Table of Contents

- Let’s Cut to the Chase!

- Now, Let’s Detail Things for You

- What’s the Catch with Wave Payroll Software?

- What You Need to Know

- What are Wave Payroll Software Competitors Offering?

- What Affects Wave Payroll Software Prices?

- What Affects Prices in the Industry Overall?

- How to Get the Best Deal With Wave Payroll Software?

- Can You Afford Wave Payroll Software Prices?

- Finally: Should You Buy Wave Payroll Software or Not?

If you’re a small business owner looking for a straightforward payroll solution, Wave Payroll could be your answer. With its user-friendly interface, automatic reminders, and a self-serve employee portal, you can easily manage payroll without feeling overwhelmed. The three-day direct deposit is a significant plus for getting your employees paid on time.

However, keep in mind that if you operate in a state where Wave doesn’t offer automatic tax filing, you’ll need to handle that manually. Plus, the lack of mobile access and some advanced features might be a drawback for those needing more robust payroll management. Overall, if you want an affordable, easy-to-use platform for basic payroll needs, Wave Payroll is definitely worth considering.

Let’s Cut to the Chase!

Get Wave Payroll Software If:

- ✅ You’re a small business owner seeking an easy-to-use payroll solution that doesn’t overwhelm you with features.

- ✅ You want quick payments, with direct deposit available that gets your employees paid just three days after processing payroll.

- ✅ You’re looking for affordability, as Wave Payroll offers competitive pricing without sacrificing essential features for your business needs.

- ✅ You value flexibility, as Wave Payroll allows you to manage both employees and contractors effortlessly, adjusting to your fluctuating payroll needs.

- ✅ You appreciate the convenience of a self-serve employee portal, letting your team handle their own tax info and pay stubs.

MORE >>> Onpay Payroll Software Review

Skip Wave Payroll Software If:

- ❌ You require advanced features, as Wave lacks robust reporting options that more complex businesses might need for detailed financial insights.

- ❌ You prefer full-service payroll solutions, since Wave doesn’t offer dedicated HR support or extensive employee management tools.

- ❌ You need consistent customer support, as Wave’s support can be less accessible, leading to potential delays when you need assistance with payroll issues.

- ❌ You have a larger workforce, as Wave may not scale effectively for businesses with many employees, especially those needing intricate payroll structures.

- ❌ You want seamless integration with other accounting software, since Wave’s integration options are limited compared to competitors, which might complicate your financial workflows.

The Bottom Line

🌐 Wave Payroll Software is a solid choice if you’re looking for a straightforward, budget-friendly payroll solution for your small business. It simplifies payroll processes with automatic calculations, direct deposits, and tax form generation, making payroll day a lot less stressful. However, if your business has complex payroll needs or requires extensive reporting features, you might find Wave lacking. For small to medium-sized businesses seeking an easy-to-use payroll system that won’t break the bank, Wave offers an appealing, no-frills package that gets the job done.Now, Let’s Detail Things for You

