 per contractor monthly fee without a base fee for contractor-only plans. Additionally, Gusto offers international contractor payments, enhancing its flexibility. On the other hand, Patriot Payroll is not well-suited for contractors as it does not support international payments.

Overall, Gusto excels in providing a cost-effective and versatile solution for managing contractor payments, especially for businesses with international contractor needs.

Payroll for Multiple States

Gusto handles payroll seamlessly across multiple states within the US, making it a straightforward and efficient option for businesses operating in different locations.

In contrast, Patriot Payroll requires a Full-Service plan, which incurs additional monthly fees per state, to manage payroll and tax filings in multiple states. Thus, Gusto stands out as the more convenient and cost-effective choice for multi-state payroll management.

Ease of Use

While users may encounter a slightly steeper learning curve with Gusto, Patriot Payroll is generally considered easier to set up and use, making it more accessible for beginners or those seeking simplicity in their payroll software. In this comparison, Patriot Payroll emerges as the winner for its user-friendly interface and ease of adoption, particularly for those with limited experience in payroll management

HR Features

If your business requires basic HR features like PTO tracking, new hire reporting, and benefits administration, along with seamless contractor payment options and multi-state operation support, Gusto emerges as the superior choice. Gusto’s comprehensive state tax filing and compliance features cater to businesses with diverse needs, especially those heavily reliant on freelance or contract work.

Alternatively, if ease of use, strong customer support, and a straightforward payroll solution are your top priorities, Patriot Payroll is the preferred option. While it may lack built-in HR features, Patriot Payroll excels at providing simple and affordable payroll services, making it a suitable choice for smaller businesses or those with less complex payroll needs.

Customer Support

While both Gusto and Patriot Payroll have generally good customer support, Gusto’s reviews suggest it may not be the preferred option for some users, possibly due to specific preferences or experiences. On the other hand, Patriot Payroll is generally well-liked for its customer support team, indicating a higher level of satisfaction among its users.

In this comparison, Patriot Payroll excels for its consistently positive feedback regarding customer support, making it a reliable choice for users seeking dependable assistance with their payroll needs.

Ultimately, the best choice depends on your specific business needs and priorities.

Standout Features

Gusto Features

Payroll Services

Gusto offers unlimited payroll runs, automated tax filings, and the ability to adjust wages to comply with various regulations, such as the FLSA Tip Credit minimum wage requirement. It automatically calculates, pays, and files federal, state, and local payroll taxes, as well as W-2s, 1099s, and new hire forms. Gusto can manage breaks, hour requirements, and payroll tax filings to ensure compliance with state laws.

HR Features

Gusto provides modern HR features such as benefits management, hiring, management resources, and compliance support, all in one place. It offers time-tracking tools for payroll or project tracking, as well as onboarding features including background checks, benefit enrollment, and e-signatures. Gusto also includes employee surveys, reports, company details, referrals, and documents as part of its HR feature set.

Customization and Integration

Gusto allows for customization, integration with external time tracking tools, and support for many integrations. It offers API/integration, expense management, and enrollment planning, among other features.

User-Friendly Interface

Gusto is popular for its well-organized and easy-to-navigate interface, making it user-friendly for businesses.

Scalability and Support

While Gusto is ideal for startups and small to medium-sized businesses, it may not be the best option for large, rapidly growing businesses due to scalability limitations. The platform provides access to certified HR professionals and a priority support team in its Premium plan.

