Table of Contents

Our Verdict

Make Workful your top choice if you need a payroll software with HR services, a wide range of onboarding, reporting, and employee time-tracking capabilities.

Why? Because Workful stands out for its affordability and comprehensive features tailored for small businesses. It offers tools for managing hourly employees, contractors, and remote workers, making it versatile and user-friendly.

Consider this: Workful’s mobile app allows employees to track paid time off, view pay stubs, and submit mileage and expense reimbursement requests from anywhere. Plus, its customer support receives high praises for being responsive and helpful.

However, if your business needs benefits administration or more advanced automation, you need to explore alternatives like Gusto or Rippling. But for basic HR needs and excellent time-tracking tools, Workful is a solid, reliable choice.

In short: For small businesses with many hourly employees, Workful is a top contender. Give it a try and see how it can streamline your payroll and HR processes!

Pros

- Reasonably Priced: Workful charges $35 per month plus $6 per employee.

- User-Friendly: It has a clean, intuitive interface and excellent mobile access.

- Time Tracking: Built-in time clock with geolocation support.

- Employee Portals: Good employee portals for easy access to payroll information.

Cons

- Limited Flexibility: Payroll runs lack flexibility and access to supporting data.

- Minimal HR Tools: Limited HR functionalities compared to some competitors.

- Few Integrations: Only integrates with QuickBooks Online.

Who Workful Payroll Software Is Best For

Consider Workful as a reliable option if you meet the following conditions:

- Small Business: If you run a small business with basic HR needs.

- Hourly Employees: If you have many hourly employees or contractors.

- Remote Work: If your team includes remote or hybrid workers.

- Time Tracking: If you need robust time-tracking and overtime management tools.

- Onboarding: If you require comprehensive onboarding and document-sharing features.

- Affordability: If you are looking for an affordable payroll solution.

MORE >>> SurePayroll Payroll Software Review

Who Workful Payroll Software Isn’t Right For

If any of these points applies to you, Workful Payroll Software may not be the best fit for you:

- Global Teams: If you have a global team needing multi-currency support and global payroll processing.

- Benefits Administration: If you require integrated benefits administration tools.

- Automated Tax Filing: If you need automated tax filing services.

- Salaried Employees: If you primarily manage salaried employees rather than hourly workers.

- Third-Party Integrations: If you need extensive third-party software integrations beyond QuickBooks.

- Advanced Automation: If you require advanced automation features for your payroll processes.

What Workful Payroll Software Offers

Here are the key products and services that Workful Payroll Software offers:

- Payroll Management: Includes direct deposit for salaried, contractor, and hourly workers.

- HR Features: Onboarding new hires, storing and sharing documents, and time tracking.

- Mobile App: For tracking paid time off, viewing pay stubs, and submitting mileage and expense reimbursement requests.

- Geolocation Time-Tracking: Accessible from anywhere for remote or traveling employees.