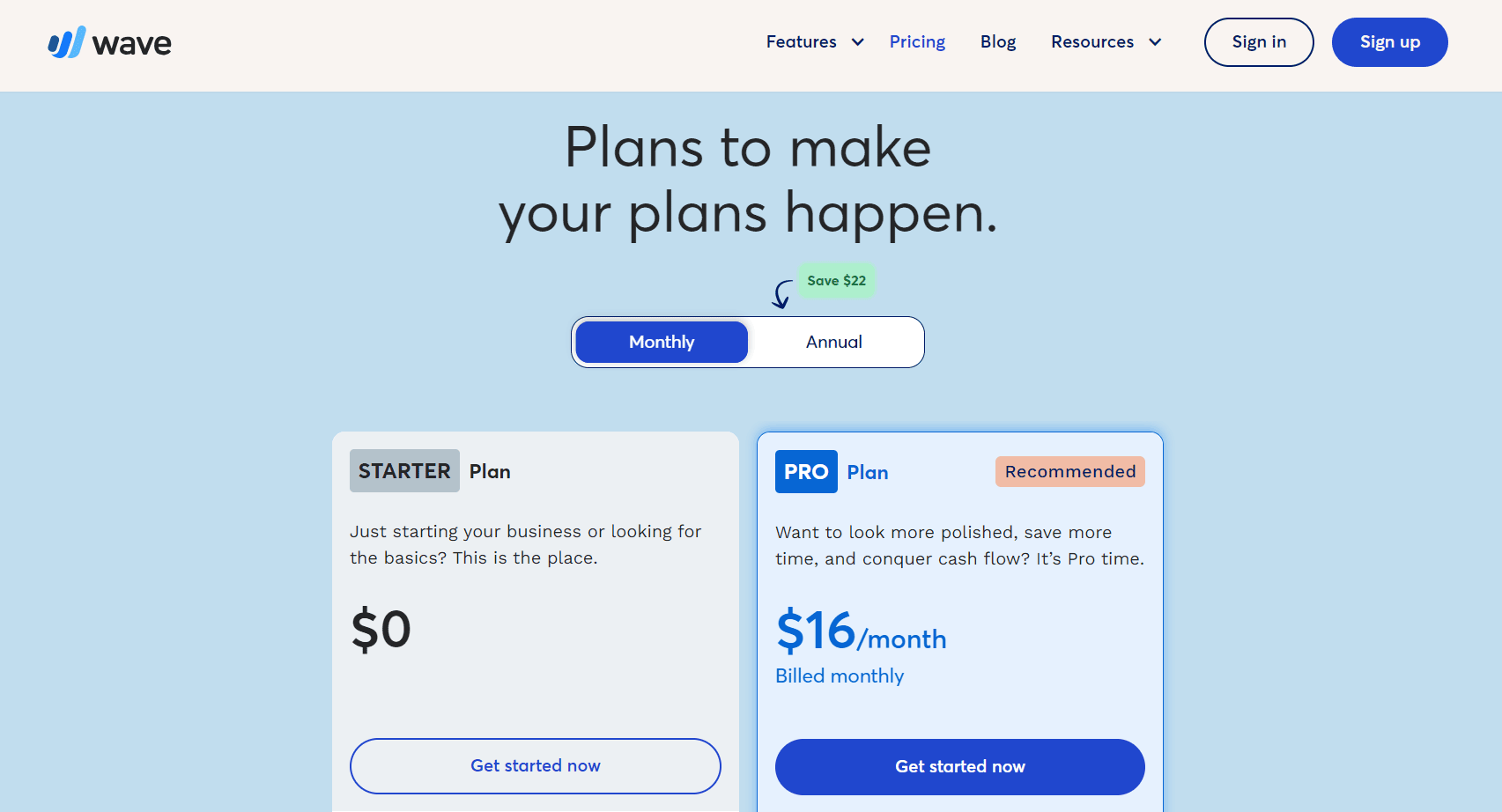

When it comes to Wave Payroll Software, understanding the pricing is key to deciding if it fits your business needs. Wave Payroll offers a competitive edge with its pricing structure, starting at $20 per month per employee. While this may not seem like the cheapest option out there, consider the value packed into that price. You get a fully integrated payroll solution that automatically calculates wages, withholdings, and even generates tax forms, all designed to streamline your payroll process.

If you manage a larger team, Wave’s pricing remains appealing. For example, as your workforce grows, the cost per employee stays consistent, allowing for predictable budgeting. Wave also offers a free version of its accounting software, so you can manage finances and payroll together without worrying about additional costs.

On the flip side, if your business requires advanced payroll features—like intricate reporting, multi-state payroll, or robust employee benefits management—you might find Wave lacking compared to some competitors. Some alternatives may charge higher monthly fees but offer a wider range of features that cater to more complex payroll needs.

What’s the Catch with Wave Payroll Software?

