Table of Contents

Our Verdict

Considering Justworks Payroll Software? Looking for a seamless payroll management solution? Look no further! Justworks Payroll Software revolutionizes the way small businesses handle payroll tasks. Bid farewell to tedious manual calculations and paperwork! This software simplifies the entire payroll process, from onboarding to tax filings. Its intuitive interface and extensive. Need to add bonuses or deductions?

No problem, it’s all easily customizable. And with its cloud-based platform, access your payroll data anytime, anywhere. Rest easy knowing Justworks keeps up with the latest tax laws and regulations, saving you time and headaches. Whether you’re a startup or an established business, Justworks adapts to your needs, making payroll management a breeze. Try it out today and see the difference it can make for your business!

Pros

- Stands out with its responsive and helpful customer support. When you encounter issues or have questions, their team is readily available to assist.

- Offers an intuitive and easy-to-navigate interface. Even if you’re not a payroll expert, you’ll find it accessible and straightforward.

- Provides additional HR features suitable for complex tasks. Whether it’s managing benefits, compliance, or employee data, Justworks has you covered.

- Stays updated with the latest tax laws and regulations, reducing the risk of compliance errors and penalties.

Cons

- Tends to be more expensive compared to some of its competitors. If budget constraints are a concern, you may want to explore other options.

- Doesn’t have some advanced features like some other platforms. If detailed analytics are crucial for your business, consider this aspect.

- Has limited third-party integrations. If seamless integration with other tools is essential, you might need to explore workarounds.

MORE >>> Gusto Payroll Review

Who Justworks Payroll Software Is Best For

Justworks Payroll software is ideal for your business if you:

- Seek a user-friendly payroll solution.

- Want to streamline payroll processes and automate tax filings.

- Love to ensure compliance with regulations.

- Desire integrated HR, benefits administration, and payroll services.

- Value scalability and flexibility in their payroll systems.

Who Justworks Payroll Software Isn’t Right For

Justworks Payroll software might not be the best fit for you if you:

- Run large enterprises with complex payroll needs requiring highly customized solutions.

- Have businesses operating in industries with unique payroll requirements that may not be fully supported by Justworks.

- Are looking for standalone payroll software without integrated HR and benefits administration features.

- Seek a purely self-service payroll solution without additional support or services.

- Run a business with strict budget constraints as Justworks may not be the most cost-effective option for all companies.

