Table of Contents

Our Verdict

Patriot Payroll is your golden ticket to problem-free payroll processing. Experience the ease and efficiency of Patriot Payroll for all your payroll management needs. With its affordable price, easy-to-use interface, and ability to access it from the cloud, it is the preferred option for small and medium-sized businesses. Its automated payroll calculations and tax compliance support helps you bid farewell to those pesky payroll headaches.

In addition, it makes employee payments easier with direct deposit, gives your team self-service capabilities, and smoothly integrates with your current systems. In addition, its customer support is always there to assist you. Patriot Payroll is a versatile solution that caters to businesses of all sizes, including those with multiple locations and a need to manage contractors.

Keep in mind, though, that if you’re a larger enterprise with complex payroll requirements or need advanced HR features, you might want to explore other options. So, evaluate your needs, weigh your budget, and let Patriot Payroll handle the rest. It’s your reliable partner on your payroll journey!

Pros

- It offers affordability

- It provides a user-friendly interface and simplifies the payroll process

- It allows for easy access from anywhere with an internet connection

- It automates payroll calculations, reducing the likelihood of errors and ensuring accurate and timely employee payments.

- It assists in ensuring tax compliance by calculating, filing, and paying federal, state, and local payroll taxes, minimizing the risk of costly tax penalties.

- It facilitates direct deposit, streamlining payroll and eliminating the need for paper checks.

- It offers employee self-service features, empowering your employees to access and update their personal information, review pay stubs, and access tax documents online.

- It integrates with other accounting software and systems, facilitating the synchronization of payroll data with financial records.

Cons

- It lacks some advanced features that larger or more complex businesses might require.

- It primarily focuses on payroll and, as a result, may not offer extensive human resources management tools for businesses with complex HR needs.

- It has limited availability, as it is limited to some regions

Who Patriot Payroll Is Best For

Explore Patriot payroll if you

- Operate a small business and handle payroll for up to 500 employees

- Run businesses with more than one location

- Need to pay your contractors and their employees.

MORE >>> Gusto Payroll Review

Who Patriot Payroll Isn’t Right For

Look for an alternative if you:

- Run businesses that require advanced features such as benefits administration or customizable reports

- Need the full-service plan, which is the more expensive of the two available options, if you want Patriot to manage payroll tax filings and deposits.

What Patriot Payroll Offers

Patriot Payroll offers two payroll software options:

Basic Payroll

This plan offers an easy 3-step process to run payroll, free payroll setup, unlimited payrolls, on-the-fly pay rate changes, a free employee portal, pay overtime, sick-time, and more, unlimited users with permissions, accurate payroll and tax calculations, free direct deposit, time-off accruals, tracking reported tips, and multiple pay rates. Explore this great option for your small businesses, to handle payroll for up to 500 employees.

Full Service Payroll

This plan includes all the features of the Basic Payroll plan, such as an easy 3-step process to run payroll, free payroll setup, unlimited payrolls, on-the-fly pay rate changes, free employee portal, pay overtime, sick-time, and more, unlimited users with permissions, accurate payroll and tax calculations, free direct deposit, time-off accruals, tracking reported tips, and multiple pay rates. In addition to these features, the Full Service Payroll plan also includes Patriot handling your payroll tax filings and deposits for you.

Patriot Payroll Details

Ideal For

Patriot Payroll is your ideal ally if you run a small to medium-sized business, managing up to 500 employees, and are on the lookout for an affordable yet effective payroll solution. It’s perfect for businesses with straightforward payroll needs, and what’s even better is its user-friendly interface that caters to your payroll needs, regardless of your accounting expertise. If your workforce is spread out or works remotely, the cloud-based platform is a game-changer. Patriot Payroll also caters to companies that frequently hire contractors or freelancers. Plus, it’s scalable, so it grows with you as your business expands.

Cost

Patriot Payroll offers two pricing plans: Basic Payroll and Full Service Payroll. See further details of each plan.

Patriot Payroll’s Basic

Patriot Payroll’s Basic Payroll plan is a great option for small businesses that handle payroll for up to 500 employees. The base price for this plan is $17/month. You also pay additional $4 per employee or $1099 per contractor. With this plan, you get an easy 3-step process to run payroll, free payroll setup, unlimited payrolls, on-the-fly pay rate changes, a free employee portal, pay overtime, sick-time, and more. You can add unlimited users with permissions and enjoy accurate payroll and tax calculations. Additionally, you can use the software to track reported tips and set up time-off accruals. In addition, you have the option to include multiple pay rates for each hourly employee.