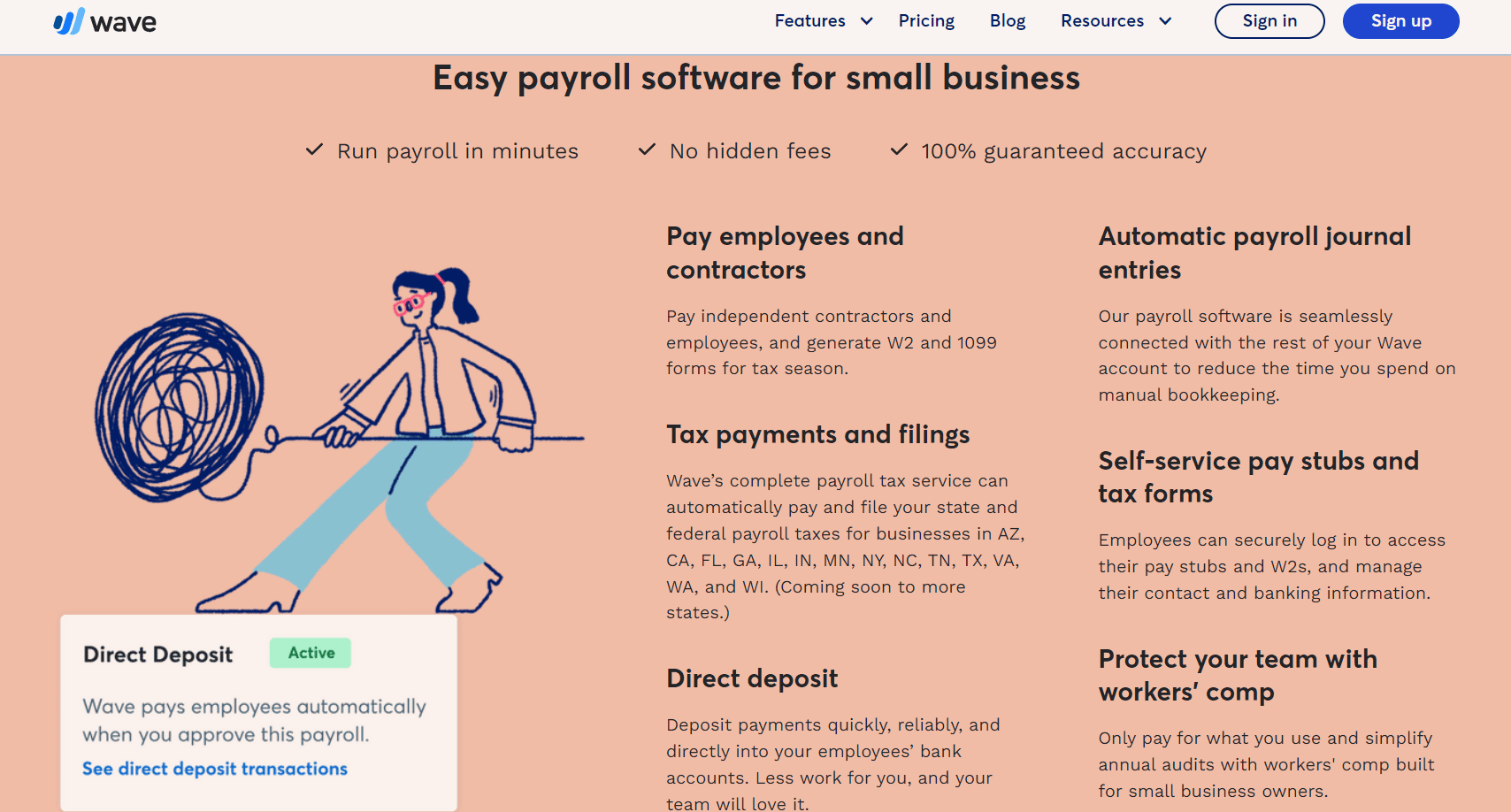

Wave Payroll seems like a great deal, especially with its user-friendly design and integration with Wave’s free accounting tools. You’re getting payroll processing, tax calculations, and direct deposit features, starting at $20 per employee. But before diving in, there are a few pricing aspects to watch out for.