What Justworks Payroll Software Offers

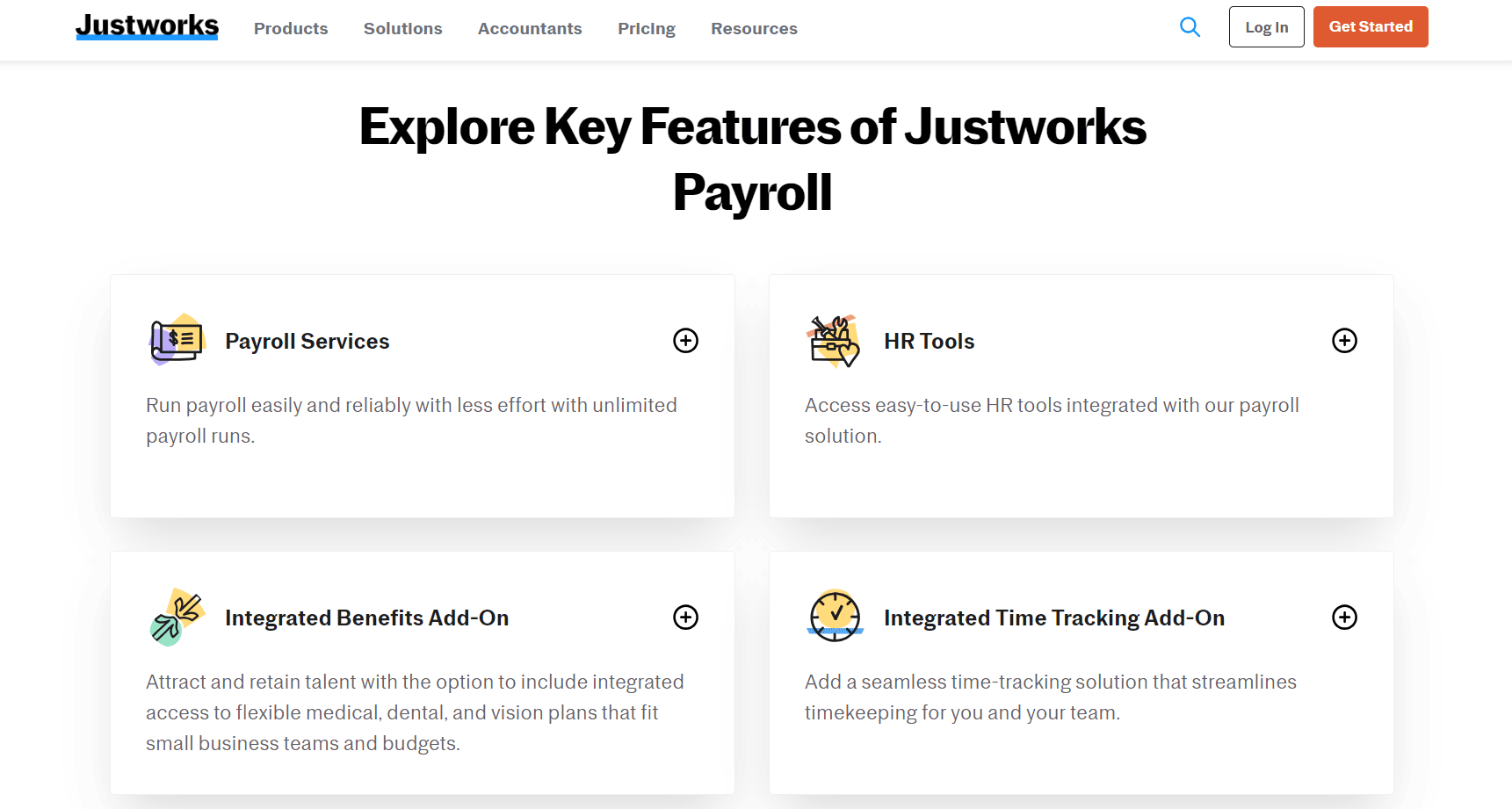

Automated Payroll Processing

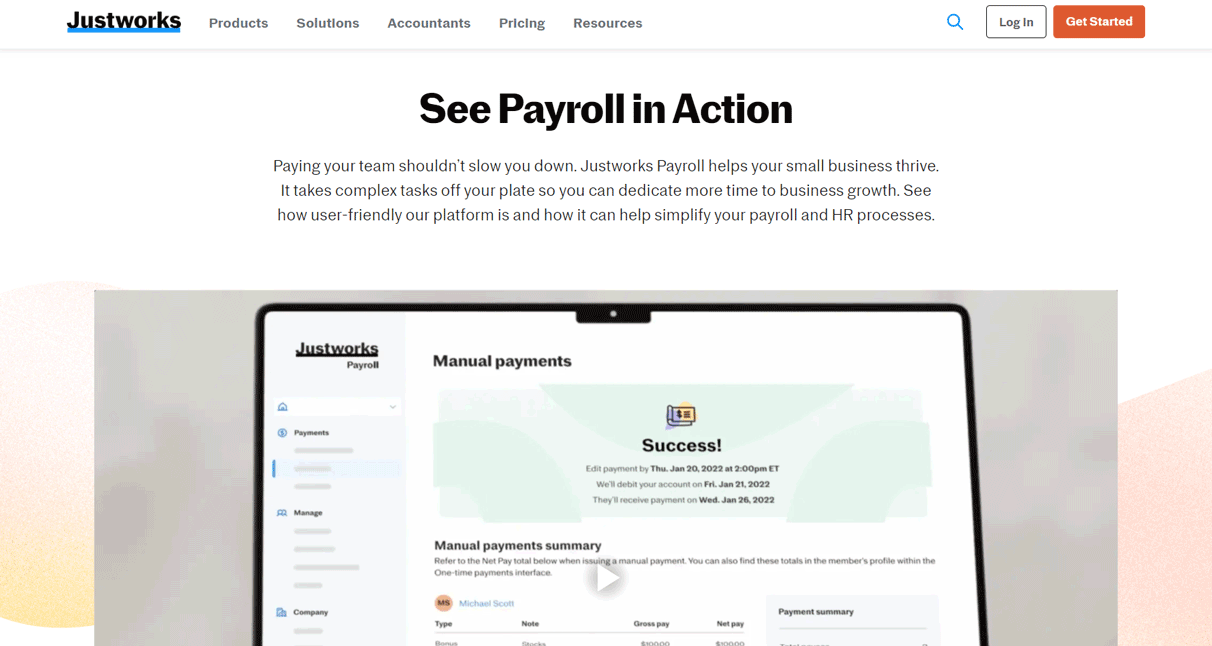

Justworks Payroll Software automates payroll processing, reducing the time and effort required to manually calculate and process employee payments. It automatically calculates wages, deductions, and taxes based on predefined settings and employee data.

