Table of Contents

Our Verdict

Xero Payroll software is a powerful tool that takes the hassle out of managing payroll, freeing up your time to focus on other crucial business matters. It seamlessly integrates with Xero’s accounting platform, ensuring proper recording of every payroll transaction, keeping your financial records accurate and up-to-date.

With features like automated payroll runs, tax calculations, and detailed payroll reporting, you don’t have to bother about manual errors and compliance issues. Your employees also get to enjoy the self-service portal where they can access pay stubs, manage tax information, and update personal details effortlessly.

Plus, Xero Payroll supports various pay types, from salaries and hourly wages to bonuses and reimbursements, making it incredibly flexible. It also connects with other essential tools like Gusto for payroll processing, Hubdoc for document management, Stripe for online payments, and many more, enhancing its functionality.

However, Xero Payroll may not be ideal for you if your business has complex payroll needs, such as varied working hours or multiple pay rates. Some users also complain about occasional delays in customer support response times. Consider these before making this choice,

In all, by choosing Xero Payroll, you’re opting for a comprehensive, efficient, and reliable solution that simplifies payroll management and boosts your business’s productivity.

Explore any of these contacts for inquiries or more information on Xero Payroll Software:

- Office Addresses:

- Australia

- Melbourne (HQ) – Level 3, 260 Burwood Road, Hawthorn, Melbourne VIC 3122.

- Brisbane: Level 10, 243 Edward Street, Brisbane QLD 4000.

- Sydney: Level 25, 45 Clarence Street, Sydney NSW 2000

- New Zealand

- Wellington (HQ)– Xero One, 19–23 Taranaki Street, Te Aro, Wellington 6011 and Xero Three, 181 Wakefield Street, Te Aro, Wellington 6011

- Auckland– Te Ara Turoa, 96 St Georges Bay Road, Parnell, Auckland 1052

- Napier, Hawke’s Bay– 2 Bridge Street, Ahuriri, Napier 4110, Hawke’s Bay

- United Kingdom

- Milton Keynes (HQ + Experience Centre)– 5th Floor, 100 Avebury Boulevard, Milton Keynes, MK9 1FH

- Manchester– 13th Floor, Landmark, St Peter’s Square, 1 Oxford Street, Manchester, M1 4PB

- London– 7th & 8th Floors, Rolling Stock Yard, 188 York Way, London, N7 9AS

- United States

- Denver (HQ): 1615 Platte Street, Suite 400, Denver, CO 80202

- New York: 45 West 45th Street, 8th Floor, New York, NY 10036

- San Francisco: 785 Market Street (Humboldt Building), 10th Floor, San Francisco, CA 94103

- Canada

- Toronto: 333 Bay Street, Suite 2400, Toronto, ON M5H 2R2

- Singapore: 12 Marina View, #23-01 Asia Square Tower 2, Singapore 018961

- South Africa

- Cape Town: Ground Floor, Willowbridge Place, 39 Carl Cronje Drive, Cape Town, 7530

- Website: https://www.xero.com/

- Support: Click “Contact Xero Support” button at the bottom of any article on its website.

- Australia

Pros

- Integrates seamlessly with Xero’s accounting software, ensuring automatic updates and reducing manual data entry.

- Automates tax calculations, direct deposits, and compliance with local tax regulations, simplifying payroll management.

- Supports employee self-service, allowing employees to access pay stubs, request leave, and submit timesheets online.

- Reduces administrative workload through its comprehensive features and user-friendly interface.

- Provides a cohesive financial management system for businesses already using Xero’s accounting software.

Cons

- Lacks flexibility for businesses with complex payroll needs, such as varied working hours or multiple pay rates.

- Delays in customer support response times have been reported by some users.

- Limits its suitability primarily to small to medium-sized businesses with standard payroll requirements.

Who Xero Payroll Software Is Best For

You need Xero Payroll Software if:

- You are a small to medium-sized business looking for a streamlined and integrated payroll solution.

- You already use Xero’s accounting software and want seamless integration to ensure automatic updates and reduce manual data entry.

- Your business has standard payroll requirements, such as regular working hours and straightforward payroll processes.

- You want to simplify payroll management with automated tax calculations, direct deposits, and compliance with local tax regulations.

- You value employee self-service features that allow employees to access pay stubs, request leave, and submit timesheets online, reducing administrative workload.

