Table of Contents

Our Verdict

Roll by ADP emerges as a standout payroll solution for small to mid-sized businesses eager for a seamless approach to payroll management. Its intuitive, user-friendly interface demystifies the often-complex payroll process, ensuring that even those without extensive HR experience can navigate it with ease. You can effortlessly handle payroll and taxes, supporting both W-2 employees and 1099 contractors, which is essential in today’s diverse workforce landscape.

What truly sets Roll by ADP apart is its affordability. You can access robust payroll features without straining your budget, allowing you to invest more in your business’s growth. The platform’s employee self-service options empower you, enabling your team to view pay stubs, manage personal information, and update tax withholding—all of which reduces administrative burdens and boosts overall efficiency.

However, it’s worth considering that Roll by ADP may not be the ideal fit for larger enterprises or those with specialized payroll needs. If you operate internationally or require comprehensive HR functionalities, you may want to explore other options.

Overall, Roll by ADP is an excellent choice for industries such as construction, consulting, and retail. It offers a reliable and efficient payroll processing experience, freeing you to focus on what truly matters—growing your business and delighting your clients.

Pros

- Provides an easy onboarding process that helps you get started quickly

- Allows for flexibility in payment methods, including direct deposits and physical checks, catering to your workforce’s preferences

- Includes built-in time tracking features, making it easier for you to monitor employee hours directly within the payroll system

- Intuitive design minimizes the chances of confusion and allows for efficient payroll processing

- Implements robust security protocols to protect sensitive employee and payroll data

Cons

- Since Roll is cloud-based, reliable internet connectivity is essential for accessing the platform

- May not offer the necessary multi-currency support

- Lacks advanced analytics capabilities that some businesses may find valuable for strategic decision-making

Who Roll by ADP Payroll Is Best For

Roll by ADP payroll is ideal for:

- Retail workers who need a payroll solution that adapts to seasonal fluctuations in staffing

- Transportation staff who require a payroll system that can handle diverse pay rates and hours worked

- IT professionals who value a streamlined payroll process that accommodates both full-time employees and contractors

- Financial professionals who require precise and timely payroll processing to ensure compliance with regulatory standards

- Food service employers who appreciate a payroll system that manages hourly wages, tips, and varying pay rates seamlessly

MORE >>> ADP Payroll Review

Who Roll by ADP Payroll Isn’t Right For

Roll by ADP payroll might not be a good choice for:

- Large enterprises that require complex payroll solutions with extensive customization and advanced reporting capabilities

- Businesses with highly specialized payroll requirements, such as those in niche industries with unique pay structures, benefits, or regulatory compliance

- Companies looking for a comprehensive human resources management system

What Roll by ADP Payroll Offers

- Payroll & Taxes

- Raises, Bonuses, and Wage Garnishments

- Employee Self-Service

- Intelligent Assistance

- W-2 and 1099 Contractors

Roll by ADP Payroll Details

Payroll & Taxes

With Roll by ADP, managing payroll and taxes becomes much simpler. You don’t have to worry about manually calculating wages, overtime, or bonuses; Roll automates all of that for you. It ensures that the correct federal, state, and local taxes are withheld for every employee and contractor. Once you input the necessary payroll information, Roll handles the rest, so you can focus on running your business. You won’t need to stress over filing taxes either—Roll submits your payroll taxes automatically and on time, which minimizes your chances of facing penalties. At the end of the year, it even generates W-2 forms for employees and 1099 forms for contractors, taking care of a traditionally tedious task. This end-to-end tax compliance ensures you always stay on top of payroll and tax filings without spending extra time or money.

Raises, Bonuses, and Wage Garnishments

Managing salary increases, bonuses, and garnishments is quick and seamless with Roll. When it’s time to give an employee a raise, all you have to do is enter the updated salary information, and Roll will automatically adjust future payrolls for you. Similarly, if you want to offer a bonus, Roll calculates the appropriate tax deductions, so you don’t have to second-guess the amounts. This saves you time and keeps everything compliant with tax laws. Wage garnishments can be a hassle, but with Roll, the platform automatically deducts garnishments like child support or tax levies directly from employees’ paychecks. It even sends the garnished wages to the proper agencies on your behalf, ensuring compliance without adding extra work for you.