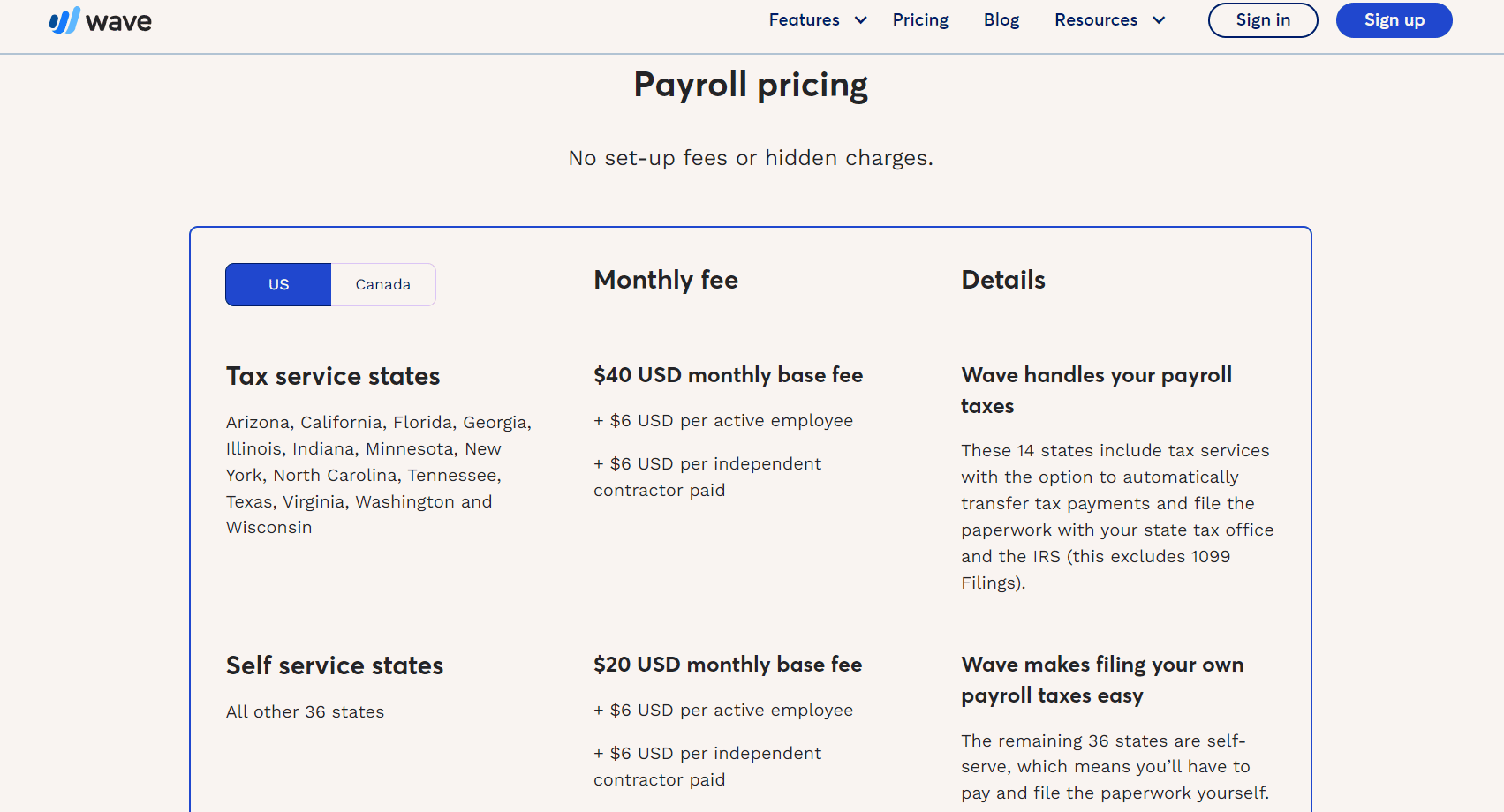

First, Wave’s services come with a regional twist. Full-service payroll, where Wave automatically files your taxes, is only available in 14 states. If you’re outside those areas, you’ll have to manually file your own taxes, which could add extra effort and cost, depending on your needs. For businesses in those states, Wave’s price may seem all-inclusive, but if you’re not, it could end up being more of a headache than anticipated.

Also, while the base price sounds low, it doesn’t account for potential extras like year-end tax forms or additional employee benefits. If your payroll needs expand or become more complex, Wave may lack the advanced features of more expensive competitors, leading you to look elsewhere as your business grows.

Before choosing Wave, consider how it fits with your business both now and in the future. A deeper look at what’s included versus what might cost extra can help you avoid surprises down the line.

