Table of Contents

Our Verdict

Gusto is an excellent choice over Quickbooks Payroll though both platforms offer robust payroll solutions but cater to slightly different needs. The reason for this is that Gusto:

- Offers extensive HR features, including employee onboarding, benefits administration, and compliance assistance.

- Has a user-friendly interface and scalability which makes it ideal for growing businesses.

- Provides a contractor-only plan, which can be more cost-effective for businesses that primarily work with contractors.

- Offers a more affordable plan for smaller teams.

- Suits businesses planning to grow beyond 50 employees, offering more robust HR capabilities.

- Integrates with a wide range of third-party applications, enhancing its functionality.

QuickBooks Payroll, on the other hand, is perfect for businesses already using QuickBooks for accounting. Its seamless integration with QuickBooks Online allows for streamlined financial management. QuickBooks Payroll also offers faster direct deposit options, including same-day deposits in higher-tier plans, which can be a significant advantage for businesses needing quick payroll processing.

It depends on your specific business needs.

So, what do you need?

Go for Gusto for a more comprehensive HR solution and scalability, and QuickBooks Payroll for seamless accounting integration and faster payroll processing.

Why Choose Gusto

Who Gusto Is Best For

Gusto is perfect for:

- Comprehensive HR Management: Gusto excels in providing a wide range of HR tools, including employee onboarding, benefits administration, and compliance assistance.

- User-Friendly Interface: Famous for its intuitive and easy-to-navigate platform, making it accessible for users with varying levels of tech proficiency.

- Automated Payroll Processing: Offers full-service payroll with unlimited runs and automatic tax filings.

- Employee Benefits: Provides extensive benefits options, including health, dental, vision insurance, and 401(k) retirement plans.

- Contractor Payments: Supports payments to both domestic and international contractors, making it versatile for different business needs.

- Time Tracking Integration: Includes tools for tracking employee hours, PTO, and project costs, which sync seamlessly with payroll.

- Financial Wellness Tools: Offers features like Gusto Wallet, which helps employees manage their finances and access earned wages.

- Scalability: Ideal for growing businesses, with features that support expansion and increased HR needs.

MORE >>> SurePayroll Payroll Software Review

Who Gusto Is Not Right For

Gusto is not the right choice for:

- Large Enterprises: Gusto may not be suitable for very large businesses due to its limited scalability for extensive HR needs.

- Advanced Time Tracking: Lacks robust in-house time-tracking features, which might be necessary for businesses with complex time-tracking requirements.

- International Payroll: Does not support payroll for international employees, limiting its use for global businesses.

- Free Trial: Does not offer a free trial, which can be a drawback for businesses wanting to test the software before committing.

- Invoicing and Accounts Receivable: Does not include invoicing or accounts receivable features, which might be needed for comprehensive financial management.

- Automated Workflows: Lacks automated workflows, which can be a limitation for businesses looking to streamline repetitive tasks.

- Mobile App Functionality: Limited functionality in its mobile app compared to some competitors.

- Geographic Restrictions: Health benefits and other services have geographic restrictions, not available in all states.

Why Choose Quickbooks Payroll

Who Quickbooks Payroll Is Best For

Quickbooks Payroll is best for:

- Seamless Integration with QuickBooks: Perfect for businesses already using QuickBooks for accounting.

- Automated Payroll Processing: Offers full-service payroll with automated tax calculations and filings.

- Faster Direct Deposit: Provides same-day and next-day direct deposit options.

- Time Tracking: Includes robust time-tracking tools via mobile devices or computers.

- Employee Portal: Allows employees to access their pay stubs, W-2s, and other payroll information online.

- Health Benefits Administration: Manages health benefits and workers’ compensation.

- Unlimited Payroll Runs: Supports unlimited payroll runs across all plans.

- Mobile App: Enables payroll processing on the go, offering flexibility for business owners.

Who Quickbooks Payroll Is Not Right For

Quickbooks Payroll is not right for:

- Non-QuickBooks Users: Not ideal for businesses not using QuickBooks Online, as it lacks integration with other accounting software.

- Complex Time Tracking Needs: Limited built-in time-tracking features, available only in higher-tier plans.

- International Payroll: Does not support payroll for international employees.

- Cost-Conscious Small Businesses: Generally more expensive than some leading competitors.

- Local Tax Filing: Requires manual filing for local taxes, which is cumbersome for businesses with multiple locations.

- Limited Integrations: Offers fewer third-party integrations, unlike some other payroll solutions.

- Scalability: It’s not suitable for very large enterprises with complex payroll needs.

- Mobile App Limitations: While it has a mobile app, it is less comprehensive in comparison to desktop features.