PRO TIPS >>> Best Payroll Software for Small Business

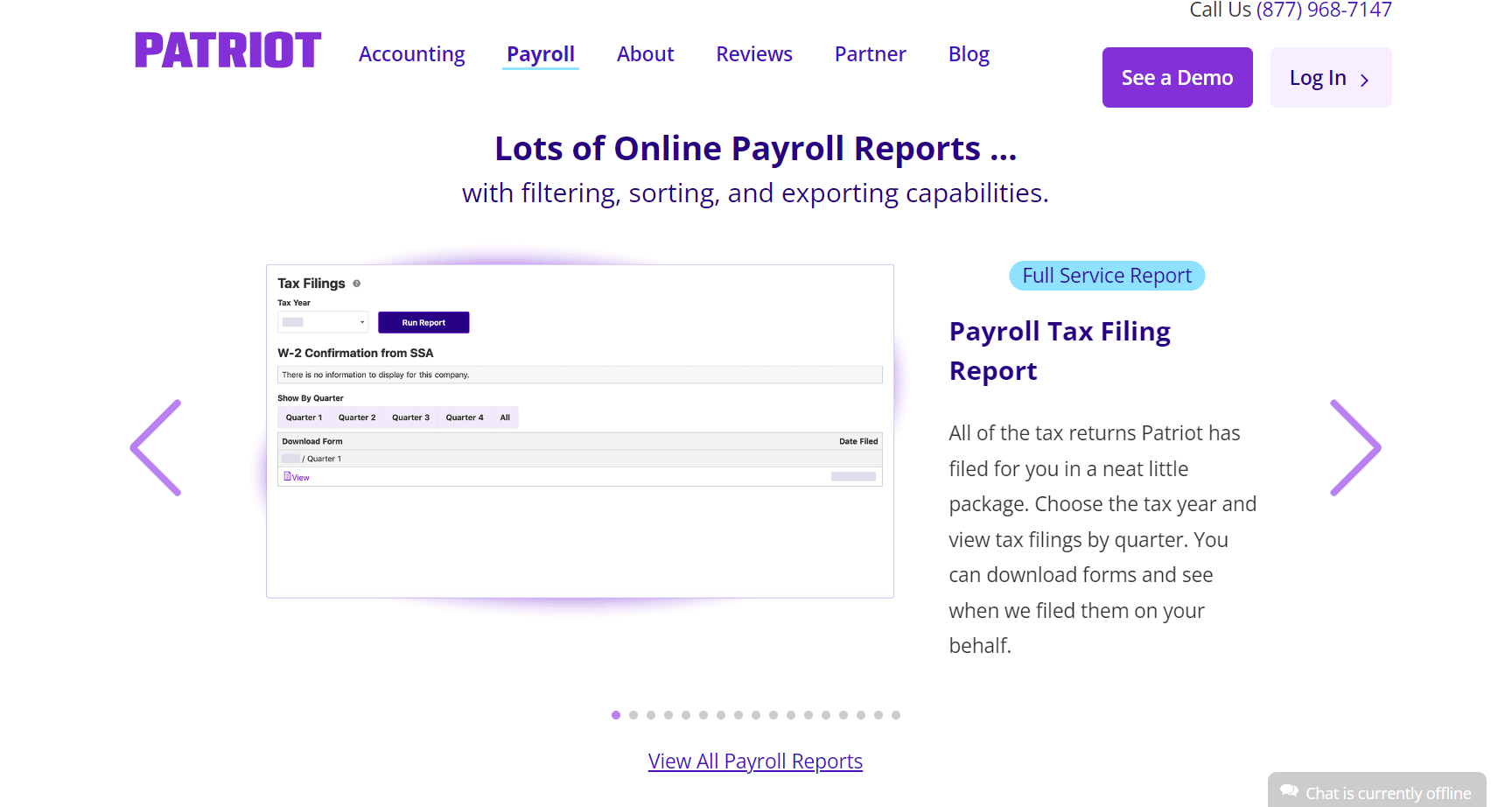

Patriot Payroll Features

Easy 3-Step Process

Running payroll involves three simple steps: enter hours, review, and approve. You can quickly process payroll without any hassle.

Free Payroll Setup

When you sign up, Patriot Payroll provides free assistance to set up your payroll system. They guide you through the initial configuration.

Unlimited Payrolls

You can run payroll as frequently as needed without any extra charges. Whether it’s weekly, biweekly, or monthly, there are no limitations.

On-the-fly Pay Rate Changes

Adjust hourly pay rates during the payroll process without canceling it. This flexibility is useful for handling changes in employee compensation.

Free Employee Portal

Employees get access to an online portal where they can securely view pay stubs, pay history, time-off balances, and electronic W-2s.

Track Various Payments

Patriot Payroll handles various payment types, including overtime, sick time, bonuses, commissions, tips, and vacation pay.

Unlimited Users with Permissions

Add multiple users to your account and control their access levels. This feature is helpful for collaboration and delegation.

Accurate Payroll and Tax Calculations

The system ensures precise calculations, including federal, state, and local taxes. Stay compliant without manual effort.

Time-off Accruals

Customize time-off accrual rules based on your company’s policies. The system automatically tracks accrued time off.

Free Direct Deposit

Pay employees via direct deposit, and Patriot Payroll offers free 2-day processing. No need for paper checks.

Tracking Reported Tips

If your employees receive tips, Patriot Payroll helps manage taxes related to reported tips accurately.

