Table of Contents

Our Verdict

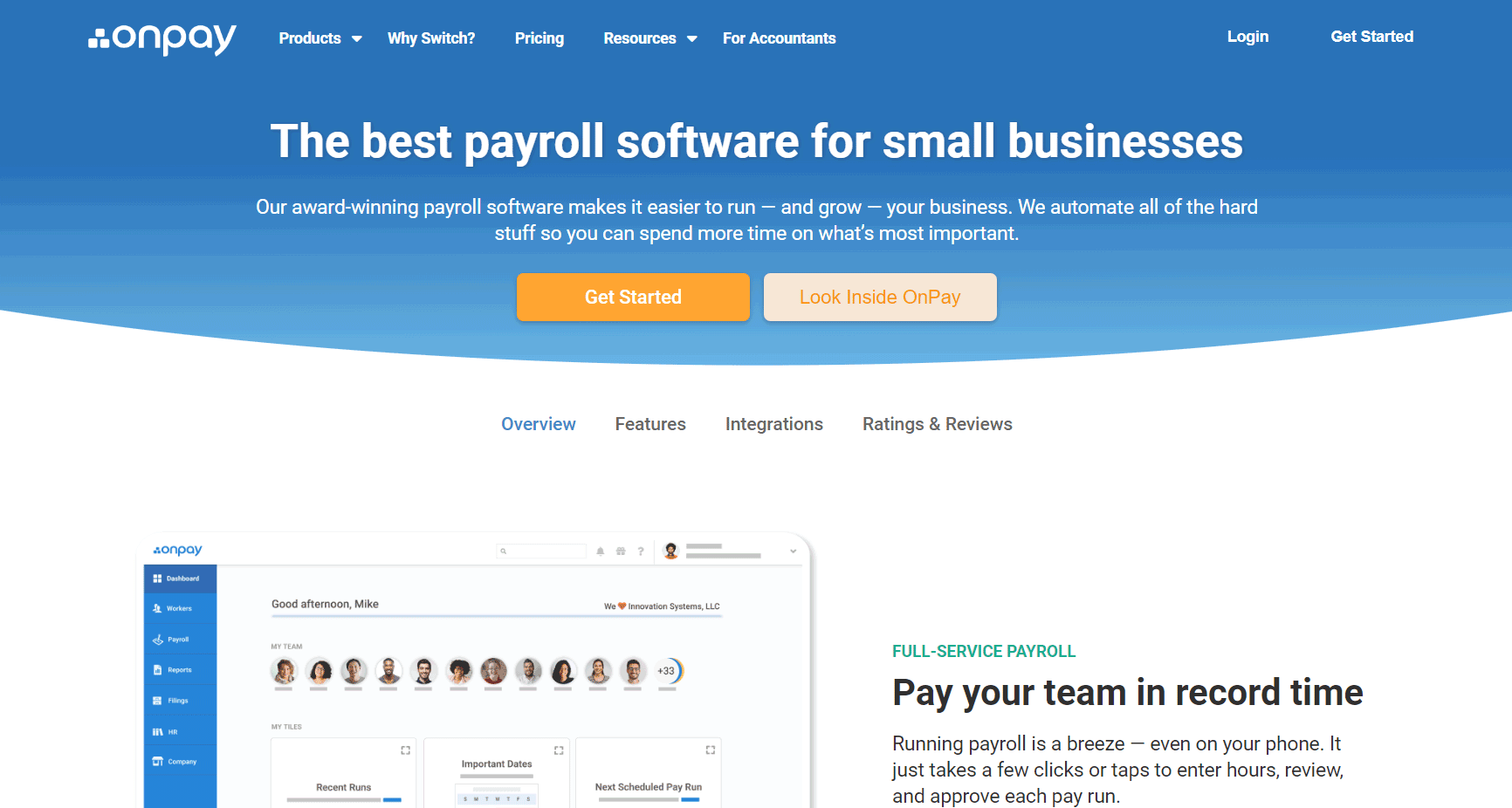

When it comes to streamlining your payroll process, OnPay payroll software is the solution that works for you. With OnPay, you can say goodbye to manual payroll headaches. You can trust OnPay to handle all your payroll needs for your small business efficiently and accurately.