MORE >>> Square Payroll Software Review

Who Xero Payroll Software Isn’t Right For

Xero Payroll Software is not an ideal choice for you if:

- Your business has complex payroll needs, such as varied working hours, multiple pay rates, or intricate payroll structures. Xero Payroll is best suited for standard payroll processes and may lack the flexibility required for more complicated setups.

- You require immediate and highly responsive customer support. While Xero’s support is generally good, some users have reported delays in response times, which could be a drawback if you need urgent assistance.

- You operate a large enterprise with extensive payroll requirements. Xero Payroll, by design, is primarily for small to medium-sized businesses, and larger organizations usually find it insufficient for their needs.

What Xero Payroll Software Offers

Xero Payroll Software

Seamless Integration with Xero Accounting

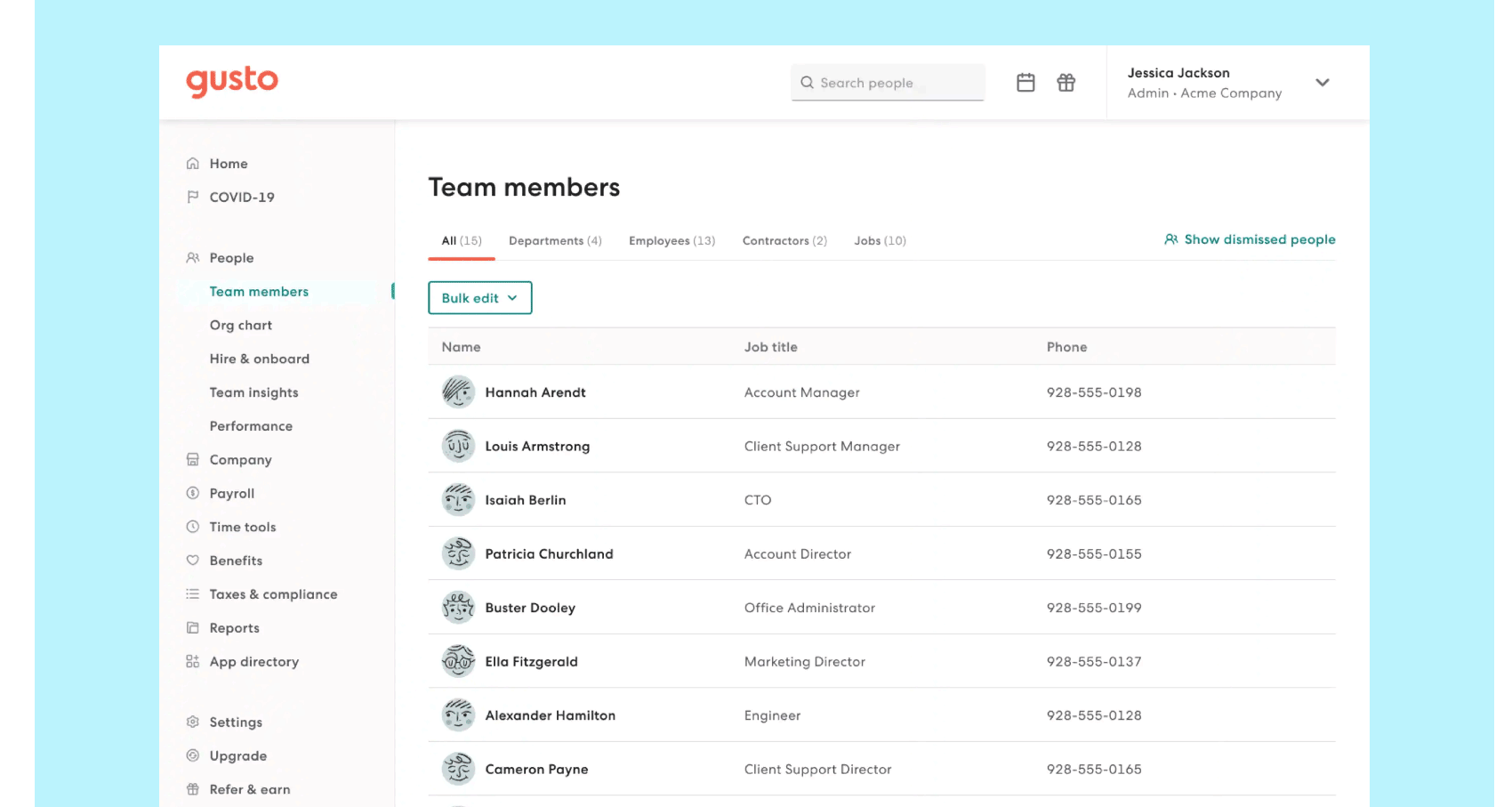

Xero Payroll integrates effortlessly with Xero’s accounting software, ensuring that payroll data is automatically updated in the accounting system. This integration reduces manual data entry and minimizes errors, providing a cohesive financial management system for businesses already using Xero accounting software.