Tax Filings

Justworks handles all aspects of tax filings, including calculating, withholding, and remitting federal, state, and local taxes on behalf of the employer. It generates and files necessary tax forms and reports, such as W-2s and 1099s, ensuring compliance with tax regulations.

Direct Deposits

The software facilitates direct deposit payments, allowing employers to electronically transfer employee wages directly into their bank accounts. This eliminates the need for paper checks and provides employees with faster access to their earnings.

Employee Self-Service Portals

Justworks offers self-service portals for employees, enabling them to view and manage their payroll information, such as pay stubs, tax forms, and personal details. This empowers employees to access their information conveniently and reduces administrative overhead for employers.

Compliance Assistance

Justworks Payroll Software helps businesses stay compliant with federal, state, and local labor and tax regulations. It keeps track of changing laws and regulations, updates tax rates and forms accordingly, and guides on compliance matters to ensure that businesses avoid penalties and legal issues.

Benefits Administration

In addition to payroll processing, Justworks offers benefits administration services, allowing employers to manage employee benefits such as health insurance, retirement plans, and other perks. This streamlines benefits enrollment, administration, and compliance, helping businesses attract and retain talent.

HR Support

Justworks provides HR support and resources to assist businesses with various human resources functions, such as employee onboarding, performance management, and HR policy development. This helps businesses effectively manage their workforce and navigate HR-related challenges.

PRO TIPS >>> Best Payroll Software for Small Business

Where Justworks Payroll Software Stands Out

If you’re considering Justworks for your payroll needs, here’s where Justworks stands out:

Full-Service PEO

Justworks is not just a basic payroll software; it’s a Professional Employer Organization (PEO) that can handle various HR functions for your business, including managing payroll, insurance, employee training, compliance, taxes, and other HR tasks.

Employee Self-Service Feature

Justworks goes above and beyond by providing an extensive employee self-service feature, which plays a pivotal role in alleviating administrative burdens and streamlining human resources operations. With this feature, employees gain autonomy in managing their information, from updating personal details to accessing important documents and resources. This not only empowers employees but also frees up valuable time for HR professionals, allowing them to focus on more strategic initiatives.

User-Friendly Platform

Justworks stands out as the premier choice for small businesses and startups seeking a user-friendly payroll platform. Renowned for its intuitive interface, Justworks offers quick and responsive support, ensuring businesses receive timely assistance whenever needed. The platform excels in providing informative communication, keeping both administrators and employees informed and engaged.

Flexible Solutions

Justworks offers a range of flexible Professional Employer Organization (PEO) plans tailored to meet the needs of small businesses and startups. With Justworks, businesses can operate with confidence, knowing they have access to transparent pricing and no hidden fees. Whether it’s managing payroll, benefits administration, or compliance, Justworks provides comprehensive solutions to streamline operations and support business growth.

Payroll Processing

Justworks simplifies payroll, taxes, and direct deposits, crucial for HR management, removing the need for a separate payroll service. It also offers a lightweight payroll solution that helps small businesses save time, combining expert support with a user-friendly platform and flexible solutions.

Where Justworks Payroll Software Falls Short

When considering Justworks for your payroll needs, it’s important to be aware of its limitations:

Limited Payment Options

Justworks falls short in terms of payment options, particularly for businesses that frequently make use of international wire transfers. While it offers options like direct deposit and check-printing, important payment channels like payment cards and international wire transfers are missing.

Mobile App Functionality

If you’re planning on managing HR and payroll on the go, you might be disappointed with Justworks’ mobile app. Not being able to add paystubs in the mobile app is also a point of improvement for the software.

Not Recommended for Basic Payroll Needs

Justworks is not recommended for startups or small businesses looking for a bare-bones payroll solution. If you’re solely in need of basic payroll software and have a limited budget, Justworks may be too robust for your needs.

Missing features

While Justworks offers a wide range of payroll features, there may be specific functionalities that your business requires which are not currently available. For instance, if you need advanced integrations with other software systems or industry-specific compliance tools, it’s crucial to assess whether Justworks can meet those needs.