One of the standout features of OnPay is its user-friendly interface. You don’t have to be a payroll expert to navigate the system. Everything is laid out intuitively, making it easy for you to manage payroll tasks with confidence.

With OnPay, you can also rest assured that you’re compliant with all tax regulations. OnPay is also known for its affordability, and comprehensive payroll features, making it a popular choice for small business

In essence, OnPay payroll software is a fantastic choice for businesses looking to streamline its payroll process. Its user-friendly interface, affordability, and compliance features make it a standout option in the payroll software market.

Pros

Consider Onpay payroll software for your payroll needs due to its:

- Efficient payroll processes, saving time and effort

- Intuitive interface and easy to navigate

- Customizable feature tailored to fit your specific payroll needs.

- Precise calculations tools, reducing errors

- Affordable and competitive pricing

- Scalable ability for your business

- Supportive customer service and support

- Seamless integration with other business software

Cons

Before you apply Onpay payroll software, take note of:

- Limited advanced features

- Faulty mobile app functionality

- Restrictive level of Customisation

- Additional time for onboarding and resources

MORE >>> SurePayroll Payroll Software Review

Who Onpay Payroll Software Is Best For

Onpay payroll software is best for you, if you:

- Automate the entire payroll process, from calculating wages to tax deductions

- Handle all federal, state, and local tax filings and payments

- Want a customizable payroll setting to fit your specific needs

- Neef self-service portals for employees

- Want software that integrate seamlessly

- Desire a scalable software to accommodate your business growth

- Require software accessible via mobile devices

- Prioritize data security, with measures such as encryption

Who Onpay Payroll Software Isn’t Right For

Onpay payroll software may not be best for you, if you:

- Want a budget friendly software

- Need software with a reliable or slow processing times

- Desire high level of customisation

- Require limited scalability for growing

- Want easy access in understanding reporting

What Onpay Payroll Software Offers

Onpay payroll software provides you with a diverse offering to meet your specific payroll needs, ensuring efficiency and productivity across various applications. Here’s an overview of what Onpay Payroll Software offers:

Payroll

OnPay payroll software simplifies payroll for small businesses like yours. It offers easy online payroll processing, including direct deposits and tax filings.