Workful Payroll Software Details

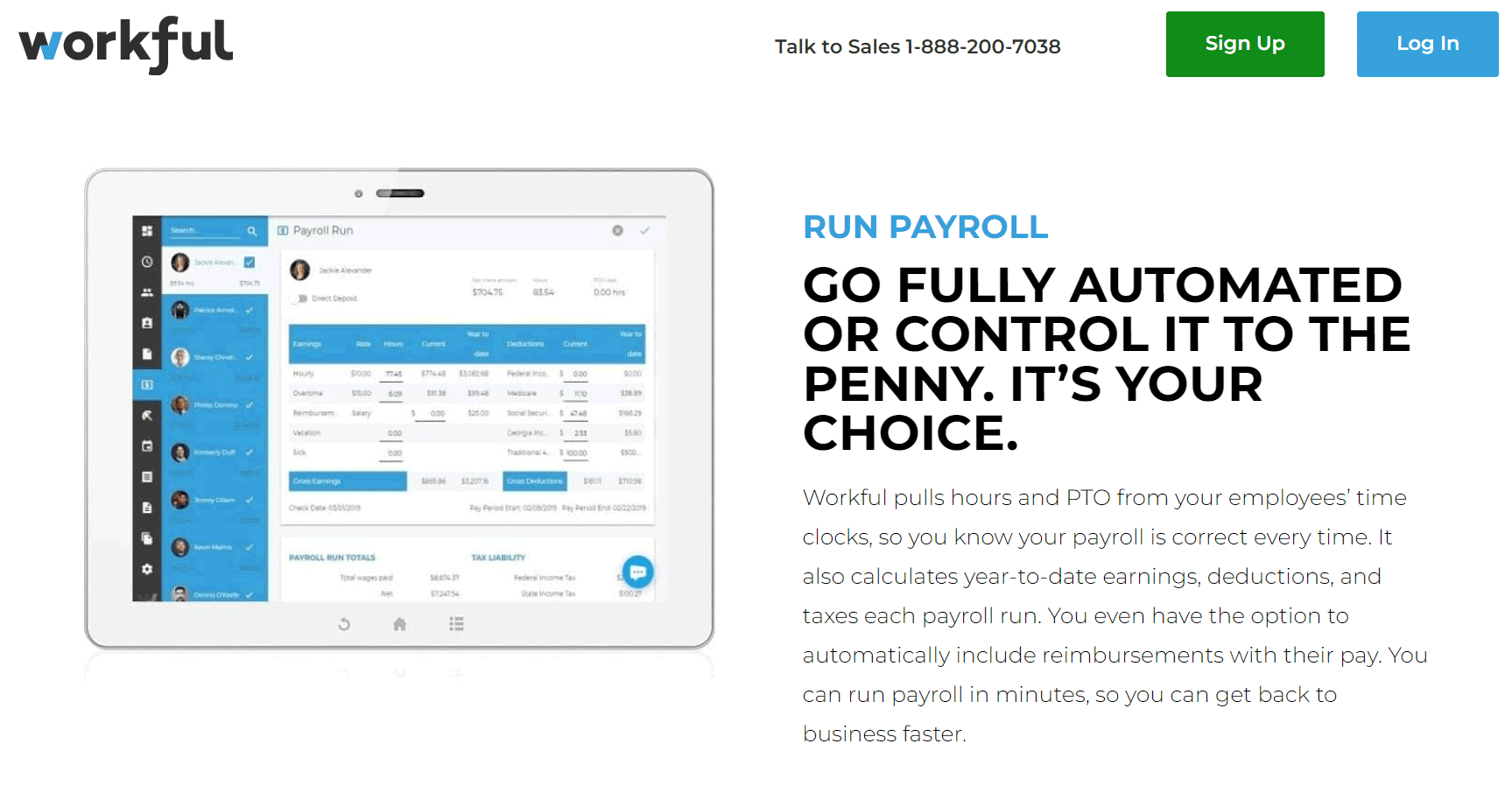

Payroll Management

Make payroll a breeze with Workful’s comprehensive payroll management system. It includes direct deposit for all your employees, whether they’re salaried, contractors, or hourly workers. This means you can ensure everyone gets paid accurately and on time, without the hassle of manual checks. Plus, it simplifies your payroll process, saving you time and reducing errors.