Main Differences

Ideal For

Gusto is ideal for you if you need a comprehensive HR and payroll solution that simplifies employee management. It offers a user-friendly interface, extensive HR features like benefits administration and compliance assistance, and supports contractor payments, making it versatile for various business needs. Additionally, Gusto’s scalability makes it grow with your business, providing robust tools for both current and future HR requirements. If you value an all-in-one platform that streamlines HR tasks and payroll processing, Gusto is a perfect fit.

QuickBooks Payroll is just right if you already use QuickBooks Online for accounting, as it offers seamless integration, allowing you to manage both accounting and payroll from a single platform. It provides automated payroll processing, including tax calculations and filings, and offers faster direct deposit options like same-day and next-day deposits. Additionally, QuickBooks Payroll includes robust time-tracking tools and an employee portal for easy access to pay stubs and tax forms, making it a comprehensive solution for efficient payroll management.

Plans and Pricing

Gusto

- Simple Plan: This costs $40 per month plus $6 per employee. This plan includes full-service payroll, employee profiles, basic hiring and onboarding tools, and Gusto-brokered health insurance administration.

- Plus Plan: This costs $80 per month plus $12 per employee, and it offers everything in the Simple plan, plus multi-state payroll, next-day direct deposit, advanced hiring and onboarding tools, PTO management, time tracking, and project tracking.

- Premium Plan: It offers custom pricing. This plan includes all features of the Plus plan, along with a dedicated customer success manager, compliance alerts, access to certified HR experts, and full-service payroll migration.

- Contractor Plan: Costs $35 per month plus $6 per contractor, and it is for businesses that only work with contractors.

Quickbooks Payroll

- Core Plan: Costs $45 per month plus $6 per employee and includes full-service payroll, automated taxes and forms, auto payroll, and next-day direct deposit.

- Premium Plan: This plan offers $80 per month plus $8 per employee, and offers everything in the Core plan, plus same-day direct deposit, HR support center, and time tracking.

- Elite Plan: Costing $125 per month plus $10 per employee, this plan includes all features of the Premium plan, along with 24/7 expert product support, tax penalty protection, and a personal HR advisor.

Accounting Integration

Gusto integrates with several accounting software platforms, including QuickBooks Online and Desktop, Xero, FreshBooks, AccountingSuite, Aplos, and ZarMoney. QuickBooks Payroll integrates seamlessly with QuickBooks Online and QuickBooks Desktop.