Pricing considerations

Justworks’ pricing structure may not be suitable for every business budget. While the software offers comprehensive payroll features, including compliance support and benefits administration, the cost may be higher compared to other payroll solutions. It’s essential to evaluate the pricing plans carefully and consider whether the benefits outweigh the investment for your business.

How to Qualify for Justworks Payroll Software

To qualify for Justworks payroll software, your business typically needs to meet certain criteria such as having a minimum number of employees, being located in a supported state or region, and being legally registered. It’s best to directly contact Justworks or visit their website for specific qualification requirements tailored to your business needs.

Justworks Payroll is available in several states, including New York, California, Texas, Florida, Massachusetts, Illinois, New Jersey, Georgia, North Carolina, Arizona, and Maine.

Additionally, Justworks requires a minimum of two individuals who are part of a Justworks member company to run payroll, with one being able to be classified as an unpaid owner. The single employee must either be a full-time W-2 employee (hourly or salaried) or a part-time W-2 employee working 20 hours or more, at no less than minimum wage.

GET SMARTER >>> Square Payroll Software Review

Alternatives to Justworks Payroll Software

Gusto

Gusto offers a user-friendly interface and comprehensive payroll features. It handles payroll processing, tax filings, benefits administration, and integrates with popular accounting software.

Gusto also provides HR features such as onboarding, time tracking, and employee self-service tools.

ADP Workforce Now

ADP is a well-established payroll solution known for its scalability and customization options. Workforce Now caters to businesses of all sizes and industries.

It offers payroll processing, tax compliance, benefits administration, HR management, and workforce analytics.

Paychex Flex

Paychex Flex is another robust payroll and HR solution suitable for businesses of all sizes. It provides payroll processing, tax services, benefits administration, and HR compliance tools.

Paychex Flex offers flexible pricing options and customizable features to meet specific business needs.

QuickBooks Payroll

QuickBooks Payroll integrates seamlessly with QuickBooks accounting software, making it a convenient choice for businesses already using QuickBooks.

It offers features such as automated payroll processing, tax calculations and filings, and employee self-service options.

Square Payroll

Square Payroll is ideal for small businesses and startups looking for a simple and affordable payroll solution.

It offers basic payroll processing, tax calculations, and filings, and integrates with other Square products for holistic business management.

Customer Reviews

Some customers recommend Justworks, emphasizing how it has streamlined their small company’s processes. From onboarding to time off management, Justworks has made life easier. Plus, their responsive support team is a big win!

Others also praise Justworks for its excellent customer service and user-friendly admin interface. The platform has reduced payroll-related tasks and errors, and the added benefits for employees are a nice touch.

A customer said that it is the most painless payroll experience, especially compared to other providers like Paychex and ADP. Perfect for their 10-employee company!

However, some complained of poor experience due to communication issues and unexpected ACH withdrawals.

Pro Tips

- Encourage employees to set up direct deposit for faster and more efficient payment processing.

- Keep all employee information updated and organized within the software to streamline payroll processing.

- Take advantage of automation features to schedule payroll runs and reminders, reducing the chance of missing deadlines.

- Justworks Payroll software often updates to reflect changes in tax laws and regulations, so make sure to stay informed and compliant.

- Explore reporting tools to gain insights into payroll expenses, employee hours, and other relevant data to help with budgeting and decision-making.

- If applicable, integrate Justworks Payroll with other HR or accounting software for seamless data flow and management.

- Provide training to your team members on how to use the software effectively to minimize errors and maximize efficiency.

- Double-check payroll entries and calculations before finalizing to ensure accuracy and avoid costly mistakes.

- Reach out to Justworks support for any questions or issues you encounter, as they can provide valuable assistance and guidance.

- Keep an eye out for software updates and new features released by Justworks to continuously improve your payroll processes.

Recap

Get ready for a quick rundown of Justworks Payroll! It’s your go-to tool for managing payroll like a champ! First, get all your employee info updated. Set up direct deposit for speedier payments. Explore automation features to schedule runs and reminders. Stay compliant with tax laws. Use reporting tools for insights. Integrate with other software for seamless operations.

Train your team on software use. Double-check entries for accuracy. Reach out to Justworks support for help. And always stay updated with new features. With Justworks Payroll, you’ve got everything to manage payroll like a pro!