Employee Self-Service

Your employees will appreciate having access to their own payroll information through Roll’s self-service feature. They can log in to the app and easily view or download their pay stubs, track their earnings, and access their W-2 forms when tax season arrives. This eliminates the need for you to manage those requests manually. Employees can also update their personal details—like changing their bank account for direct deposits or adjusting their tax withholding preferences—on their own, without needing your intervention.

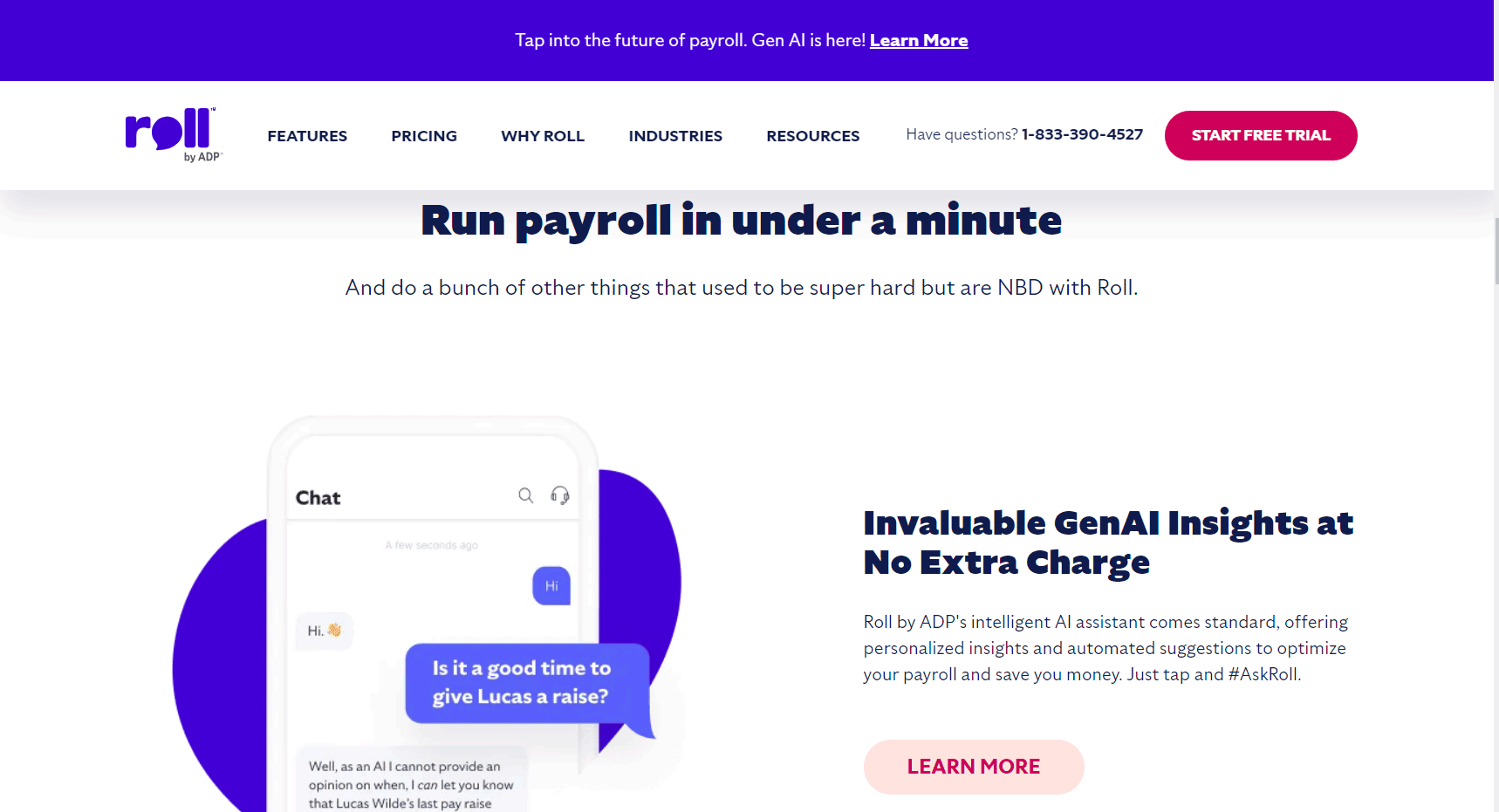

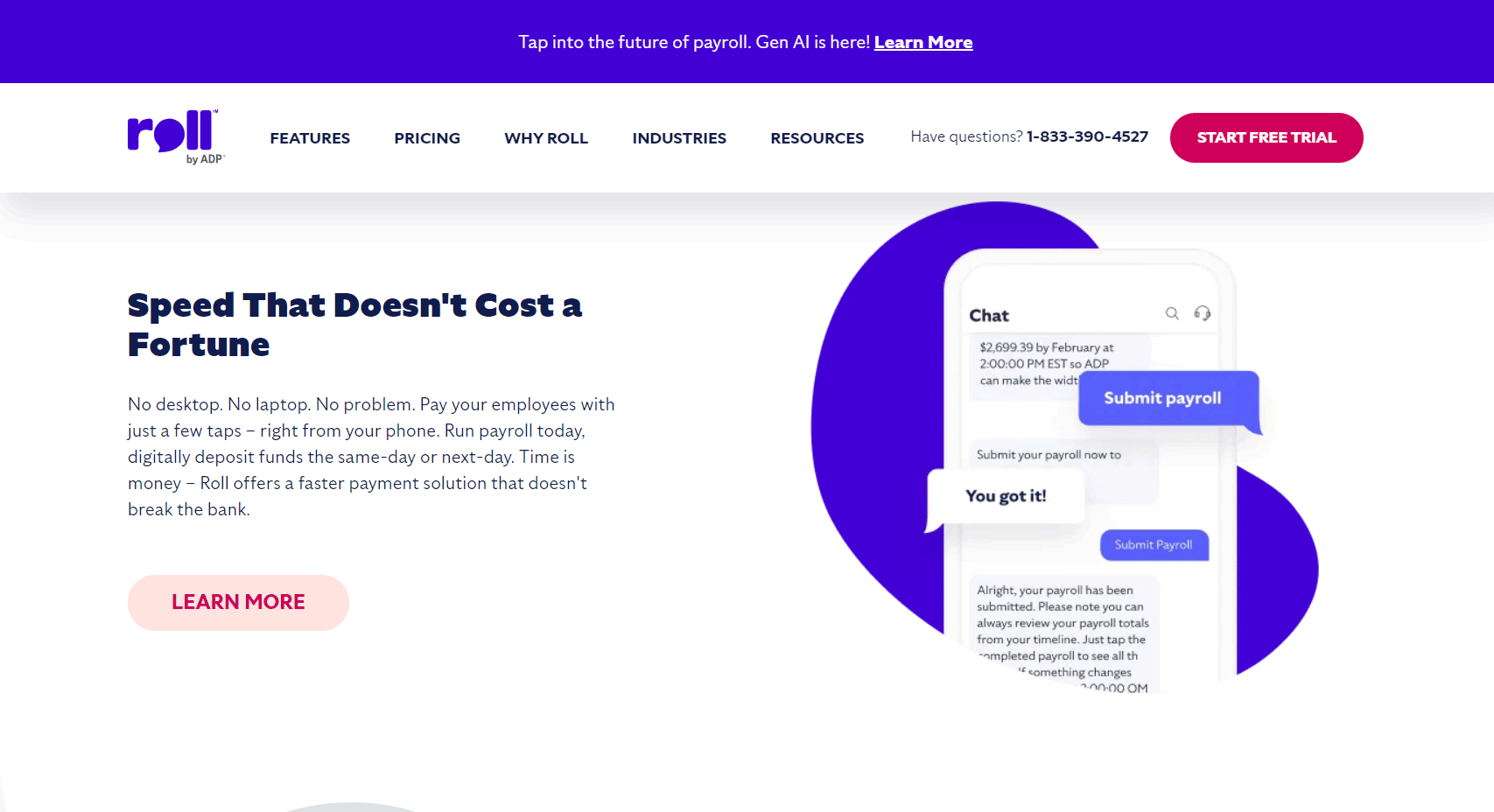

Intelligent Assistance

One of Roll’s standout features is the AI-powered chat assistant that makes running payroll incredibly easy for you. Instead of dealing with complex software, you can simply engage with the assistant through text-based commands. It will guide you through running payroll, filing taxes, and managing other payroll-related tasks step by step. The assistant is always available to remind you about payroll deadlines and tax filings, so you don’t miss anything important. If there’s an error—like missing employee information or incorrect salary entries—it will flag the issue before payroll is processed, ensuring everything is accurate.

W-2 and 1099 Contractors

Whether you have W-2 employees, 1099 contractors, or a mix of both, Roll has you covered. For your full-time employees, it manages everything from payroll deductions to benefits and tax withholdings, ensuring you meet all legal requirements. Roll automatically generates W-2 forms for your employees at year-end, keeping you compliant without extra effort. If you hire independent contractors, Roll can seamlessly handle payments for them too. Since contractors are responsible for their own taxes, Roll doesn’t withhold any tax amounts but still generates 1099 forms at the end of the year. You’ll find it easy to manage both types of workers through the same platform, making it a flexible solution that adapts to your business needs.

PRO TIPS >>> QuickBooks Payroll Software: Get It or Not?