Automated Tax Calculations and Compliance

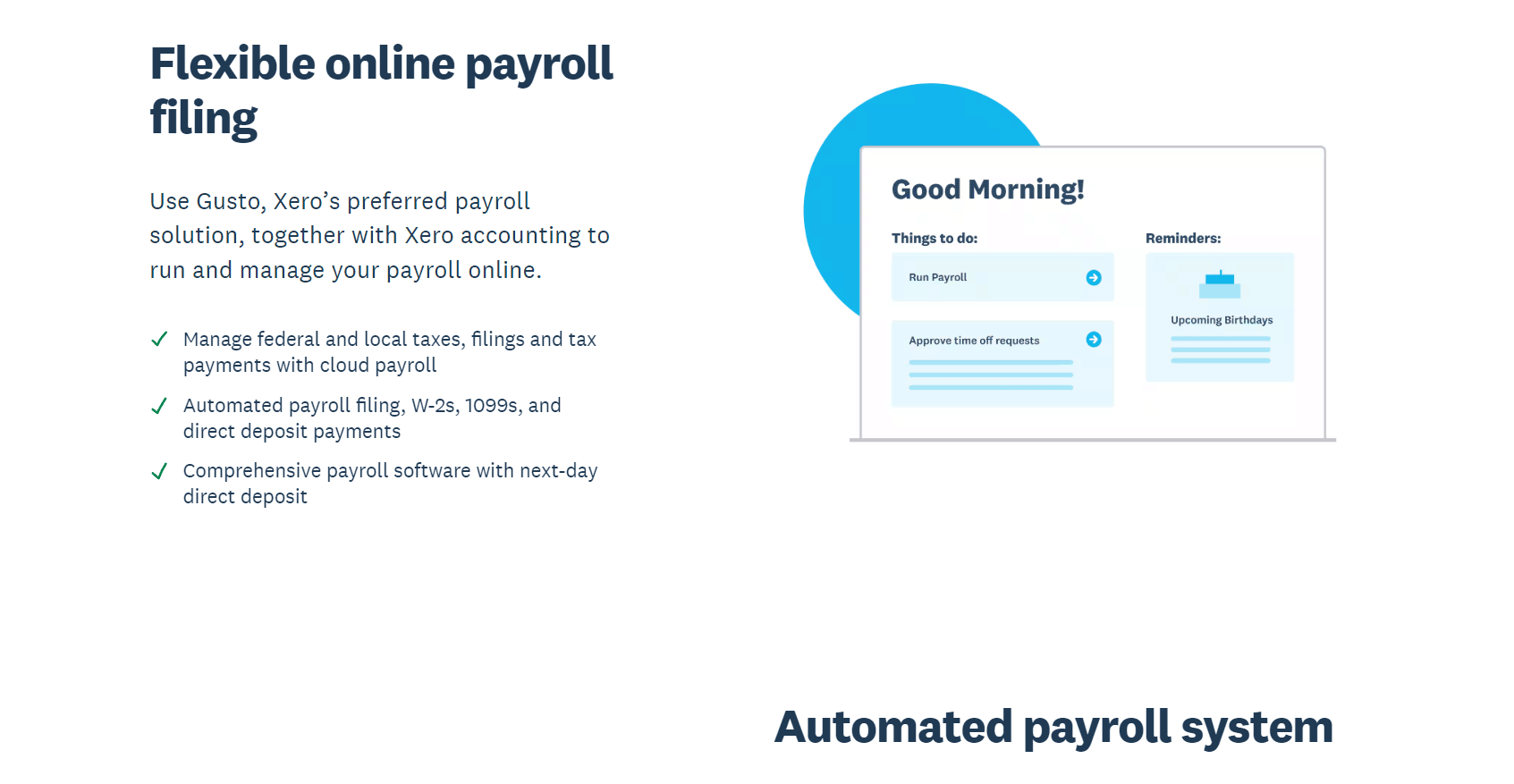

The software automates tax calculations, direct deposits, and compliance with local tax regulations. This feature simplifies payroll management by ensuring that all tax-related tasks are handled accurately and efficiently, reducing the risk of errors and penalties.