What You Need to Know

Wave Payroll offers a flexible pricing model tailored to the specific needs of your business, starting at either $20 or $35 per month, depending on the state where you’re running payroll. For businesses located in the 14 states where Wave can handle automated tax filing, you’ll pay $35 per month for the convenience of having taxes paid and filed on your behalf. If you’re outside those states or prefer to manage your own filings, the base price drops to $20 per month.

In addition to the base fee, there’s a $6 charge per active employee or contractor on your payroll each month. However, there’s a notable twist when it comes to contractors: you only pay for them in the months you actually process their payments. This means if you have several contractors but only pay a few in a given month, you’ll only incur charges for those specific individuals. For example, if you have six contractors on your roster but only need to pay three this month, your total for contractor fees will be just $18.

Direct deposits for contractors function just like those for standard employees, but it’s crucial to classify them correctly within the payroll system to maintain accurate tax information. Overall, Wave’s pricing structure provides flexibility, making it an appealing option for businesses looking to manage payroll efficiently while keeping costs in check.

What are Wave Payroll Software Competitors Offering?

Wave Payroll is an affordable, easy-to-use payroll solution, but it’s not the only option you’ll find. Here’s how it compares to a few top competitors: Gusto, QuickBooks Payroll, ADP, and Paychex.

Wave vs. Gusto

If you’re looking for more automation, Gusto might catch your eye. It handles full-service payroll in all 50 states and offers extras like benefits administration. Wave, by contrast, is perfect if you just need a simple solution without all the added bells and whistles. Gusto starts at $40/month plus $6 per employee, so it’s more expensive, but the advanced HR tools might be worth it if that’s what you need.

Wave vs. QuickBooks Payroll

Already using QuickBooks for your accounting? QuickBooks Payroll integrates seamlessly, which could be a huge win for you. It offers tax filing in all 50 states, which Wave only does in 14. QuickBooks Payroll starts at $45/month plus $5 per employee, though, making Wave the cheaper option, especially if you’re willing to handle taxes yourself in states where Wave doesn’t offer automated filing.

Wave vs. ADP

If you’re after a more robust payroll system, ADP could have what you’re looking for. It covers both payroll and HR management for companies of any size, but it comes with more complexity and higher costs. ADP’s pricing isn’t as transparent as Wave’s, and unless you need full HR services, Wave’s simplicity and lower cost might be a better fit.

Wave vs. Paychex

Paychex is a powerful all-in-one option that includes payroll, HR services, and benefits management. It’s great if your needs grow over time, but it can be overkill—and expensive—if all you want is to run payroll. Wave’s flat monthly fees and pay-per-contractor system keep things simple and affordable, perfect if you don’t need all the HR extras.

PRO TIPS >>> Paycor Payroll Software: Buy or Not?

What Affects Wave Payroll Software Prices?

Several factors can influence what you end up paying for Wave Payroll, so it’s important to understand the key elements that impact your costs:

State-Specific Services

Where you run payroll matters. If Wave handles tax filing and payments for your state, you’ll pay $35 per month. But if your state isn’t covered, you’ll pay $20 per month and have to file taxes yourself. Make sure to check if automated tax filing is available in your state, as it can simplify your workload.

Number of Employees or Contractors

Wave charges a flat $6 per month for every employee or contractor on your payroll. The more people you pay, the higher your monthly costs. But remember, with contractors, you only pay the $6 fee if you actually pay them that month. This flexibility can help you manage payroll expenses based on actual needs.

Discounts or Promotions

From time to time, Wave offers promotions or discounts, so it’s worth staying alert for deals that can lower your initial payroll costs. Keep an eye out for any offers to help maximize value.

Payroll Frequency

How often you run payroll affects costs indirectly. While Wave doesn’t charge extra per payroll run, if you’re paying employees weekly versus bi-weekly or monthly, those $6 per-person fees can add up. Keep this in mind when deciding how frequently to process payroll.

Add-Ons and Integrations

Wave is a great free accounting tool, but if you want to integrate with other software or add services like benefits management, you might need to explore third-party tools. These extras aren’t included in Wave’s base payroll pricing and can increase your overall costs.

What Affects Prices in the Industry Overall?