Roll by ADP Payroll Pricings

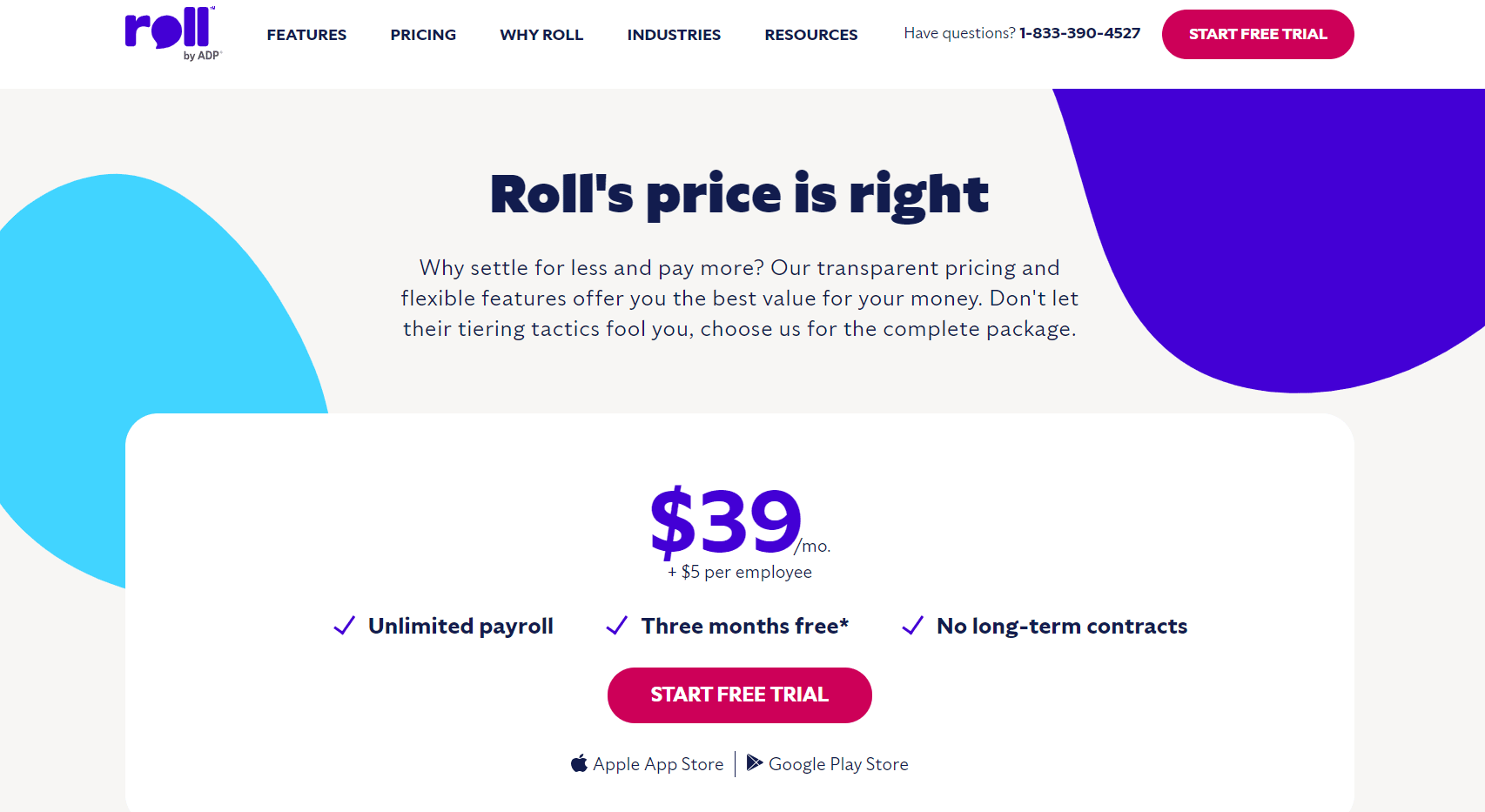

Roll by ADP offers an attractive pricing structure designed to accommodate small to mid-sized businesses. The pricing is straightforward and includes:

- Base Monthly Fee: $39 per month, providing access to the platform’s core features.

- Per Employee Fee: An additional $5 per employee per month, allowing for scalable costs as your workforce grows.

This pricing model includes unlimited payroll processing, making it easy for you to run payroll as often as needed without incurring extra charges. Additionally, Roll by ADP frequently offers a promotion of three months free*, allowing you to explore the platform’s features and benefits without immediate financial commitment.

Where Roll by ADP Payroll Stands Out

Affordable Pricing

One of the primary advantages of Roll by ADP is its competitive and transparent pricing structure. Unlike many payroll solutions that can become quite costly as your business grows, Roll offers a pricing model that is accessible to small and mid-sized businesses. This affordability allows you to manage payroll without straining your budget, making it a practical choice for startups and businesses that are just beginning to scale. The pricing plans are designed to ensure that you receive a robust payroll service without unnecessary financial burden, allowing you to allocate resources more effectively across other areas of your business.

Extensive Resources

Roll by ADP provides a wealth of resources that support you in managing your payroll and compliance needs. This includes educational content, webinars, and articles that cover various aspects of payroll management, tax regulations, and best practices. Having access to such resources can be invaluable for you, especially if you’re new to payroll processing or if you’re looking to stay updated on the latest compliance requirements. These resources not only empower you to handle payroll more effectively but also help you make informed decisions regarding workforce management and financial planning.

Wide Industry Focus

Another area where Roll excels is its applicability across a wide range of industries. Whether you operate in retail, healthcare, technology, or professional services, Roll is designed to meet the specific payroll needs of diverse sectors. This flexibility makes it a versatile option for businesses in various fields, allowing you to customize your payroll processing according to the unique demands of your industry. The broad industry focus ensures that regardless of your business type, you can find tailored solutions that align with your operational requirements and compliance challenges.

Commitment to Compliance

Roll’s commitment to compliance management goes beyond just offering features. The platform actively keeps you informed about changes in labor laws and tax regulations, which can be critical for maintaining good standing with regulatory bodies. This commitment helps mitigate risks associated with non-compliance, allowing you to focus on growing your business while ensuring that payroll processes adhere to legal standards. With Roll, you can rest assured that your payroll management is aligned with the latest compliance requirements.