Employee Self-Service

Xero Payroll supports employee self-service, allowing employees to access their pay stubs, request leave, and submit timesheets online. This feature significantly reduces the administrative workload for HR departments and empowers employees to manage their payroll-related tasks.

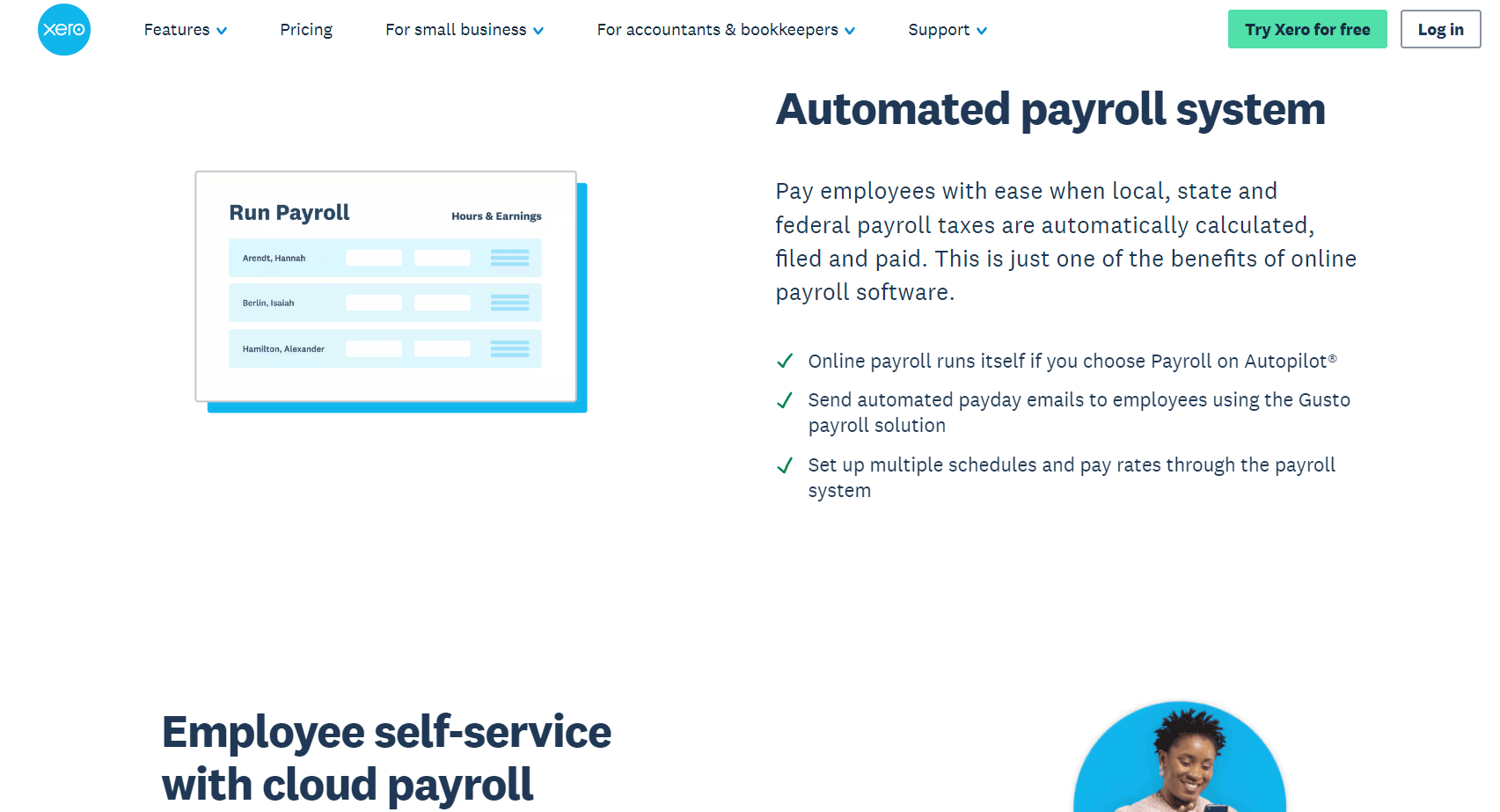

Flexible Pay Schedules and Rates

The software allows businesses to set flexible pay schedules and rates, accommodating different payment frequencies and structures. This flexibility ensures that businesses can tailor their payroll processes to meet their specific needs.