Patriot Payroll’s Full Service

Patriot Payroll’s Full Service Payroll plan includes all the features of the Basic Payroll plan plus Patriot handling your payroll tax filings and deposits for you. The base price for this plan is $37/month. You pay an additional $4 per employee or 1099 contractor. This plan is ideal for businesses that want to outsource their payroll tax filings and deposits. With this plan, you receive all the features of Basic Payroll, and Patriot will take care of your payroll tax filings and deposits on your behalf.

PRO TIPS >>> Square Payroll Software Review

Where Patriot Payroll Stands Out

Patriot Payroll is exceptional for its

Budget-friendly pricing

Patriot Payroll boasts a straightforward and cost-effective pricing structure. Your monthly expenses comprises of a base fee, either $17 or $37, contingent on your chosen service level, and an additional charge of $4 per employee or contractor. No concealed charges or contractual obligations will catch you off guard.

User-friendly interface.

Seamless process for running payroll effortlessly

Patriot Payroll extends the convenience of unlimited monthly payroll processing, inclusive of complimentary off-cycle and bonus runs. You have the flexibility to remunerate your workforce, whether employees or contractors, through the seamless channels of direct deposit or traditional printed checks.

Free payroll setup and unlimited payrolls

The setup process with Patriot Payroll is both cost-free and uncomplicated. You can embark on this journey within minutes with the invaluable assistance of Patriot’s proficient support team. Furthermore, a wealth of online resources awaits you on their website, comprising instructional videos, guides, FAQs, blogs, webinars, and calculators.

On-the-fly pay rate changes with ease

Accurate calculation of payroll and taxes, while also offering free direct deposit.

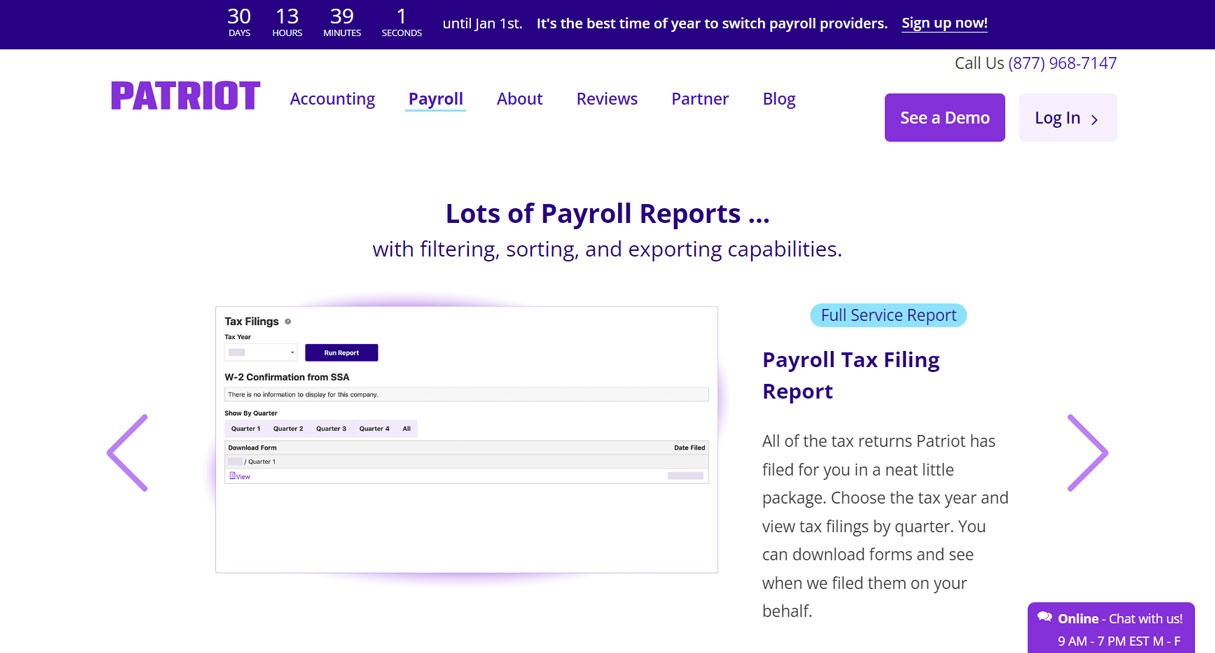

Impressive tax-filing guarantee

Patriot Payroll offers a tax-filing guarantee as part of its Full Service Payroll plan. This entails the handling of federal, state, and local tax withholding and filing. Should any tax-related errors occur on Patriot’s part, they pledge to rectify them and bear any associated fines imposed by the IRS.

Where Patriot Payroll Falls Short

Patriot Payroll falls short in some areas

Supports no international payroll

One notable drawback of Patriot Payroll is its lack of international payroll support. If your business operates globally or has employees or contractors outside the United States, this software may not be the ideal choice for managing their payroll needs.