HR Features

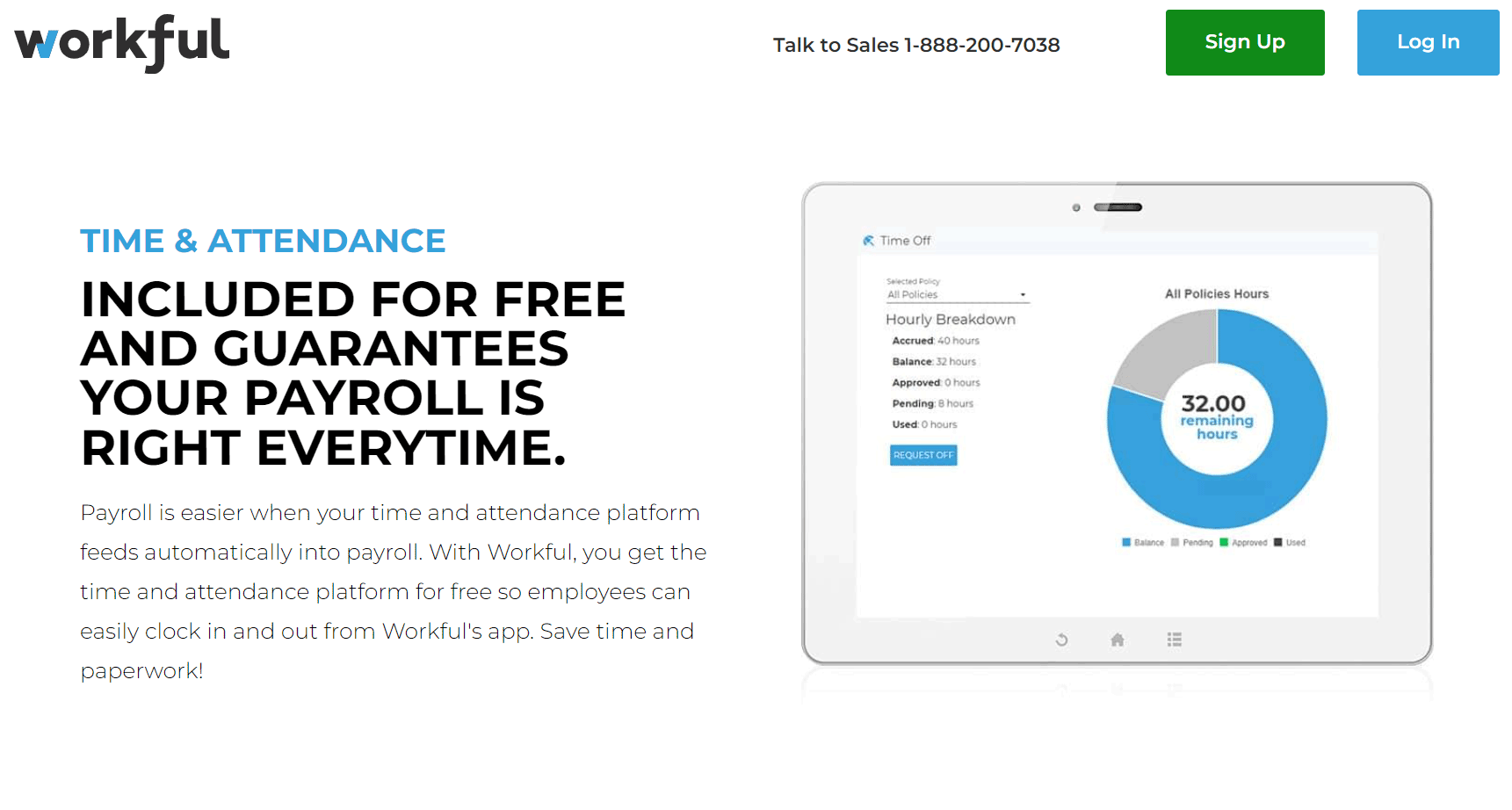

Streamline your HR tasks with Workful’s robust features. Onboarding new hires is a snap, with tools to help you manage all the necessary paperwork and processes. You can store and share important documents securely, ensuring everyone has access to what he or she needs. And with built-in time tracking, you can easily monitor employee hours, manage overtime, and ensure compliance with labor laws.

Mobile App

Empower your employees with Workful’s mobile app. They can track their paid time off, view pay stubs, and submit mileage and expense reimbursement requests—all from their smartphones. This not only makes it convenient for them but also keeps everything organized and accessible for you. It’s a win-win for both sides!

Geolocation Time-Tracking

Keep track of your team’s hours no matter where they are with Workful’s geolocation time-tracking feature. This is perfect for remote or traveling employees, allowing them to clock in and out from anywhere. It ensures accurate time tracking and helps you manage your workforce more effectively, whether they’re in the office or on the go.

Where Workful Payroll Software Stands Out

Pricing and Plans

Workful offers a single pricing plan at $35 monthly, plus $6 for each team member. This makes it more affordable compared to some competitors like QuickBooks Payroll, which starts at $75 per month.