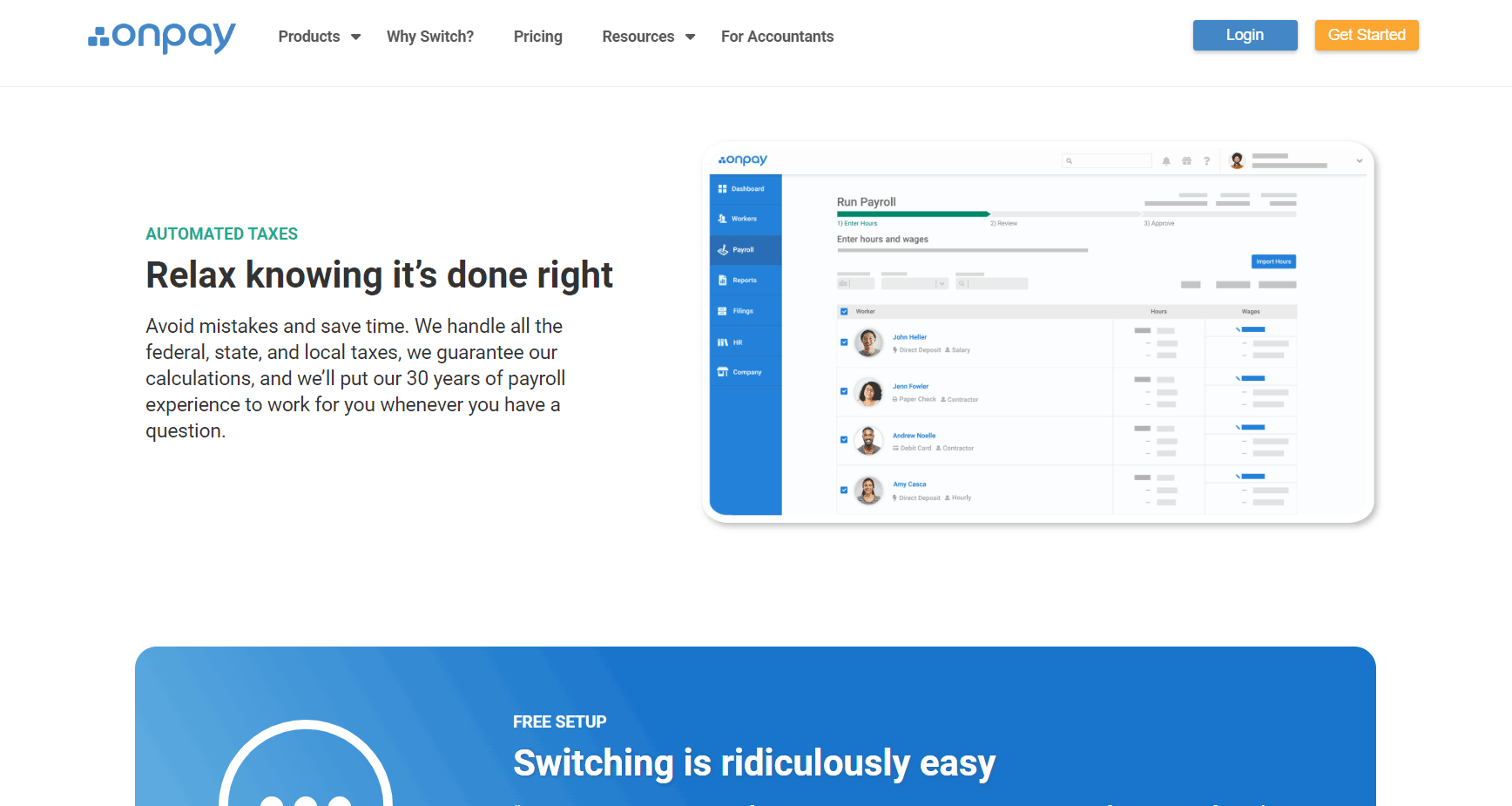

Automated Taxes

Automated Taxes from OnPay payroll software simplify tax filings for you. The system calculates and withholds federal, state, and local taxes accurately. It also prepares and files your tax forms, ensuring compliance and automating the process.

Benefits Management

With OnPay payroll software, you can manage employee benefits seamlessly. You can handle health insurance, retirement plans, and other benefits easily. Track employee enrollments, changes, and costs effortlessly.

Payroll Reporting

With OnPay payroll software, you can easily handle payroll reporting. You get detailed reports on wages, taxes, and more. You can also generate reports for different time periods, helping you stay compliant and make informed decisions.

Tax compliance

Onpay payroll software ensures tax compliance by calculating, withholding, and filing payroll taxes accurately. You can easily manage federal, state, and local taxes, as well as deductions and contributions.

Compliance Audits

Compliance audits in OnPay payroll software ensures your payroll processes meet legal standards. It helps you stay updated with changing regulations, avoiding penalties. You can rely on OnPay to keep your payroll compliant, giving you peace of mind.

Employee Self- Service Portal

With Onpay payroll software offering employee self-service portal where you can access your pay stubs, W-2 forms, and update your personal information. You can also request time off, view your benefits, and communicate with your HR department.