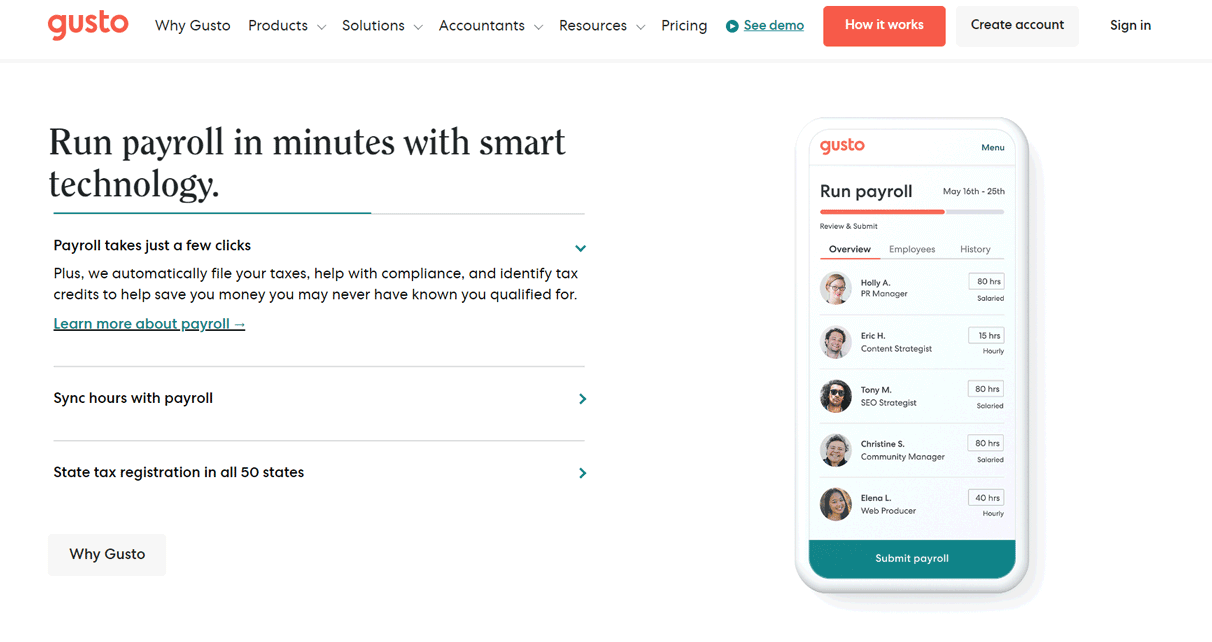

Standout Features

Gusto stands out for its comprehensive HR and payroll features, including automated payroll processing, benefits administration, and compliance assistance. It offers a user-friendly interface, making it accessible for users with varying levels of tech proficiency. Gusto also supports payments to both domestic and international contractors, provides extensive employee benefits options like health, dental, and vision insurance, and includes tools for time tracking and employee financial wellness. Additionally, its scalability makes it ideal for growing businesses.

QuickBooks Payroll excels for its seamless integration with QuickBooks Online and Desktop, offering a unified platform for managing both payroll and accounting. It features automated payroll processing, including tax calculations and filings, and provides faster direct deposit options like same-day and next-day deposits. The platform includes robust time-tracking tools, an employee portal for easy access to pay stubs and tax forms, and comprehensive health benefits administration. Additionally, QuickBooks Payroll supports unlimited payroll runs and offers 24/7 expert product support in its higher-tier plans

Standout Features

Gusto

Outstanding features of Gusto include:

- Provides comprehensive HR management, including employee onboarding, benefits administration, and compliance assistance.

- Offers a user-friendly interface that is intuitive and easy to navigate.

- Automates payroll processing with full-service payroll, unlimited runs, and automatic tax filings.

- Provides extensive employee benefits options, including health, dental, and vision insurance.

- Supports payments to both domestic and international contractors.

- Includes tools for tracking employee hours, PTO, and project costs.

- Offers financial wellness tools like Gusto Wallet to help employees manage their finances and access earned wages.

- Scales effectively to support growing businesses with expanding HR needs.

Quickbooks Payroll

Here are the features that make Quickbooks Payroll outstanding:

- Integrates seamlessly with QuickBooks for accounting, ideal for businesses already using QuickBooks.

- Automates payroll processing, including tax calculations and filings.

- Provides faster direct deposit options, including same-day and next-day deposits.

- Includes robust time-tracking tools via mobile devices or computers.

- Allows employees to access their pay stubs, W-2s, and other payroll information online through an employee portal.

- Manages health benefits and workers’ compensation.

- Supports unlimited payroll runs across all plans.

- Enables payroll processing on the go with a mobile app, offering flexibility for business owners.

Pros and Cons of Gusto

Pros

- Provides comprehensive HR management, including employee onboarding, benefits administration, and compliance assistance.

- Offers a user-friendly interface that is intuitive and easy to navigate.

- Automates payroll processing with full-service payroll, unlimited runs, and automatic tax filings.

- Supports payments to both domestic and international contractors.

- Includes tools for tracking employee hours, PTO, and project costs.

- Offers financial wellness tools like Gusto Wallet to help employees manage their finances and access earned wages.

- Scales effectively to support growing businesses with expanding HR needs.

Cons

- Lacks a free trial, which can be a drawback for businesses wanting to test the software before committing.

- Requires manual data entry upfront, which can be time-consuming.

- Excludes invoicing or accounts receivable features, limiting comprehensive financial management.

- Lacks automated workflows, which can be a limitation for businesses looking to streamline repetitive tasks.

- Offers limited mobile app functionality compared to some competitors.

- Restricts health benefits and other services geographically, not available in all states.

- Becomes costly at scale due to per-person pricing.

Pros and Cons of Quickbooks Payroll

Pros

- Integrates seamlessly with QuickBooks Online and Desktop, providing a unified platform for accounting and payroll.

- Automates payroll processing, including tax calculations and filings.

- Offers faster direct deposit options, including same-day and next-day deposits.

- Includes robust time-tracking tools via mobile devices or computers.

- Allows employees to access their pay stubs, W-2s, and other payroll information online through an employee portal.

- Manages health benefits and workers’ compensation.

- Supports unlimited payroll runs across all plans.

- Provides a mobile app for payroll processing on the go, offering flexibility for business owners.

Cons

- Limits integration with other accounting software, making it less ideal for non-QuickBooks users.

- Requires manual filing for local taxes, which can be cumbersome for businesses with multiple locations.

- Becomes more expensive than some leading competitors.

- Offers time tracking only in higher-tier plans.

- Charges additional fees for HR add-ons and multi-state tax filings.

- Lacks 24/7 support in the base plan.