Automated Payroll Processing

Xero Payroll automates the entire payroll process, from calculating pay and deductions to filing taxes and making direct deposits. This automation streamlines payroll management, making it easier for businesses to handle payroll tasks efficiently and accurately.

Compliance with Local Regulations

The software by design, complies with local payroll regulations, ensuring that businesses meet all legal requirements. This compliance feature helps businesses avoid legal issues and ensures that payroll processes are in line with the law.

Comprehensive Reporting

Xero Payroll offers robust reporting capabilities, providing businesses with detailed insights into their payroll data. These reports can help businesses make informed decisions, track payroll expenses, and ensure transparency in payroll management.

Xero Payroll Software Details

Ideal for

- Small business owners

- Medium-sized business owners

- Accountants

- HR managers

- Payroll administrators

- Financial managers

- Entrepreneurs

- Startups

- Freelancers with employees

- Businesses using Xero accounting software

- Companies with standard payroll needs

- Businesses seeking automated payroll solutions

- Organizations looking for employee self-service features

- Firms needing compliance with local tax regulations

- Businesses aiming to reduce administrative workload

Its Plans and Pricing

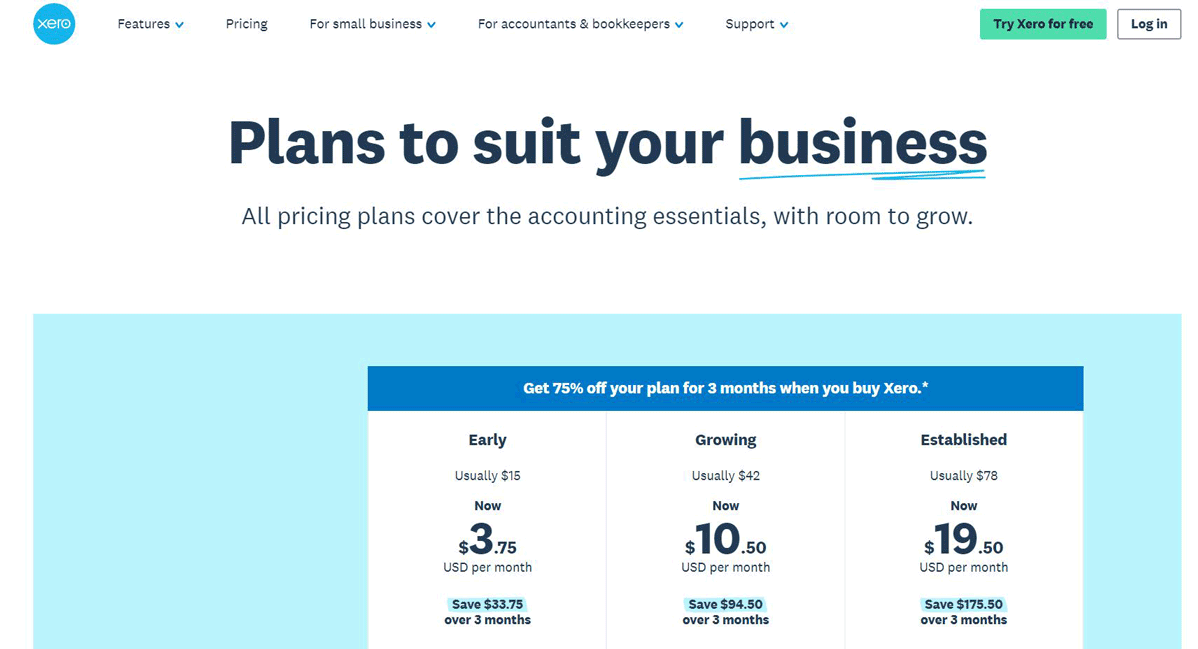

Early Plan

The Early Plan costs $15 per month, currently discounted to $4.50 for the first 6 months. This plan is ideal for small businesses just starting out. It includes features such as sending quotes and up to 20 invoices, entering up to 5 bills, reconciling bank transactions, capturing bills and receipts with Hubdoc, and managing sales tax. Additionally, it offers short-term cash flow and business snapshot tools, as well as W-9 and 1099 management.