Several key factors can influence the price you pay for payroll software, and understanding them helps you make a more informed decision:

Tax Filing and Compliance

Some payroll software can handle tax filings for you, which usually comes at a higher cost. If the software includes automatic tax filing in your state, expect to pay more than if you’re manually handling taxes. This is a feature that saves time, but it’s something you pay for.

Integrations and Add-Ons

If you want to connect your payroll software with other systems like accounting tools or benefits management platforms, you might need to pay for additional integrations. Some platforms charge extra for connecting to third-party services, so check for any add-on costs.

State and Local Regulations

Where your business operates matters. Payroll software may charge differently based on the complexity of local tax laws and compliance requirements. States with more complicated tax regulations might come with higher service fees.

Number of Employees and Contractors

The more people you have on your payroll, the higher your costs will be. Payroll software often charges a per-employee or per-contractor fee, so as your team grows, so will your monthly expenses. Make sure to factor in both current and future team size when choosing a plan.

Payroll Frequency

How often you run payroll—weekly, bi-weekly, or monthly—can also affect the price. While some payroll systems offer unlimited payroll runs at no extra cost, others may charge based on how frequently you pay your staff. It’s important to pick software that matches your payroll cycle without adding unnecessary fees.

How to Get the Best Deal With Wave Payroll Software?

Leverage Wave’s Free Tools

Wave Payroll integrates with Wave’s free accounting and invoicing tools, letting you manage payroll without spending extra on additional services. Make sure to take full advantage of these free tools to streamline your finances without adding to your budget.

Stay Alert for Discounts

Wave sometimes offers promotional deals or discounts. Keep an eye on their website or subscribe to their emails to catch these opportunities. Taking advantage of a promotion can save you a significant amount.

Plan for Growth

While Wave’s pricing is transparent, it’s important to plan for any upcoming business growth. As your team expands, so will your payroll fees. Keep this in mind when forecasting your future costs, so you don’t face unexpected increases.

Pick the Right Plan for Your State

Wave Payroll has two pricing tiers based on your location. If you’re in one of the 14 tax-service states, Wave will handle tax filings for $35 per month. For other states, it’s $20 per month, and you manage the tax filings. Make sure you know which plan applies to your state, so you don’t pay for features you don’t need.

Track Your Team Size

You’ll pay $6 per employee or contractor each month, but you only pay for contractors when they’re actively working. So, if you have several contractors on standby but aren’t paying them this month, there’s no fee. Keep an eye on your active team to avoid unnecessary costs.

GET SMARTER >>> Gusto vs OnPay Payroll

Can You Afford Wave Payroll Software Prices?

When considering Wave Payroll, it’s essential to know if it fits both your budget and needs.

First, what’s your payroll budget? Wave offers two pricing tiers: $35 per month for full-service tax states and $20 per month for self-service states. On top of that, you’ll pay $6 per active employee or contractor. If you run a small team or only pay contractors occasionally, these costs can be manageable. But it’s crucial to know how much you’re comfortable spending monthly on payroll.

Second, how important is payroll automation for your business? If handling payroll smoothly and efficiently is key to your operations, Wave’s affordable and easy-to-use platform can be a great fit. The time savings alone from automated tax filings in full-service states may justify the cost.

Lastly, have you explored alternatives? Wave Payroll’s pricing is competitive, especially with its free accounting and invoicing features. However, if your business is growing rapidly or you need more advanced features, comparing it with other payroll services might help you find the best match for your budget and requirements.

Assess your finances and payroll needs to determine if Wave is the right solution for your business.

Finally: Should You Buy Wave Payroll Software or Not?

So, is Wave Payroll the right choice for you? If you’re looking for a cost-effective, user-friendly payroll solution that simplifies your payroll processes, Wave Payroll is definitely worth considering. With its straightforward pricing and seamless integration with Wave’s free accounting and invoicing tools, it can be a great asset for small businesses and freelancers.

However, keep in mind that Wave Payroll might not suit everyone. If your business requires more advanced payroll features or handles complex employee benefits, you might want to explore other payroll services that offer greater flexibility and options.

In a nutshell, Wave Payroll is a solid choice if you prioritize affordability and ease of use. If you need a straightforward solution for managing payroll without breaking the bank, Wave can meet your needs effectively. But if you find yourself requiring more advanced functionalities down the line, it might be worth looking into other options.