Customer Reviews

Gusto has positive reviews for its comprehensive HR features, user-friendly interface, and scalability. Forbes Advisor gives it 4.4 out of 5 stars, U.S. News rates it 4.5 out of 5 stars, Trustpilot at 3.2 out of 5 stars, and G2 at 4.5 out of 5 stars. Users appreciate Gusto’s extensive features and ease of use, though some note the higher cost at scale and the absence of a free trial.

QuickBooks Payroll also receives strong reviews, with Forbes Advisor and NerdWallet both rating it 4.5 out of 5 stars, Business.com at 9 out of 10, and Fit Small Business at 4.54 out of 5 stars. QuickBooks Payroll has commendations for its seamless integration with QuickBooks accounting software, automated tax filings, and faster direct deposit options. However, it can be more expensive and has limited integrations with non-QuickBooks accounting software.

GET SMARTER >>> Gusto vs Patriot Payroll

Competitors

Rippling

Rippling is a comprehensive platform that combines HR, payroll, and IT management into a single system. It excels in automating administrative tasks, such as onboarding, offboarding, and device management, making it ideal for businesses looking for an all-in-one solution. Rippling’s flexibility and extensive integration capabilities allow it to adapt to various business needs, providing a seamless experience for managing employee data across different systems.

Paychex Flex

Paychex Flex is notable for its scalability and extensive payroll features, making it suitable for businesses of all sizes. It offers a wide range of services, including payroll processing, HR management, benefits administration, and compliance support. Paychex Flex’s robust reporting tools and dedicated customer support make it a reliable choice for businesses seeking a comprehensive payroll and HR solution.

OnPay

OnPay is a cost-effective payroll solution for small to medium-sized businesses. It offers a flat-fee pricing model and includes features such as payroll processing, tax filings, and benefits administration. OnPay is particularly popular for its ease of use and excellent customer support, making it a great option for businesses looking for a straightforward and affordable payroll service.

ADP RUN

ADP RUN is a versatile payroll and HR solution that caters to small and medium-sized businesses. It provides a range of services, including payroll processing, tax compliance, and employee benefits management. ADP RUN is known for its robust features, scalability, and strong customer support, making it a popular choice for businesses looking to streamline their payroll and HR processes.

Square Payroll

Square Payroll is good for small businesses, particularly those in the retail and service industries. It offers an easy-to-use platform with features such as payroll processing, tax filings, and employee benefits management. Square Payroll integrates seamlessly with other Square products, providing a unified solution for businesses already using Square for their point-of-sale and payment processing needs.

Pro Tips

Here are some pro tips to help you make the right choice:

- Assess your current tools. If you already use QuickBooks for budgeting, QuickBooks Payroll is a better choice because it works better with QuickBooks. This makes managing your money easier.

- Consider your business size. Gusto is ideal for businesses planning to grow beyond 50 employees, offering more comprehensive HR capabilities. QuickBooks Payroll is great for smaller businesses that need efficient payroll processing and already use QuickBooks.

- Evaluate your HR needs. If you need extensive HR features like benefits administration, employee onboarding, and compliance assistance, Gusto provides a more robust solution.

- Prioritize direct deposit speed. QuickBooks Payroll offers faster direct deposit options, including same-day and next-day deposits, which can be crucial for timely payroll processing.

- Compare pricing structures. Gusto tends to be more affordable for smaller teams, while QuickBooks Payroll offers advanced features in its higher-tier plans.

- Focus on user experience. Gusto has a reputation for its user-friendly interface, making it easier for users with varying levels of tech proficiency. If ease of use is a priority, go for Gusto.

- Utilize mobile access. QuickBooks Payroll’s mobile app provides flexibility and convenience if you need to run payroll on the go.

- Leverage third-party integrations. Gusto integrates with a wide range of third-party applications, enhancing its functionality. If you rely on multiple tools, Gusto’s integration capabilities is more beneficial for you.

- Consider customer support needs. QuickBooks Payroll offers 24/7 expert product support in its higher-tier plans, which is a significant advantage.

- Review user feedback and trial periods. Look for user reviews and consider any available trial periods to test the platforms. This gives you a better sense of which one aligns with your business needs and preferences.

Recap

Take your company’s unique requirements into account when comparing Gusto with QuickBooks Payroll. Gusto is ideal if you require a comprehensive HR solution with features like employee onboarding, benefits administration, and compliance assistance, making it perfect for growing businesses with extensive HR needs. It also offers a user-friendly interface and supports contractor payments. On the other hand, QuickBooks Payroll is best if you currently use QuickBooks for accounting, as it integrates seamlessly, providing a unified platform for managing both payroll and accounting. It offers faster direct deposit options and robust time-tracking tools, making it suitable for businesses that prioritize efficient payroll processing and financial management. Evaluate your current tools, business size, HR needs, and budget to make the best choice.