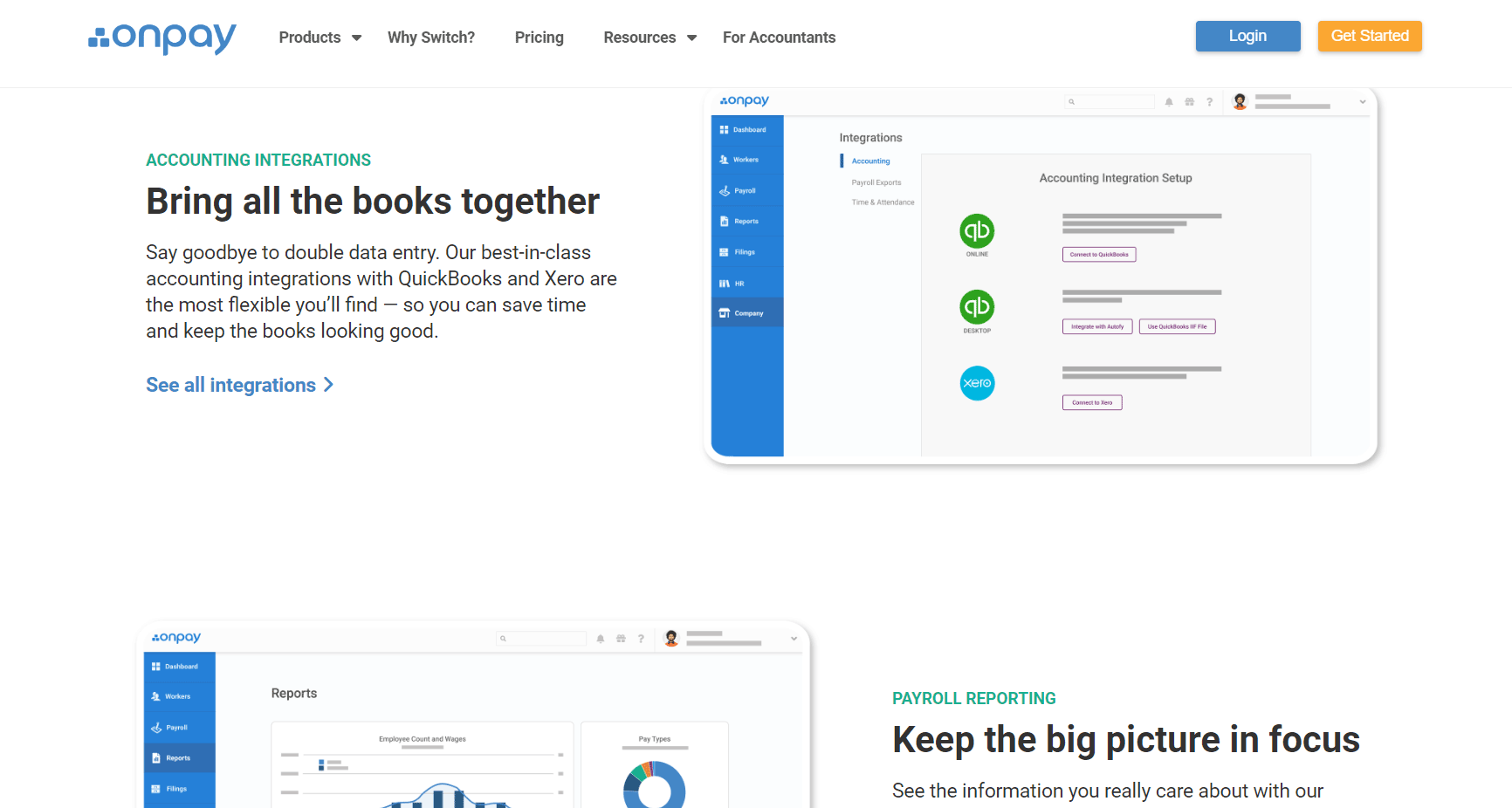

Integrations

OnPay payroll software integrates seamlessly with popular accounting and time-tracking systems, simplifying payroll management. You can easily sync employee data, pay rates, and hours worked.

Onboarding

OnPay payroll software streamlines onboarding for you. It guides you through new employee setup, helping you gather necessary information. You can easily create custom forms and documents, ensuring compliance.

Direct Deposit

Direct Deposit with Onpay payroll software allows you to pay employees conveniently and securely. With direct deposit, you can electronically deposit employees’ salaries directly into bank accounts, saving time and reducing the need for paper checks.

PRO TIPS >>> Payroll Software: How Does It Work

Onpay Payroll Software Details

Payroll

Payroll with OnPay payroll software is like having a personal payroll assistant. You can manage all your payroll needs effortlessly. When you use OnPay, you have access to a cloud-based system, so you can run payroll from anywhere. You can easily calculate wages, deductions, and taxes.