Where Roll by ADP Payroll Falls Short

Limited Customization Options

While Roll provides a user-friendly interface and essential features, it may lack the extensive customization options that some businesses require. For organizations with unique payroll structures or specific requirements, this limitation could hinder your ability to tailor the system to perfectly fit your operations. You might find that the pre-defined settings do not accommodate specialized payroll needs, making it less adaptable for businesses that require a highly personalized payroll process.

Integration Limitations with Third-Party Software

While Roll integrates seamlessly with other ADP services, its compatibility with some third-party applications may be limited. If you rely heavily on other software tools for operations, you might find that Roll doesn’t integrate as smoothly with them as desired. This limitation can lead to potential inefficiencies, as you may need to manually transfer data between systems or compromise on using your preferred software tools.

Less Comprehensive HR Functionality

Although Roll offers payroll services, it might not provide the same depth of HR functionalities that some larger businesses require. If your organization needs robust HR management features such as advanced performance tracking, employee engagement tools, or comprehensive recruitment functionalities, you may find Roll lacking in these areas. This could necessitate the use of additional platforms, complicating your overall management processes and possibly increasing costs.

Alternatives to Roll by ADP Payroll

Gusto

Gusto provides a comprehensive solution for managing payroll and HR. If you need a platform that goes beyond payroll, Gusto’s integrated approach helps you with benefits administration, employee onboarding, and more. Its user-friendly design ensures you can process payroll quickly, and it automatically takes care of tax filings, which can save you time and stress. Additionally, Gusto offers great flexibility in managing both employees and contractors, giving you the tools to issue payments and track benefits all in one place.

Square Payroll

Square Payroll is perfect if you want a simple, no-fuss payroll system. It’s designed for smaller businesses or those who are already using Square’s payment solutions. The ease of use will allow you to run payroll without getting bogged down in complicated settings. Square Payroll is especially good if you’re managing part-time or seasonal staff, as it seamlessly fits into Square’s ecosystem of payment tools. Its straightforward pricing and features make it a practical choice if you’re just starting out or have a lean operation.

GET SMARTER >>> Square Payroll Software Review

Zenefits

Zenefits stands out if you need a more comprehensive HR system. Beyond payroll, Zenefits gives you robust tools for managing employee benefits, time tracking, and compliance, which will help you handle a wide range of HR tasks in one platform. Its intuitive design makes it easier for you to manage both full-time employees and contractors. If you want to streamline HR alongside payroll, Zenefits can help you reduce administrative overhead while staying compliant with labor laws and benefits requirements.

Customer Reviews

Roll by ADP has a rating of 4.8 out of 5 from 21 reviews on G2 and 4.6 out of 5 on the Apple Store. Users consistently praise the platform for its user-friendly interface and streamlined payroll processing capabilities. Many appreciate the affordability of the service, highlighting how the competitive pricing model allows them to manage payroll without straining their budgets.

Feedback often emphasizes the convenience of the employee self-service features, which empower team members to access their information and manage their pay details independently. Users also note the helpful customer support provided by Roll by ADP, which assists them in resolving any issues promptly and effectively.

Pro Tips

- Explore integration options with other software you use, such as accounting or project management tools

- Don’t hesitate to reach out to Roll by ADP’s customer support for assistance

- Familiarize yourself with the available resources, including FAQs, online tutorials, and support channels, to resolve issues quickly and efficiently

- Provide training or resources to employees about the payroll process and how they can best utilize the self-service features

- Take advantage of mobile access to Roll by ADP to manage payroll on the go

- If your business experiences seasonal fluctuations, plan ahead by utilizing Roll by ADP’s flexible payroll features

Recap

Roll by ADP is the go-to payroll solution tailored for small to mid-sized businesses that seek efficient payroll management without the hassle of complex systems. You’ll find its user-friendly interface offers essential features like payroll and tax management, support for both W-2 employees and 1099 contractors, and convenient employee self-service options.

Designed with affordability and accessibility in mind, Roll by ADP is perfect for industries like construction, consulting, and retail. While it may not suit large enterprises or those with specialized payroll requirements, it provides you with a streamlined approach to reliable payroll processing and compliance support.