Growing Plan

The Growing Plan costs $42 per month, with a current discount bringing it to $12.60 for the first 6 months. This plan builds on the Early Plan by offering unlimited invoices and bills, making it suitable for growing businesses with higher transaction volumes. It also includes bulk reconciliation of transactions, which can save time and improve efficiency in financial management.

Established Plan

The Established Plan is available for $78 per month, currently discounted to $23.40 for the first 6 months. This comprehensive plan includes all the features of the Growing Plan, plus additional capabilities such as multi-currency support, project tracking, expense claims, and advanced analytics. These features make it ideal for established businesses with more complex financial needs and international operations.

Accounting Integrations

Xero Payroll integrates seamlessly with Xero’s accounting platform, Gusto for payroll processing, Hubdoc for document management, Stripe for online payments, Zapier for connecting with over 2,000 apps, Xero Practice Manager for staff and billing management, Link My Books for e-commerce sales data, Tipalti for global payables, and WellyBox for expense tracking.

PRO TIPS >>> QuickBooks Payroll Software: Get It or Not?

Where Xero Payroll Software Stands Out

Xero Payroll Software is unique because it:

- Integrates seamlessly with Xero’s accounting software, ensuring automatic updates and reducing manual data entry.

- Automates tax calculations, direct deposits, and compliance with local tax regulations, simplifying payroll management.

- Supports employee self-service, allowing employees to access pay stubs, request leave, and submit timesheets online.

- Reduces administrative workload through its comprehensive features and user-friendly interface

- Provides flexible pay schedules and rates, accommodating different payment frequencies and structures

- Ensures compliance with local payroll regulations, helping businesses avoid legal issues

- Offers robust reporting capabilities, providing detailed insights into payroll data for informed decision-making

- Streamlines the entire payroll process, from calculating pay and deductions to filing taxes and making direct deposits.

Where Xero Payroll Software Falls Short

Some of Xero Payroll Software limitations include:

- Lacks flexibility for businesses with complex payroll needs, such as varied working hours or multiple pay rates.

- Delays in customer support response times have been reported by some users, which can be a drawback for those needing urgent assistance.

- Limits its suitability primarily to small to medium-sized businesses, making it less ideal for larger enterprises with extensive payroll requirements.

- Restricts customization options for more intricate payroll setups, which might not meet the needs of businesses with unique payroll structures.

- Depends heavily on internet connectivity, which can be an issue for businesses in areas with unreliable internet access.

Alternatives to Xero Payroll Software

Here are some alternatives to Xero Payroll Software:

QuickBooks Online

QuickBooks Online is a highly popular alternative to Xero Payroll Software, known for its robust features and user-friendly interface. It offers comprehensive payroll services, including automated tax calculations, direct deposits, and compliance with local regulations. The software integrates seamlessly with QuickBooks’ accounting platform, providing a cohesive financial management system. Additionally, QuickBooks Online supports multiple users and offers extensive reporting capabilities, making it suitable for businesses of various sizes. Its mobile app is also highly rated, allowing users to manage payroll and accounting tasks on the go.

Zoho Books

Zoho Books is another strong contender, particularly famous for its mobile app and multilingual capabilities. It offers a range of features similar to Xero, including automated payroll processing, tax compliance, and employee self-service portals. Zoho Books integrates well with other Zoho applications, creating a comprehensive ecosystem for business management. It also provides detailed financial reports and supports multiple currencies, making it ideal for businesses with international operations. The software is unique for its affordability and scalability, catering to both small and growing businesses.

FreshBooks

FreshBooks is an excellent choice for very small service-based businesses and freelancers. It offers simple yet effective payroll and accounting features, including automated invoicing, expense tracking, and time tracking. FreshBooks integrates with Gusto for payroll services, ensuring accurate tax calculations and direct deposits. The software is user-friendly and provides a clean, intuitive interface, making it easy for non-accountants to manage their finances. FreshBooks also offers strong customer support and a variety of pricing plans to suit different business needs.