With OnPay, you can pay your employees via direct deposit or print checks yourself. OnPay also takes care of tax filings and payments, saving you time and hassle. It’s user-friendly, so you don’t need to be a payroll expert to use it effectively. Plus, you get excellent customer support to help you whenever you need it.

Automated Taxes

OnPay payroll software offers automated taxes to simplify tax compliance for small businesses. With this tool, you can streamline tax calculations and payments effortlessly. When you use automated taxes, you no longer need to manually calculate deductions or worry about missing deadlines. The software automatically calculates federal, state, and local taxes based on the latest regulations, ensuring accuracy. It also generates and files tax forms, such as W-2s and 1099s, saving you time and reducing the risk of errors.

Benefits Management

With OnPay payroll software, benefits management becomes effortless for you. You can easily handle various benefits like health insurance, retirement plans, and paid time off. OnPay allows you to tailor benefits to each employee, ensuring they receive the best options for their needs.

Adding new benefits or making changes is a breeze. OnPay also aids in compliance with regulations by providing tools for benefits enrollment, eligibility, and reporting. In essence, OnPay’s benefits management feature simplifies the management of employee benefits, saving you time and ensuring accuracy in administering these crucial aspects of your business.

Payroll Reporting

Payroll reporting with OnPay payroll software gives you detailed insights into your payroll data. You can easily access and view reports on employee wages, taxes, deductions, and more. With OnPay, you can generate reports for specific time periods, such as weekly, bi-weekly, or monthly, helping you stay organized and compliant.

These reports also help you track trends over time, allowing you to make informed decisions about your payroll processes. Additionally, OnPay offers customizable reporting options, allowing you to tailor reports to meet your specific business needs. Overall, OnPay’s Payroll reporting feature makes managing your payroll easy and efficient.

Tax compliance

When you use OnPay payroll software, you can handle your tax compliance with ease. You can easily manage your federal, state, and local taxes all in one place. With OnPay, you don’t need to worry about missing deadlines or calculating taxes manually.

The software automatically calculates and withholds the correct amount from each paycheck. It also takes care of filing your taxes accurately and on time. OnPay keeps you updated with any changes in tax regulations, ensuring you stay compliant. Additionally, it provides detailed reports for your records and for easy access during audits.

Compliance Audits

Compliance audits in OnPay payroll software ensure that your business meets all legal and regulatory requirements. You can easily conduct audits to verify compliance with various laws, such as wage and hour regulations, tax laws, and employee benefits laws.

With OnPay, you can customize audit parameters based on your specific needs and industry standards. The software provides detailed reports on audit findings, highlighting areas of non-compliance and suggesting corrective actions. This helps you identify and rectify any issues before escalating, reducing the risk of penalties or legal action.

Employee Self- Service Portal

With OnPay’s employee self-service portal, you can empower your employees to manage personal information and payroll details conveniently. You can access the portal from anywhere, anytime, making it easy for you to update your information, view pay stubs, and manage your tax withholdings. You can also use the portal to request time off, track your hours worked, and view your benefits information. This feature saves you time and gives you more control over your payroll and HR-related tasks.

Integrations

OnPay payroll software offers a range of integrations to streamline your payroll process. You can integrate with popular accounting software like QuickBooks and Xero, ensuring seamless data transfer. This means you can manage your finances more efficiently without manually entering data. OnPay also integrates with time-tracking software like When I Work and TSheets, making it easy to track employee hours and calculate wages accurately. Additionally, OnPay integrates with benefits providers such as Guideline and SimplyInsured, simplifying benefits administration.

Onboarding

When you use OnPay payroll software, you’ll find that it offers an Onboarding product that makes the process of welcoming new employees smoother and more efficient. With OnPay’s Onboarding, you can easily guide new hires through the necessary paperwork and documentation, ensuring that everything is completed accurately and on time.

This product allows you to customize the onboarding experience to fit your company’s specific needs, making it easier for you to provide a personalized welcome to each new employee. OnPay’s Onboarding also integrates seamlessly with the rest of the OnPay Payroll Software, streamlining your HR processes and saving you time and effort.