Multiple Pay Rates

For hourly employees with varying roles, assign up to five different pay rates. This feature accommodates different job responsibilities.

Customizable Hours, Money Types, Deductions

Tailor payroll settings to your business needs. Define custom hours, money types (e.g., regular, overtime), and deductions.

Pros and Cons of Gusto

Pros

- Offers clear and straightforward pricing, making it easy to understand costs.

- Runs payroll as often as necessary without additional charges.

- Handles both employee and contractor payroll.

- Provides a college savings feature.

- Simplifies tax compliance with automated filing and guidance.

- Includes features to help employees manage their finances.

Cons

- Doesn’t offer a free trial, so you can’t test it before committing.

- Lacks invoicing or accounts receivable features.

- Requires upfront manual data entry.

- Lacks automated workflow features.

- Has limited mobile app functionality.

Pros and Cons of Patriot Payroll

Pros

- Offers clear and straightforward pricing, making it easy to understand costs.

- Offers Free Trial; you can try Patriot Payroll before committing.

- Runs payroll as frequently as needed without extra charges.

- Handles payments for contractors easily.

- Manages payroll-related documents efficiently.

- Integrates with accounting and time-tracking tools.

Cons

- Lacks a dedicated mobile app.

- Includes a $12 fee for each additional state tax filing.

- Requires data entry during initial setup.

- Lacks International Payroll Support.

- Experiences limited third-party integrations.

Customer Reviews

Gusto has 3,880 reviews with an average rating of 4.63 out of 5 stars. Users appreciate Gusto’s transparent pricing, flexibility, and excellent customer service.

Some users mention issues with tax and benefits support and the lack of a mobile app.

Patriot Payroll has 3,407 reviews with an average rating of 4.81 out of 5 stars. Customers label their overall Patriot experience as “excellent.” While Gusto scores lower on Trustpilot, Patriot Payroll receives high praise for its customer service.

In summary, both platforms have their strengths, but Patriot Payroll stands out for its customer satisfaction and excellent support. Consider your specific needs when choosing between them!

GET SMARTER >>> Gusto Payroll Review

Competitors

QuickBooks Payroll

QuickBooks Payroll is a popular choice for small businesses, offering seamless integration with QuickBooks accounting software. It provides features such as automatic payroll runs, tax calculations, and employee benefits management. For businesses already using QuickBooks for their accounting needs, QuickBooks Payroll can be a convenient alternative to Gusto.

ADP and Paychex

ADP is a well-established competitor in the payroll and HR solutions space. It offers a range of services, including payroll processing, tax filing, and HR management. ADP’s extensive experience and comprehensive suite of services make it a strong alternative to Gusto.

Square

Square is another alternative to consider. It offers a range of payroll features and strengths that might align well with your business’s needs. While it may not be as cheap as Patriot, it could offer the specific features and support that your business requires. Square provides payroll services with additional features, including benefits administration and customizable reports, which might be beneficial for your business.

Paychex

Paychex is another major player in the payroll and HR industry. It provides payroll processing, HR solutions, and employee benefits administration. With its robust set of features and a focus on serving businesses of all sizes, Paychex presents a compelling alternative to Gusto.

Zenefits

Zenefits offers a comprehensive HR platform that includes payroll, benefits administration, time tracking, and compliance management. It provides a seamless integration of HR and payroll functionalities, making it a strong contender for businesses looking for an all-in-one HR solution.

Pro Tips

- Encourage your employees to utilize the self-service features to update personal information, access pay stubs, and manage their benefits.

- Ensure that you stay informed about tax deadlines and filings to avoid any penalties.

- Explore the customizable reporting features to gain insights into your payroll data and make informed decisions.

- Both Gusto and Patriot Payroll offer support and training resources. Don’t hesitate to reach out to their customer support teams for assistance or take advantage of available training materials to maximize the use of their features.

- Consider integrating Gusto or Patriot Payroll with your accounting software to streamline financial processes and ensure seamless data flow between payroll and accounting functions.

Recap

Consider Gusto if you need robust HR features like PTO tracking and benefits administration, along with seamless contractor payments, ideal for businesses relying on freelancers. Gusto’s multi-state support and comprehensive tax filing make it great for operations across different locations.

Go for Patriot Payroll if you prioritize simplicity and strong customer support. It offers straightforward payroll services, suitable for smaller businesses with basic needs. While lacking built-in HR features, Patriot Payroll shines with its user-friendly interface and reliable support team. Evaluate your needs carefully and choose the solution that best fits your business requirements and preferences.