Wave

Wave is a free alternative to Xero, ideal for small businesses and freelancers with basic payroll and accounting needs. It offers essential features such as invoicing, expense tracking, and receipt scanning. Wave’s payroll services include automated tax calculations and direct deposits, though its capabilities are more limited compared to paid solutions. Despite being free, Wave provides a solid user experience and integrates with various third-party applications. It’s a great option for businesses looking to manage their finances without incurring additional costs.

QuickBooks Enterprise

QuickBooks Enterprise is perfect for larger businesses with more complex financial needs. It offers advanced payroll features, including job costing, advanced reporting, and support for multiple company files. The software integrates seamlessly with QuickBooks’ accounting platform, providing a comprehensive financial management solution. QuickBooks Enterprise also supports a higher number of users and offers extensive customization options, making it suitable for businesses with specific requirements. Its robust feature set and scalability make it a powerful alternative to Xero for larger enterprises.

GET SMARTER >>> Best Payroll Software For Large Clients

Customer Reviews

Xero Payroll software generally receives positive reviews for its seamless integration with Xero’s accounting platform, making it a popular choice for small to medium-sized businesses. Forbes Advisor gives it a 4.5 out of 5 for its user-friendly interface, competitive pricing, and extensive features. Merchant Maverick gives Xero a total rating of 4.0 out of 5, highlighting its robust feature set, unlimited users, and numerous integrations. However, some users find the learning curve steep and customer support lacking.

On Trustpilot, Xero Payroll Software holds a rating of 4.1 out of 5 stars from 6,848 reviews, with customers appreciating the payroll support and helpful customer service, though some mention a learning curve. G2 users rate it 4.3 out of 5 stars based on 684 reviews, praising its seamless integration with Xero’s accounting software, ease of use, and comprehensive features, while noting it may not suit very complex payroll needs.

Software Advice reviews highlight the software’s ease of use, great functionality, and prompt customer service, particularly for report-building and bank feed Processing. TrustRadius reviews also reflect positive sentiments, with users finding Xero excellent for report building, bank feed processing, and BAS preparation, though it may not be ideal for complex payrolls requiring additional software. Overall, Xero Payroll Software gets praise for its integration capabilities, user-friendliness, and customer support, despite some limitations for businesses with more intricate payroll requirements.

Pro Tips

Here are some pro tips for you:

- Integrate Seamlessly: Ensure you fully integrate Xero Payroll with Xero’s accounting software to automate data updates and reduce manual entry. This streamlines your financial management and minimizes errors.

- Automate Tax Calculations: Take advantage of the automated tax calculations feature to ensure compliance with local tax regulations. This saves you time and reduces the risk of errors and penalties.

- Utilize Employee Self-Service: Encourage your employees to use the self-service portal to access their pay stubs, request leave, and submit timesheets online. This significantly reduces your administrative workload.

- Customize Pay Schedules: Set up flexible pay schedules and rates to accommodate different payment frequencies and structures. This ensures your payroll processes are tailored to your business needs.

- Leverage Reporting Tools: Use Xero’s robust reporting capabilities to gain detailed insights into your payroll data. These reports can help you make informed decisions and track payroll expenses effectively.

- Stay Compliant: Regularly update your payroll settings to comply with local regulations. This includes keeping up with changes in tax codes and other legal requirements to avoid any compliance issues.

- Train Your Team: Provide training for your HR and payroll staff to ensure they are familiar with all the features of Xero Payroll. This helps them use the software more efficiently and effectively.

- Use Support Resources: Make use of Xero’s support resources, including online guides, tutorials, and customer support, to resolve any issues quickly and get the most out of the software.

Recap

Xero Payroll software is a comprehensive solution that streamlines payroll management for small to medium-sized businesses. Explore its key features such as automated tax calculations, direct deposit, and compliance with local tax regulations that simplify payroll processing. The software also includes an employee self-service portal, allowing staff to access pay stubs, request leave, and submit timesheets online, thus reducing administrative workload.

Using Xero Payroll significantly reduces the time and effort you expend to manage payroll, minimizing related errors with manual data entry and ensuring compliance with tax regulations. It supports multiple pay schedules and rates, which is particularly useful for businesses with diverse payroll needs.

By automating payroll tasks, businesses can focus more on their core operations, improving overall efficiency and productivity. Additionally, the integration with Xero’s accounting platform provides a unified view of financial data, enhancing decision-making and financial planning.