Direct Deposit

Direct Deposit with OnPay payroll software makes paying your employees easy and convenient. You can pay your team directly into their bank accounts, saving them the hassle of cashing physical checks. With OnPay, you can set up Direct Deposit for your employees in just a few simple steps. You’ll need your employees’ bank account numbers and routing numbers.

Once you have that information, you can enter it into the OnPay system. After you’ve set up Direct Deposit, OnPay will automatically deposit your employees’ pay into each employee account on payday. This eliminates the need for paper checks and reduces the risk of lost or stolen checks.

Where Onpay Payroll Software Stands Out

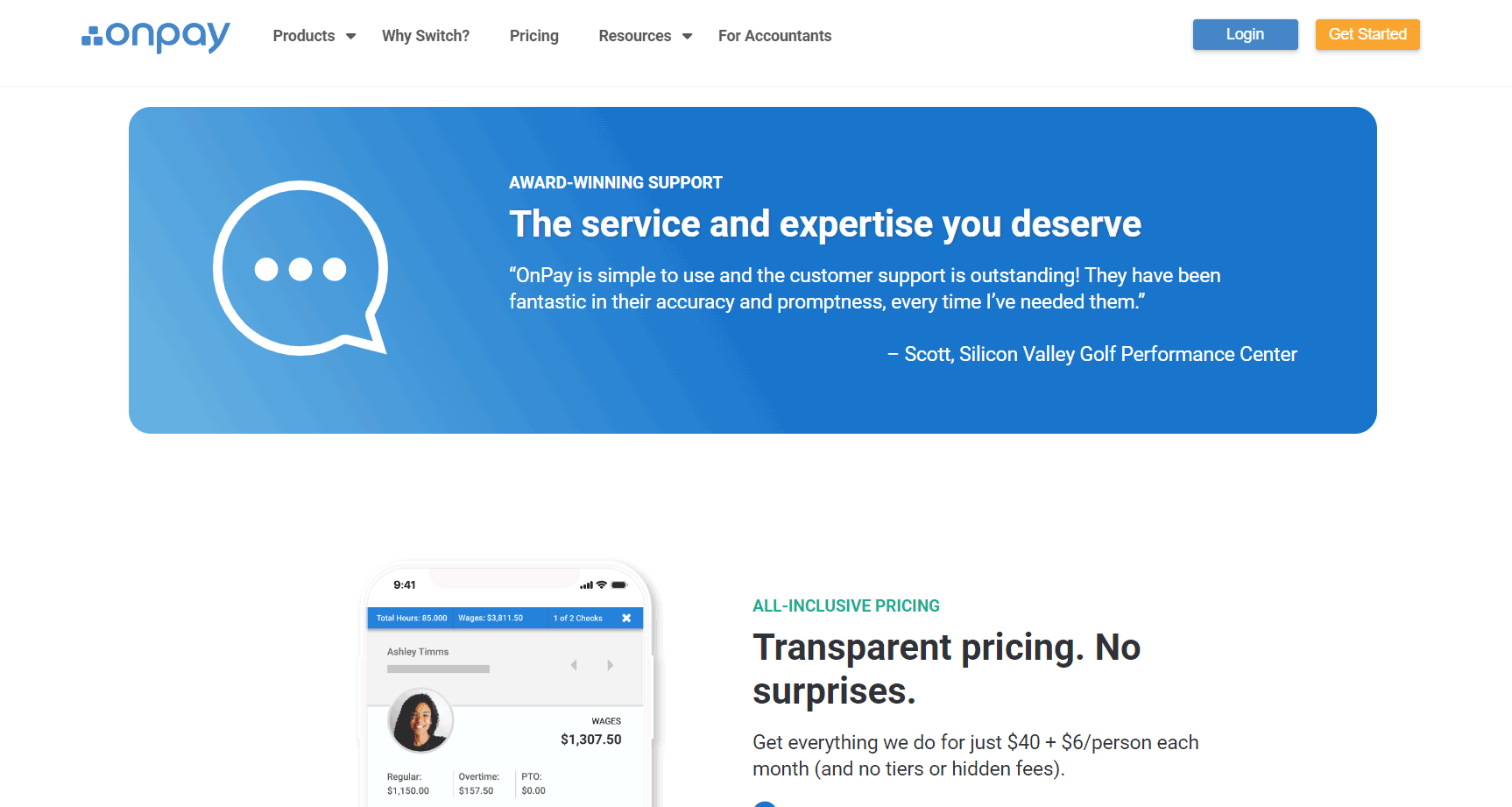

Affordability

With OnPay payroll software, you benefit from it being affordable. You pay a flat monthly fee regardless of your employee count. This transparent pricing model ensures you won’t face unexpected costs as your business grows.

Comprehensive Features

OnPay payroll software stands out with comprehensive features tailored for you. It offers easy setup, seamless integration, and user-friendly interface. You can manage payroll, benefits, and HR tasks efficiently.

Integration Capabilities

OnPay payroll software shines with its integration capabilities, ensuring seamless connectivity with various tools and platforms. You can easily link OnPay with accounting software, time-tracking systems, and HR platforms, streamlining your workflow.

Where Onpay Payroll Software Falls Short

Complexity for Larger Businesses

OnPay Payroll Software may fall short for larger businesses due to its complexity. You might find it challenging to navigate and manage the intricacies of a larger payroll system. The software’s design, though user-friendly, may not scale well for larger teams, making it less suitable for complex payroll needs.

Customer Support

OnPay Payroll Software may fall short in customer support. You might find delays in getting assistance or answers to your queries. If you encounter issues, you could feel frustrated due to the lack of timely and effective support.

Mobile App

OnPay Payroll Software lacks a robust mobile app, limiting your ability to manage payroll on-the-go effectively. The app offers basic functionalities like viewing pay stubs and accessing employee information, but lacks advanced features for full payroll processing.

GET SMARTER >>> Sage Payroll Software Review

Alternatives to Onpay Payroll Software

Gusto