HR and Payroll Features

Get access to a wide range of HR and payroll tools, including time tracking, overtime tracking, and multiple pay rate management, making it ideal for managing hourly workers.

Remote Work Support

Whether you are an employee or contractor, you can track your hours and submit reimbursement requests for expenses and mileage from anywhere, which is great for remote and hybrid work arrangements.

Customer Support

Leverage features such as phone, email, and live chat support during business hours, to ensure that you get help when you need it.

Mobile App

Workful has a mobile app for iOS and Android that allows you to track paid time off, view pay stubs, and submit mileage and expense reimbursement requests.

Ease of Use

Users have praised Workful for its ease of use and excellent customer support, making it a reliable choice for small businesses.

PRO TIPS >>> Best Payroll Software For Large Clients

Where Workful Payroll Software Falls Short

Pricing and Plans

Workful offers a single pricing plan: $35 per month plus $6 per team member. While this is on the affordable end compared to some competitors like QuickBooks Payroll, which starts at $75 per month, it is a bit steep for very small businesses or startups. Additionally, there are cheaper options available, such as Patriot Software, which starts at $17 per month.

Limited Flexibility

Be aware that, though Workful is great for managing payroll for hourly workers, it lacks the flexibility needed for more complex payroll scenarios. If your business has a mix of salaried and hourly employees, or if you need to handle multiple pay rates and schedules, you may find Workful a bit restrictive.

Minimal HR Tools

While Workful does offer some HR features, it doesn’t provide a comprehensive suite of HR tools. For instance, it lacks benefits administration and advanced HR management capabilities that some other payroll software solutions offer. If your business needs robust HR functionalities, you need to look elsewhere.

Limited Integrations

Remember that Workful only integrates with QuickBooks Online. This can be a significant drawback if you use other accounting or business management software. Many other payroll solutions offer a wider range of integrations, making them more versatile and easier to fit into your existing tech stack.

No Multi-Currency Support

If your business operates internationally or deals with multiple currencies, Workful might not be the best fit. It doesn’t support multi-currency transactions, which can be a hassle if you need to manage payroll across different countries.

Basic Mobile Apps

Workful’s mobile apps for employees are quite basic and lack some of the advanced features found in other payroll software. This can be a limitation if your team relies heavily on mobile access for managing their payroll and HR tasks.

How to Qualify for Workful Payroll Software

To qualify for Workful Payroll Software, follow these steps:

- Sign Up for a Free Trial: Start by signing up for Workful’s 30-day free trial. The best part? You don’t need a credit card to get started.

- Add Your Employees: Once you are done with the signing up, add your employees to the system. This includes entering their details, approving time off requests, and managing expense and mileage requests.

- Run Payroll: With Workful, running payroll is straightforward. The system syncs automatically with your employees’ time clocks and other requests, allowing you to run payroll in just a few clicks.