Offers no mobile app

In a world where mobile accessibility is a priority, Patriot Payroll’s absence of a mobile app may be a hindrance. This means you cannot conveniently access or run your payroll on the go from your smartphone or tablet.

Demands additional state tax filing fees

Patriot Payroll imposes a $12 fee for each additional state tax filing. If your business has employees spread across multiple states, this added cost can accumulate and affect your budget.

Requires manual data entry during setup

Setting up Patriot Payroll may require a considerable amount of manual data entry, including employee information, tax rates, and bank account details. While this ensures accuracy, it can be time-consuming, particularly for businesses with numerous employees.

Lacks automated payroll

Patriot Payroll does not feature automated payroll processing. This means you’ll need to initiate the payroll process manually each time. While this offers control, it may not be the most efficient option for businesses looking to streamline their payroll operations.

Alternatives to Patriot Payroll

Here are some alternatives to Patriot Payroll:

Gusto

Gusto is a cloud-based payroll and HR management software that offers features such as employee self-service, benefits administration, and compliance management. Gusto is a great option for small businesses that need a comprehensive payroll solution.

OnPay

OnPay is a cloud-based payroll software that offers features such as tax filing and payment, employee self-service, and time tracking. OnPay is a good option for small businesses that need an affordable payroll solution with advanced features

Paychex Flex

Paychex Flex is a cloud-based payroll software that offers features such as tax filing and payment, employee self-service, and compliance management. Paychex Flex is a good option for small businesses that need a comprehensive payroll solution with advanced features

Rippling

Rippling is an all-in-one HR and payroll software that offers features such as employee onboarding, benefits administration, and compliance management. Rippling is a great option for small businesses that need an all-in-one HR and payroll solution.

Square Payroll

Square Payroll is a cloud-based payroll software that offers features such as tax filing and payment, employee self-service, and time tracking. Square Payroll is a good option for small businesses that need an affordable payroll solution with basic features

GET SMARTER >>> Gusto vs. Roll Payroll

Customer Reviews

Patriot Payroll garners a rating of 4.0 out of 5 on NerdWallet. As per its evaluation, this payroll software is cost-effective and boasts a straightforward setup process. However, it’s worth noting that it may lack certain functionalities. Furthermore, for Patriot Payroll to manage tax filings and deposits, users must opt for the pricier full-service plan. It’s also distinct in charging extra fees for specific services, and it doesn’t provide features related to benefits administration or customizable reporting.

On SoftwareReviews, Patriot Payroll achieves a commendable customer rating of 94 out of 100. This score is a reflection of actual user data amalgamated to encapsulate product performance and the overall user experience.

In U.S. News’ 2023 Best Payroll Software assessment, Patriot Payroll ties for the third position, underscoring its competitive standing in the payroll software realm. Additionally, it secures the top position in U.S. News’ ranking for the most budget-friendly payroll software.

On Capterra, Patriot Payroll garners an impressive customer rating of 4.8 out of 5. According to user reviews, Patriot Payroll stands out for its user-friendliness and exceptional customer support.

Pro Tips

Here are some tips to help you get the best from Patriot Payroll:

- Utilize the complimentary setup service. Patriot Payroll provides a service to set up your payroll data at no cost. This service can save you time and prevent inaccuracies. Simply furnish them with your employee details, tax rates, bank account information, and prior payroll reports.

- Explore the integration options. Patriot Payroll seamlessly connects with other Patriot software solutions, including accounting, time and attendance, and HR. It also offers compatibility with popular applications like QuickBooks, Xero, and Gusto. These integrations can enhance your workflow efficiency and harmonize data across various platforms.

- Opt for direct deposit for expedited payments. Patriot Payroll grants you the ability to remunerate your employees and contractors through direct deposit, a secure and convenient method that eliminates the need for check printing and mailing. Additionally, direct deposit reduces the risk of mislaid or stolen checks.

- Access the online educational materials. Patriot Payroll offers a plethora of online resources to expand your knowledge of the software and payroll processes. You can find free videos, guides, FAQs, blogs, webinars, and calculators on their website. Furthermore, their proficient support team can be reached via phone, email, or chat for any inquiries or concerns.

- Regularly review your payroll reports. Patriot Payroll generates a variety of reports that facilitate monitoring your payroll activities and ensuring compliance. These encompass payroll summaries, tax liabilities, deductions, employee particulars, contractor payments, and more. You can also export or print these reports for record-keeping or auditing purposes.

Recap

If you’re looking to simplify your payroll management and save time and money in the process, Patriot Payroll is your answer. With its affordability, seamless setup, integration capabilities, direct deposit, online resources, and robust reporting features, it’s the comprehensive solution your business deserves. Make the switch today and experience the difference that Patriot Payroll can bring to your payroll management process. Your business deserves it, and your peace of mind will thank you.