Gusto is known for its user-friendly interface and comprehensive features. With Gusto, you can easily manage payroll, benefits, and taxes all in one place.

ADP

ADP is a well-established payroll software provider with a range of solutions for businesses of all sizes. The software is known for its reliability and scalability, making it a good choice for growing companies. ADP also offers a variety of additional HR services, such as time tracking and employee benefits.

QuickBooks

QuickBooks is a popular accounting software serving as an alternative to Onpay. Its payroll feature integrates seamlessly with the rest of their platform. With QuickBooks Payroll, you can easily manage payroll and track expenses in one place. The software also offers customizable reporting options, allowing you to get the insights you need to manage your business effectively.

Paychex

Paychex is another well-known name in the payroll software industry, offering a range of solutions for businesses of all sizes. This software is known for its flexibility, allowing you to choose the features that best suit your needs.

Customer Reviews

OnPay payroll software generally receives positive reviews from customers. Users appreciate its user-friendly interface, which makes payroll processing easy and efficient. The software’s affordability is also a highlight, particularly for small businesses.

Customers often praise the customer support team for being responsive and helpful. The ability to handle taxes and compliance issues is another commonly cited benefit, as it simplifies payroll management for businesses. However, some users have noted occasional glitches or issues with the software’s performance.

Pro Tips

Use these pro tips to opt for Onpay payroll software as solution to your payroll needs:

- Ensure the software is scalable

- Look for software that is intuitive and user-friendly

- Make sure that OnPay complies with all relevant tax laws

- Check if OnPay can integrate with other software systems you use

- Consider the overall cost of using the software

- Ensure that the software has robust security measures in place

- Read reviews from other users to get an idea of their experiences

Recap

OnPay payroll software makes managing payroll simple for you. It offers easy setup and a user-friendly interface. With OnPay, you can pay employees via direct deposit, print checks, and handle taxes effortlessly. It also integrates seamlessly with popular accounting software. OnPay ensures compliance with tax regulations and provides excellent customer support. You can access it anytime, anywhere, making payroll a breeze for you.