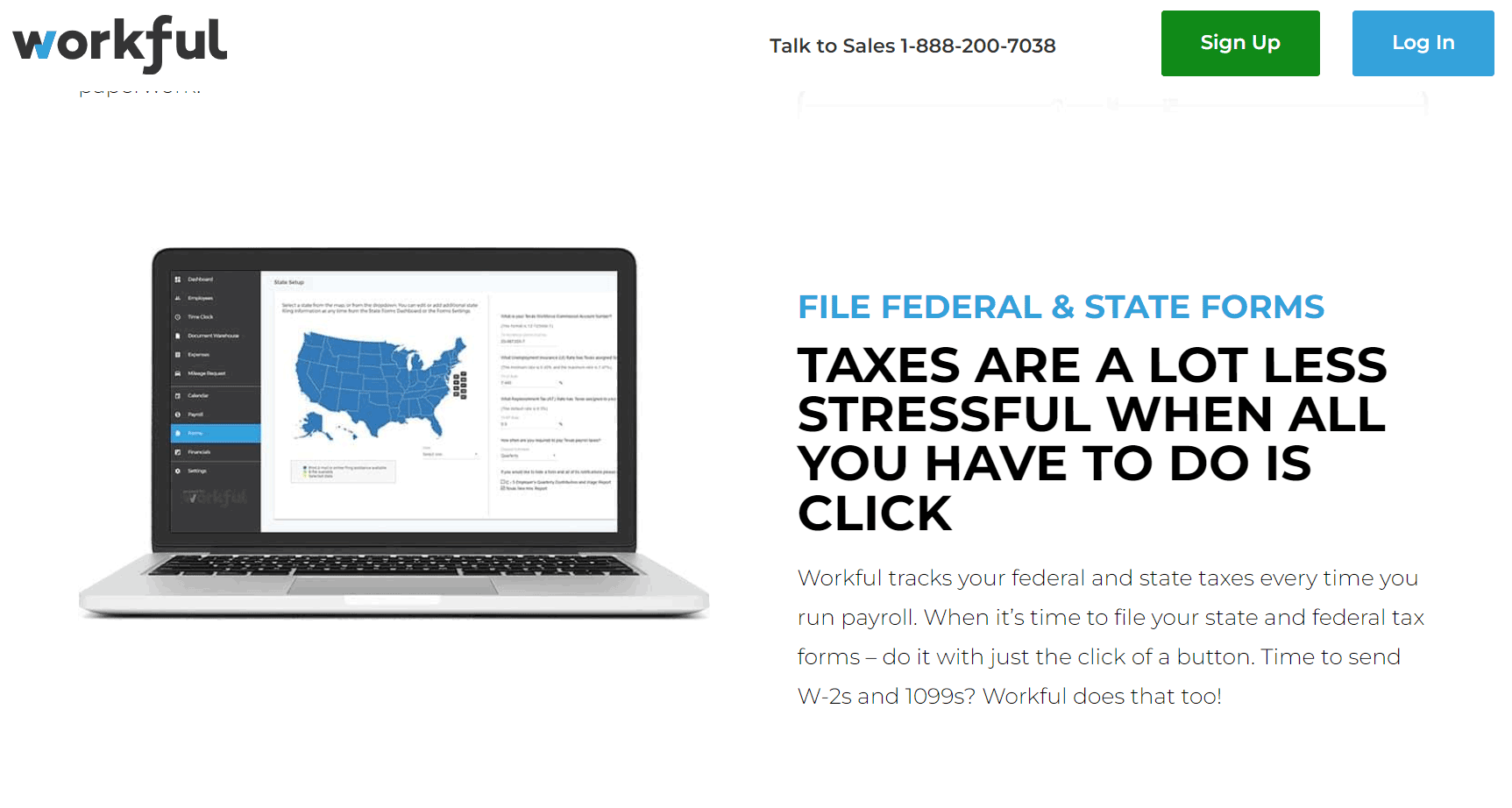

- File Tax Forms: Workful tracks your federal and state tax liabilities every time you run payroll. When it’s time to file, Workful helps you prepare and submit necessary forms like W-2s and 1099s.

- Utilize HR Features: Take advantage of Workful’s HR features, such as onboarding new hires, storing and sharing documents, and time tracking. These tools help you manage your workforce efficiently.

- Access Mobile App: Encourage your employees to use the Workful mobile app. They can track paid time off, view pay stubs, and submit mileage and expense reimbursement requests from anywhere.

If you follow these steps, you are on your way to making the most out of Workful Payroll Software.

Alternatives to Workful Payroll Software

Gusto

Consider Gusto if you need a more comprehensive payroll and HR solution. First, Gusto offers integrated benefits administration, which Workful lacks. Second, Gusto provides automated tax filing at federal, state, and local levels, making it easier to stay compliant without extra effort on your part.

GET SMARTER >>> Onpay vs Paychex

Rippling

Think of Rippling as a great choice if you want a unified platform for all your HR needs. It excels with its extensive third-party integrations, allowing you to connect with a wide range of software beyond just QuickBooks. Additionally, Rippling offers advanced automation features, streamlining many HR and IT tasks that Workful doesn’t cover.

Paychex Flex

Paychex Flex is ideal if you need robust payroll and HR services. It provides comprehensive HR tools, including benefits administration and employee training, which Workful lacks. Moreover, Paychex Flex offers 24/7 customer support, ensuring you can get help whenever you need it, unlike Workful’s limited support hours.

OnPay

Consider OnPay a solid alternative if you’re looking for affordability and functionality. It offers lower pricing starting at $40 per month plus $6 per employee, which can be more cost-effective than Workful. Additionally, OnPay includes benefits administration and workers’ compensation management, providing more comprehensive HR support.

ADP Run

Does your business need to move to the next level? Understand that ADP Run is perfect for businesses that need a scalable solution. It offers multi-currency support, making it suitable for international operations, which Workful doesn’t provide. Furthermore, ADP Run has advanced reporting and analytics, giving you deeper insights into your payroll and HR data.

Customer Reviews

PCMag gives Workful Payroll Software a rating of 3.5 out of 5 stars. Although it does not specify the exact number of reviews, users generally appreciate the reasonable pricing and intuitive interface. However, they point out a lack of flexibility in payroll runs and minimal HR tools, which might be a deal-breaker for some.

On the other hand, USA Today (Blueprint) rates it 3 out of 5 stars based on six reviews on Google Play. Customers like the full suite of HR tools and the fact that it offers unlimited payroll runs. Despite these positives, they find the app complicated to use and wish it included features like multi-currency support, indicating a mixed experience.

Software Advice provides a more favorable rating of 4.3 out of 5 stars, with 57 reviews. Users highlight the ease of use and the excellent customer service as major advantages. However, some reviewers mention that the limited integrations can be a downside, suggesting that while it is generally well-received, it may not meet all needs.

Lastly, Capterra gives the software a perfect score of 5 out of 5 stars. Although it does not mention the number of reviews, reviewers consistently praise its ease of use, customer service, and the range of features offered. This high rating makes it a highly recommended option, especially for those who prioritize user-friendly interfaces and reliable support.

Pro Tips

- Assess Your Payroll Needs: First, take a close look at your business’s unique payroll needs. Consider the size of your company, the number of employees, and the complexity of your payroll requirements. Do you need features like direct deposit, tax calculations, time tracking, and employee self-service? Understanding your needs can help you determine if Workful has the essential functionalities you require.

- Ensure Compliance with Regulations: Make sure the payroll software you choose stays up-to-date with changing tax laws, labor regulations, and reporting requirements. Workful provides automatic updates to ensure your payroll processes remain compliant with the latest rules and regulations.

- Seek a User-Friendly Interface: Payroll tasks can be intricate, but your payroll software must not be. Look for a user-friendly interface to streamline your payroll processes and save time on training. Utilize its intuitive interface to navigate seamlessly, making payroll management stress-free.

- Embrace Automation for Efficiency: Automation is key to enhancing productivity and accuracy. Choose payroll software that automates tasks like tax calculations, time tracking, and payroll deductions. With Workful, you can automate repetitive tasks, reduce the chances of errors and free up valuable time for your team.

- Consider Integration Capabilities: Seamless integration with other business systems is crucial for efficient payroll management. Check if Workful can integrate with your accounting software and other relevant platforms. Remember that Workful integrates effortlessly with QuickBooks, ensuring your financial data remains synchronized and accurate.

- Prioritize Data Security: The security of your payroll data must be a top priority. Look for payroll software that employs robust security measures, such as data encryption and secure servers. Workful implements state-of-the-art measures to safeguard your sensitive payroll information.

Recap

Understand that Workful is not going to solve all your payroll problems instantly. See it like a useful tool you keep handy—it does the job but is not perfect. It handles the basics like direct deposits and time tracking well enough. However, if your business has complex needs, Workful may not be enough. Think of it as a reliable car that gets you where you need to go but doesn’t have all the fancy features.

Here’s the key: Context matters; If you’re a small business with a tight budget and hourly workers, Workful can be just right for you. But if you need extensive HR features, benefits management, and more complex payroll functions, consider options like Gusto or Rippling. Remember, no software is perfect. So, choose wisely and keep your payroll organized. Cheers to you, the hardworking payroll manager!